With some great innovation in financial services over the last few years, we’re comparing two of the newer competitors. In this article, we’ll be seeing who comes out on top in the head to head: Chip vs Moneybox. Read until the end for my verdict.

Chip vs Moneybox: What are these apps?

Chip* and Moneybox are both apps that can help your finances.

However, there are differences between the two apps that mean this isn’t a complete like for like.

Chip* is principally an automatic savings app. It looks at your spending (via connecting to your current account) and uses AI to figure out when and how much you can save. All with the purpose of building good savings habits and a pot of money for you. They’ve started to expand their core features to also include an easy way to start investing.

Moneybox also has some handy features which will put money away for you, but not as smart as Chip. Similarly to Chip, it will do this (such as its round-up rules), by connecting to your current account via the Open Banking API. I like to think of Moneybox more as a modern platform for you to easily manage your savings and investments.

Chip vs Moneybox: The Comparisons

Automatic saving capability

Chip

The pillar of the Chip app is the automatic savings feature. All other features are built around it, so you’d expect it to be good!

Chip has 5 levels which you can adjust based on how “aggressive” you want the auto-saving to be.

Also, Chip notifies you ahead of an auto-save, which gives you time to cancel it if you want to.

Moneybox

Moneybox also has an automatic saving capability. But this is much simpler than Chip’s. It won’t use any fancy AI capability to analyse your spending and figure out how much you can save.

Instead, it allows you to set up a few default rules that, if triggered, will automatically put money away for you.

These are rules such as:

- spare change round-ups (i.e rounding up your purchase to the nearest pound and saving it)

- double round-ups (i.e double the above round-up)

- payday boost (i.e on payday set to save a specified amount – this is great for paying yourself first and squirrelling money away on payday).

- regular payments (i.e save £x per week)

You will need to connect your bank account for these to work (this is handled via the Open Banking API). This is normally pretty easy to do and they also have great compatibility with UK banks.

Even though you may have connected a separate bank account that is used for the roundup rules, the money actually gets taken via the account you set up the direct debit for when first signing up for Moneybox.

This money is taken on a weekly cycle.

Winner: Chip due to its superior automatic savings feature

Platform availability

Both apps are available on the App Store (iOS) and the Play Store (Android) – as you would expect.

Winner: Draw

Account options

Chip

- Savings Account

- General Investment Account

- Stocks & Shares ISA (ChipX only)

Moneybox

- Savings Accounts

- Simple Saver

- 95 Day Notice

- 45 Day Notice

- Stocks & Shares ISA

- Lifetime ISA

- General Investment Account

- Personal Pension

Winner: Moneybox due to the greater range of accounts

Interest rates

Chip

With Chip+1, you can get access to the current market best return of 1.25% (variable). This is up to £10,000 on their ChipAI plan (which also gives you the auto-save functionality) or up to £2,000 on the free plan (without the auto-save functionality).

Moneybox

For the savings account products offered via the Moneybox app, the interest rates are as below:

- Simple Saver: 0.25% AER (offered by Shawbrook Bank)

- 95 Day Notice: 0.6% AER (offered by Investec)

- 45 Day Notice: 0.45% AER (offered by Investec)

Winner: Chip due to the leading rate

Chip vs Moneybox: Investment platform

Ease of access

I love the way this new wave of apps are trying to simplify investing for people. It is easy to get overwhelmed by the 1m+ options that you can invest in.

With both Chip and Moneybox, they’ve done a great job at stripping the experience back to basics. Only showing you what you need to know, with a carefully selected range of funds to cover your bases.

In terms of the experience of setting up an account and selecting a fund, both are fairly straightforward.

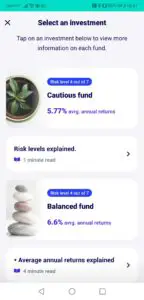

I would issue a word of warning though. On the Chip screen to select investments, they have an eye-catching “average annual returns” line under each investment. Remember that past performance is not an indicator of future performance!

Funds available

Chip

This is an area Chip has been building out this year. The core funds offered by Chip are powered by BlackRock based and their Census funds, and are:

- Cautious Fund

- Balanced Fund

- Adventurous Fund

The main difference between the three relates to their asset allocation.

More funds are unlocked on the ChipX plan. Such as another set of Cautious/Balanced/Adventurous funds, this time powered by BlackRock’s MyMap funds instead of their Census funds. These actually have cheaper fees than the Consensus funds.

Other funds unlocked include:

- Ethical

- Healthcare Innovation

- Clean Energy

- Emerging Markets

These are all based on different funds offered by BlackRock.

Moneybox

With Moneybox, there is a limited selection of three main funds you can choose based on your desired risk level.

These are the:

- Cautious fund

- Balanced fund

- Adventurous fund

The only difference between the three is the asset allocation between stocks and bonds. Generally, a higher allocation of bonds means the fund will be less volatile, and therefore less risky. Flip it the other way, and a fund with a higher allocation to stocks means it is more volatile and therefore riskier.

With the adventurous fund, you have a higher allocation towards stocks and shares, with a lower proportion in less volatile assets like property, bonds and cash.

The default asset allocation for each fund has been set by investment experts based on Modern Portfolio Theory, with the aim of maximising returns at a given risk level.

Moneybox, however, gives you the ability to customise and adjust your asset allocation between the funds as you see fit.

There is also a socially responsible version of these three funds, which I will discuss in more detail below.

Moneybox uses reputable providers for its fund options such as Old Mutual, Fidelity and iShares.

It’s worth noting that neither Chip nor Moneybox offers financial advice on their platforms.

Socially Responsible Investment Options

Chip

On ChipX, there are a couple of “ethical” investment funds offered by BlackRock.

The Ethical X is based on the BlackRock MyMap 5 Select ESG Fund and the Clean Energy option is based on the iShares Global Clean Energy UCITS ETC.

Moneybox

Moneybox also caters for investors looking to invest in ESG funds. You can switch the global shares component in any of your 3 fund choices (Cautious, Balanced or Adventurous) to a socially responsible version.

This changes the global shares component to a socially responsible global shares index offered by Old Mutual (Old Mutual MSCI World ESG Index).

Note that this option will only switch your equities fund to a socially responsible fund. The other components of your asset allocation such as Bonds and Property remain as the default.

With Moneybox, you do have control of setting a custom asset allocation (where in theory you can dial up the ESG global shares index to 100%), but the suggested allocations were designed by investment experts using Modern Portfolio Theory to try to maximise the returns at each risk level.

Investment Fees

To start investing on Chip, you need to be subscribing to at least their ChipAI plan (£1.50/28 days) to unlock the basic funds. On their ChipX plan (£3/28 days), you get access to their wider range of funds.

On the ChipAI plan, the platform fee is 0.75%, whereas, on the ChipX plan, the platform fee drops to 0.25%.

Note that regardless of the plan, you’ll also pay a fund management charge dependent on the plan selected. These range from 0.17%-0.65%.

For Moneybox, you pay £1 a month (although this is waived for the first 3 months), and 0.45% of the value of your investments per year.

Additionally, there are fund provider costs of 0.12%-0.30% per year.

Interestingly this means that Moneybox is cheaper when you start out, but Chip becomes the cheaper option (ChipX) when you have more than £1,000 invested (incl the subscription costs).

Winner: Draw. Both have good fund availability and if you have less than £1,000 to invest Moneybox is cheaper. If you have more than £1,000 to invest, the ChipX plan is the cheapest out of the two.

Other Features

Chip

- create and track savings goals

- auto-saving AI features (ChipAI and ChipX)

Moneybox

As well as the savings rules such as payday saving and roundups, Moneybox also offers:

- Mortgage advice

- House deposit calculator (albeit basic)

- Lifetime ISA

- Cashback via Moneybox+ with 3rd parties

Winner: Draw.

Withdrawals

Chip withdrawals are unlimited and fee-free. This includes the savings accounts and the investment accounts.

Withdrawals from the savings accounts take between 1-2 working days. Withdrawals from investments will take longer as they need to be sold on your behalf – these take up to 5 working days.

It is worth calling out though that scanning the Trustpilot reviews for Chip show a lot of frustration from users around slow and buggy withdrawals.

Moneybox

Stocks & Shares ISA and General Investment Account have no fees and unlimited withdrawals. The time for withdrawal generally takes 1-2 weeks.

For Simple Savings accounts, the funds will be sent back to you on the next available working day. However, note that you only get one withdrawal per month.

For the 45 day and 95 day notice accounts, it will take either 45 days or 95 days to be able to withdraw, with which the amount requested to withdraw still continues to earn interest. The money is then received the next working day after the notice period ends. It means it is less flexible but that is why they offer higher interest rates.

Lifetime ISA withdrawals are a little bit more complicated as they are impacted by the government penalty if it is used for anything other than your first home purchase or retirement. See below from Moneybox which helps explain the penalty you would incur if withdrawing from your Lifetime ISA outside of those two reasons.

Winner: Moneybox due to the reliability

Pricing

Chip

There are three tiers to Chip’s pricing.

The free, basic tier gives you access to the 1.25% interest rate on savings up to £2,000 and the ability to save and track savings goals.

The ChipAI plan (£1.50/28 days) gives you:

- same as Chip basic

- automatic savings feature

- access to the investment platform (only the basic funds)

The ChipX plan (£3/28 days) gives you:

- same as ChipAI

- wider range of funds

- cheaper investment platform fee of 0.25%

Moneybox

The fees charged by Moneybox varies based on the account you’re setting up.

For any of their savings accounts (such as their Simple Saver or either of their notice period accounts), there are no fees.

This is also the case for their Cash Lifetime ISA.

However, for their pensions and investment accounts there will be fees charged.

Pensions – for the first £100,000 the platform fee is 0.45%, after this amount it is 0.15%. Additionally there will be a fund charge / provider fee, for the Fidelity fund this is 0.14%.

For all other investment accounts (i.e Stocks & Shares ISA, Stocks & Shares Lifetime ISA and General Investment Account), you will be charged £1 a month (for the first three months this is waived). There will additionally be a platform fee of 0.45% per year. On top of this, you will pay a fund management charge dependent on the funds selected, ranging from 0.12% to 0.28% per year.

Winner: Moneybox due to the free savings accounts and cheaper investment platform if investing <£1,000.

Is my money safe with Chip and Moneybox?

Chip

The money held in your “interest account” and Chip+1 account is covered by the FSCS scheme as it is held within their partner bank ClearBank, whereas any money held in your e-money wallet is not.

Anything held in your e-money wallet is held in a ring-fenced Barclays account via electronic money specialists Prepaid Financial Services (PFS). And so in the instance of Chip going bust, your money will remain within the ring-fenced Barclays account.

Worth noting that the interest is not protected under the scheme by default due to technically being a marketing bonus.

Moneybox

Moneybox are authorised and regulated by the Financial Conduct Authority. Further, your money is protected by the Financial Services Compensation Scheme (FSCS) and they use bank-level encryption for all of your personal information.

For their investment products, Moneybox is protected by the FSCS scheme up to £85,000. Although bear in mind this does not protect you from investment losses, only in the instance that Moneybox goes out of business.

For its cash and savings products, this money is held in ring-fenced accounts with third-party banks. This is covered under each respective bank’s FSCS scheme.

Moneybox partners with various banks for various products, the full list of which can be found on Moneybox’s website here:

- the personal pension is held with Barclays Bank Plc.

- Cash Lifetime ISA is held with either OakNorth Bank plc, Investec Bank plc or across a range of diversified banks who all have FSCS coverage

- 95 day notice account is held with Investec Bank plc

- 45 day notice account is held with Charter Savings Bank plc

- reward savings account is held with Cynergy Bank

Moneybox vs Chip: what are other people saying?

Chip

Chip has an average of 4.2 out of 5 stars on Trustpilot with <1k reviews. On the Play Store, it has 4 stars out of 5 from 3.4k reviews and on the App Store it has 4.5 out of 5 from over 10k ratings.

Moneybox

On Trustpilot, Moneybox has an average of 4.3 out of 5 stars from ~800 reviews. On the Play Store, it has 4.5 out of 5 stars from more than 8k reviews. And on the App Store, it has 4.7 out of 5 stars from nearly 24k ratings.

Alternatives to Chip and Moneybox

If you’re looking for an automatic savings app, try looking at Plum* or Cleo.

See related: Chip vs Plum and Plum vs Moneybox.

However, if you’re looking for a budgeting and spend tracking app which you can connect to your bank account to help you understand your spending habits in more detail, you can look at:

Similarly, you get great budgeting capabilities built into some of the newer digital banks such as Starling and Monzo.

Chip vs Moneybox: My Verdict

And the winner is…. Moneybox.

Why?

Moneybox is a great one-stop shop for saving and investing. They make it simple to set up a savings account, and simple to start investing with a wide range of accounts.

Especially for beginners, where the first £1,000 invested will be cheaper with Moneybox than with Chip.

Further, they are well-reviewed by other users on Trustpilot, with far fewer complaints around slow/buggy withdrawals.

However, if you’re looking to build up more than £1,000 in invested funds, the ChipX plan will be the cheaper option for you (subscription costs + platform fee). Further, you’ll be able to benefit from the Chip auto-save feature and market-leading interest rate on your savings.

A really close call today.

Have you used either Chip or Moneybox? How have you found them? I’d love to hear your opinions in the comment section below.

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent. The views expressed are based on our own experience and analysis of the service.