Using an app can help automate your personal finances and keep you in tip-top shape. But which one should you use? In this article, I’ll pit two of the best head to head – Money Dashboard vs Emma.

What is Money Dashboard?

Money Dashboard is one of the UKs leading fintech companies, and has won the 2018 British Bank award for best personal finance app.

The app boasts over 500,000 users and is available online (as a web app), on iOS and on Android.

In early 2020 they completely redesigned their platform, introducing their new version of the app which uses Open Banking. This new version was originally branded “Money Dashboard Neon”. The old version is now branded as “Money Dashboard Classic” however is going to continue to be supported. This article will look at the new app for my Money Dashboard review.

If you have a classic Money Dashboard account, read more about the changes on their website here.

Check out my full Money Dashboard review here.

What is Emma?

Emma is a budgeting and spend tracking app which helps you manage your money.

The team at Emma bill “Emma” as your “Best Financial Friend” and is available on Android and iOS. Emma was set up in the UK in 2018 by two entrepreneurs who met at university. They’ve since secured $2.5m in seed funding earlier this year to help their expansion into the US and Canada.

Check out my full Emma review here.

Money Dashboard vs Emma – Let’s Start The Comparisons

Connecting Bank Accounts

Both use the Open Banking API and as such are reliant on the various financial institutions and banks to have this enabled to connect.

Most, if not all, of the main high-street banks such as Lloyds, Halifax, Barclays, Natwest, HSBC etc are included on both as well as the newer competitors such as Monzo and Starling Bank.

However, the connections for investment accounts such as Hargreaves Lansdown is limited because these providers have not activated Open Banking. To get around this, you can create manual “offline accounts” which is part of the paid-for feature set in Emma and is free within Money Dashboard.

You can find a full list of compatible banks/institutions for Money Dashboard here and for Emma here.

Categorising Transactions

Both use a proprietary algorithm to automatically categorise transactions and learn from your input to ensure future transactions are categorised to your liking. With Emma that happens automatically, whereas with Money Dashboard you need to specify you want it to create a categorisation rule.

Out of the two, Emma wins on this front. It tends to get the categorisation right on the first pass, and it learns and remembers your categorisations for any future transactions.

However, worth noting that both have a convoluted process to change categorisations. If you want to change categorisations on transactions from lots of vendors it can take longer than it should.

Analytics

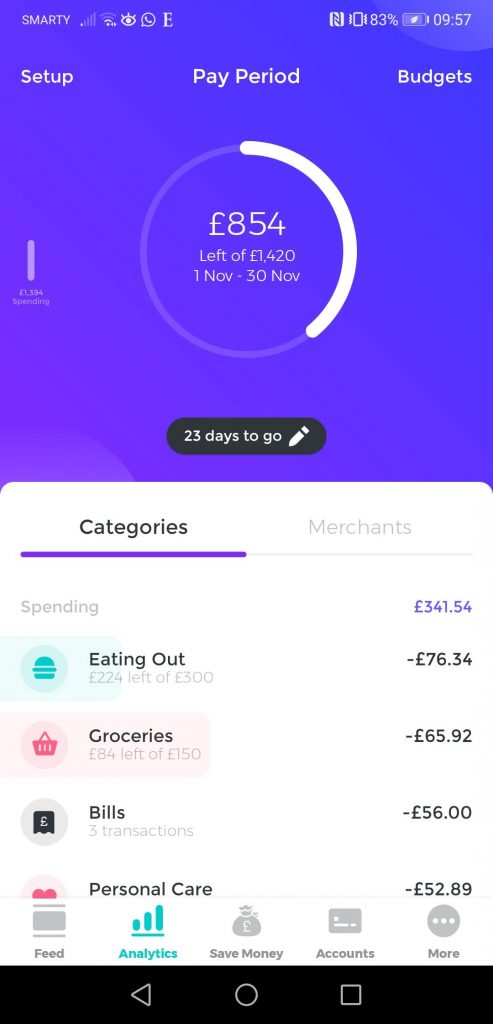

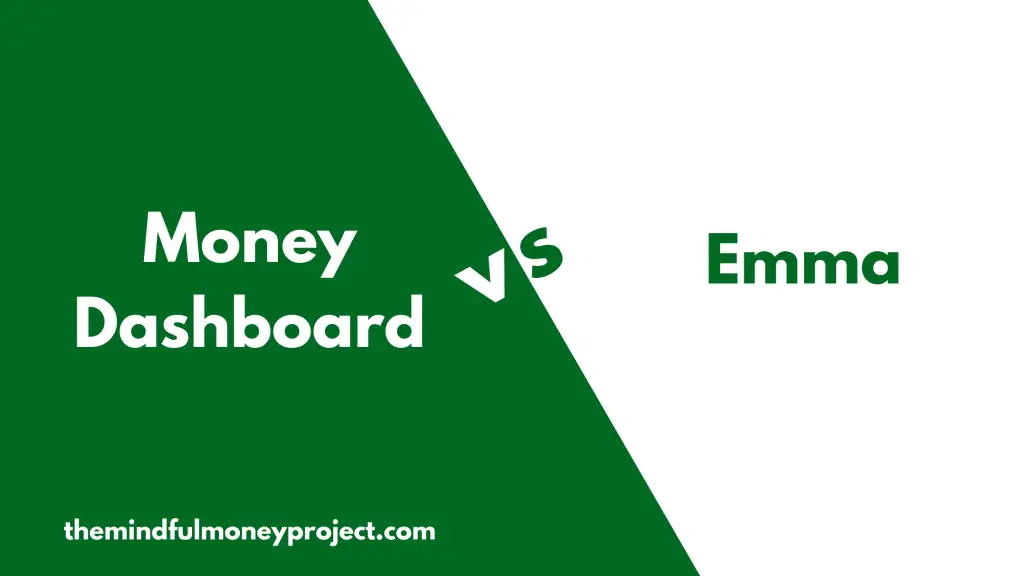

In-app, the analytics from Emma is better to find out your prior months spending or spending per individual categories. Even though this is available in Money Dashboard, I find the interface frustrating to go backwards.

However, in the Money Dashboard web app you have a much superior set of visualisations to track trends and track historic spend over time in both histograms and analyse your spend visually with pie charts.

Budget setting

They are both neck and neck here. They both provide you the ability to create a budget for different categories and both provide your average monthly spend on those categories which will help inform your budget setting.

Budget tracking

They both are able to track against your budget categories that you have set.

This is where the two diverge and it is not easy to find a clear winner.

Emma has a really intuitive tab called “Analytics” which tells you how you are performing on all of your categories versus your budget. As well as showing the totals, telling you how much you have left of your total budget.

Whereas with Money Dashboard it is not clear immediately how to access your budget tracking.

However, Money Dashboard has a really handy feature called “Spending Plan” which predicts how you’ll end the month (or end your payday period that you specify), which allows you to see at a glance how much money you have left. This takes your balance and takes off any expected/scheduled payments and takes off any budgeted amounts for categories such as “Groceries”, “Travel” and “Entertainment”. A really useful feature in my opinion.

If you already have a budgeting system where you budget to zero (some call it zero-based budgeting) then you may not find this useful at all. If you don’t have a system like this, then it is a handy feature to show you how much you’re expected to end the month with.

Money Dashboard edges ahead here because of this feature.

Set payday

Both apps allow you to fix your budget cycle to a set date, so rather than tracking spending in a monthly period you can track your expenditure in a payday cycle.

Subscription Tracking

Both keep track of your subscriptions and recurring expenses, so neck and neck here. In both you’re able to manually add specific transactions if they haven’t recognised them as recurring automatically.

Platform

Both Emma and Money Dashboard are available on Android and iOS.

However, Money Dashboard also offers a web-app version which gives you much better analysis / insight capability. A big tick for Money Dashboard here.

Security/Privacy

Both use the Open Banking API, and both are authorised and regulated by the FCA along with operating bank-level security protocols. Neck and neck here.

The difference is that Money Dashboard does aggregate and anonymise your transactional and account information to sell in the form of market research and insight data to other companies. This doesn’t contain any personal information, however.

Monetisation

Emma makes money from:

- Premium feature-set; “Emma Pro”

- Affiliate commissions if you switch provider via its app on its marketplaces

Money Dashboard makes money from:

- Using aggregated and anonymised financial data to provide insight to other companies

- Affiliate commissions if you switch provider via its app

If you aren’t comfortable with the fact that Money Dashboard essentially sell your data, then I would recommend using Emma, who have confirmed they don’t do this.

Price

Emma operates a decent free version of the app, but some features such as creating offline accounts and splitting transactions are only available on the premium version of its app, which costs £4.99 per month.

Money Dashboard is free to use, and includes some features that are reserved for Emma’s premium feature set such as the ability to add offline accounts and to export your transactions to CSV (via its web app).

Ease

Emma takes the win here. Even though it is slightly child-like in its design, it is a very intuitively and beautifully designed app.

Money Dashboard looks good and isn’t unintuitive as such, but some of the key items are slightly harder to find such as having the ability to track and set budgets hidden away.

Conclusion: Money Dashboard vs Emma?

If you are looking for a really good spend tracker, then use Emma. It is more intuitive, has better insights on the move (via the app), and tends to categorise better on the first pass.

However, if you are starting your personal finance from scratch or haven’t been very good at sticking to a budget in the past, then choose Money Dashboard. Even though it isn’t quite as intuitive as Emma, the Spending Plan feature will allow you to see a snapshot of how you are looking to end the month, as well as the web app providing really useful insights and flexibility.

See my full Money Dashboard review here.

See my full Emma review here.

Have you used both? What would your choice be out of Money Dashboard vs Emma? I’d love to hear your thoughts in the comments section below or drop me an email from my “Contact” page.

Personal Profit is now The Mindful Money Project!

Hello there good reader! I’m proud to announce that I have re-branded my site. No…

What is the difference between income and wealth? And why you should care!

Understanding the difference between the two is important, especially when you’re trying to improve your…

How To Cancel Les Mills On Demand UK

Bored of your subscription or wanting to move to another provider? We get you. We’ve…

Moneyfarm vs Nutmeg – The Battle of the Robo Advisors

Looking to invest to reach your financial goals? Fortunately investing nowadays is much more accessible…

Money Dashboard Review UK 2021 – Will This Sort Out Your Finances?

If you’re not interested in tracking your spending using a spreadsheet, then using a budgeting…

Average Food Bill Per Month in the UK – How Do You Compare?

It is often quite difficult to figure out whether your budgeted weekly food budget figures…

Snoop vs Money Dashboard

An app has the power to simplify your life. Especially your finances. Rather than cracking…

Wonderbill Review: A Tool To Finally Get On Top Of Your Bills?

Ah bills, bills, bills. I feel like we should extend the saying “the only certainties…

How To Cancel Noom UK

Looking to trim back on your subscriptions by cancelling Noom? We got you. In this…

Pingback: Money Dashboard Review UK 2020 - Will This Sort Out Your Finances?

Pingback: Emma App Review: Is It the Best Spend Tracker Out There?

Pingback: 4 of the Best Budgeting Apps for Students in the UK in 2020

Pingback: Best Spend Tracker App - Will One Of These Help Your Finances?

Pingback: Yolt vs Money Dashboard - Who Wins? | The Mindful Money Project

Pingback: Yolt vs Emma - Which Spend Tracker App Should You Use?