Unsure of what “good” looks like when it comes to saving from your paycheck? You’re not alone. Even though personal finance is, you guessed it… personal, it sure does help to have some guidelines to keep it simple. A simple rule of thumb can easily answer the question; “what is a good percentage to save from your paycheck?” – with 20%. To understand the rule of thumb in more detail, and to know when you should be aiming for more, keep reading…

- The 50/30/20 Rule

- So, what is the 50/30/20 rule?

- How to calculate your after-tax percentages?

- How much should I be saving based on my income?

- A one-off sense check on your expenses

- Combining with the Pay Yourself First rule

- Automate the process

- How to track your saving percentages

- What are you saving for?

- Advanced Personal Finance

- Conclusion: what is a good percentage to save from your paycheck?

- FAQs

The 50/30/20 Rule

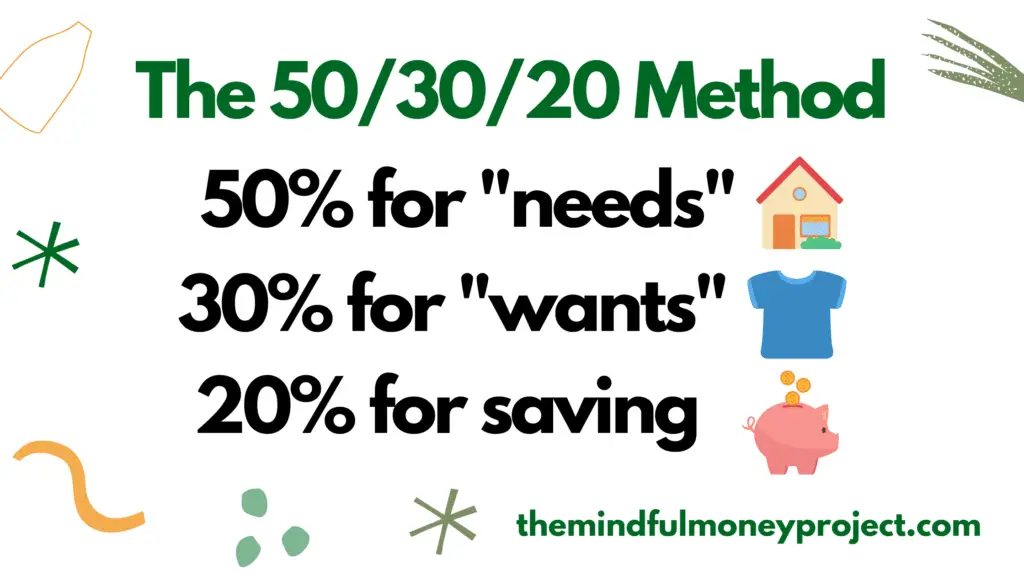

Popularised by Elizabeth Warren (an American Senator and personal finance expert) in her book; All Your Worth: The Ultimate Lifetime Money Plan, this rule of thumb has gained widespread adoption as a great starting point due to its simplicity.

So, what is the 50/30/20 rule?

Rather than having to set budgets for distinct categories, the 50/30/20 rule sets an easy to remember percentage allocation of your after-tax income to three different categories:

- Needs (50%)

- Wants (30%)

- Savings (20%)

Needs – 50%

This will cover essentials such as Housing, Utilities, essential groceries, travel costs to get to work, minimum debt repayments and other costs deemed essential to live and/or work.

Wants – 30%

This covers your classic luxuries. You may have heard of these are discretionary expenses; things that you don’t need to live, but make life a lot nicer! These are things such as a SkyTV subscription, cinema trips, restaurants and pub trips etc.

Savings – 20%

The third category is the one we’re going to be focussing on the most; savings. This doesn’t strictly need to be money literally going into a savings account. Anything that helps to grow your net worth will do the trick. This means paying off debt, saving and investing all count under this section.

What is a good rule of thumb for how much you should save?

Using the 50/30/20 rule, a great starting point is 20% of your after-tax salary. This 20% doesn’t neccessarily all need to flow into an actual savings account, but indeed anything that grows your net worth. Things such as paying off debt or investing also count here.

How to calculate your after-tax percentages?

If you are employed, this should be fairly simple. The money that drops into your account on a regular basis is your after-tax monthly income (your employer withholds and pays the tax on your behalf so no need to make any additional adjustments).

In this instance, simply multiply that income figure by the percentages to get to your target budget per bucket. For example, if you receive £1800 per month into your bank account (i.e after-tax) from your main job, you should aim to save £360 per month (£1800 * 0.2).

How much should I be saving based on my income?

If you follow the 50/30/20 rule, the minimum you should be saving per month based on your income level can be seen in the table below:

Pre-Tax Annual Income | After-Tax Monthly Income* | Monthly Savings (@20%) |

£20,000 | £1,438 | £288 |

£25,000 | £1,722 | £344 |

£30,000 | £2,005 | £401 |

£35,000 | £2,289 | £458 |

£40,000 | £2,572 | £514 |

£45,000 | £2,855 | £571 |

£50,000 | £3,139 | £628 |

£55,000 | £3,382 | £676 |

*Calculated using 2021 tax rates via The Salary Calculator (assuming no pension contributions, no student loan repayments and no additional benefits or salary sacrifice.

If you are self-employed, then you receive your income pre-tax and tend to pay tax each year separately based on your self-assessment. In this case, make an estimate using The Salary Calculator “take-home pay” calculator. If your income is variable and changes from month to month, I would recommend calculating an average profit per month (you should be able to find this by taking your last self-assessment and dividing by 12 to get your monthly average) and then using The Salary Calculator’s take-home pay calculator to work out your estimated after-tax income.

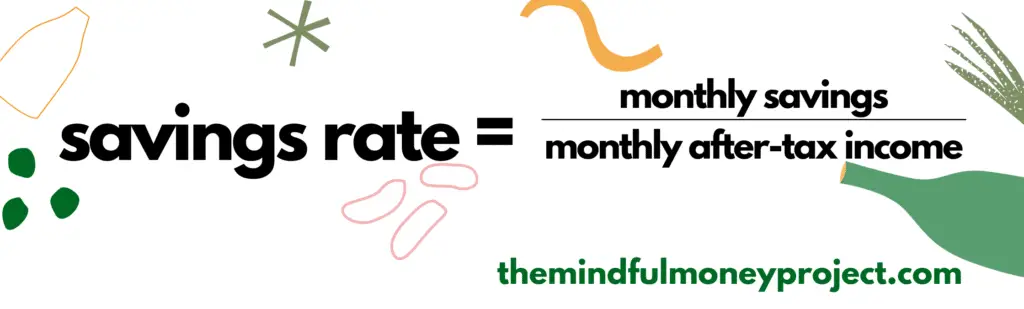

If you are already saving some money, and want to know what your current savings rate is then divide your monthly saving amount by your monthly after-tax income.

A one-off sense check on your expenses

If this is the first time you are looking at your personal finances, then it makes sense to sense check your Needs and Wants to see what percentage they make up. Note if you are part of a household, then tally up both your household after-tax income and your household income in the below. If you manage your finances separately, however, then simply divide your household expenses by 2 (or however many people you live with) to get to your share.

You can do this by writing down your key expenses for each category.

Needs

Write down your monthly expenses for categories such as:

- Housing costs such as rent/mortgage payments

- Utility bills such as energy, water, council tax, broadband, landline

- Transport costs to get to/from work

- Minimum debt repayment(s)

- Medication or treatment

Even though some may not be, your “needs” category tend to be fixed expenses. This means they tend to stay the same from month to month regardless of usage (e.g. your mortgage payment doesn’t change depending on how much time you spend in your home!). The obvious examples where that is not true are your utility bills such as energy, which increase in line with usage.

Wants:

Do the same with this category and estimate your spend on categories such as:

- Entertainment

- Eating out/ takeaways

- Non-essential groceries (i.e luxuries such as alcohol and chocolate!)

- Personal Care such as fancy hair treatments and spa treatments

Once you’ve tallied up your totals for both your wants and needs, see what percentage they make up of your after-tax income. You can calculate this by doing your total spend for each category divided by your monthly after-tax income (then multiply by 100).

For example, if you calculate your Needs total as £1000 and you receive an after-tax income of £1800, your Needs percentage is currently 55.55%. Close, but a little high compared to the rule. Over time, you can work on reducing these expenses. Normally, renegotiating your utility bills are the easiest way to cut these expenses without sacrificing any of your lifestyle. Read our top tips on how to save £1000 in a month using the COST method which provides a useful framework to reduce your living expenses (most don’t even require a change in any lifestyle).

Combining with the Pay Yourself First rule

The beauty of this rule lies in its simplicity. When your paycheck rolls into your bank account each month (or week!), you can easily transfer 20% of it straight into a savings account.

You may have heard of this concept in personal finance; pay yourself first.

Typically people wait until they have money left over at the end of the month before putting any excess into savings.

If you’re like most people, that leftover money at the end of the month never comes and you get stuck in a cycle of living paycheck to paycheck. No savings and no buffers.

To counter this, and working in tandem with the 50/30/20 rule, is paying yourself first.

To do this, simply transfer your 20% of allocated savings from your paycheck into a savings account when you receive it.

This way, you don’t see the cash and now that it is out of sight and out of mind, you won’t spend it.

Automate the process

As with most things in personal finance, and indeed life, we want to minimise the amount of time spent on things that can easily be automated.

In order to automate this process, set up a standing order to transfer your 20% savings away from your current account on payday. This effortlessly will funnel this cash away from your bank and will drop it into your savings. Taking you a step closer to your financial goals, without even breaking a sweat.

What’s not to like?!

How to track your saving percentages

The simplicity of this approach is that you don’t need to be tracking all of your spending. Some people love the detail, but other people (like me) love to keep it easy.

When it comes to tracking, you can be as detailed and diligent, or as laid-back and carefree as you like.

If you find yourself being able to save 20% of your paycheck, and at the end of the month you aren’t digging into your emergency fund or savings (or indeed eating tins of beans!), then you know you’re finances are working in line with this rule of thumb.

If, however, you find that you keep digging into your savings, then you know you are overspending on your Needs and/or Wants.

In order to fix it, you’ll need to start tracking your spend in these categories. This will allow you to see where you are overspending and will help you find areas that you can cut back on or optimise further.

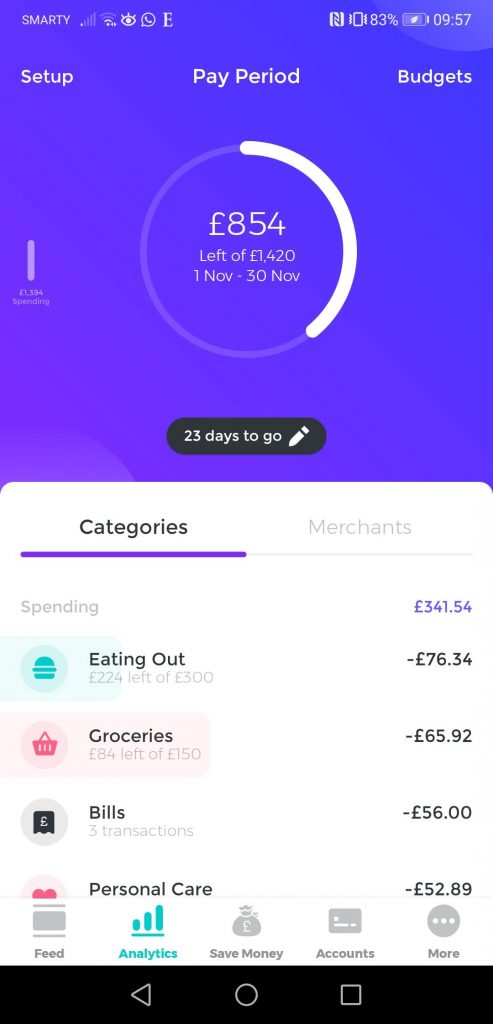

You could manually track your expenses using a spreadsheet. But in my opinion the easiest way to track your spending is by using a spend tracker app. As with most things it seems nowadays, there is an app that can do most of the heavy lifting for you.

There are some great options out there. These apps work by connecting to your bank accounts and credit card accounts and aggregating all of your transactions in one place. You can also set budgets which make it really easy to see at a glance how you are spending compared to your budget. Similarly, if you are overspending, you can easily identify the area which is driving it.

For example, if you find yourself digging into your emergency savings at the end of the month, and you see that you consistently go over on your Needs bucket, you can comb through your utility payments and run comparison checks to see if you can renegotiate a cheaper rate with a different provider. Alternatively, if you keep spending too much on groceries, you can google money-saving recipe ideas and try tips such as shopping down a brand or maybe try going vegetarian for a month.

Some of the best spend tracker apps are Yolt, Money Dashboard and Emma. All are simple to use and allow you to track your spend against budgets. Read our three-way comparison here.

What are you saving for?

When it comes to saving money, it is very easy to undo months of hard work in one or two spend-heavy months, resulting in your savings goal being pushed out by many more months.

Therefore, it is very important to have a reason for “why”. Why are you saving?

Having this in place can improve your motivation, and keeps you disciplined when you’re tempted to dip into your savings pot.

You can split your savings goal based on the timeframe of the financial goal.

- Short-term = anything you’re looking to buy in the next year or two. E.g. saving for a holiday, paying off a credit card debt, creating a fully-funded emergency fund.

- Medium-term = anything you’re looking to buy in the next 2-5 years. E.g. saving for a house deposit, paying off your student loans, becoming debt-free, saving for a wedding.

- Long-term = anything you’re looking to fund in over 5 years time. E.g. saving for your child’s education, retirement saving (that pension pot needs some love!) and financial freedom

It is worth taking a piece of paper and writing down your financial goal so you are clear. Put a timeframe against your goal.

Advanced Personal Finance

The 50/30/20 rule is a fantastic introduction to personal finance and a great rule of thumb to live by.

It encourages people to engage with their finances and encourages saving but doesn’t impose a massive admin burden.

If you have managed to hit your 20% rate for a while now, it might be time to start levelling up your personal finance game.

There are multiple ways to budget, so I recommend experimenting with both different ways of budgeting and different techniques to stick to your budget until you find a combination that works for you.

As part of this journey, you can begin to revisit whether a 20% savings rate is sufficient for your financial goals.

If it is, great keep doing what you’re doing. If it isn’t, then there are many ways to increase your savings rate. I cover many of them in my article discussing the COST method.

If your ultimate goal is financial freedom, then your savings rate will need to be much higher than 20% to get to your goal of financial independence long before normal retirement age. There are some great resources in the FI/RE (financial independence/retire early) community in both the USA (here and here) and UK (here and here) which I encourage you to take a look at if FIRE is something that might interest you.

Conclusion: what is a good percentage to save from your paycheck?

Using the 50/30/20 rule of thumb for budgeting popularised by American Senator Elizabeth Warren, you should be aiming for a minimum 20% of your after-tax income to be saved.

This will allow you to work towards your financial goals, such as paying off debt, building up an emergency fund, investing for financial freedom or increasing your pension contributions so you don’t need to rely on the state pension when you retire.

If you’ve been able to hit your 20% savings target for a while, try to challenge yourself to go further.

I hope this helped answer your question “what is a good percentage to save from your paycheck?”. I would love to know what kind of savings range you target in your budgeting, drop a comment below!

FAQs

How To Cancel Wall Street Journal (WSJ) Subscription in the UK?

You’re looking to cancel your Wall Street Journal (otherwise known as WSJ) subscription in the…

How To Save For A House Deposit In A Year (Whilst Renting In The UK)

As a fellow first time buyer, I’m sure you know the struggle already. We really…

Best Credit Score Apps UK – Monitor and Save With These

If you think you’ll ever need to borrow money in the future, and let’s face…

Yolt Review UK 2021 – Does This Take The Throne?

If you’re looking to get on top of your finances, an app can do some…

What is Personal Profit?

A profit and loss statement is how a company keeps track of all of its…

Plum vs Cleo – Will These Clever Apps Save You Money?

The personal finance app world is always evolving. Originally it was simple spend tracking apps….

Financial Independence – Why I’m Chasing It

Phwoar, look at the state of that. Camper van loaded up with surfboards (or are…

How To Cancel Weight Watchers (WW) Subscription UK

Bored of your subscription and looking to cancel? We’ll show you how to cancel your…

Yolt vs Money Dashboard vs Emma – The Comparison!

Don’t want to dust off a spreadsheet? A budgeting app can do most of the…

Pingback: Is Saving £1000 a Month Good? | The Mindful Money Project

Pingback: How To Calculate Your Savings Rate - Savings Rate 101