Cor I bet you’re bored of using an excel spreadsheet to track your expenses? Me too! Don’t even track your expenses because of the faff? Well, you’re in luck. A spend tracking app can do the work for you. In this article, I’ll be comparing the best spend tracker apps on the market today that can turn you from a personal finance zero to a personal finance hero.

- Quick Summary

- What does a spend tracker app do?

- What type of app do I need?

- Why should I track my spending?

- Best Spend Tracker App

- What is the best app for tracking spending?

- How much does a spend tracker app cost?

- I follow the Zero Based Budgeting technique, which app works best for me?

- I use the envelope budgeting technique, but want to use an app to track my spending – which app works best for me?

- Alternative ways to track spending:

Quick Summary

My top picks are below. These are best for:

Emma* – best for premium features

Money Dashboard* – best for free flexibility

Goodbudget – best for offline tracking

Honeydue – best for couples (not available in Europe**)

**update April 2021 Honeydue is no longer supporting accounts from Europe.

If you want a more thorough deepdive, keep on reading…

What does a spend tracker app do?

Sometimes referred to as a budgeting app, an expense tracker app does what it says on the tin and helps you with your expense tracking.

The traditional approach would be to download your bank statements, fire up a spreadsheet and tag up each expense to analyse your spend.

Now that we’re in the app-age though, who has time for that?!

This is where an expense tracking app comes in. If you used to use a spreadsheet, these bad boys can easily save you hours of time per month. Time that you can now use boosting your income oh yeahhh!

What type of app do I need?

These expense tracking apps can either be:

- offline

- online (by connecting to your bank accounts)

Offline apps work as a digital equivalent of a spending diary. You need to enter each expense as you go, just like you would in a physical spend diary.

Whereas an online (bank compatible) app connects to your accounts and automatically tracks each expense as you make it.

For these bank-compatible apps, they can help you:

- aggregate your transactions in one place from multiple bank accounts, credit card accounts and even investment accounts

- track spend against a budget

- keep on top of subscriptions and bank fees

The benefit of an online connected app is that you save time manually entering each expense.

Some people love the mindfulness of a physical spending diary or an offline app, as it forces them to engage in their spending in a more mindful manner.

Why should I track my spending?

Keeping your expenses lower than your income is key to great money management. Having money left over each month improves your cash flow, allowing you to work towards your financial goal such as a savings goal or paying off debt (or even improving your credit score).

What’s not to like, eh?

But enough of my waffle, let’s get into it.

Best Spend Tracker App

Best for premium features = Emma*

Best for free flexibility = Money Dashboard*

Best for offline tracking = Goodbudget

Best for couples = Honeydue (note not available in Europe)

Emma

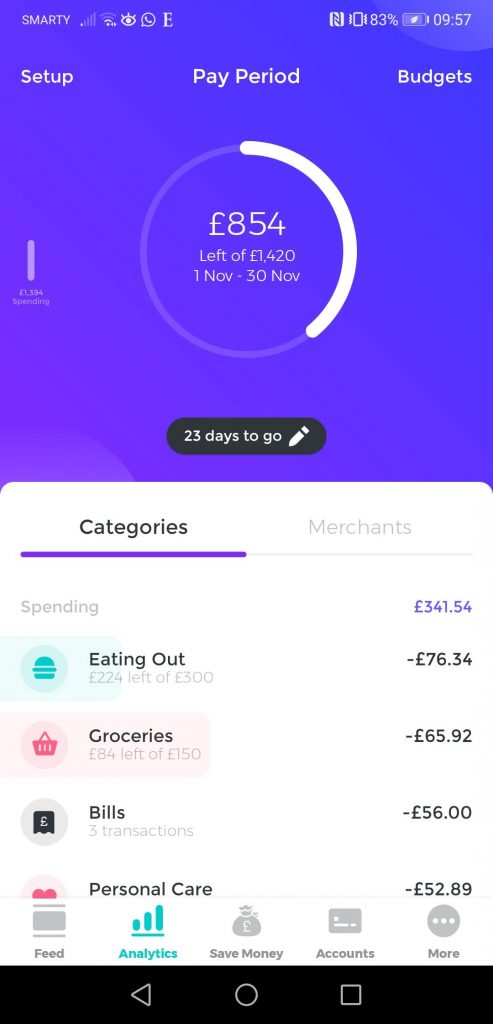

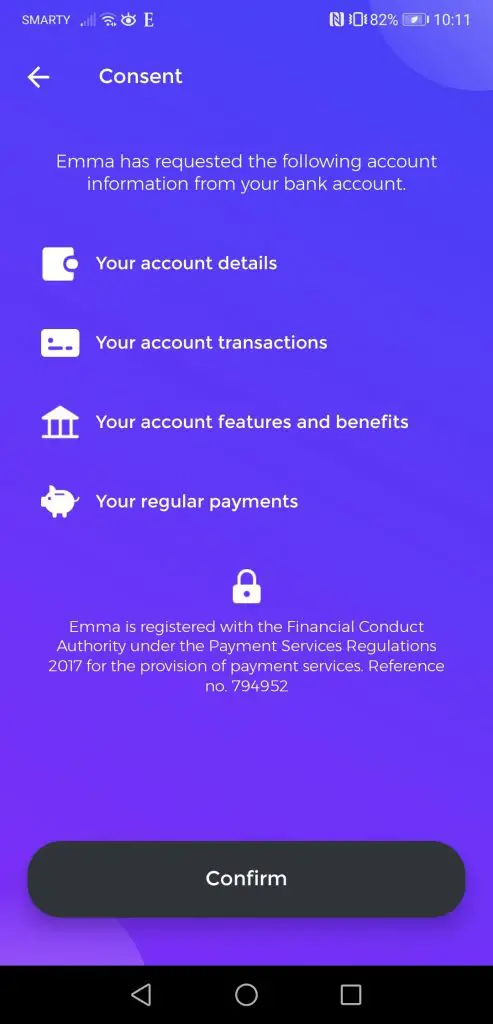

Emma is a budgeting app with personality. Billed as your “best financial friend”, she connects to your bank accounts, tracks your expenses and provides helpful insights into your spending.

You might find the Emma personality a little bit grating, especially if you’re not a child, but stick with it because it has some great features.

Oh, and they also run weekly quizzes with cash prizes.

Emma is available on iOS and Android. It is free to use, but there is a premium subscription which unlocks more advanced features such as:

- custom categories

- adding offline accounts such as a savings account which you can’t connect automatically

- splitting transactions

- exporting to CSV

- and more…

The good

- Wide range of accounts to connect, including investment accounts such as Nutmeg and alternative providers such as Coinbase

- Keep on top of your budgeting within the app by setting budgets per category

- Incredibly intuitive and easy to use

- Handy spending insights that compare you against their user base

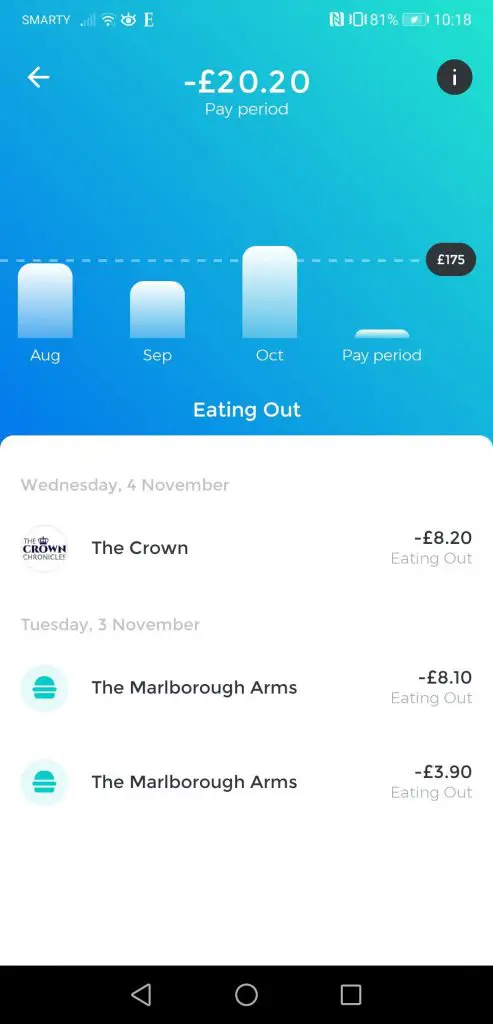

- Insightful analytics showing monthly expenses by category and vendor

The bad

- Some premium features are included as standard (i.e offline accounts/custom categories available in Money Dashboard)

- No web app

I find the experience and interface of Emma to be a delight to use. Everything is clear, and the weekly insight reports are a great help. I’ve not had much luck with their weekly quiz yet though…

You can find out more about the Emma app in my full review here.

Money Dashboard

This app is an old hat in the budgeting app sphere. With over 500k users and an award for best personal finance app in 2018, it knows its stuff.

In 2020 they re-designed and relaunched a new version of their app called Money Dashboard Neon, with which they are focussing their development attention going forward.

The good:

- Spending plan feature is great and provides a forecast of your bank balance at the end of the month

- Can connect bank accounts and credit card accounts

- Has a web app with more advanced analytics

- Can add custom categories and offline accounts

The bad:

- Not as intuitive as some of the other apps

- App analytics not as strong as some of the others

Money Dashboard is a great option if you want to connect your accounts and want great flexibility i.e to add custom categories and offline accounts.

Adding these offline accounts is a handy way to turn it into a way to track your net worth or tracking your debt pay-off over time.

They monetise their business via commissions from 3rd parties if you take out a product/service via their app, as well as providing market research/consumer insight to 3rd parties based on aggregated financial data. This means that they offer a decent feature set without an attached price (when the product is free, it generally means you’re the product!).

You can find out more about Money Dashboard in my full review here as well as a comparison between Money Dashboard vs Emma here.

Goodbudget

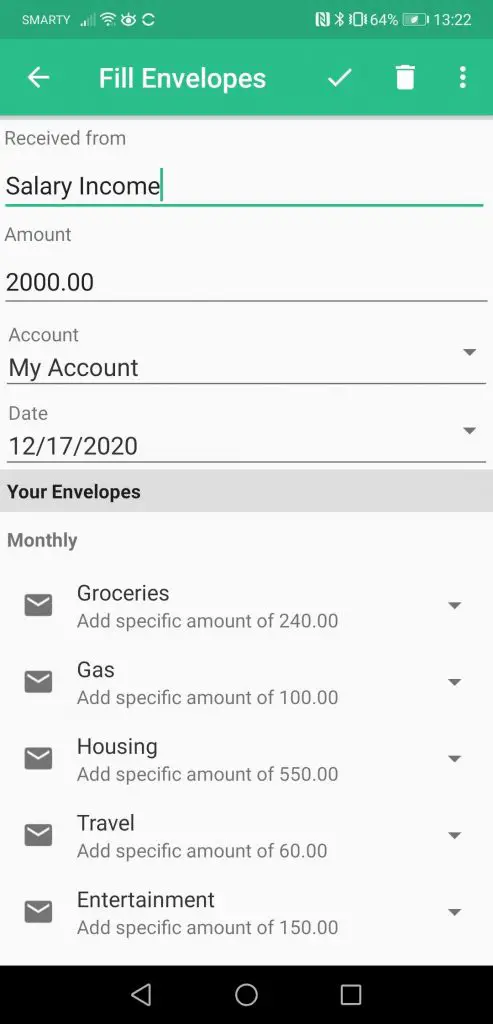

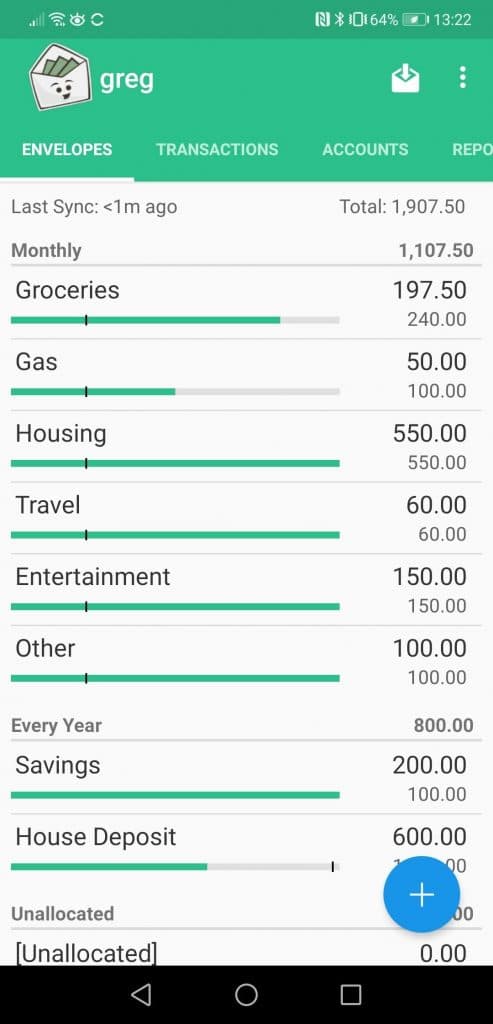

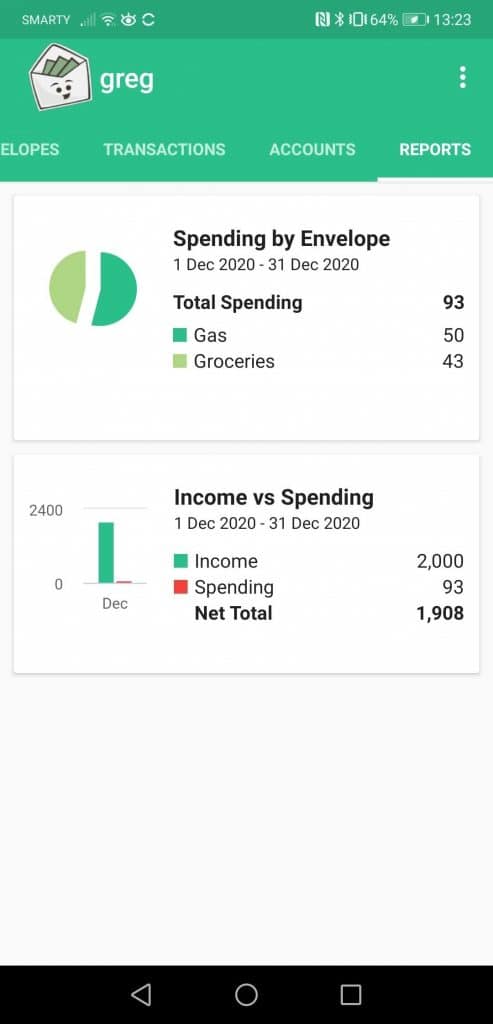

The only offline expense tracker app featuring on our shortlist. Goodbudget aims to digitise the envelope budgeting method, where you allocate your money into different virtual “envelopes” to be used for specific spend.

For example, you may have virtual envelopes for:

- bills

- rent/mortgage payments

- eating out

- entertainment

- groceries

This means that as and when you spend from one of these categories, you can add the expense to your relevant envelope. This will slowly chip away at your envelope.

The beauty of this form of budgeting is that it becomes very clear how much money you have left in each category.

I found envelope budgeting to be a really effective way of changing my spending habits and getting my expenses under control, so any app that helps this gets a tick from me!

Goodbudget is the only budget app on our list which doesn’t connect to your bank account. This means that it is reliant on you entering in your expenses, but on the flip side is great for people who are worried about privacy and feel uncomfortable connecting their bank account to an app via Open Banking.

The good:

- Envelope budgeting is a great way to allocate your money and keep spending under control

- Helpful analytics tab

- Available via your browser as well as an iOS app and Android app

- Doesn’t connect to your bank account, so ideal for people with privacy concerns

The bad:

- Relies on you consistently entering your expenses manually

- Can only get 10 envelopes on the free plan (more available on the paid “Plus” plan

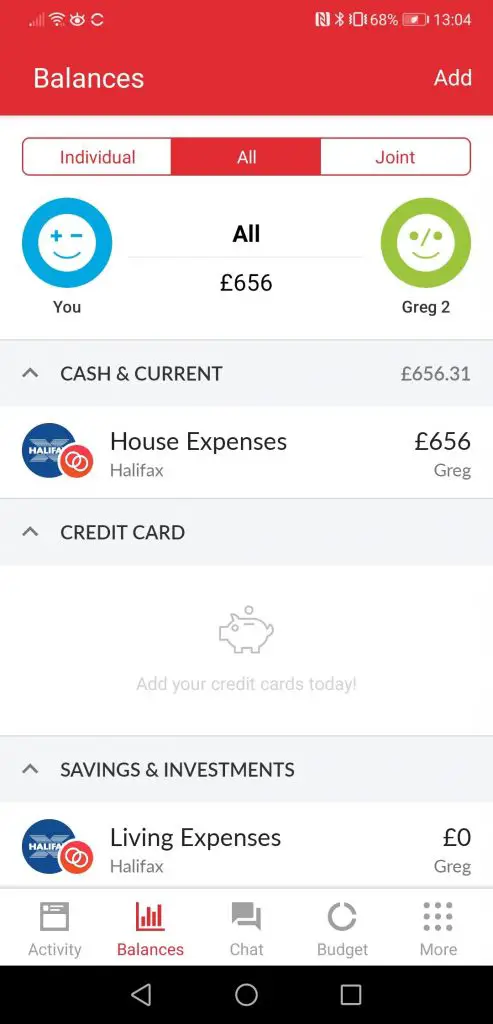

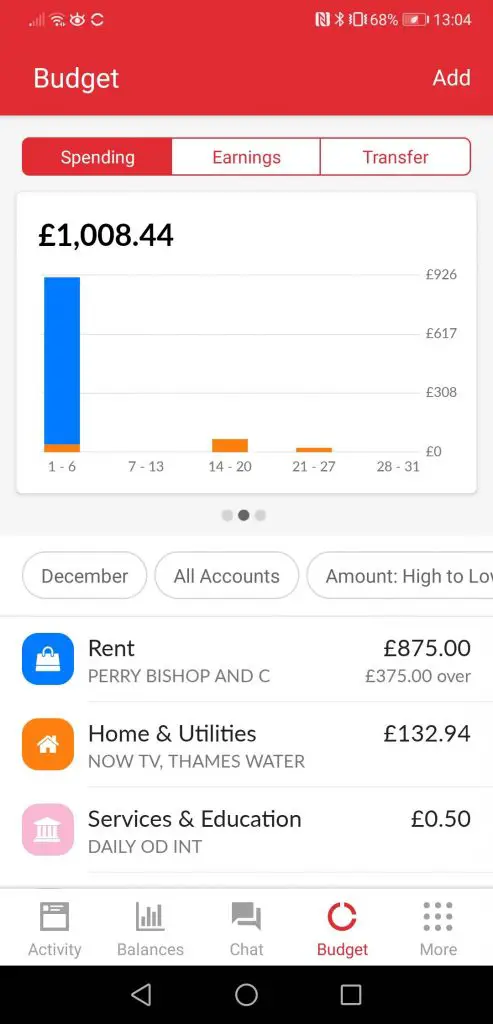

Honeydue

This is the only app on our list which is designed specifically for couples to help with their expense tracking and budgeting.

Even though Honeydue used to be available to UK and European users, they have since rolled back this capability. Unfortunately for us based in these countries, we no longer have access to this kind of service. But if you are based in the US, you’re still able to use the app.

The good:

- Connect bank accounts and credit card accounts

- Can customise single or joint accounts to differentiate

- Both partners have access to the app via their own login (only one on list with this feature)

- Can create custom categories for budgeting

- Can add manual/offline accounts

The bad:

- Slower to update transactions than other alternatives (likely to do with the use of an integrator rather than directly, but just a theory!)

- Insight and analytics not as powerful as others

- The in-app partner messaging feels a bit of a gimmick as if you’re sharing finances surely you can just talk to each other?

- No longer available in the UK and Europe

Overall, I like the spirit of Honeydue and the way they are tackling joint finances.

If you’re in a couple where you are starting to, or already have, integrate your finances then Honeydue should help you both to improve your mutual understanding and communication of your finances, making budgeting a breeze.

What is the best app for tracking spending?

Down to the big money question! Which is the best spend tracker app in our line up? The best spend tracker app is Emma in my opinion.

This is due to its ease of use and surfacing of handy insights. I love getting my weekly report which shines a light on areas of my spending I may have otherwise missed (although I must admit I’m not too keen on knowing I spend more at Gregg’s than 99% of their users ffs).

Even though the free version is more than sufficient to use as an expense tracker app, if you want to unlock some of the more advanced features such as custom categories you will need to upgrade to their premium subscription.

If you want a full feature set without having to pay, however, then the next best option will be Money Dashboard. Even though the user experience isn’t as great as Emma, it still provides a quality experience and you shouldn’t be left disappointed!

Do you want an offline-only app? In that case, you’ll be in good hands with Goodbudget. The envelope budgeting method will set you up in good stead to improve your money management and start smashing your savings goal.

Want to manage your finances with a partner? Check out Honeydue – they are built specifically for people like you!

How much does a spend tracker app cost?

Most of the apps we are featuring are free. There are, however, some apps that require a subscription in order to unlock better features. Emma and Goodbudget have a free version but you can unlock more features by subscribing to a premium version.

I follow the Zero Based Budgeting technique, which app works best for me?

Ah this isn’t your first rodeo! Good to have you on board. For those of you who aren’t versed in ZBB, this is a budgeting method popularised by Dave Ramsey. You plan out your income into its separate uses ahead of time. When your income rolls in, you know exactly where each pound lives.

I actually use zero-based budgeting myself. For this style of budgeting, you can use apps such as Emma or Money Dashboard. You can set your budget each month and then these apps will track your expenses against them as you go.

I use the envelope budgeting technique, but want to use an app to track my spending – which app works best for me?

Another great method. This is when you simply allocate your money out to various “envelopes” based on the type of spend. I.e you’ll have an envelope for “eating out” and an envelope for “groceries”. This had its beginnings by using real, physical envelopes which you would fill with actual cash.

There is no reason you cannot make a digital version of this method though.

Simply allocate out your different “envelopes” into different accounts each month and only spend from the relevant one. OR, use an app like Goodbudget to track your spending in those various envelopes.

I actually use the envelope method by keeping my money in separate pots for various uses. I.e I have one account which all of my housing costs come out of, I have one account which all of my bills come out of, and I have a separate current account which my groceries, entertainment and travel come out of (and is the only card I carry with me).

To track spending, you can use any of the options above (both online and offline).

Alternative ways to track spending:

There are some more traditional alternatives you can use such as:

- physical spend diary

- spreadsheet software (see how to setup a budget in Google sheets here)

And then some more digital versions:

- offline spend tracker app (i.e Goodbudget above)

- online spend tracker apps

- digital-first banks such as Starling or Monzo

- money manager smart AI apps such as Plum or Cleo

If you’re in the market for a spend tracker app, the list above will do you proud.

There has been, however, a massive explosion in innovation in the financial services space over the last 5 years.

This has meant that not only are traditional banks improving their own spend tracking within their own banking app, but also the digital-first banks such as Starling and Monzo have built out brilliant spend tracking capabilities so if you bank with these, check out what they have first.

There have also been some great new innovations in applying AI to improve your finances. Some apps to check out include Plum and Cleo.

Have you used any of the apps we’ve featured today? I’d love to hear your view on which app you think is the best spend tracker app? Let me know in the comments below.

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent. The views expressed are based on our own experience and analysis of the service.

How To Cancel Racing TV UK (Sky or Direct)

Staying on top of your monthly subscriptions can help to streamline your finances. You may…

Wealthify vs Hargreaves Lansdown

Investing in the stock market used to be an inaccessible world full of jargon, stockbrokers…

Are Money Saving Apps Safe?

Ah apps. Love them or hate them, they are an increasingly important part of our…

What Is A Budget?

Everyone talks about a budget, but do we actually know what one is? Budgets are…

Is Saving Money Worth It? The Pros and Cons of Saving Your Hard-Earned Cash

Saving money is one of the most important things you can do for your financial…

How To Cancel Snap Fitness Membership UK

Finding you never use the Snap fitness gym and are looking to cancel your Snap…

What is Personal Profit?

A profit and loss statement is how a company keeps track of all of its…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….

Chip vs Plum: Which One Will Boost Your Money?

With personal finance, the aim of the game is to simplify and automate when and…

How to deal with an unexpected expense

This always seems to be the way of the world – you’ve managed to get…

Pingback: Does PayPal Credit Affect Credit Score? | The Mindful Money Project

Pingback: Average Food Bill Per Month in the UK - How Do You Compare?

Pingback: How to save £1000 in a month using the COST method

Pingback: How To Save For A House Deposit In A Year UK - How I Saved £20k+

Pingback: Snoop vs Money Dashboard | The Mindful Money Project

Pingback: Easy and painless ways to save money every month

Pingback: Snoop vs Emma: Which Is Best? | The Mindful Money Project