Sometimes even hearing the word “finance” is enough to start an eye-rolling yawn, but I tell you what isn’t boring? Investing! Ok, that might elicit the same response in most people. But the fact you’re here suggests it isn’t you. And I respect that! You’re here to find out if investing in Vanguard’s funds directly makes more sense than going via Plum, and I’m here to help – Plum vs Vanguard: what is the better option?

What are these services?

Straight off the bat, I want to avoid any confusion with this article.

Both services are very different at their core.

Plum is principally a budgeting and automatic savings app. Vanguard is an investment fund manager.

However, Plum also offers a set of features allowing people to invest in a selection of Vanguard funds, easily. This is likely why you are here, as you want to know whether it makes more sense (from a platform fee and other costs perspective) to be investing directly into Vanguard’s funds on Vanguard’s own investment platform rather than via the Plum app.

What is Plum?

Plum* is a budgeting and automatic savings app. You connect your bank account and credit card account (via the Open Banking API), and it helps you to stay on top of your finances by giving your bank a brain.

It’s a great service for beginners to personal finance who are looking for a money management app to help them reach their financial goals by improving their savings, making them aware of their spending habits and helping them to stick to a budget.

Plum also offers a great investing feature, which provides its users with a great selection of basic funds and advanced funds from reputable fund providers (such as Vanguard). The great part of Plum’s app is that they know perfectly who their target audience is, and don’t overwhelm them with thousands of options. They have a core range mixed with a more “advanced” range, along with useful guides and helpful tips to help educate yourself on investing as you go.

What is Vanguard?

Vanguard is an asset manager that has been in business since 1975 and popularised index fund investing. Index funds allow you to access a diversified portfolio at a low cost. They have a range of actively managed funds and passively managed funds and are known within the industry for pioneering market-leading low fees as a result of these passively managed fund options.

Why are fees important to an investor?

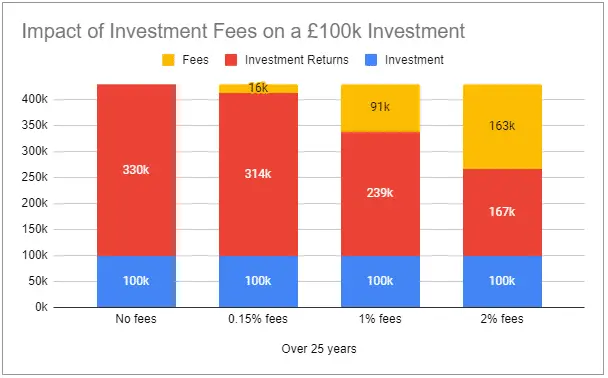

The fees charged on your investment often goes unnoticed by investors. Typically because they are small percentages, they can easily be ignored. But just like your investment returns, your investment fees compound over time and so can cost you a lot of money over the long-term unless you optimise now.

Using the example of having £100k invested, you can see that assuming a 6% annual return you will have £430k in 25 years. If you had to pay 2% a year in fees, you would have a portfolio of £267k in 25 years time. Those pesky fees charged at 2% would have cost you an eye-watering £163k over the 25 year period. These are the costs of both actually paying the fees, but also the opportunity cost of not having that money invested. For anyone unfamiliar to the term, an opportunity cost is the cost of the next best option which has been foregone (in this case, the money that was paid in fees has not been invested and so the future returns on that amount is the foregone benefit).

So that seemingly small 2% fee has ended up reducing your portfolio value by 38% (!).

Next time an investment salesman or financial planner starts discussing fees, be armed with this knowledge.

Now, unfortunately, you won’t be able to avoid investment fees altogether, but you will be able to minimise them. Even though we can’t control the future (and therefore our investment returns), you do have control over the fees you pay.

There are three things certain in this world: death, taxes and investment fees

Some wise, wise man

Plum vs Vanguard: Are you better off investing directly with Vanguard or via a service like Plum?

So now into the meat of it. Are you better off investing directly with Vanguard or via Plum?

In order to arrive at an answer, we’ll need to take into account a few things. Note of course that none of this article acts as financial advice.

We will be looking at:

- fees comparison

- account limits/ minimums

For this comparison, we’ll be looking at the costs to invest in the Vanguard Lifestrategy fund (the 80% accumulation fund, as this is also the “Growth Stack” fund within the Plum app). This provides a useful reference point, but bear in mind if you choose any of the more adventurous funds within Plum the fees will be higher (although, those funds are not with Vanguard, so I’m assuming you’re here because you want to compare the Vanguard funds).

Fees Comparison

Plum Investment Fees

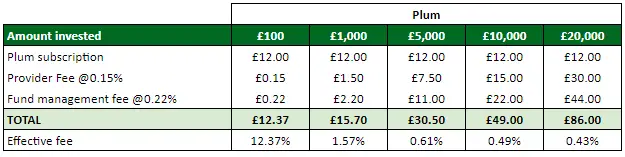

You will need to be on a minimum of their “Plus” plan which is charged at £1 per month (although the first month is free).

Further, there will be a product provider fee (levied by Plum’s technology partner and fund administrator Gaudi Regulated Services Ltd) of 0.15% and a fund management fee of 0.22% for the “Growth Stack” fund (the Vanguard Lifestrategy 80% fund). This takes the total to £1/month & 0.37% per year.

Both of those fees are automatically reflected in your portfolio balance as the price is updated by the providers.

Assuming varying levels of investment, you’ll be paying this per year:

You can see that the £1 per month Plum subscription weighs heavily on the total cost, especially at the lower invested amounts. The provider fee & ongoing costs are very similar to the Vanguard fees.

Vanguard Investment Fees

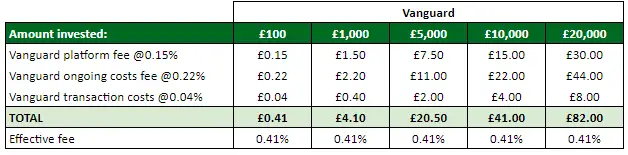

With Vanguard you pay two main types of fees:

- ongoing costs (essentially the fund management fee)

- and your account fee

The account fee is a flat 0.15% annually of the amount you have invested.

For the Vanguard Lifestrategy 80% accumulation fund, the ongoing cost is 0.22%. There are also additional transaction costs at 0.04%. This takes the total to 0.41% per year.

Assuming varying levels of investment, you’ll be paying this per year:

You can see that the fees are cheaper at all levels as the Vanguard platform doesn’t charge a fixed £ fee.

Account Limits

Minimum investment limits

Vanguard: to set up the account you need to invest either a £500 lump sum, or if looking to do monthly investments then a minimum of £100 per month (or a combination of the two). Once you’ve set up the account, you can add whatever amounts you like.

Plum: with Plum, the minimum investment is only £1.

Account Availability

Both platforms allow you to set up:

- Stocks & shares ISA

- General Investment Account

- Personal Pension

Additionally, Vanguard has a Junior ISA and the option to get financial advice. Plum does not offer financial advice.

Plum, on the other hand also provides an interest bearing easy access saving Pocket (offered by Investec) within your Plum account.

Other Features

Vanguard is principally an investment fund manager, and therefore don’t offer anything else other than a financial advice service giving you access to a financial adviser.

Plum, on the other hand, is principally an automatic savings app, and so does have a suite of features you might enjoy such as:

- Ability to connect bank accounts and track spending

- Diagnostics benchmarks your spend against other users

- Analysis to understand your spending patterns and spending behaviour

- AI to automate your savings

- Money Maximiser feature tries to get you to payday without running out of money

- Set and track savings goals

- Easy-access interest pockets provided by Investec Bank Plc

- The investment features we’ve discussed here already

See related: Plum vs Moneybox

Conclusion: Plum vs Vanguard

If you’re looking to invest in a Vanguard fund and the minimum investment limits are not a problem to you, then investing on the Vanguard platform directly will save you money, as it is the cheapest option.

However, Plum has lower minimum investment limits and if you find you’re using the other features (and get enough value from it that you would have it anyway), then starting your investing journey with Plum makes sense. Once you have enough capital and/or cash flow that you can meet Vanguard’s minimums, it might be worth moving across to their platform directly to save on fees.

Sources and references for this article:

Vanguard Costs & Charges

Vanguard Minimum Account Limits

Plum Investment Fees

Vanguard discussion on investment fees

Help with the calculation of the impact of fees via the investment fees calculator here.

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent. The views expressed are based on our own experience and analysis of the service.

How Much Does It Cost To Own A Car UK

If you’re looking to buy a car in the UK, it’s important to be aware…

What are the benefits of budgeting?

Even the word “budget” may evoke a deep-seated sense of fear, anxiety and loathing, but…

3 of the Best Budgeting Apps for Young Adults in the UK

As a young adult with a wealth of opportunity ahead of you, I salute you…