Staying on top of your own finances is a difficult enough task, yet add a partner and children, and you’ve got yourself a complex budget to manage! As with most other things nowadays, there are apps available to do some of the work for you. In this article, I’ll run through the best budgeting apps for families which can make your life easier. I’ve even included an app that can help teach your kids important money management skills.

What to look for in a budgeting app for families

Whenever anyone thinks of personal finance, they think of spend tracking. There are many types of budgeting tool you can use to track your spending, but a budget app is one of the easiest.

Having visibility of your household spend will help both of the household heads to manage your household spending and to assess your current spending habits to find areas you can improve. In order for you to pick the right budget app, I’ll be looking for the apps which have the key features below.

- Connect to bank accounts and credit card accounts to automatically track spending

- Ability to set budgets and track spend against them

- Creating custom categories

- Adding offline accounts (i.e to track your savings account so you can stay on top of your savings goal)

- Powerful insights

- Ability to sync between two devices (so you both have access)

- Available across multiple platforms (i.e Android and iOS) so you aren’t restricted. Access via the web would be a bonus

- Ability to login via multiple accounts (so you don’t have to use your partners’ login)

- Apps authorised by the Financial Conduct Authority to give further peace of mind

Do you also have some little ones? If you do, I’ll also take a look at some money management apps designed specifically for your kids. These aim to help your kids to learn how to manage their money.

A quick intro to Open Banking

The budgeting apps which connect to your bank accounts do so via the Open Banking API. Open Banking means that banks must let you share your financial data with other authorised providers, rather than them retaining exclusive control of it. If you’re sharing your data with an authorised 3rd party, then you’re protected too.

For more details, Money Saving Expert have done a great write up here.

Best budgeting apps for families

Money Dashboard – best for automatic spend tracking and insights

Honeydue – best for couples (not available in UK/Europe from April 2021)

Goodbudget – best for offline tracking

Emma – best spend tracker for independent teens

GoHenry – best for teaching money management to kids

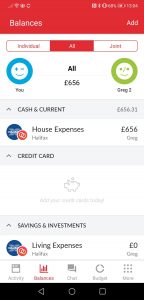

Money Dashboard

The team behind Money Dashboard are no strangers to providing a strong budgeting app for people from all walks of life, having won the 2018 British Bank award for best personal finance app.

They recently redesigned and relaunched a completely new version of their app called “Money Dashboard Neon”, which we will be discussing here.

The app boasts over 500,000 users and is available online (as a web app), as well as on iOS and Android.

Money Dashboard has a feature-packed offering, all available for free.

The good

- Connect your bank account (over 40 providers compatible)

- Automatically categorise transactions (and can customise the tagging rules)

- Can easily create custom categories

- Can add offline accounts (if your provider is not integrated)

- Has a powerful “Spending Plan” feature which shows your balance after bills, accounting for all of your bills and subscriptions

- Subscription tracker that helps you eliminate wasteful subscriptions

- FCA authorised and regulated

- Available on both iOS and Android but additionally on your browser as a web app

The bad

- No built-in solution designed specifically for couples

- No built-in solution to accommodate your children’s budgets

- Money Dashboard make money by using it’s users’ aggregated financial data to provide market research and insight to 3rd parties

Money Dashboard has some great features, but the support for household finances is currently a weak point.

The only current solution is connecting your joint bank accounts and sharing the same login to Money Dashboard in order to track your spending.

This means that you will both be able to see whichever banks you have connected. As a result, if you’ve connected some of your personal (i.e non-joint) accounts, then be aware that your partner will be able to see these too.

Currently, there is also no capability to add the same account twice (if you were thinking of creating separate Money Dashboard accounts for your personal bank accounts and then connecting your joint account into both separate accounts).

This is due to the Open Banking authorisation system. You can find out more on Money Dashboard’s advice for people wanting to share their account/access here.

Money Dashboard is free. But it is worth bearing in mind that they make money by recommending financial products, of which they take a commission if you take one. Further, they also sell market research and insight based on aggregated and anonymised data from their user base.

See related: Money dashboard review UK 2020

Honeydue

Honeydue is designed specifically for couples managing their money together. As a result, it has an ideal feature set for the parents in a family unit to manage their finances together.

The app Honeydue is the product of a company called WalletIQ Inc which is based in San Francisco in the US. They launched the app in 2017 to help their friends and family to develop better financial literacy and habits.

Even though Honeydue used to provide their full service to UK and European users, from April 2021 they stopped doing this so the app is only available to those of you based in the US.

The good

- Ability to connect bank accounts

- Specify whether accounts are joint or single and whether you want these accounts to be shared with your partner or not

- Invite your partner to view your joint accounts with their own account (their own email address and password within Honeydue)

- Set budgets and track spending against these categories

- Can create custom categories

- Can add manual/offline accounts to track any loans or investments you cannot connect automatically

- Set bill reminders

- Query transactions with your partner within the app

- Available on iOS and Android

- In-app messaging system to tag up transactions or ask for more information from your partner

The bad

- No web app for access via the browser

- Not as many investments accounts available to connect as either Money Dashboard or Emma at the moment

- Insight/analytics not as powerful compared to Money Dashboard and Emma

- Slower to update transactions compared to Money Dashboard and Emma

- No longer available in the UK and Europe

An app designed specifically for couples managing their finances. Honeydue will help you both to explore your finances whilst keeping your logins separate and only sharing banking data that you want to share.

Goodbudget

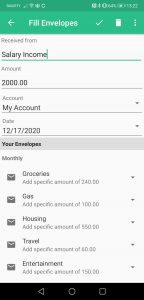

Started in 2009 as a virtual envelope system it has developed into a well put together app along with reams of educational content concerning budgeting.

Wondering what the envelope system is? The envelope system is very simply:

- defining a budget per category such as “eating out”, “date night” or “groceries”

- tracking your spend against that budget

- when your envelope is empty, stop your spending

The envelope method is great because it provides you with a quick and easy view of how much budget you have left in the month. This should allow you to slow down your spending if you need to.

I used the envelope method to great effect when I was in university. I can vouch for its effectiveness as it was the only method that allowed me to keep within my budget!

Rather than having physical envelopes full of cash, in Goodbudget you plan your spend by creating virtual “envelopes” for each of your spend categories (such as eating out, groceries, transport etc). You can then track your spending against these planned amounts.

Goodbudget does not automatically connect to your bank accounts, unlike most of the other apps in this article. This may or may not be a good thing dependent on your opinion on connecting your accounts to 3rd party apps.

The good

- Can set budgets (via envelopes) and track spend against these

- Helpful analytics tab splitting your spend by envelope, versus income and over time

- Available on iOS, Android and through your browser as a web app

- Syncs between devices

- As no bank account connection, you can share easily with your partner using your household account login

- Loads of content and educational courses with budgeting tips, how-to’s and methods

The bad

- Can’t connect your bank account to automatically pull through transactions

- Can only get 10 monthly envelopes (+ 10 more annual envelopes) on the free plan, you need to sign up to the “Plus” account to unlock unlimited envelopes for $7 per month (or $60 annually)

- Entering transactions manually will take time

For people who don’t want their bank accounts connected to 3rd party apps, Goodbudget is a good compromise. As long as you are diligent with entering your transactions, you’ll have visibility on your spend. This manual process will also force you to engage more mindfully in your spending. This teamed with the envelope method of budgeting that this app encourages should set your household finances up well to smash your financial goals!

See related: How to budget salary wisely – 4 methods to make you budget-wise (including a shout-out for the physical and digital envelope method)

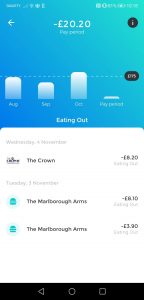

Emma

The team at Emma bill “her” as your “best financial friend”, allowing you to avoid overdrafts, find wasteful subscriptions and giving you the control you need over your finances.

Emma is a budgeting and spend tracking app which you can use to connect to your bank accounts via the Open Banking API.

The good

- Intuitive and friendly design

- Able to connect to many different banks, credit cards and even some investments accounts

- Set budgets and track spend against each

- Ability to flex your monthly cycle based on payday rather than calendar month

- Pretty and insightful analytics

- Coaching notifications (“slow down your spending!”)

- Available across both iOS and Android

- Authorised and regulated by the Financial Conduct Authority

The bad

- Some premium features are available for free on Money Dashboard (such as custom categories, exporting to CSV and offline accounts)

- No web app available

- No specific feature-set designed for couples

The personality of the app shines through, with helpful coaching notifications and insights provided throughout the app. Although I must admit I’m not sure I want to know that my spending at Greggs is in the top 0.01% of their users (gulp).

As with Money Dashboard, there are no specific features built to accommodate couples using the app. You will, however, be able to access the app using the same login. Just bear in mind that all accounts visible in the Emma app will also be visible to your partner if you share your login details with them.

Emma really shines compared to the competition with its personality, visual design, ease of use, coaching notifications and insightful analytics dashboards. They even run regular quizzes where cash prizes are up for grabs, as well as “quests” which are an attempt to gamify personal finance.

If you want to access some premium features, you’ll need to subscribe to Emma Pro. Some premium features include the ability to add offline accounts and to create new custom categories.

For transparency, both of these features are available in Money Dashboard for free. But it is worth noting that Money Dashboard uses your spending data to sell market research and insight services to 3rd parties (all data is aggregated and anonymised so not personally identifiable), whereas Emma doesn’t monetise in that way. Emma makes its money through the premium feature set and by earning a commission on any financial products you take out via its app.

See related: Emma app review – is it the best spend tracker out there?

Bonus: GoHenry

GoHenry are different to the apps we have discussed above. Whereas the other apps are all related to simply budgeting and spend tracking, GoHenry is designed specifically to educate your children how to manage their money.

Launched in 2012, and now boasting over 1m members in the UK and America, GoHenry have been named by KPMG and H2 Ventures as one of the world’s Leading 100 Fintech Innovators and have ranked 8th fastest-growing British tech business in the Sunday Times TechTrack100 too.

With the name inspired by their first ever customer, the product was built out of collective frustration as parents who wanted a simple, meaningful and common-sense solution for kids’ money management.

How does it work?

There’s an account for you, and linked accounts for each of your kids. Your children get their own GoHenry debit cards, which come with unique parental controls. There is no risk of debt or overdrawn accounts as they can only spend the money that is on the card.

The features

- iOS and Android app for both you to manage and your kids to see their balances (web app also available)

- Parental controls so you can choose where the card is used as well as being able to block/unblock when you need to

- Set up automatic weekly pocket money

- Can make one-off transfers if your child completes tasks (helping them to earn extra)

- Set spending limits

- Get notifications about what your child is buying in real-time

The service has one month free, after which you will pay £2.99 per month per child.

If you want to help your kids to learn to manage their money responsibly through doing, take a look at GoHenry following the button below.

Conclusion

Staying on top of your finances when there are multiple people managing the household’s money is hard. Then adding in the complexity of little ones and it is no wonder people are turning to apps to help do some of the heavy lifting!

Not all apps are perfect for everyone though. Even though I’ve put together a list of the best budgeting apps for families, don’t feel like you can only pick one.

Experiment with them until you find one which resonates with the way you think and work.

Money Dashboard

Due to the great free feature-set and cross-device compatibility, I would recommend this for the adults of a household who want to really dive deep into their budgets and spending.

Honeydue

The only app in my roundup which was designed specifically for couples managing their finances, this is great if you want to be able to manage your personal accounts alongside your joint accounts as you can specify what they can or cannot see. Your partner gets their own login/account, and so you never need to share details.

Goodbudget

If you’re sceptical about connecting a 3rd party app to your banking data, then Goodbudget is for you. No banking connections required. Using the time tested envelope method of budgeting, if you’ve ever had problems actually sticking to a budget, try this one.

Emma

Another brilliant spend tracking app. Due to the personality, coaching and ease of use, this app is best suited for the teenagers and young adults of the family who don’t want the level of monitoring from their parents that the GoHenry solution offers. This can be seen as the natural next step for them, providing them with the independence they crave.

GoHenry

This has to be included on a list of the best budgeting apps for families. Even though it isn’t aimed at helping you manage your household finances, it enables your kids to learn about managing their money effectively. All whilst under the watchful eye of yourself.

Have you found any of these apps helpful in managing your households finances in the past? If you’ve used any other apps and had success with them, I’d love to include them in my roundup of the best budgeting apps for families, so make sure you drop a comment below or send me an email 🙂

How to cancel The Economist subscription and stop it from auto-renewing

I always harp on about giving your finances a shot in the arm by cutting…

Wealthify vs Hargreaves Lansdown

Investing in the stock market used to be an inaccessible world full of jargon, stockbrokers…

How To Cancel Stitch Fix UK

Giving your finances a trim is a great idea to save some easy money. Looking…

3 of the Best Budgeting Apps for Young Adults in the UK

As a young adult with a wealth of opportunity ahead of you, I salute you…

Are Money Saving Apps Safe?

Ah apps. Love them or hate them, they are an increasingly important part of our…

Budget Like A Boss – What Does My Budgeting Process Look Like?

If you’ve decided you need a budget, most people tend to advise a very similar…

Personal Profit is now The Mindful Money Project!

Hello there good reader! I’m proud to announce that I have re-branded my site. No…

What Is A Good Percentage To Save From Your Paycheck?

Unsure of what “good” looks like when it comes to saving from your paycheck? You’re…

Yolt vs Money Dashboard – Who Wins?

We have an app for everything nowadays. Using an app can remove the heavy lifting…