With personal finance, the aim of the game is to simplify and automate when and where you can. I’ll be comparing two apps that are trying to dominate the automatic saving app market in a head-to-head. Chip vs Plum, who will come out on top?

Keep reading to hear my verdict.

Chip vs Plum – what are these auto-saving apps?

Both Plum* and Chip* are automatic savings app. These are apps that connect to your bank account to view your historic income and spending patterns. They then analyse this data to figure out how much you can be saving.

They then periodically save for you, building up a savings pot without you needing to lift a finger.

Both of these apps also go a bit further and have more features that allow you to either earn interest on these savings or to invest your money in the stock market.

But which one is worth your while? Let’s kick off the head-to-head!

Want to jump straight to the verdict? Scroll to the bottom section to see who takes the win.

Chip vs Plum: The Comparisons

Connecting your bank account

Both Chip and Plum use the Open Banking API. This allows you to connect your current account, giving the apps access to your transactions.

Why do they need this? One of their core features is to automatically save for you. To do this, they analyse your income and outgoings to figure out what you can afford, and when.

In terms of the banks that you can connect;

- Chip currently connects to 17 UK banks, including some big names such as Halifax, Lloyds, Monzo and Nationwide with some ommissions such as Metro Bank, Tesco Bank and Co-operative Bank

- Plum currently connects to 19 UK banks, with some big names such as Barclays, Halifax, Lloyds, Nationwide and TSB included as well as the newer fintech/challenger banks such as Monzo and Starling. They do not support Metro or Co-operative, but do have a connection to Tesco Bank.

Note that you can also connect credit card accounts to Plum to make use of all of its features on top of auto-saving.

Winner: Plum has support for more connections, so takes the win here.

Platform Availability

Chip is available on iOS and Android.

Believe it or not, Plum started life out as a Facebook messenger app. Today, Plum is available on iOS and Android, as you would expect.

Winner: Draw

Auto-save capability

The main focus of both apps is to put away cash for you automatically.

Plum has a series of saving levels. The savings levels adjust how much cash will be put away for you. These are labelled “moods” and range from “Shy” (expecting 50% less saving than normal) all the way up to “Beast Mode” (75% more savings than the default setting). All in all, there are 6 “moods” to choose from, so you can play around over time to find the balance that works for you and your money.

With Chip, there are 5 levels. Starting at Level 1 labelled “Take your time!”, there is no indication as to the impact on this, other than to assume less will be saved! It works all the way up to Level 5 “Serious Stuff.”, which is the highest auto-save level. You can easily edit within the app, to find the level that works for you.

With Chip, you’ll get a notification and an email when there is a pending auto-save. Before the auto-save is taken, you can easily dip into the app and increase, decrease or cancel if needed.

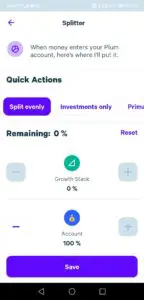

With Plum, you can customise where your automatically saved money ends up, splitting between your cash pockets and your investment funds (if you’ve enabled these).

Winner: Draw. Even though Plum is more intuitive, both apps give you a range of options to tweak your auto-saving spice until it is just right.

Interest Rates

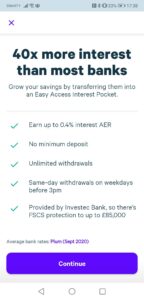

With Plum, the rate you receive on your cash varies whether you are on their free plan (Basic) or one of their paid plans.

On their Basic plan, which is free, you can earn 0.25% with an easy access interest pocket. This is held with Investec Bank Plc and so you also get FSCS protection up to £85,000.

On any of their paid plans, this interest rate jumps to 0.4%, once again held with Investec Bank Plc, with the same FSCS protection. Note that you don’t earn any interest on the Plum Primary Pocket.

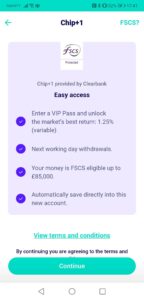

With the Chip+1 account, you can earn 1.25% annually if you’re on the paid-for ChipAI (£1.50 every 4 weeks) on up to £10,000 worth of savings. Alternatively, you can earn this rate on up to £2,000 for free with ChipLite. Your money held will be protected by the FSCS protection up to £85,000. It’s worth noting though that the interest paid is technically a “marketing bonus” and therefore isn’t protected under the FSCS protection.

Winner: Chip – for having a market-leading return.

Other Features

Both of these apps are principally auto-saving apps and is the focus of them both.

Chip is certainly more narrow in the range of features it offers compared to Plum. Chip’s features include:

- its flagship auto-save AI algorithm

- by default, Chip will not auto-save for you if you’re in your overdraft (can be turned off)

- access to investment funds (which we will cover in more detail in a later section)

- savings rules such as putting money away automatically on payday

- savings goals

The benefit of this approach is that it is a simple app to use and intuitive to find your way around.

Plum has a more robust feature set. This includes:

- its flagship auto-save AI algorithm

- setting to not auto-save when you’re in your overdraft (can turn on if needed)

- an accessible route into investing (we’ll cover this in a later section)

- savings rules such as;

- putting away money at payday, but also additional rules such as

- rounding up purchases,

- savings challenges (i.e £x each week for 52 weeks) – available on paid plans only

- and a neat feature that literally puts money into a rainy day fund every day it rains (!) – available on paid plans only

- savings goals

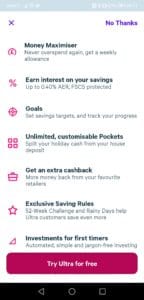

- a new budgeting feature called “Money Maximiser”. This suggests a weekly allowance by analysing your income, regular payments, expected spending and expected Plum savings with the intention of getting you to your next payday without running out of money – available on Plum Ultra only

- Diagnostic Reports (iOS only) which compare your spending against matched lookalikes

- Lost Money feature which scans the market to flag any opportunities to save by switching. Very useful for energy and broadband bills!

Winner: Plum – due to not only the great core auto-save capability but the additional suite of features available.

How easy are they to set up and use?

Chip has a nice, simple set-up. Intuitively designed and with no hiccups for me in the setup process, the whole experience was a breeze.

By default though, you are signed onto a free 28 day trial of their paid-for ChipAI plan, without seemingly an option to start on the free plan first. This was pretty frustrating as I bet a tonne of people simply forget they were on it in the first place and end up rolling over onto the paid plan before they’re happy the service is for them. One thing to watch out for if you’re signing up for Chip. It is easy enough to downgrade your account to the free ChipLite plan.

With Plum, I had a bit of a rocky start where my initial submission to sign up just got stuck in limbo. After waiting for a bit, I tried again successfully and the rest of the onboarding was smooth and well designed.

A plus compared to Chip, you start on the Basic (free) plan with Plum to try it out for size without the threat of forgetting about it.

Generally, the app is thoughtfully designed, with an intuitive dashboard and suite of features where I’ve not had a problem finding what I need. I also love the visual design of Plum.

Winner: It’s a draw. Plum has a tick because it puts you onto its free plan by default, whereas Chip had a smoother onboarding experience and is an app I found very easy and intuitive to use.

Chip vs Plum: Withdrawals

It’s all well and good having these apps build you a mountain of savings, but how easy is it to actually get hold of the moolah?

Are withdrawals unlimited and fee-free?

Chip – Yes, unlimited withdrawals and no fees charged.

Plum – Yes, unlimited withdrawals and no fees charged.

How long do withdrawals take?

Chip – for Chip+1 accounts, it will take between 1-2 working days depending on whether you trigger the withdrawal before 11am or after (before 11am = 1 working day). It is worth noting that deposits into your Chip+1 account take 3 working days, with which your money will only be able to be withdrawn once it has cleared (i.e after the 3 working days).

Plum – these are processed in less than 2 hours but Plum do say to allow up to 24 hours. In my own experience it was pretty quick, within the 2 hour period.

Withdrawals from investments will take longer because the funds need to be sold on your behalf – allow up to 5 working days for the funds to be deposited into your Plum account.

It is worth noting that scanning the Trustpilot reviews of both Plum and Chip shows that there have been some frustrations from users trying to withdraw from Chip, with the withdrawals either being slow or buggy.

Winner: Plum due to the shorter turnaround (and much fewer negative reviews on Trustpilot complaining about withdrawals).

Chip vs Plum: Pricing

Both apps have a free and paid-for tier.

Chip

On their free, ChipLite plan you can save up to £2,000 at the headline 1.25% rate. You won’t have access to its auto-save feature set though, unfortunately.

On their paid-for ChipAI plan, this will cost you £1.50 every 28 days and gives you access to their 1.25% rate for savings up to £10,000 and access to their auto-save feature set and their investment platform.

Plum

The Plum app has a range of tiers, with which you are on the Basic (free) plan to start with. All of the paid plans have a 30-day free trial and can be cancelled at any time.

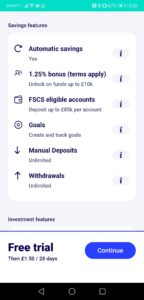

Plum Basic (free)

- 1 pocket to be used to store your auto-saves (earn up to 0.25%)

- auto-saving ability

Plum Plus (£1/month)

- auto-saving ability

- earn up to 0.4% AER on your easy access interest pocket (provided by Investec Bank Plc)

- 3 pockets

- access to investment funds via the app

Plum Pro (£2.99/month)

- auto-saving capability

- earn up to 0.4% AER on your easy access interest pocket (provided by Investec Bank Plc)

- unlimited, customisable pockets

- cashback from retailers

- exclusive savings rules such as the rainy day fund and a 52-week challenge

- access to investment funds via the app

- Diagnostic Reports helping you benchmark against other Plum users (iOS only currently)

Plum Ultra (£4.99/month)

- auto-saving capability

- earn up to 0.4% AER on your easy access interest pocket (provided by Investec Bank Plc)

- Money Maximiser (budgeting tool)

- set savings goals

- unlimited, customisable pockets

- cashback through 3rd party retailers

- savings rules such as 52-week challenge and rainy days fund

- access to investment funds via the app

Winner: Plum – given the basic plan is free which gives you access to the auto-saving feature.

Chip vs Plum: Investment Platform

Ease of access

Both apps do a great job of making investing much more accessible. With well explained and well thought out onboarding to both investment platforms, I can’t complain.

Both do require their paid-for subscriptions to access the investments side of the apps, but once you’re up and running they’re both easy to find and choose.

They both offer either a Stocks & Shares ISA or a General Investment Account too which is useful. A Stocks & Shares ISA has a limit of £20,000 contributions per tax year, but all returns are tax-free. Whereas a General Investment Account has no such limit, but also no such tax benefits.

Both apps do not offer financial advice, and will not provide any kind of guidance as to what investment or risk profile is right for you.

Investment Funds available

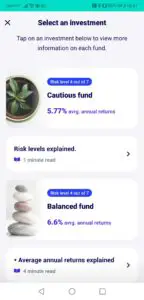

Chip

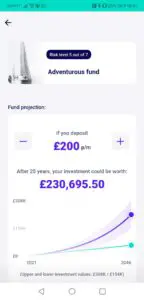

Chip has partnered with BlackRock to bring a set of their funds into their app for their users. They have a “Cautious”, “Balanced” and “Adventurous” fund, dependent on your risk profile. It is important to remember at this point that with investing, your capital is at risk.

These are based on the BlackRock Consensus range of funds, with:

- Cautious being the “BlackRock Consensus 35 Fund”

- Balanced being the “BlackRock Consensus 60 Fund”

- Adventurous being the “BlackRock Consensus 85 Fund”

I like the fact that Chip have limited to three, simple funds from a reputable provider, based only on the user’s appetite for risk and volatility.

This makes it super accessible to new investors, and they have helpful guides explaining key terms and concepts such as the risk levels and average annual returns.

Plum

Plum has a wider investment platform. But they are still catering to their audience by providing a stripped back range of funds (compared to the range of funds available on platforms such as Hargreaves Lansdown* or on individual stock trading platforms such as Freetrade). At this point, it is important to reiterate the fact that with investing, your capital is at risk.

Plum has a range of basic funds, based on Vanguard’s LifeStrategy series. These are labelled:

- Slow & Steady (Vanguard LifeStrategy 20%)

- Balanced Bundle (Vanguard LifeStrategy 60%)

- Growth Stack (Vanguard LifeStrategy 80%)

Once again, I love the way they’ve set out a slimmed down range of three, core funds from a reputable provider (Vanguard).

Plum also have a range of “Advanced Funds” which you can supplement your basic funds with. These range from funds investing in;

- companies selected for their social responsibility (Clean & Green)

- top Tech Giants,

- American companies (“American Dream”)

- British companies (“Best of British)

These are all funds picked from reputable providers such as Vanguard and Legal & General.

Out of the two, Plum is the only provider to offer investments into funds that only invest in companies with high environmental, social and governance scores.

Fees

For Chip, you need to be a subscriber to ChipAI (costing £1.50 every 28 days).

On top of this, there is a 0.75% annual platform fee to use Chip’s platform on the ChipAI plan.

Additionally, the fund manager (BlackRock in this case), charges an annual management charge which also gets taken – in this case it is 0.22%.

Chip is planning to launch a new paid plan, ChipX which will be £3 every 28 days and reduces the platform fee to 0.25%.

For Plum, you need to be a subscriber to at least the Plus plan (£1/month) to access their investment platform.

You will be charged an average 0.48% average annual fund management and provider fee (which includes a management fee of 0.15% and a 0.06%-0.9% fund provider fee dependent on the fund choice you make).

Winner: Plum due to the lower subscription plan entry point (£1 vs £1.50), lower annual platform/management fee, wider choice of funds whilst still keeping it accessible and jargon-free and the availability to invest in funds focusing on ethical companies.

However, keep an eye out for the ChipX launch as this will put it pretty much on parity with Plum’s pricing.

It is also worth noting that there are cheaper rates available on the market today if you know where and how you want to invest.

Is my money covered by the FSCS protection?

Both Chip and Plum are authorised and regulated by the Financial Conduct Authority.

The money held in your Chip+1 account and “interest account” is covered by the FSCS scheme because it is held within their partner bank ClearBank. Any money held in your Chip e-wallet isn’t. However, this is held in a special ring-fenced e-money account with Barclays. What this essentially means is that in the event of Chip going bust, your money is safe with Barclays.

With Plum, the “interest pockets” are held with Investec Bank Plc and therefore are protected (alongside any other funds held within Investec by you) up to the £85,000 FSCS limit.

Any money held in the standard Pocket in Plum is an e-wallet and so isn’t afforded the same protection. This money is held in a ring-fenced account and can’t be lent to other customers. So if Plum or their e-money provider were to go out of business, your money should still be safe.

If you want to find out more about the FSCS deposit protection scheme, there is a great article by Which covering it.

Winner: Draw

Chip vs Plum: what are other people saying?

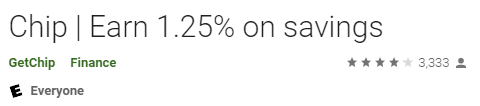

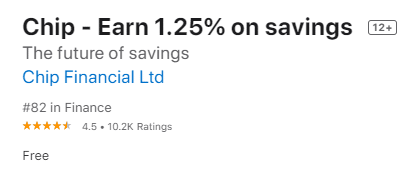

Chip

At the time of writing, Chip has received an average of 4.2 out of 5 stars on Trustpilot from 782 reviews.

On the Play Store, they have an average of 4 out of 5 stars with over 3k reviews.

And on the App Store, they have an average of 4.5 out of 5 stars from over 10k reviews.

Even though users on the whole have praised the app for its auto-saving feature, some users have also expressed frustration on Trustpilot at the slow withdrawals, explaining some difficulties they’ve had withdrawing from their Chip accounts as well as some generic customer service responses.

It might be prudent to dip your toes in the water with Chip first and test out its deposit and withdrawal timeframes to make sure you’re confident in it before transferring larger sums of money.

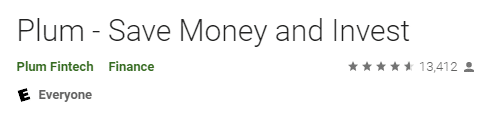

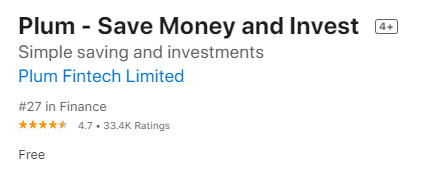

Plum

At the time of writing, Plum has received 4.5 out of 5 stars on Trustpilot based on nearly 2k reviews.

On the Google Play Store, Plum has received an average 4.6 out of 5 stars from over 13k reviews.

And on the App Store, Plum has received an average 4.7 out of 5 stars from over 33k reviews.

Alternatives to Chip or Plum

If you’re looking for another auto-save app, check out Moneybox or Cleo which offer a similar(ish) set of features.

However, if you’re looking for a personal finance app that helps you keep on top of your spending patterns and budgeting, check out:

See related: Yolt vs Money Dashboard vs Emma and Emma vs Snoop

Chip vs Plum: Final Verdict

And the winner is….. Plum. This is due to its strong free feature set, expansive paid-for features and accessible route into investing.

Chip

The good:

- market-leading interest rate

- intuitive, easy to use app

- access to BlackRock investment funds

The bad:

- auto-save only available on paid plan (ChipAI)

- slow withdrawals

- investment platform fees expensive

Plum

The good:

- auto-save available for free

- suite of additional features

- stronger range of investment funds

The bad:

- some of the user experience not as smooth as I’d like

- investment platform fees not the best in market

- spend tracking not very flexible (i.e no custom categories)

Verdict breakdown; Chip vs Plum

Chip has a lot going for it. With its intuitive design, market-leading interest rate, focused feature set and access to BlackRock investment funds, there is a lot to like.

However, the reason Plum is coming out on top in this review is due to its reliability (especially regarding withdrawals evidenced by superior reviews from other users), its wider set of investment funds, and its much wider set of features.

It is as close as I can find (yet), to an all-in-one app for your personal finances. Look at these times when you can use the Plum app to see what I mean:

- Want to optimise your bills? Check, have a look at the Lost Money feature.

- Want a nudge helping to save money for you? Make sure you turn auto-save on.

- Want help getting to payday without running out of money? Turn on Money Maximiser.

- Want to know how your spending looks compared to your peers? Diagnostic Reports can help (iOS only).

- Know you should get into investing but it all seems a bit stressful? Plum strips it back with a strong core of funds from reputable investment management firms.

The natural evolution…

I think both Plum and Chip are great for beginners (along with other autosave apps such as Moneybox). People who are taking their first steps to become more aware and engaged with their finances. Or people who have struggled to engage in their finances before.

Once you’ve developed good saving and spending habits (which is where these apps can help you), and are more comfortable with the idea of investing in the stock market. You can graduate to a more hands-on approach to your personal finances where your money management is not delegated to an app.

For example, free budgeting and spend tracking apps such as Emma or Money Dashboard can help keep you accountable to your budget (which you can set yourself), as well as funnelling your investments via a platform with cheaper fees than both Chip and Plum, maximising your returns by reducing the fees eating into your returns (i.e via the Vanguard platform directly).

See related: Plum vs Emma and Yolt vs Emma vs Money Dashboard

Have you ever used Plum or Chip? I would love to hear your own verdict on who would win in the face-off; Plum vs Chip – drop your comments in the section below.

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent. The views expressed are based on our own experience and analysis of the service.

What Is A Good Amount Of Savings UK?

Generally in life, more tends to be better. But is that true for savings? Whilst…

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

Tracking your expenses isn’t all about firing up a spreadsheet and restricting your spending. Having…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….