Ever had the joy of tagging up your monthly bank statements manually in a spreadsheet? Believe it or not this is how I used to stay on top of my finances before all of these money apps came along. It meant I didn’t do it as much as I should have. Now, however, I’m spoilt for choice. In today’s article, I compare two of the apps available; Snoop vs Emma.

This post may contain affiliate links (any links we earn commission on if you go on to make a purchase are marked with an * asterisk). These do not influence our editorial content and we remain independent. If you would prefer to use a non-affiliate link, there are some at the bottom of the post.

Quick summary

Emma* is a budgeting and spend tracking app. This is where it excels and can’t (yet) be beaten.

Snoop* is a money saving, bill-optimising app. It specialises in keeping you on top of your regular payments such as energy, insurance, telephone, broadband etc. An area where Emma is not as strong.

As a result, they are extremely complementary. For this, I’m going to go a bit off-piste and recommend you use both. This will ensure all angles are covered.

Emma Summary

Recommended for: spend tracking and budgeting

Platforms: iOS and Android

The good:

- weekly insights report

- useful analytics

- intuitive design and easy to use

- weekly quiz (with prize money up for grabs)

The bad:

- need a subscription for some features

- the personality/design might not be to everyone’s taste

- subscriptions tracker not as good as Snoop’s

Summary

As a budgeting and spend tracker app, you can’t do much better than this. Emma is well designed, intuitive and a delight to use. You can connect a wide array of providers, including some investment accounts, and automatically aggregate and categorise transactions. The in-app tagging algorithm is the smartest I have used, ensuring you don’t need to manually override that often.

Snoop Summary

Recommended for: keeping on top of your regular payments and bills

Platforms: iOS and Android

The good:

- the contextual tips and tricks from Snoop help to save money on your spending

- the Payments Hub feature helps you stay on top of regular bills and subscriptions

- Can switch provider within the app

The bad:

- poor budgeting capability

Summary

With a delightful little robot acting as your own financial coach, Snoop is a free app which makes saving money easier than it otherwise would have been. I love the payments hub feature, making it easy to stay on top of all of your monthly bills and providing an easy way to make savings on your regular payments by recommending when you can get a cheaper deal elsewhere. A great addition to your personal finance set up alongside a budgeting and spend tracking app such as Emma.

Deep dives

Emma deep dive

Set up by two university friends in 2018, Emma has expanded rapidly to become a much loved contributor to the personal finance app scene. In fact, it is the budgeting app I use in my own set up. It is an app that aggregates your spending transactions from all of your different accounts, allowing you to view all of your transactions in one place rather than having to use the respective banking apps to access that data.

The team behind Emma refer to her as your “best financial friend”. It has a playful personality which is consistent throughout the app.

Each week, you’ll get weekly insights that take you through your expenses, pulling out interesting comparisons with Emma’s average user as well as any trends in your spending behaviour. Plus, there’s a weekly quiz with prize money up for grabs (I’ve yet to win).

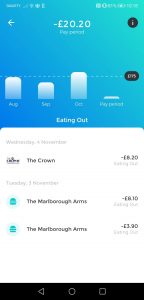

Features

- Connect your bank account(s) and credit card account(s) using the Open Banking API

- Emma will automatically tag up your transactions

- Track spending against budgets

- Analytics features to understand your spend over time and against budget

- Set your tracking period to your payday period

Highlights

Weekly insights

Each week, you will get a report that Emma has prepared for you. It provides handy insights looking at any areas of spend which have been increasing, or improving compared to your average over time.

I’ve found these super useful to bring awareness to my spending, even when I may not be engaging with my finances as much as I should be. For example, I was shocked when I found out I was spending nearly double on my food shop than I thought I was, which was flagged on this weekly report.

Great analytics

Being able to dig into my spend has helped me keep on track with my budgets, and identifies areas where I should cut back on.

Intuitive design

This is a very well designed app, with soft and playful aesthetics. More than just looks, the app is very intuitive and easy to use. Without requiring much onboarding, I found it no problem adding new categories and utilising most of the features within the app.

Lowlights

Some features behind a paywall

If you want to add offline accounts or create custom categories, unfortunately you’ll have to pay a subscription to Emma Pro.

These features are behind a paywall, because compared to some of it’s competitors, Emma monetises with a premium feature set.

The flipside to this is that Emma does not aggregate and sell on any information from its user base, in contrast to some of its competitors.

Subscriptions tracker not as full featured as Snoop

Even though you are able to track your recurring payments within Emma, the features are not comparable to Snoop’s for this purpose.

What are other people saying about Emma?

Emma has been around for a few years and has generally positive reviews on the likes of Trustpilot.

After scanning through the reviews, a few positive themes pop up:

- responsive customer service team

- receptive development team (pushing updates and improvements regularly)

- ease of consolidating/connecting accounts

- ability to stay on top of subscriptions

There aren’t a huge number of reviews on their Trustpilot page, but there are a lot more on the Apple Store and Play Store, with 4.4 out of 5 stars with over 3k reviews on the Play Store and over 4k reviews with an average score of 4.7 on the Apply Store.

Snoop deep dive

A fairly new kid on the block, having launched in 2020, Snoop is a free app that is quickly gathering momentum.

Styled with a delightful little robot called Snoop, this little chap is your money-saving ninja. He’ll keep an eye out for money saving deals, with the other eye firmly fixed on your recurring payments and bills to make sure you aren’t being overcharged compared to what is available on the market.

I always bang on about how important it is to stay on top of your recurring bills here at The Mindful Money Project. Why? Because making sure you aren’t being overcharged is something that takes a little bit of time only once a year, but provides you potentially massive savings that repeat each and every month.

Features

- Easily connect your bank, credit card and savings account(s)

- Your transactions will be tagged up automatically

- Snoop will monitor your monthly bills and subscriptions

- Renewal reminders

- Context dependent money saving tips

Highlights

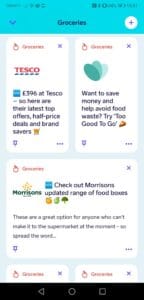

Tips and tricks from Snoop to save money

These are pretty handy money-saving tips that Snoop will present to you when you’re digging into your spending in the app.

For example, when I was looking at my eating out category, Snoop provided a way to get a discount on a KFC offer – nice!

But these could be a mixture of informational, how-to type tips, or they are discounts just like my KFC offer I mentioned above.

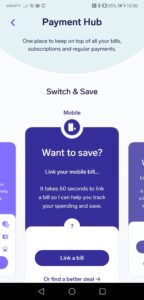

Stay on top of regular bills

Now we’re talking. Snoop is the king of the castle out of these two apps when it comes to monitoring your regular bills and payments because of this Payments Hub feature.

For any of you who have read any of my other articles, you’ll know that I am always waxing lyrical about optimising your monthly bills. THE easiest way to save money, easily.

The best ways to do that are to:

- Make sure you’ve cancelled any monthly subscriptions you don’t use

- Optimise your monthly bills

Snoop can help with both of these.

Firstly, by identifying all of your recurring transactions you can quickly comb through and cancel any that you no longer believe you’re using enough to justify.

But secondly, Snoop can help you keep in control of your recurring bills such as energy, insurance, phone, broadband and TV.

You simply need to link up the right payments with the type of spend it is (i.e if it is for energy, phone, broadband etc), and Snoop will notify you of any bill increases, bill renewals and if there are cheaper options available on the market for you to reduce your monthly bills.

You can even change your provider within the app for some areas.

Intuitive design

The app is very well designed. As with Emma, there is minimal need for onboarding as you can intuitively work your way through the app and the features, adding all of the relevant payments and transactions that you need to stay on top of.

Connecting accounts is a breeze too via the Open Banking API.

Lowlights

Poor budgeting capability

Even though Snoop tracks your spending by automatically categorising all of your transactions, its focus is definitely on recurring bill payments. As a result, they don’t have a way to set up budgets that you can track your spending against, with the spend tracker being inflexible as a result.

What are other people saying about Snoop?

Snoop hasn’t been around for that long, having launched in early 2020. As a result of this, there aren’t many reviews posted on Trustpilot yet. But the ones that are there are positive. They’ve received 3 reviews, all at 5 stars. As there are such a small number of reviews there at the moment, I would take it with a pinch of salt.

On the Play Store (Android) and the Apply Store (iOS), they’ve got a lot more which provides encouraging signs that other users are also finding this app useful. On the Play Store, they’ve received more than 1,000, averaging 4.5+ out of 5 stars.

They have a similar story on the iOS app store with more than 600 reviews and an average rating of ~4.8.

Alternatives to Snoop and Emma

If you are looking for an alternative budgeting and spend tracking app, take a look at:

See my round up of the head to head of these three big budgeting apps here.

If you are looking for an app which can help you save money, look at:

- Plum

- Wonderbill (to stay on top of your bills)

Conclusion: Snoop vs Emma

Both are good at different things, so why not use both!

Even though both are personal finance apps, the Snoop app and the Emma app actually can help you with different things. As a result, this Snoop vs Emma article isn’t going to provide one clear recommendation.

Instead, you should think about using both in your personal finance set up to create the ultimate money management app.

You can use Emma* for budgeting and spend tracking, using it as an aggregator to connect your bank account(s), investment account(s) and credit card account(s). This is great to help change your spending habits.

And you can use Snoop* to ensure you optimise your bill payments, reduce the number of wasteful subscriptions you have, and through its contextual Snoops save some cash.

Using the two together, you should be well placed to reach your financial goals.

Non-affiliate links:

Have you used Snoop and Emma before? I’d love to hear your experience with these two apps – drop your comments in the section below.

What Is A Good Amount Of Savings UK?

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

How To Cancel Graze Subscription UK

Icons made by Freepik from www.flaticon.com