Using an app is a great way to automate your personal finances. Making your tracking a breeze and gleaning helpful insights. However, there is a fair chunk of choice in this area, so which app should you use? In this, I’ll pitch two of the biggest head to head; Yolt vs Emma.

Update: Yolt has announced they are closing down their service from 4th December 2021.

What is Yolt

Yolt is a money management app that connects your separate bank accounts so you can view and track your spending all in one place. Their aim is to “give everyone the power to be smart with their money”.

We believe that staying on top of your money shouldn’t be a hassle. That’s why we built Yolt with a fresh approach, smart insights and easy actions, so you can make the most of life.

Pauline Van Brakel – Yolt CPO

It is an ING Bank venture, meaning it has the support, funding and security know-how of a big retail bank.

Launched in the UK in 2017, the app boasted 500k users within its first 18 months, and have now expanded to Italy and France.

Yolt uses the Open Banking API to connect your bank accounts.

If you want a more in-depth analysis of Yolt as a standalone app, read my full Yolt review.

What is Emma

Emma is a budgeting and spend tracking app which helps you manage your money, using the Open Banking API.

The team at Emma bill “Emma” as your “Best Financial Friend” and is available on Android and iOS. Emma was set up in the UK in 2018 by two entrepreneurs who met at university. They’ve since secured $2.5m in seed funding earlier this year to help their expansion into the US and Canada.

I have been using Emma for my spend tracking for the last two years or so, and so you’ve got the benefit of this Emma app review having my experience of it over time.

If you want a more in-depth analysis of Emma as a standalone app, read my Emma review.

Yolt vs Emma – Let’s Start The Comparison

Connecting Bank Accounts

Both use the Open Banking API, and as such are both reliant on the financial institutions to have signed up to their plans.

Emma however, has a few more options including some investment accounts such as Wealthsimple , PensionBee and some alternative investment accounts such as Coinbase.

Further, Yolt has no option to add a manual offline account on its Android app (but it does on it’s iOS app). This feature is available within Emma, but only as part of its premium Emma Pro membership.

You can see the complete list of supported financial institutions on their respective websites below:

Categorising Transactions

Both Yolt and Emma automatically categorise your transactions, and both do a decent job. However, I found Emma the better here. There were less instances of me needing to change the category on the first pass and I found its machine-learning algorithm adapted to my preferred categorisations easily.

Further, Yolt has no ability to create a custom category. Emma does have this ability, but once again as part of its premium feature set.

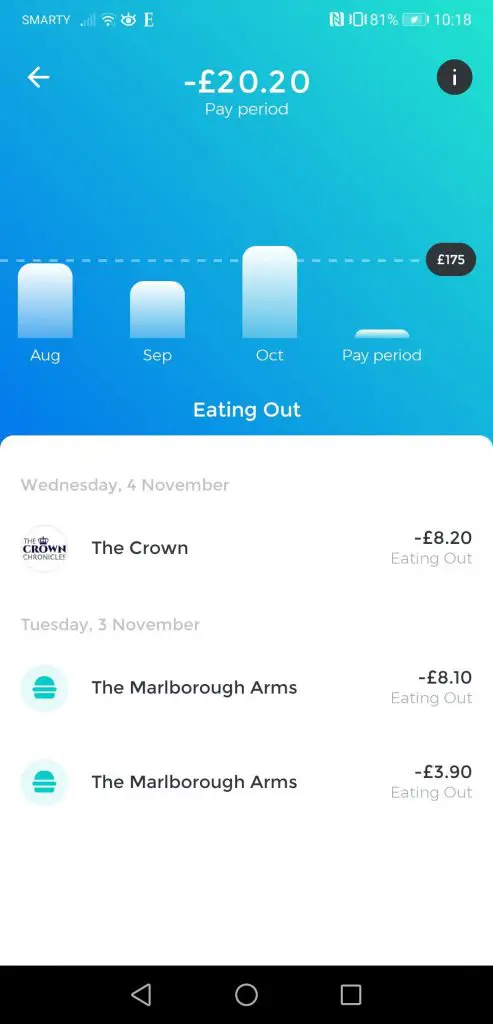

Analytics

Both perform well on this front. Both have a dashboard that surfaces some key insights such as your spending over the last week, as well as visualisations such as pie charts to see which spending categories are dominating, as well as spend over time.

They are also both intuitive in accessing this analytics data, so neck and neck on this front.

Budgets

Once again, the two apps are neck and neck here. You can easily set budgets for categories within the app and track your spending against these budgets.

Both apps also provide you with your average monthly spend that can be a helpful benchmark to check if your budget is realistic.

Payday Flexibility

Again a neck and neck tie. Both apps provide this feature, which allows you to set a custom period to report against rather than just a standard monthly period.

This is helpful if you get paid on a specific day of the month and want to track your budgets against that.

Subscription Tracking

Both apps have the ability to track your recurring expenses and subscriptions, and the ability to add transactions to the list if they haven’t picked it up automatically.

You’re also able to update the frequency of these recurring expenses as well as changing the predicted payments within the app.

Yolt just inches ahead here though because of the ability to enter the renewal date. This makes it a handy way to track the likes of your utilities, insurance and entertainment packages so that you can renegotiate cheaper rates (or cancel!) when they’re up for renewal.

Platform

Both Yolt and Emma are available on iOS and Android. No web-app is available for either.

Security/Privacy

Emma uses bank-grade security with read-only access via the Open Banking API. They are also regulated and authorised by the FCA.

Yolt is similar. As part of the ING Bank network, it is authorised and regulated by the FCA and utilises bank-grade security systems.

Monetisation

Both do not sell your data to third parties to generate revenue.

Emma makes its money via:

- A premium feature set in its Emma Pro membership

- Commissions if you sign up for a third party service via the app such as changing energy supplier or taking out a savings/investment account

Yolt makes its money via:

- Earning commissions if you choose a third party service via the app such as savings accounts, pensions management or an investment account

Price

Both Emma and Yolt are free to use. However, Emma has some features that are restricted to its premium plan called “Emma Pro”.

This comes in at £4.99 per month in the UK with discounts if you pay yearly (note these prices may change).

The Emma Pro feature set gives you access to the following features:

Manual accounts: the ability to add manual accounts so you can track your net worth more accurately

Custom categories: allowing you to really fine tune your budget

Data export: allowing you to manipulate your data. Bearing in mind Emma aggregates your data from multiple sources this is actually a good time saver

Split transactions: assigning part of a transaction to one budget category and part to another

Advanced transaction editing: this means you can update transactions regardless of merchant, speeding up the sometimes painful process that I’ve experienced(!)

Ease

Both are very intuitive and easy to use, no complaints from either of these on either their onboarding or their design. Everything that needs to be accessed is easy to get to.

Conclusion: Yolt vs Emma

As you can see from the above, there is a lot of points where they are neck and neck.

However, because of the additional accounts available on Emma, the better-automated categorisations and the availability of features such as custom categories (even if behind a paywall), I would recommend Emma as the better choice out of these two.

Other articles you might find helpful:

I hope this has helped you understand the ultimate showdown; Yolt vs Emma! If you have had experience with both apps, which one did you prefer? I would love to hear from you in the comments section below.

How to cancel The Economist subscription and stop it from auto-renewing

I always harp on about giving your finances a shot in the arm by cutting…

Plum vs Emma – Which One Will Help You Save Money?

Wish you could harness technology to help your finances? You’re in luck. Today we pit…

7 tips for how to stop living paycheck to paycheck

Lobster at the start of the month and baked beans at the end? Living month…

How to set up a budget in Google Sheets

The trusty spreadsheet is no longer dominated by Microsoft Excel. Google’s offering; Google Sheets, is…

How to deal with a financial emergency step by step: dealing with income loss

Life is predictably unpredictable. When a financial emergency strikes it might seem like the world…

Moneyfarm vs Vanguard: Lowest Fees On The Market?

Investing is the most impactful tool you have to reach an ambitious financial goal. Sometimes…

How To Cancel Gousto Subscription UK

Bored of the recipes or wanting to try a different provider and looking for instructions…

How To Cancel Wall Street Journal (WSJ) Subscription in the UK?

You’re looking to cancel your Wall Street Journal (otherwise known as WSJ) subscription in the…

How To Cancel Hellofresh Subscription UK

Bored of the meal kits or want to try a competitor? We get you. We’ve…

Pingback: Yolt vs Money Dashboard - Who Wins? | The Mindful Money Project