Understanding the difference between the two is important, especially when you’re trying to improve your personal financial situation. Ever heard the story of the janitor who surprised everyone when he died by leaving $5 million to his local library? Or the story of the famous athletes who earned multiple millions a year filing for bankruptcy? The fact that you’re asking yourself “what is the difference between income and wealth?” means that you’re trying to figure where on that scale you want to sit, and I salute you for it. Read on!

Wealth vs income – why does it matter?

The two terms income and wealth tend to be used interchangeably in the mainstream.

You know the comments; you see your neighbour driving off in a luxury sports car and you think “blimey, he must be rich”. Or you see someone walk into a big and luxurious house and you resentfully mutter “urgh, she must be wealthy”.

Just because someone is earning a high income, doesn’t make them wealthy. Not all people who earn stacks and stacks of cash are wealthy. And not all people who are wealthy have a high income.

How can that be the case? Let’s take a minute to understand what the hell income and wealth actually are:

What is income?

Income is the one that people tend to intuitively understand. This is the money you receive in a certain period of time, normally yearly.

Your income could come from a variety of sources:

- Employment (salary/wage)

- Self-employment (profits)

- Interest

- Dividends

- Letting out property

- State benefits

Income is important because it can be used to pay for your expenses and to save/invest.

What is wealth?

Wealth can simply be described as the total of your assets minus your liabilities. Being a bloomin’ accountant, I can’t help but express it formulaically (sorry all):

Net worth (wealth) = Assets – Liabilities

Assets

In terms of personal finance, the definition of what gets classed as an asset can vary depending on who you listen to.

Some only include income-producing assets which may be considered their “freedom fund” or “early retirement portfolio”, this tends to exclude their primary residence and depreciating assets like a car.

Whereas the Office for National Statistics includes a broader list of assets in their survey of wealth in the UK over time. This includes the categories below:

- Property (not only your primary residence but any investment properties)

- Financial assets (such as investments in the stock market, savings accounts, bonds)

- Pension assets

- Physical assets (such as cars, artwork, furniture etc)

For the time being, let’s stick with the broader definition the same as the ONS and include all assets that you own that are of value.

Liabilities

Your liabilities are any obligations that you need to pay in the future. This is typically from these types of sources:

- Personal loans

- Credit cards

- Mortgages

Net worth

This is simply calculated by taking your assets and subtracting your liabilities.

So, how come a high income doesn’t make me wealthy?

It isn’t all about how much you earn, its about how much you keep.

To grow wealthy, you need to have assets that are higher than your liabilities. To do that, you need to consistently be earning more than you spend. How so? If you are spending more than you earn consistently, you’ll be running down savings (an asset) or building up debts such as overdrafts or credit card balances (a liability).

Therefore, it doesn’t matter how much you earn, but how much you spend.

Let’s crack out our favourite example names. If Billy earned £100,000 a year after-tax, but spent 99% of it, would he be better off than Ben who earned £40,000 a year after-tax but saved 25% of it? Billy’s lifestyle might be sexier for sure but he won’t be wealthier. Billy would have saved £1,000 a year and Ben would have saved £10,000.

Over time, it makes a BIG difference.

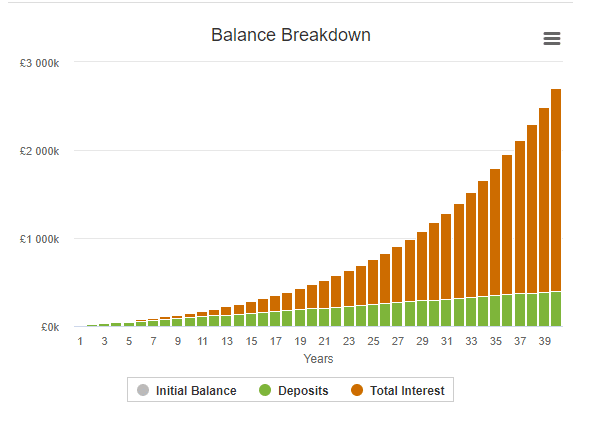

Assume that both invested their savings into a low-cost, diversified index tracker which aims to match the stock market returns, earning an 8% nominal return.

In 20 years’ time, Ben would be earning an additional £40k per year from his investments alone. In 29 years’ time, Ben would be a millionaire with over £1 million in his portfolio. This is more than enough for Ben to retire, and if he had annual expenses of £30,000 a year, then he would have been able to retire in 25 years’ time when his portfolio gets to £750,000. If he waited for 32 years, he would be earning over £100k from his portfolio alone, without having to do an ounce of work!

Compare this to Billy the baller, investing £1,000 into the same investment. In 40 years’ time, his portfolio would be worth £270k, earning an annual return of just short of £20k. Now, don’t get me wrong this is still a good portfolio, but he has squandered the chance at building his wealth aggressively and retiring earlier.

Why is wealth more important than income?

With wealth, you have invested (or investable) assets that can work for you. These will generate you an income without the need to trade your time for money in a standard job or profession.

Whereas to maintain an income that is not generated from your assets you need to show up and put in the work to earn that income.

Not only that, but when you build up your wealth with investable assets, you open the door for compounding returns to explode your wealth. You simply wouldn’t be able to keep up a salary increase as quickly.

Having wealth and investable assets gives you security and stability because you know you have more assets than your obligations and a diversified income stream (so if you lost your job, you could still pay for your obligations and expenses via selling an asset or using the income it generates).

How do I build my wealth/net worth?

There are a few simple steps to get you to improve and build your net worth, but the key (and the difficulty) is in consistency.

- Make a personal profit (this is where your income is higher than your expenses) and set a budget to help you stay consistent

- Pay off debts (excluding mortgages)

- Build up an emergency fund of 3-6 months’ worth of expenses (this protects you from life’s face-slaps and avoids you having to withdraw your investments early)

- Invest (in income and appreciating assets such as low cost diversified index funds)

- Wait for the magic of compounding returns to grow your wealth

Whilst you are working through the steps, make sure to constantly revisit step 1 by building your income and keeping a lid on your expenses.

A higher income gives you the potential to become wealthier in a shorter timeframe than those on a smaller income, but you need to be mindful of your spending and putting your personal profit to work via investments as soon as you can.

What is the average net worth in the UK?

It sure as hell surprised me and I’m sure it will surprise you! It is far higher than I was expecting.

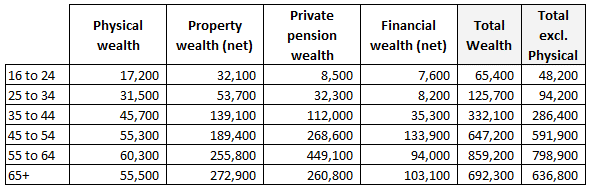

I’ve ran a deeper analysis based on The Office for National Statistics’ Wealth and Assets survey looking at the average net worth in the UK, which you can find here.

I’ve summarised the mean average net worth below by age group and category of wealth (in GBP).

The mean average is when you add up all of the wealth and divide it by the number of people (in this case households). Note that this will be skewed by the outliers at the top end dragging up the average. Here, the mean average is £564,300.

Whereas the median average is £286,600. This is the average where if you lined up all households from poor to rich and selected the household in the middle.

Conclusion

Income and wealth are often mistaken to be the same thing, but they are very different. A high income certainly helps you to become wealthy, but is not the whole story. To become wealthy, you need to focus on how much you keep, and subsequently invest that. Therefore people on lower incomes have the potential to become much wealthier over time than those on higher incomes, simply by being consistently diligent by saving and investing a higher proportion of their income.

How Do I Invest In The Metaverse?

Heard Facebook rebranded its corporate identity to Meta? This was the first introduction to the…

Yolt Review UK 2021 – Does This Take The Throne?

If you’re looking to get on top of your finances, an app can do some…

How Much Does It Cost To Own A Car UK

If you’re looking to buy a car in the UK, it’s important to be aware…

What Is A Good Percentage To Save From Your Paycheck?

Unsure of what “good” looks like when it comes to saving from your paycheck? You’re…

17 Actionable Tips on How to Pay Off Debt Faster

You’re not alone. Living with debt has become a common issue for people in the…

How to Budget Salary Wisely – 4 Methods To Make You Budget Wise!

Do you always find yourself running out of cash at the end of the month?…

How To Save For A House Deposit In A Year (Whilst Renting In The UK)

As a fellow first time buyer, I’m sure you know the struggle already. We really…

Snoop vs Money Dashboard

An app has the power to simplify your life. Especially your finances. Rather than cracking…

Snoop vs Yolt: Will These Help You Save Money?

Is there an area not yet touched by the app revolution? If there is, then…

How to deal with a financial emergency step by step: dealing with income loss

Life is predictably unpredictable. When a financial emergency strikes it might seem like the world…