You’re not alone. Living with debt has become a common issue for people in the UK, with The Office for National Statistics data showing the average household has £2,204 of credit card debt alone, with the annual interest payments on debts gobbling up 3% of average earnings. The fact you’re here shows you want to improve your situation. Which is where I can help. Today, I’ve got 17 actionable tips on how to pay off debt faster.

- Tips on How to Pay Off Debt Faster

- 1. Understand your current situation

- 2. Prioritise your debt

- 3. Refinance your debt

- 4. Pay more than the minimum on the highest priority debt

- 5. Build a budget that challenges you

- 6. Stop taking out new debt

- 7. Develop a method to stick to your budget

- 8. Boost income

- 9. Sell old belongings

- 10. Get brutal on your subscriptions

- 11. Renegotiate your bills regularly

- 12. Ditch the phone contract

- 13. Drop the impulse purchases

- 14. Use a round-up app to eek out a few more savings

- 15. Become a frugal king/queen

- 16. Prioritise debt repayment over an emergency fund

- 17. Seek help if it is needed

- Conclusion: Tips on How to Pay Off Debt Faster

Tips on How to Pay Off Debt Faster

1. Understand your current situation

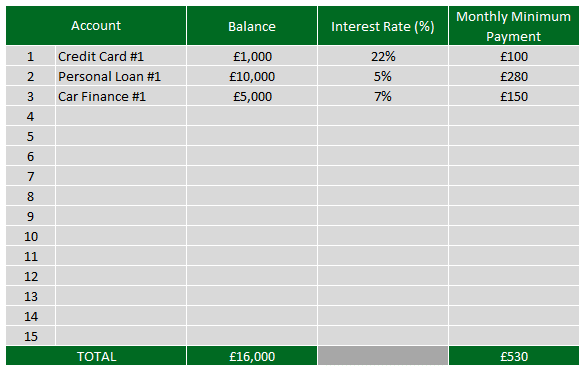

First, you need to make sure you are fully aware of your situation. You want to be able to answer questions such as:

- How much debt do I have?

- How many accounts is it spread across?

- What is the interest rate per account?

- What is the minimum payment needed on each account?

Even though this is very likely to be an emotional and uncomfortable process, it is important. It will allow you to finally visualise “the beast”. Once you can see it, you can work through finding a solution much more effectively.

Without it you’re essentially driving a car blind.

Try to take the emotion out of the process. This is the start of your journey and what has happened up until now doesn’t dictate how you will act from now on. Now is the time that you can change your future, by confronting your present.

I’ve prepared a template debt schedule you can use to capture all of the key bits of information you need to tackle your debt. You can download my template here.

2. Prioritise your debt

Understanding the different strategies to pay off debt will go some way to help you in your journey.

There are two main ways:

- Debt avalanche. This is when you pay off the debt with the highest interest rate first

- Debt snowball. This is when you pay off the smallest balance first

The most efficient (aka cheapest) way to pay off your debt is by using the debt avalanche method.

This will mean that you are paying off the most expensive debt first, resulting in less overall interest being paid.

However, you might find that keeping the momentum of paying off smaller balances will motivate you to go further and faster.

3. Refinance your debt

If you can reduce the cost of your debt, you will incur lower interest charges, more of your money will be spent on reducing the principal, and you will be out of debt faster.

This is a really powerful way of reducing the time it takes for you to get out of debt.

A few examples of how you could achieve a lower rate:

- Taking out a balance transfer credit card and moving your balances over to this card

- Using a debt consolidation loan (assuming the rate is lower than your others)

- Remortgaging and using the extra funds to pay off your other debt (remortgaging tends to come with other costs and fees so make sure you’ve run the maths first to make sure it is worth it)

Now you should have:

- Visibility of your debt (via your debt schedule)

- A strategy to repay your debt (e.g. debt avalanche)

- Have your debt on the cheapest rate you can get

4. Pay more than the minimum on the highest priority debt

You’ll know the debt that is most important to pay off first from your debt schedule. It’ll be the one that has the highest interest rate if you’re using the debt avalanche method.

But to pay this debt off fast, you need to pay more than the minimum.

In fact, any additional payment you can make will both reduce the amount you pay in interest as well as reducing the time it takes for you to pay it off.

Keep all of your other debts at the minimum repayment whilst you’re focusing any overpayments on the priority debt.

This will ensure you don’t incur any late payment fees, credit score declines or additional penalties by not keeping up with your other debts. But it does allow you to focus on the highest priority.

You’ll need to find additional cash to overpay, which this next suite of tips can help with.

5. Build a budget that challenges you

Similarly to building out the debt schedule, it is hard to know how much you have each month to overpay your debt if you don’t know how much you earn or spend in a typical month.

Building a budget (and then sticking with it) will help you to answer the questions:

- “How much do I spend and earn each month?”

- “By how much can I overpay my debts each month?”

To create a budget;

- List your average income (you can look at your last 6-12 months’ worth of transactions to pull out the monthly average)

- List your average expenses (once again, 6-12 months’ worth will give you a good idea)

Then for each category set a budget that challenges you. If you’ve historically spent £400 per month on your food shopping, try seeing if you can hit £300.

For your debt repayments only include the minimum repayments amount in your budget. Remember, we’re trying to answer “by how much can I overpay my debts each month?”, so we need to know what you have leftover after you take off your minimum repayments and your budgeted expenses.

At the end of this process, you’ll have the difference between your income, less your budgeted expenses, less your minimum debt repayments.

Hopefully this is a positive number. This is the amount with which you can overpay your debt with.

6. Stop taking out new debt

If you’re trying to overpay your existing debt, then taking on new debt will pull the brakes on your efforts.

It’s almost as if you are pumping out water from the bath whilst you’ve still got the taps on.

Try your best to budget realistically so you aren’t caught out with any overspend.

7. Develop a method to stick to your budget

Building a budget is a really helpful step to managing your finances effectively. But the next step (and the one I find the damn hardest!), is to stick to your budget.

There are a few ways that you can stick to your budget. As everyone is different, not all of these will work for you. But hopefully one will resonate with you:

Envelope method. Take your weekly budgeted spend for items like groceries, entertainment and transport out in cash. Deposit these within a physical envelope marked up with the category. This acts as an immediate feedback loop to work out whether you are over or under spending.

Digital envelope method. Transfer your spending for the likes of the same categories (groceries, entertainment etc) into a separate bank account each week. Only take that card shopping and leave all of your others at home. Similar advantages, but a more modern approach.

Tracking your spending. Using a spend-tracker/budgeting app like Emma or Money Dashboard will give you a snapshot of how you are spending compared to your budget. You can then rein in your spending as required.

The above are really helpful to stay on top of your spending in areas that require more discipline and consistency, such as:

- groceries

- entertainment

- eating out

- travel

- subscriptions

Whereas, you want to make sure that you are prioritising your “need” type expenses, such as:

- housing

- utilities

- bills

To do this, I’ve had a lot of success using the digital envelope method above. These payments tend to be stable from month to month. Therefore, I transfer my budgeted amount into a separate current account each month. This account has direct debits/standing orders set up with which my housing/utilities/bills are all paid from.

8. Boost income

If you’re struggling to squeeze any additional cash flow from your current situation and already stick to a lean budget, then boosting your income is your best bet.

All of this additional income can be used to overpay your debt.

You could boost your income by:

- taking on a part-time job alongside your current job

- ask for a raise

- position yourself for a promotion

- use a skill you have developed to freelance (picking up clients on a platform like Upwork for example)

- matched betting

- sell crafts you make on Etsy

If you do take on a side hustle such as freelancing or selling crafts, you’ll need to make sure you’ve registered for self-employment on the gov.uk website. It will also pay to keep a portion of your profits kept to one side for the future tax payments.

Note, even though matched betting is risk-free if done correctly, it is still counted as gambling income and is therefore tax free in the UK.

9. Sell old belongings

If you’re anything like me, you’ll find yourself surrounded by tat within a couple of years without a clear out.

Surprisingly, some of this tat is worth a few bob if you sell it on. This could give you a good one-off windfall that you can use to

You can list your items for sale on platforms such as eBay, Gumtree or even the Facebook Marketplace.

Some ideas for things to sell:

- old clothes

- CDs

- DVDs

- games (Xbox, Playstation, PC etc)

- Vinyl

- Instruments

- Old phones

- Unused furniture

- Exercise/gym equipment

10. Get brutal on your subscriptions

For any of you who are regular readers of my articles, you’ll know I have a vendetta against subscriptions.

You know the ones; Netflix, Amazon Prime, magazine subscriptions, gym subscriptions, Disney+, media packages etc etc.

Boosting your monthly cashflow will mean more money to overpay your debts. More overpayments = quicker debt-free status! In my mind, being debt-free is definitely worth the short-term sacrifice of no Netflix etc.

If you stripped these all back, you’d likely save >£100 per month. If you’re also cutting back on your gym subscription and media packages you could easily save more than £100 per month on those alone.

This means £1,200 per year!

11. Renegotiate your bills regularly

Jump onto Money Super Market and do a price comparison of your energy and heating bills at least annually. I recently managed to save £50 a year for simply moving to paying by direct debit instead of bank transfer(!).

Areas to look for cheaper deals:

- heating

- energy

- car insurance

- home insurance

- media packages

- telephone/internet

I’ve got a more detailed article on easy and painless ways to save money, of which renegotiating existing bills is a big one!

12. Ditch the phone contract

Rather than automatically upgrading to the newest model at the earliest you can, try moving to a sim-only plan.

Keep your existing headset until it literally dies or is unusable.

So many smartphones that are being manufactured now will last for longer than the two years of a typical contract.

This could easily save you anywhere between £20-50 per month. That’s £600 per year you could be overpaying your debt with!

13. Drop the impulse purchases

The impulse purchase is the lifeblood of retailers but the death knell of almost anyones budget.

If you find yourself coming in over budget regularly, impulse purchases may be at the nub of it.

To avoid impulse buying;

- only go shopping when you need something

- don’t put yourself in positions where you’re browsing for “fun” or out of boredom – stay off the websites and don’t wander the shopping mall

- only take the cash for what you need – you can’t spend more than your budget if that is all you have in actual cash

- put at least a week between you wanting something and you buying something – putting the time between takes emotion out of the equation and you might decide you don’t want it after all

I’ve got more tips on how to avoid impulse purchasing here.

14. Use a round-up app to eek out a few more savings

Newer financial technology start-ups such as Monzo or Moneybox have come up with clever ways to help you save.

They both have a “round-up” feature which will round-up your purchase to the nearest pound, taking the difference and putting it away in a savings account.

The round-ups are so small you won’t even notice, but they do add up by a surprising amount.

You could then take the saved up roundups and use it to overpay your debt at the end of each month.

15. Become a frugal king/queen

There are bound to be expensive habits, preferences or hobbies that are not actually giving you what you ultimately want.

For almost anything, there will be a frugal alternative.

These don’t have to be forever either, but can be short-term cut backs in order to accelerate your debt repayment and build the momentum you need to become debt-free.

For example, how about swapping the expensive gym membership for running, cycling and bodyweight HIIT workouts using youtube as your coach?

I don’t want to be too cliche, but those damn daily lattes are holding you back! Haha look if you really enjoy it then I’m not hear to tell you otherwise. But critically evaluating your spending habits, at least once, is an important way to sense check that what you’re doing is in line with your goals.

If you’re in debt and struggling to generate positive cash flow each month to overpay your debt, does it then make sense that you’re going out for fancy meals, grabbing daily baguettes from the delicatessen or going to a £150/month gym?

I would caveat though with there is a limit. Have an eye on the big picture. Sinking 5 hours into making a saving of £10 is not a good use of your time.

Some great resources for money saving ideas:

16. Prioritise debt repayment over an emergency fund

This might be a bit controversial for some people.

To pay debt off fast, you want to be using as much of your positive cashflow to overpay your debts.

However, not having any emergency fund opens you up to any setbacks or unexpected expenses which will likely result in you taking out additional debt.

Therefore, I would recommend building up a very small emergency fund of either £1,000 or 1 months’ worth of expenses.

From there, any additional positive cashflow you generate should all go into paying off your debt in the order you have already worked out in #2.

This means that you minimise the amount of interest you are incurring on your debt.

You can find out my more detailed article on whether you should build an emergency fund or pay off debt here.

17. Seek help if it is needed

If you have been struggling with debt for a long time and/or you are struggling to meet the minimum repayments, then there might be bigger solutions available to you.

Professionals who specialise in debt management and counselling will be able to help you work through your situation and provide a tailored plan to get you there.

Rather than just providing tips on how to pay off debt faster, they’ll be able to tailor advice to you as well as an action plan and solution.

There are plenty of free debt advisor services available. These debt advisors are trained and non-judgmental, so don’t feel ashamed or scared of reaching out to them.

The Money Advice Service provides a helpful roundup of the best free debt advice services in your area. Most of these will likely be charities, so you can be sure that they are not profiting from your situation.

Conclusion: Tips on How to Pay Off Debt Faster

Lots of people are living with debt currently in the UK. Even though it is an uncomfortable thing to do, the first step to reducing your debt is to get visibility of your current situation. From there, you can start to create a plan and a strategy, by prioritising your debts, reducing the cost of your debt where you can, and building yourself a budget which will challenge and stretch you.

Once you pick up some momentum, you’ll likely want to lean into the process further. Making further changes which generate positive cashflow which you can use to overpay your debt with. This will make the flywheel turn faster as you incur fewer interest expenses, which means you can pay your debt off faster.

I would love to hear any tips on how to pay off debt faster that you may have had success with in the past or currently. Drop a comment in the comments below!

How To Cancel NFL Game Pass UK

Looking to trim back your subscriptions? Good on ya! In this article, we’ve pulled out…

Moneyfarm vs Nutmeg – The Battle of the Robo Advisors

Looking to invest to reach your financial goals? Fortunately investing nowadays is much more accessible…

How to deal with an unexpected expense

This always seems to be the way of the world – you’ve managed to get…

Snoop vs Emma: Which Is Best?

Ever had the joy of tagging up your monthly bank statements manually in a spreadsheet?…

What are the benefits of budgeting?

Even the word “budget” may evoke a deep-seated sense of fear, anxiety and loathing, but…

Is Saving £1000 a Month Good?

Saving £1000 a month is quite an iconic milestone for many of us. A big…

7 tips for how to stop living paycheck to paycheck

Lobster at the start of the month and baked beans at the end? Living month…

How to Save Money Fast in the UK – 13 Easy Wins You Can Implement TODAY

Found yourself in a squeeze and looking to shoot rocket fuel into your personal finances?…

Is Saving Money Worth It? The Pros and Cons of Saving Your Hard-Earned Cash

Saving money is one of the most important things you can do for your financial…

Pingback: Does PayPal Credit Affect Credit Score? | The Mindful Money Project

Pingback: How I Paid Off £2,000 Debt and Saved £9,000 In Less Than One Year | The Mindful Money Project

Pingback: How Big Should My Emergency Fund Be? | The Mindful Money Project