A key part of managing your personal finances is tracking your spending. You can use a spreadsheet, but seeing as we live in the 21st century, why not try an app? The Emma money app is one of them. In this article, I’ll share my Emma app review. Want to know whether this app can improve your finances? Read on…

- What is Emma?

- What is Open Banking?

- What are the main features of the Emma app?

- What bank accounts can be connected to the Emma app?

- Is Emma safe and secure?

- How does Emma make money?

- What are the disadvantages of Emma?

- What are the advantages of Emma?

- What do you get with Emma Pro?

- What is Emma best used for?

- Who should use Emma?

- How should Emma fit into your personal finance system?

- Do I use Emma myself?

- What are people saying about the Emma money app?

- How do I get the Emma money management app?

- My verdict

What is Emma?

Emma is a budgeting and spend tracking app which helps you manage your money, using the Open Banking API.

The team at Emma bill “Emma” as your “Best Financial Friend” and is available on Android and iOS. Emma was set up in the UK in 2018 by two entrepreneurs who met at university. They’ve since secured $2.5m in seed funding earlier this year to help their expansion into the US and Canada.

I have been using Emma for my spend tracking for the last two years or so, and so you’ve got the benefit of this Emma app review having my experience of it over time.

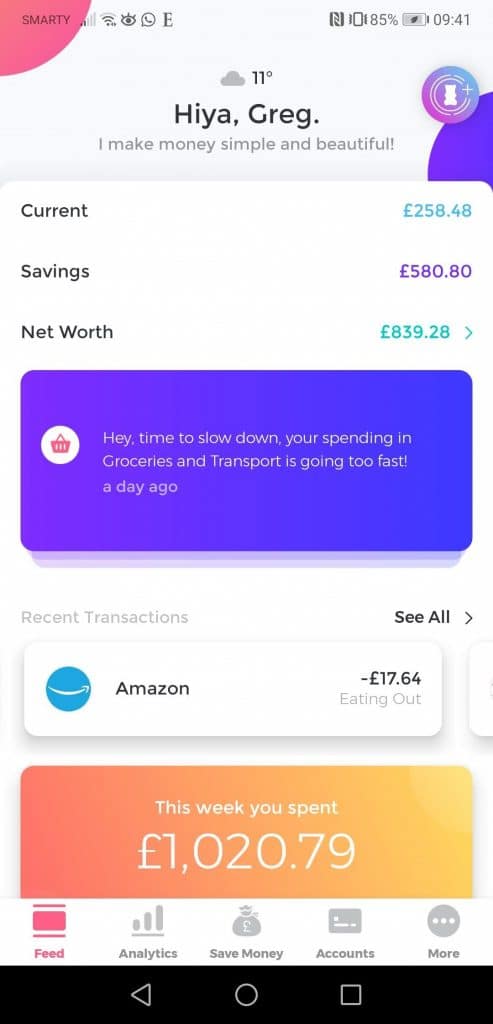

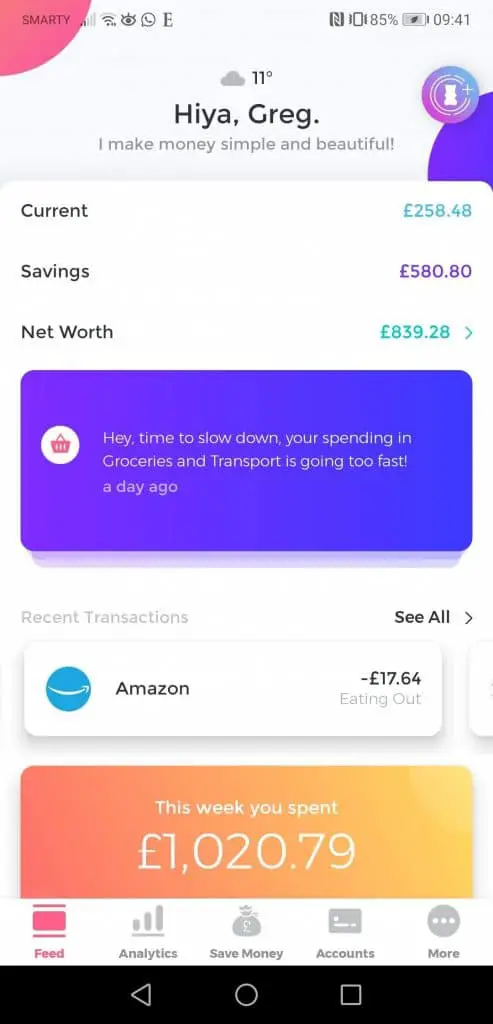

This is the homepage of the app when you first open it, giving you a snapshot of your finances:

Let’s jump straight into it…

How does it work?

The Emma app uses the Open Banking API to access your transaction data. This is a recent development in financial services in the UK, allowing fintech providers (like Emma) to access data, and therefore provide services, that they otherwise wouldn’t have been able to.

It is great for the likes of you or me because we have control over who has access to our financial data, rather than just remaining under the control of the bank you use.

For more information on Open Banking, this guide/explainer from Money Saving Expert is very useful.

What are the main features of the Emma app?

Connecting bank accounts

In order to track your expenses effectively, you need to have all of your transactions in one place.

Emma connects your bank accounts and imports your transactions automatically. This means you’ll have a complete view of your transactions easily.

This kind of feature is the bread and butter of money management apps, so Emma doesn’t change the world with this.

However, the experience of connecting your bank account is painless and quick, so it has a thumbs up from me here.

Automatic categorisation

This is one of the areas where Emma really shines.

Once the transactions are imported, they use their machine-learning algorithm to tag up the transaction to the most appropriate category.

Now this sounds like one of those techy buzzwords that doesn’t have any substance. However, with Emma you can really feel the benefit.

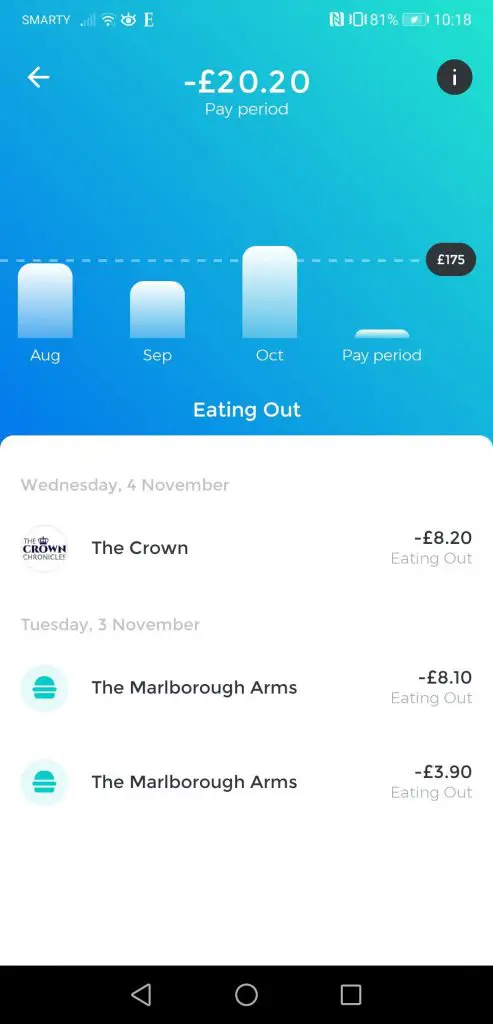

It tends to categorise your transactions fairly well on the first pass. For example, the below transactions for pubs have been tagged up correctly for me first time without me having to make any adjustments:

But if you want to change it, it will remember this and keep the tagging consistent for any future transactions.

For example (and don’t judge me on this example); if you bought a 12-pack of Gregg’s sausage rolls it might tag it up as “Eating Out” initially. But if you wanted it to fall under your “Groceries” budget then you can update it. This means that any new Gregg’s transactions should default to the “Groceries” categorisation for you.

Budget suggestions

I’m a proper budget nerd and can’t stop shouting about the benefits of budgeting.

However, Emma could provide an easy solution for those amongst you who don’t share my enthusiasm for budgeting.

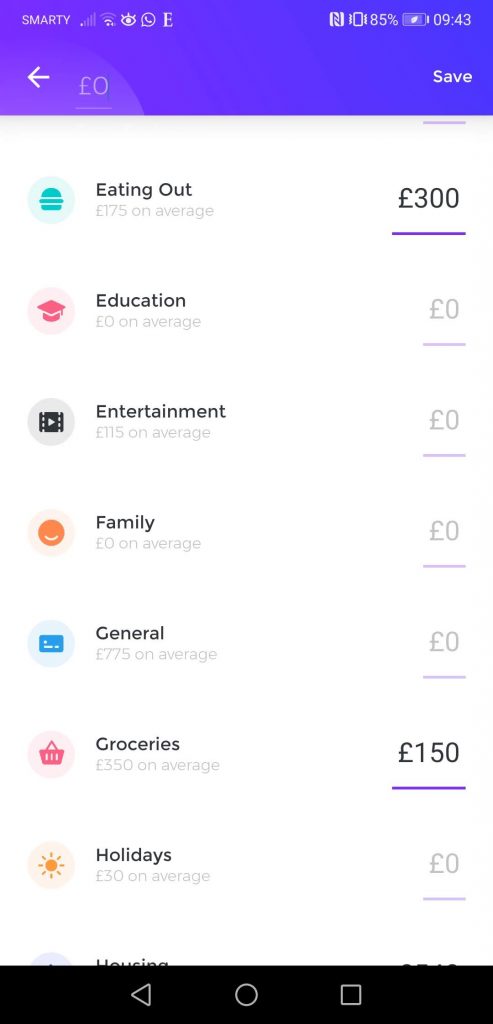

You can set your budget for various categories in the app, which you can track your spending against.

To help you whilst setting your budget, Emma provides you your average historic monthly spend. A handy benchmark which saves you time calculating it yourself with a trusty spreadsheet, which you can see below whilst setting my budget:

Do bear in mind though that your historic spending is just one benchmark that could and should be used. It would be great if Emma included external benchmarks or benchmarks based on demographics such as “this is the average weekly spend on groceries for someone similar to you (age/household composition/income)”. Maybe they’ll read this and build it in!

Budget updates

Once you’ve set your budget, you’ll receive coaching notifications to flag if you’re set to go over your budget for the month.

If you don’t check the app that often, it is a useful reminder of how you’re doing against your budget.

Although you might get some sassy notifications from the app which might be too judgmental for your liking.

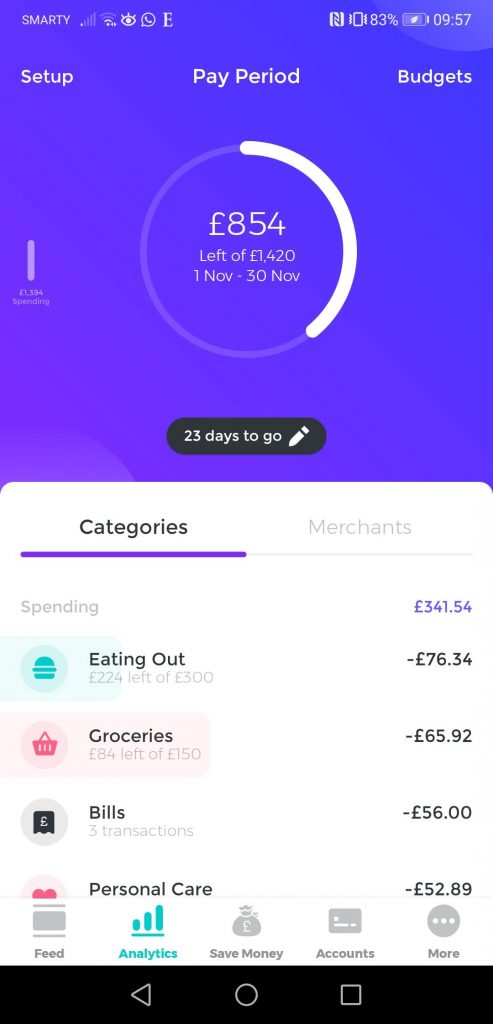

Other than the notifications, you can go into the app itself to track your performance against your budget on the “Analytics” tab, which looks like the below screenshot:

Fixing your budget to your payday cycle

This is a big selling point for Emma.

You can either run your budgeting cycle from payday to payday, or just a standard rolling monthly. You can see in the screenshot above that I’ve set mine based on payday.

This means I can easily see a snapshot of my finances and how much I have to last me until payday.

If you have irregular income or multiple paydays, then setting it to a rolling monthly budget works by just fixing your budget to the full month like you would normally expect.

Analytics

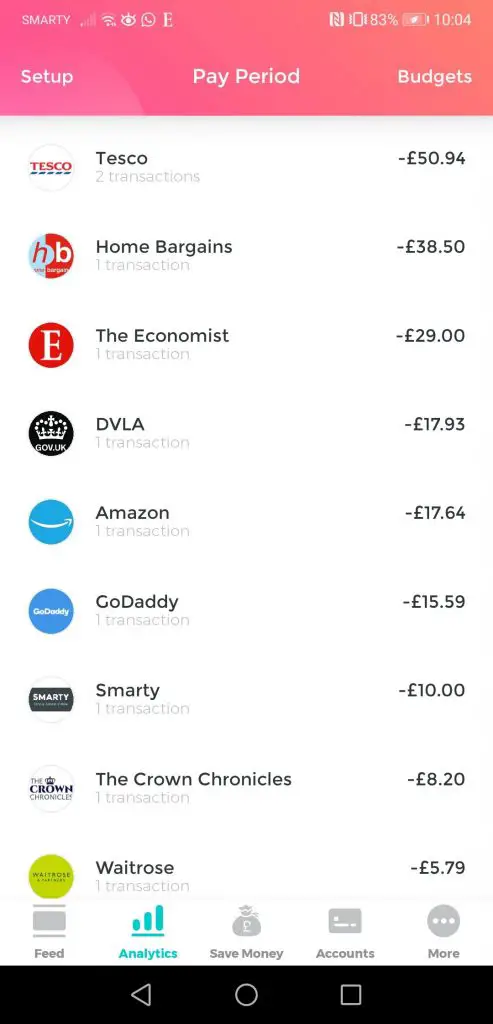

Wondering how much you’ve spent in Tesco over the last 6 months?

How about how much you’ve spent on Personal Care in the last year?

What about the amount you’ve spent in Wetherspoons over the last month? (ouch).

These are the kinds of questions that are an absolute breeze to answer within the Emma app.

You can track your spending in each period (payday or month) by category against your budget. Or by merchant, as you can see in the screen below.

Ability to exclude transactions

This is such a handy feature for dealing with “exceptions” or transfers.

Within the Emma app, you’re able to tag up a transaction to “Exclude” it, which keep it out of the tracking and it won’t count towards your budget.

This is ideal if you have had any exceptional expenses or income that you don’t want to be counted towards your standard budget.

For example, when I bought my car last year I excluded that transaction from my tracking so as not to skew my yearly travel expenses.

Automatically nets off transfers

In a similar vein to the above, Emma automatically recognises money moving between accounts and will net them off. This feature works only if you have both sides of the transfer set up. If you don’t, then simply exclude the transfer so it doesn’t count towards your budget.

This is normally a messy process if you need to do it manually via a spreadsheet, so is a really valuable feature that I was glad to see.

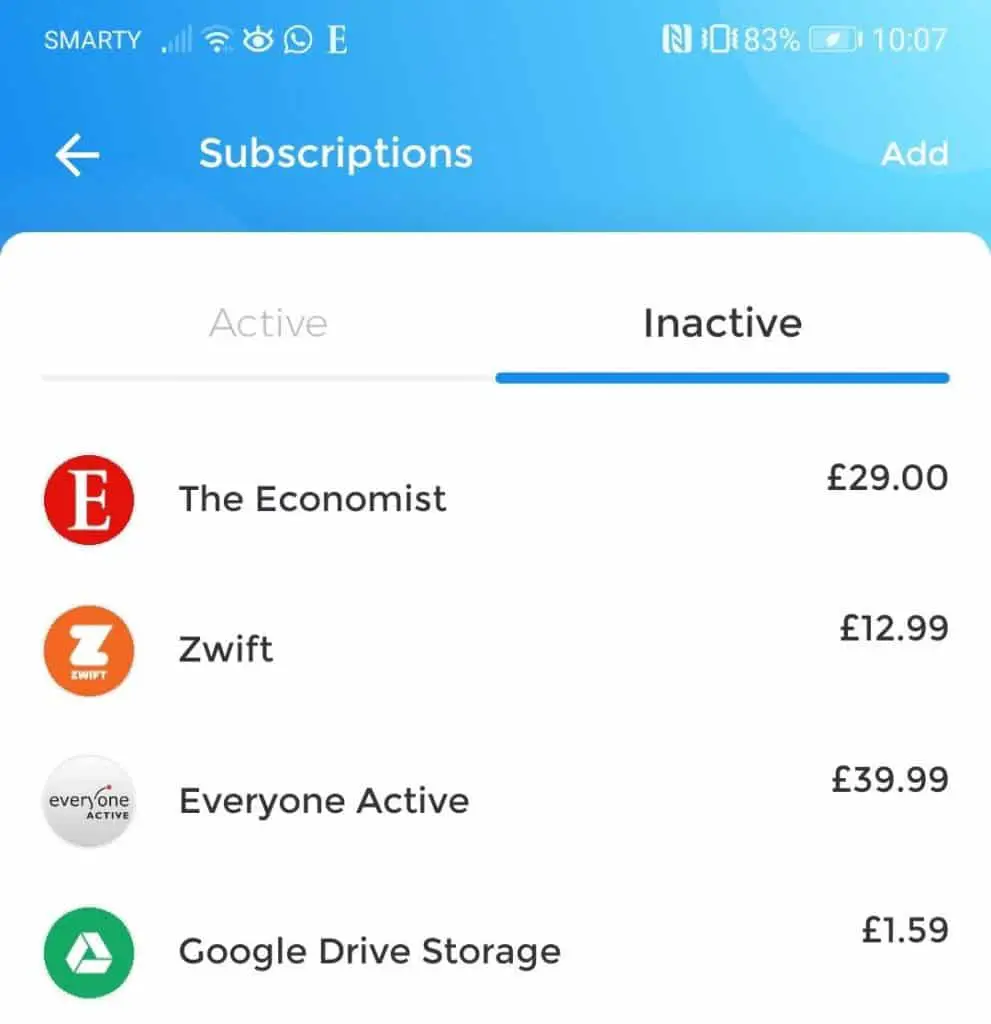

Manage subscriptions

I bet you lot are bored to death of hearing me bang on about recurring subscriptions.

It is such an easy place to make painless savings without changing your lifestyle.

Emma has a feature that tracks your recurring expenses and subscriptions which makes this a doddle. It is easy to run through your recurring expenses to spot any that you no longer use.

It will also alert you of any increases or decreases in these recurring expenses, once again allowing you to easily work out if this is wasteful spending.

A tick from me!

What bank accounts can be connected to the Emma app?

The Emma app uses the Open Banking API to connect to financial institutions, and it is an ever-growing list. You can get the most up to date listing on Emma’s site directly here.

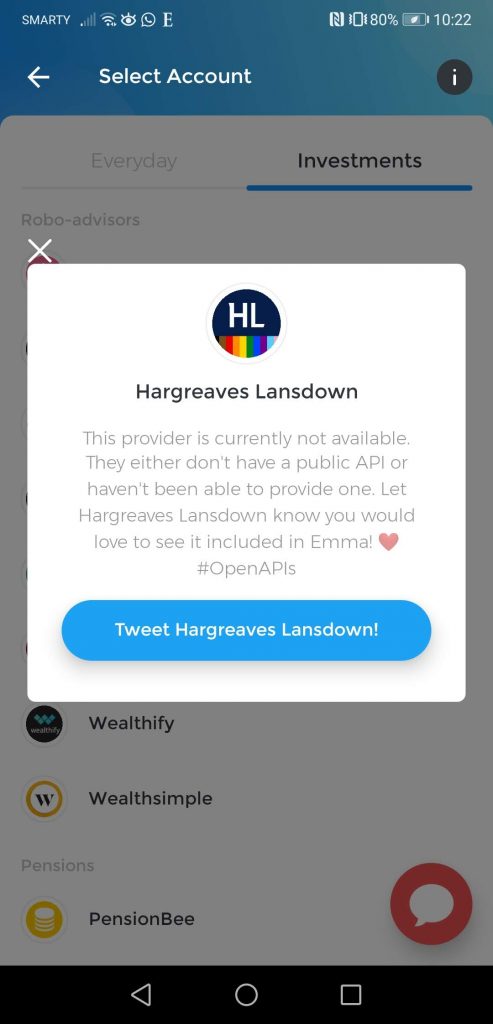

Most of the big banks are included, but there is still some way to go to get coverage on investment accounts if you want to use it as a net-worth tracker.

Banks

- American Express

- Bank of Scotland

- Barclays

- Barclaycard

- Capital One

- Chip

- Clydesdale Bank

- Danske Bank

- First Direct

- HSBC

- Halifax

- Lloyds Bank

- MBNA

- Marks & Spencer

- Monzo

- Nationwide Building Society

- NatWest

- PayPal

- Revolut

- Royal Bank of Scotland

- Sainsbury’s Bank

- Santander

- Starling

- TSB

- Tesco Bank

- TransferWise

- Ulster Bank

- Virgin Money

- Vanquis

- Yorkshire Bank

Investment Platforms

- Nutmeg

- Wealthsimple

Pensions

- PensionBee

Crypto Exchanges

- Binance

- Bitfinex

- Bitstamp

- Bittrex

- Coinbase

- Kraken

Crypto Wallets

- Bitcoin Wallet

- Ethereum Wallet

Is Emma safe and secure?

You might not be too comfortable with the idea of sharing your financial information with a 3rd party, and rightly so.

However, they utilise bank-grade security with only read-only access. This means that they never have access to make any changes to your account.

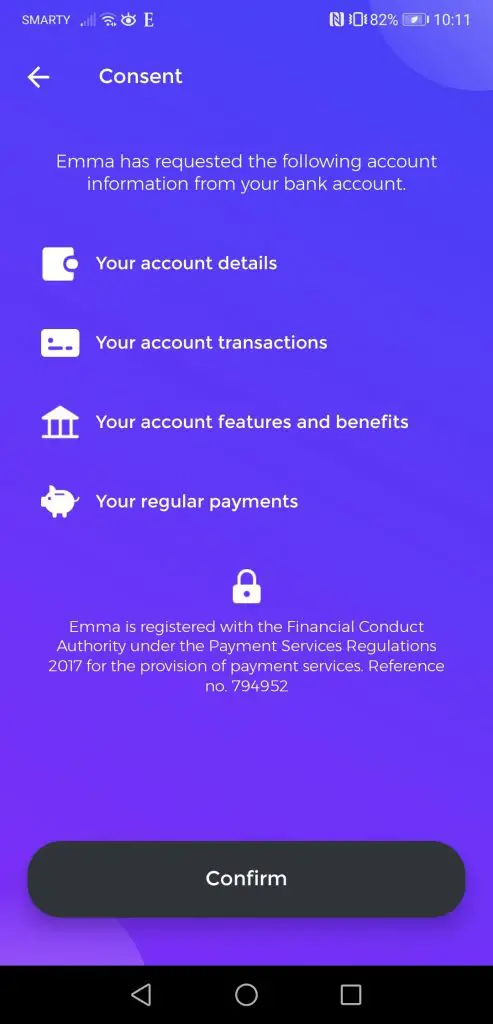

Whenever you are asked to connect your bank account, you are forwarded through to the relevant bank’s page to confirm the data you want to share, meaning that you never enter your details directly with Emma.

This has come a long way from pre- Open Banking when these kinds of apps (pre-Emma) actually asked for your login details to log in on your behalf. A much riskier proposition!

Below is an extract from their website:

The protection of your data is our highest priority. Emma uses state-of-the-art security measures when handling your information. All connections between your device, our servers and your banks are protected using TLS 256-bit encryption. When requesting statements from your financial institutions, bank-level security with read-only access is utilized. This means your login credentials are never stored on our servers, and we never have access to make any changes to your accounts.

Emma App

The benefit of being app-only using Android and iOS also means they have biometric security enabled. This is where you can use your fingerprint on your smartphone to unlock the app – which adds another level of security.

How does Emma make money?

The Emma app is monetised in two ways:

- Premium feature set called Emma Pro

- They have a “Save Money” feature to check for quotes on bills/utilities via the likes of USwitch and MoneySuperMarket which will give Emma an affiliate commission

Emma have confirmed that they do not sell any of the spending/financial data collected via its app (unlike competitors such as Money Dashboard).

What are the disadvantages of Emma?

Slow to update lots of different transactions

If you want to override any of the default categorisations, it has the potential to take a lot of time. Rather than select the transaction and changing category all without changing screens, you have to go through around 3 screens to make the changes which seem excessive to me.

This adds up to more time than it should be to update categories.

However, this setup works well if you want to recategorise all transactions from one vendor. You select one transaction, select the new category and then Emma will provide an option to update all of the vendors’ transactions to the new category in bulk.

Due to the strength of its algorithm, once you’ve set your preference by categorising old transactions you shouldn’t have to continue to do this and it will learn.

If you upgrade to the paid subscription, you’ll unlock the feature where you can update transaction categories faster without going through multiple screens. But in my opinion, this should be a standard feature.

Isn’t an automated net worth tracker

The homepage in the app provides you a view of your “net worth”. However, this is unlikely to be a full view as a lot of investment account providers are not currently available.

You can add accounts manually, but you need to be on the paid plan to do so.

However, the fact these investment companies haven’t activated Open Banking isn’t Emma’s fault, so they actively encourage users to tweet their provider to encourage them to activate this functionality.

But until then, and assuming you’re not manually inputting your balances, it isn’t an effective net worth tracker. But all other money tracker apps will be in the same boat on this, so if you want to track your net worth in the UK you’ll need to be prepared to do some manual work.

Some paid features I would expect to be standard

Exporting to CSV

Sometimes it is easier to export your transactions into a spreadsheet to run some more thorough analysis (if you’re a right keen bean like I am, anyway!).

Unfortunately in Emma this is a part of their premium feature set.

Custom categories

Being able to create custom categories to track against gives you the flexibility to use the app for your own situation. Even though I’m glad to see the feature is there, it is only part of their Emma Pro feature-set.

The “personality” might not be for everyone

Considering they’ve named the app “Emma” and have billed it as “your Best Financial Friend”, it is no surprise that the app speaks to you.

When you log in, you get little quotes on the home screen which depending on who you speak to is either a little cringe or really motivational.

For me, I find them a little strange but certainly not a reason not to use it. Some people don’t like it at all though, so for this Emma app review, I wanted to make sure you’re aware of what lies in wait if you do give the app a try!

For example, today I was greeted with; “Be unique and different, say yes”.

Be unique and different, say yes

Emma

Same with the visual design

The app has an almost child like design to it, with lots of curves and bright colours.

For clarity, the experience design of the app is very good. It is very easy to use and very intuitive. However, the visual design may not be to everyone’s tastes.

What are the advantages of Emma?

Algorithm

I must say, it is pretty smart when it comes to automatically tagging up your transactions.,

Most times it gets it right on the first pass, but if I go in and manually update to a different category then it will remember this for future transactions from the same vendor.

Analytics

It is easy to peel the onion back on your finances with Emma.

Going deeper than simple questions like “what is my groceries spending?” to more data-intensive questions like “which merchant do I spend the most with?” or “how has my groceries spend changed over time?”.

You can cut your data on all fronts, and the app is responsive and fast to provide the insights you need.

Notifications/coaching

If Emma thinks that you’re set to overshoot your budget due to your current spending patterns, you’ll get a notification telling you so!

Also within the app it will show you a card (the big blue section below) where it says you’re over or underspending.

Ease

The experience design of the app is very good. Everything is clear and it is intuitive to do most things.

What do you get with Emma Pro?

Emma has a paid-for premium feature set called Emma Pro. The price varies dependent on the country you are in, but is £4.99 per month in the UK with discounts if you pay yearly.

For this, you get:

Manual accounts: the ability to add manual accounts so you can track your net worth more accurately

Custom categories: allowing you to really fine tune your budget

Data export: allowing you to manipulate your data. Bearing in mind Emma aggregates your data from multiple sources this is actually a good time saver

Split transactions: assigning part of a transaction to one budget category and part to another

Advanced transaction editing: this means you can update transactions regardless of merchant, speeding up the sometimes painful process that I’ve experienced(!)

What is Emma best used for?

Tracking your spending against budgets.

It does this job exquisitely well, consolidating all of your accounts so you have a full picture of your spending. The algorithm categorises well, and it is easy to override if needed.

If you have the paid-for feature set, Emma Pro, then it is also a handy net worth tracker as you can bring in your other debt or investment accounts.

Who should use Emma?

Anyone who has access to a smartphone and wants to have an automated way of keeping track of their finances.

From the visual design it is clearly aimed at a younger audience, but due to its feature set, it is suitable for students, young professionals, families and retirees – as long as you have a smartphone and are fairly confident at using it.

The user experience is intuitive, if a little playful and child-like, so all ages should be able to navigate it fairly confidently.

How should Emma fit into your personal finance system?

Finding the tools, techniques and processes that work for you is really important to good money management.

Emma is a really handy tool to automatically and easily track your spending.

Once you already have a budget, set up Emma to make sure you’re on track (and to help stay on top of those pesky monthly subscriptions).

If you pay for the premium feature set, you’ll be able to also track your complete financial position including your net worth by including accounts that are not currently supported via Open Banking.

Do I use Emma myself?

Yes.

It fits into my own personal finance system exactly as described above.

I have already set up my budget, and use Emma to track my spending against my budget so I have a complete picture of where my money is going. On the day to day, I use my digital piggybanking method to make sure I stick to my budget (compartmentalising my cash into different accounts based on its use).

But tracking my spending on Emma helps me to dig into any areas where I’m overspending and keeps me on top of my subscriptions.

Mixed with decent tracking using Emma I tend to be across most of my spending and know when to rein it in or when I’ve got a bit of spare that I can spend.

What are people saying about the Emma money app?

On Trustpilot, the Emma app is currently rated 4.2 out of 5, with 36 reviews.

After scanning through the reviews, a few positive themes pop up:

- responsive customer service team

- receptive development team (pushing updates and improvements regularly)

- ease of consolidating/connecting accounts

- ability to stay on top of subscriptions

And of the 36 reviews, only 4 were rated as “Poor” or “Bad”, with the below being flagged:

- unable to link bank accounts

- even when cancelled weren’t able to get a refund (a quick note on this, normally you need to cancel your app subscriptions through the Google Play Store on your phone or via the App Store directly)

- the visuals/”personality” of the app with one user saying: “I think the tone of the weekly expenses is quite judgmental”

On Google Play Store, the Emma money app gets 4.4 out of 5 stars with over 3,000 reviews, and 4.7 on the App Store with over 4,000 reviews.

How do I get the Emma money management app?

Go to their website using this link to download the app and get tracking.

My verdict

My Emma app review is a strong 4.5 out of 5 stars.

Emma is a very helpful tool when you’re setting out improving your finances and one I wouldn’t hesitate to recommend – after all I use this app myself.

Having the ability to interrogate your spending and track yourself against your budget is a key part of having a healthy set of finances and Emma makes this job simple.

Even with a personality and visual design that might not appeal to everyone, you can’t fault the ease and intuitiveness of the app.

Although some paid-for features would have been great to see as standard features (advanced transaction editing, manual accounts and data exports).

Some other articles you might find useful:

I hope you enjoyed my Emma app review. I would love to know if you have used Emma before? Share your own Emma app review in the comments below and I’d love to know how you’re getting on.

The Big Bad Budget – My Top 5 Reasons Why You Need A Budget

Budgeting. The word alone has probably sent shivers down your spine. It is a strangely…

What is the Average Weekly Food Shop For 2 Adults UK?

With the current cost of living crisis in the United Kingdom, it makes sense to…

How to budget when you get paid weekly

With nearly 17% of jobs getting paid weekly, you’re certainly not alone in trying to…

What are the benefits of budgeting?

Even the word “budget” may evoke a deep-seated sense of fear, anxiety and loathing, but…

Is Saving Money Worth It? The Pros and Cons of Saving Your Hard-Earned Cash

Saving money is one of the most important things you can do for your financial…

Chip vs Moneybox: Which One Can Grow Your Wealth?

With some great innovation in financial services over the last few years, we’re comparing two…

How to deal with a financial emergency step by step: dealing with income loss

Life is predictably unpredictable. When a financial emergency strikes it might seem like the world…

Budget Like A Boss – What Does My Budgeting Process Look Like?

If you’ve decided you need a budget, most people tend to advise a very similar…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….

Pingback: Money Dashboard vs Emma? Does the underdog win? - Personal Profit

Pingback: Yolt Review UK (November 2020) - Does This Take The Throne?

Pingback: Yolt vs Emma - Which Spend Tracker App Should You Use?

Pingback: Money Dashboard Review UK 2020 - Will This Sort Out Your Finances?

Pingback: Yolt vs Money Dashboard vs Emma - The Comparison!

Pingback: Yolt vs Money Dashboard - Who Wins? | The Mindful Money Project

Pingback: 4 of the Best Budgeting Apps for Students in the UK 2020

Pingback: 3 of the Best Budgeting Apps for Young Adults in the UK

Pingback: Best Budgeting Apps for Families | The Mindful Money Project

Pingback: Snoop vs Yolt: Will These Help You Save Money?

Pingback: Plum vs Yolt: Which One Will Save You Cash? | The Mindful Money Project

Pingback: Wonderbill Review: A Tool To Finally Get On Top Of Your Bills?

Pingback: Best Spend Tracker App | The Mindful Money Project

Pingback: How to save £1000 in a month using the COST method

Pingback: How To Save For A House Deposit In A Year UK - How I Saved £20k+

Pingback: How I Paid Off £2,000 Debt and Saved £9,000 In Less Than One Year | The Mindful Money Project

Pingback: Snoop vs Money Dashboard | The Mindful Money Project