If you think you’ll ever need to borrow money in the future, and let’s face it who doesn’t at some point, then credit monitoring is very important. It doesn’t, however, need to be complicated. I’ve compiled a list of the best credit score apps in the UK, to make it super easy for you to find the one suitable for you.

The different credit reference agencies in the UK

In the UK, there are three main credit reference agencies. The biggest credit reference agency is Experian, but there is also TransUnion and Equifax.

What is a credit score?

Each credit reference agency has its own method and measurement of a credit score, so you will find your credit score varies between the agencies.

However, a credit score is essentially a metric that represents how lendable you are to a potential lender. Generally, a higher score means you are lower risk to the lender (i.e you’re more likely to not run into problems repaying).

Why is a good credit score important?

A high credit score means that you represent a fairly low risk to a lender. As a result of this lower risk, the lender will be more likely to extend their best deals such as a 0% balance transfer deal on a credit card or a lower interest rate on a personal loan.

The differences in interest rate given can have a significant impact on the amount of money you’ll be paying over the life of a loan, so monitoring your credit score and keeping an eye on your credit report is one of the more impactful things you can do to improve your finances.

Most of these apps also provide great insights and actionable tips which tell you exactly what you need to work on to improve your score. Perfect for taking the guesswork out of improving your score.

What does a credit score app do?

A credit score app will tend to give you these by default:

- access to your credit report

- visibility of your credit score

- ongoing credit monitoring relating to your credit report (i.e when anything on your report changes)

Some of the apps provide more granular data, such as visibility of your credit history, payment history (and any missed payments). They may also provide additional services such as fraud monitoring that can help protect you from identity theft.

Best Credit Score Apps UK

ClearScore (Equifax)

ClearScore uses the Equifax credit reference agency, and critically, is completely free.

Features include:

- credit score

- credit report details such as personal details, accounts and credit limits

- progress over time (incl. payment history)

- search for offers with a higher chance of being accepted based on your credit score

- basic level of identity protection monitoring through their Protect feature

Additional services offered include Protect Plus, which involves a higher level of monitoring, including instant notifications of any breaches of data, as well as a fraud case manager on hand if you were to become a victim of fraud – charged at £4.99 a month.

ClearScore is also rolling out a BETA feature where you can link your bank account using Open Banking connections in order to see how you look from a lenders point of view to give you more confidence when applying for credit.

As ClearScore earns money by recommending personal loans, or a credit card that you are likely to be accepted for, it is worth bearing in mind that sometimes it can be a bit obtrusive. If you’re not keen on these offers being promoted, I would suggest looking at one of the paid alternatives.

ClearScore is available for both iOS and Android.

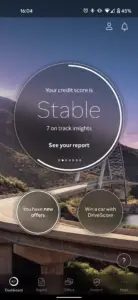

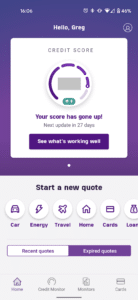

Credit Karma (TransUnion)

Credit Karma is another free credit score app, this time using TransUnion.

It provides:

- visibility of your credit score and full report

- credit score over time

- insights on factors affecting your credit score and tips on what needs improving

- personalised offers based on your credit score which you have a higher chance of being accepted on

Credit Karma has a few additional features which may be useful for you, such as comparison services on broadband and mobile contracts.

They are also rolling out a BETA Bills feature which gives you visibility of your bills in one place (similar to Wonderbill), view of your upcoming bills and provides a prediction of your balance after bills (by connecting your bank account).

Experian Credit Expert (Experian)

The credit monitoring service by the largest credit bureau themselves. They offer two services, their Experian app, and then the paid-for Credit Expert.

This is available on any browser, but they do also have the Experian app on both iOS and Android.

The free version gives you visibility of your Experian credit score, but unfortunately, the features stop there. Even though it will also provide you with a view of any cards, accounts and mortgages you have, it will not give you a full view of your credit report.

This is where the paid-for Credit Expert comes in. This service costs £14.99 a month, but provides you:

- insights on actions to take to build your score

- full Experian credit report

- alerts on any changes

- insights on what is currently positively or negatively impacting your score

- fraud alerts with enhanced fraud support if you become a victim of fraud

Other services by Experian that are useful are the Credit Boost which may give your credit score an instant boost once you connect your bank account (by allowing more data on your spending). This is a free service.

MoneySuperMarket Credit Monitor (TransUnion)

Within the MoneySuperMarket app (or on their site), you can use their free Credit Monitor service.

Similarly to Credit Karma, this uses the TransUnion credit bureau for the credit scoring.

- check your credit score

- monitor credit score over time

- insights on what is going well along with what needs work

- further credit report details such as personal details, accounts held and search history

As this is part of MoneySuperMarket, they also have an additional “monitor” service that keeps you on top of your other bills. My app, for example, has a tracker set up for my car insurance and for my energy provider at home.

Alternatives that are not an app:

CheckMyFile (not an app)

So.. not an app. But, a great service. This is the only service out of the ones listed which combines your report from ALL three Equifax, Experian and TransUnion.

This is very convenient, rather than having them scattered between different apps.

- credit scoring from 4 credit reference agencies

- insights and tips on how to improve score

- detailed credit report from Equifax, Experian and TransUnion including granular detail of each account and 6 years’ worth of repayment history

- access to credit analysts from within the portal to help with any queries you have

This service isn’t free. It costs £14.99 a month after the initial 30-day free trial.

However, due to this model of earning money, they don’t constantly promote credit deals like some of the other providers.

The best credit score apps in the UK: conclusion

There are plenty of options, both free and paid-for, which give you visibility of your credit score and credit report.

If you want visibility of your score and credit report across all three providers, you’ve got the option of using a paid service like CheckMyFile (which aggregates all of them), or alternatively, you could download all three of the free apps (ClearScore for Equifax, Credit Karma or MoneySuperMarket Credit Monitor for TransUnion and the free Experian app for Experian data).

By doing this, you’ll get a feel for yourself which app you prefer.

For me, I have ClearScore and Credit Karma as my main two (the Experian app is too simplistic without paying for it to be any use for me). I have found this combination to be great, and both give me useful tracking of my score over time as well as the comfort that I’ll be able to see if there are any changes that have not come from me (i.e if there is a new account added or there have been any searches which have not originally come from me).

Have you got a clear favourite out of these credit score apps? I’d love to hear in the comments section below.

What Is A Good Amount Of Savings UK?

Generally in life, more tends to be better. But is that true for savings? Whilst…

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

Tracking your expenses isn’t all about firing up a spreadsheet and restricting your spending. Having…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….