Wish you could harness technology to help your finances? You’re in luck. Today we pit two of the best personal finance apps head to head; Plum vs Emma.

Quick summary – Plum vs Emma

Plum* is best for people looking for a digital assistant to think for them. Plum siphons off money it thinks you can afford into savings and will keep you on top of your regular payments.

Emma* is best for people wanting a budgeting app to keep tabs on their spending habits and track their spending against a budget. As a budget and spending tracker, you can’t beat it.

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent. The views expressed are based on our own experience and analysis of the service.

Plum Summary

Recommended for: people after a hands-off approach to personal finance

Platform available: iOS and Android

The good:

- Helps you be across your utility and subscriptions

- Automatically siphons money into savings

- Can invest in the stock market via the app

- Can “pay yourself first” at payday, out of sight out of mind!

- Provides insightful comparisons with other “similar” users via its Diagnostic Reports feature (iOS only currently)

- Money Maximiser feature suggests weekly spend limits to keep you from overspending (based on income, committed payments and Plum savings).

The bad:

- Budgeting a paid-for feature (Money Maximiser)

- Less flexibility for editing transactions to different categories

- Investment platform fees not the best on the market

- Some of the user journeys aren’t as smooth as you would expect (but Plum is growing fast, so to be expected)

Summary

If you’re not interested in firing up a spreadsheet and doing things the old-fashioned way, Plum will be for you. Plum can link to your accounts, siphon off savings (when it thinks you can afford it), stop you from overspending with the Money Maximiser feature and provide you easy access to a range of investment funds.

Emma Summary

Recommended for: spend tracking and budget tracking

Platform available: iOS and Android

The good:

- weekly insights report

- wide range of bank, credit card and investment accounts to link

- intuitive, easy to use design

- flexible (can edit transactions, add offline accounts etc although Pro only)

- weekly quiz (with prize money up for grabs)

The bad:

- some features only unlocked with a paid subscriptions

- the personality/design not to everyone’s taste

- not as many advanced features as Plum

Summary

As an app to automate your spend tracking, and hold yourself accountable to your budget, you can’t do better than Emma.

With a delightful and easy to use design, Emma will surface insightful tid bits that help you to stay on top of your spending and understand your spending habits.

For people who are looking to simply understand where their money ends up, without the bells and whistles of further features, Emma is top-drawer and highly recommended.

Plum Deepdive

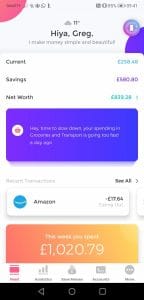

The team at Plum have described the app as “the AI assistant that grows your money”.

You can link Plum up to your bank accounts, and Plum will use its algorithm to put money away for you when it thinks you can afford it. Many users on Trustpilot have commented just how well it built up a pot of cash for them without them even realising!

Additionally, Plum offers an easy way into investing for their users. This is great, as a big barrier to investing for a lot of people is inertia and the shroud of complexity that investing seems to be covered in. Plum makes it super simple. Just remember that your money is at risk if you invest because the value of your investments can go down as well as up.

Where Plum falls short is in its availability of free features to be used as a full-fledged spend tracker and budget tracker, which is where alternatives such as Emma shine.

Plum does, however, have great features such as Diagnostic Reports (allowing you to compare your spending against “similar users”) and Money Maximiser (aiming to stop you from overspending, so you get to next payday with money left in the bank!).

Features

- Connects to bank accounts via the Open Banking API

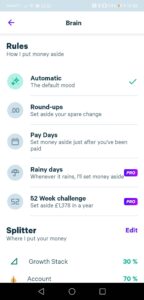

- The app will siphon off money for you when it thinks you can afford it

- Smart money rules such as “pay yourself first” on payday

- Easy access to a decent range of investment funds from the likes of Vanguard and Legal & General

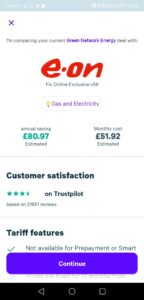

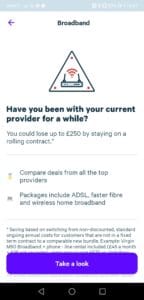

- Lost Money feature keeps you on top of utility bills to stop you from being overcharged

- Earn up to 0.40% on your savings with an easy access interest pocket provided by Investec Bank Plc

- You can earn cashback through the app

- Set savings goals and track progress (Pro subscription only)

- The “Diagnostic Reports” feature (iOS only currently) compares your spending against matched lookalikes (basically, people like you). Great for figuring out where you spend like crazy!

- Money Maximiser gives you a suggested spending limit each week with the aim to get you to next payday

Pricing

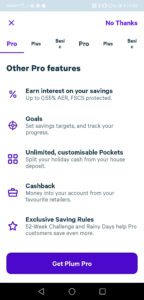

There are four levels of subscription on Plum’s premium offering. At the time of writing, these are:

- Basic (free)

- Plus (£1/month)

- Pro (£2.99/month)

- Ultra (£4.99/month)

Automated investing is only available on Plus, Pro and Ultra plans, which you can try for free for 30 days.

The Ultra plan is the most feature-rich, offering you:

- savings goals (and tracking against these)

- Money Maximiser (budgeting and weekly allowances)

- unlimited pockets

- exclusive savings rules

- diagnostic reports (comparing your spending against other “lookalikes”) – this is currently only available on iOS

With these kinds of services, it normally is always a good idea to start out on the free Basic plan. See how you get on with it. If you like the service, you can then start to upgrade to unlock the features you need.

Highlights

Automated Saving

If you’re new to the personal finance game, or simply aren’t interested in dusting off a spreadsheet, automatic saving is a great feature for you.

Plum basically figures out when you can afford to save, and siphons off some money for you.

Users on Trustpilot have repeatedly shown surprise at just how effective Plum has been at building up a pot for them, without them even noticing the pinch. The level can be adjusted to be more “aggressive” (i.e it tries to save more).

Reviews utility bills

Their “Lost Money” feature is great. I always bang on about staying on top of your utility bills and regular payments here on The Mindful Money Project. And it looks like Plum has my back here.

The feature will provide suggestions of where you can save money on your utilities or regular payments. If it thinks you can save money, it will recommend an alternative.

It was a little bit off-putting that they knew my energy provider before I provided them any information other than my address. But after a dig around, this information is available through a 3rd party based on your address.

Easy access to investment funds

With any cash saved via Plum, you can either;

- keep in a cash savings account

- split a portion to be invested into a range of index funds via either a Stocks & Shares ISA or within a General Investment Account (both available within Plum)

FYI: a Stocks & Shares ISA will mean any returns received are tax-free, but there is a limit of £20,000 that you can contribute in any tax year. Note you can only open one per tax year. A General Investment Account has no such limit, but any gains are taxable.

One of the main hurdles to investing lies in the massive choice that is available, with newer investors unsure how to navigate. This is where Plum hits the nail on the head. Its offering is perfect for its target market, allowing younger and/or newer investors the right entry into investing.

They have a basic range of 3 funds which are based on your risk profile. They don’t offer any recommendations or questions to figure out what your risk profile is (so you’re on your own there), but the three funds are:

- Slow & Steady

- Balanced

- Growth Stack

These are all based on the Vanguard Lifestrategy funds. The difference between the three is relating to the weighting of bonds within the fund.

For example, Slow & Steady will invest your money into the Vanguard Lifestrategy 20% Equity fund (i.e 20% of the money is in equity, the remainder is in bonds). Whereas the Growth stack will invest into the Vanguard Lifestrategy 80% Equity fund (i.e 80% is invested into stocks and the remainder into bonds).

If you have a lower risk tolerance, a portfolio with a higher weighting of bonds will be preferable. This is because bonds are less volatile (meaning their returns are more stable over time). Having a portfolio with a higher weighting of stocks means the returns will be more volatile, but that tends to mean larger returns over time.

…including themed funds

There are also further funds available, marketed as an “advanced” set of funds which they describe as being great for “expressing your opinion – pick something that matters to you”. These are some of the options:

- Clean & Green (i.e socially responsible companies)

- Tech Giants (tech stocks like Apple and Facebook)

- Best of British (shares of the top 100 companies in the UK)

- American Dream (shares in the top 500 companies in the US)

- and more…

Plum has nowhere near the choice available on some other investment platforms such as Hargreaves Lansdown* and no ability to purchase individual company shares like on trading apps like Freetrade.

But that is basically the point.

Plum have set it up to not overwhelm you with choice. The choices they do provide you are solid, reputable funds provided by large (and reputable) investment firms such as Vanguard and Legal & General.

This means that you’re unlikely to be managing a large portfolio via Plum, but it is a great place to start your investing journey.

In terms of fees, it is made up of:

- standard Plum subscription costs (see above)

- 0.48% average annual fund management and provider fee (which includes a management fee of 0.15% and a 0.06%-0.9% fund provider fee dependent on the fund choice you make)

Please note: as with all investments, your capital is at risk.

Lowlights

Limited Spend Tracking Functionality

Even though Plum does track your spend, and has features like Money Maximiser to stop you from overspending (Money Maximiser only available on the Ultra plan at £4.99/month), there isn’t an easy way to edit transactions and customise your spend/budget categories.

These are the kinds of features that alternatives like Emma absolutely excel in.

Can’t be used as a full-featured net worth tracker

As you cannot add bank accounts or investment accounts that are not yet connected to the Open Banking API, nor can you add offline accounts. Therefore you won’t be able to use Plum to track your net worth.

Now to be fair to Plum, that isn’t what they’re about. But alternatives like Emma do provide this feature, which is very useful.

Some of the user experience needs ironing out

Overall, I’ve been impressed with the experience of using Plum. It has a beautiful, simple visual design, and the interface has clearly been thought through.

There were a few times though that raised my eyebrows. These are the standard growing pains of a fast-growth, innovative app. But ones to bear in mind.

For example, when setting up my first investment fund I selected the one I was interested in, followed through the steps and then once I thought it was confirmed it just kept me hanging on a loading screen in my browser (rather than the app). After ~5 minutes of waiting I just loaded up the app to see the fund choice had already been selected and remembered. This is obviously a minor example, but I had a similar experience when first setting up the account which caused me to essentially sign up twice (due to a hanging loading screen).

What are other people saying?

Plum has received over 1900 reviews on Trustpilot at the time of writing, with an average rating of 4.5 out of 5 stars.

A lot of users are praising the app for being able to save money for them without them even realising it (showing the algorithm works without people feeling the pinch!).

The negative reviews tend to mention the time lag between money going in (and out) of Plum (up to a couple of days).

Additionally, one was complaining that a Plum transaction pushed them into their overdraft. As a note on this, by default Plum won’t put money away for you if you are in your overdraft unless you activate the “Overdraft Deposits” feature in the app.

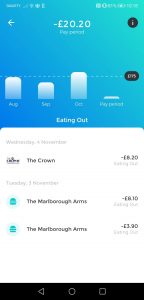

Emma Deepdive

The team behind the Emma app refer to it as “your best financial friend”.

The app essentially connects to your bank account, credit card accounts and investment accounts (via the Open Banking API).

It then can be used to track your spending against budgets that you set. Emma provides some great analytics and insight reports that help you understand your spending habits and can help you to rein them in when you’re spending too much.

Emma also helps you keep tabs on your regular payments, useful in trying to get rid of any wasteful subscriptions that you no longer use.

Features

- Connect your accounts via Open Banking

- Your transactions will be automatically tagged up to spend categories

- Set, and track, budgets

- Can set up custom categories and add offline accounts (Pro subscription only)

- Analytics features to help understand spending habits

- Track spending periods within a payday period rather than just monthly

Highlights

Weekly insights

These are great weekly reports that compare your spend against your historic spend, as well as against Emma’s average user.

This helps you to be aware of your spending habits and flags areas where you may want to think of cutting back on.

Budgeting

Emma will provide suggested budgets when you first create your budget, based on your historic spend. This is a really useful starting point, as any budget needs to be realistic and using your historic spend is one of the best ways to start.

You can create custom categories that you can track spend against (Pro subscription only), but the standard set of categories should cater for the majority of users.

Great Analytics

Digging into your spending to understand where you may have overspent is a breeze with Emma.

They have a very well designed homepage and analytics capability which provides you with split by vendor, over time and by category. Easily allowing you to drill into the areas you want to understand, all the way down to the individual transaction.

Intuitive Design

The importance of this can’t be underestimated. Being able to easily set up, and then use, this app makes it massively helpful.

Very well thought out and with a beautiful visual design, Emma is nice and easy to use with a very small learning curve. Meaning you’ll be up and running in no time.

Lowlights

Some features behind a paywall

Want to add custom categories or an offline account? It’s great those feature are there, but unfortunately they’re behind a paywall.

These features are free on some of their competitors (such as Money Dashboard), but you get the benefit of knowing that Emma monetises mainly through their Pro subscription, rather than selling user data.

Simpler set of features

I’ve included this as a lowlight when comparing against Plum, with its all singing and all dancing AI technology.

However, Emma is great because of the fact it is very focused on doing one thing very well. Which is spend and budget tracking.

What are other people saying about Emma?

Emma has been around for a few years and has generally positive reviews on the likes of Trustpilot.

After scanning through the reviews, a few positive themes pop up:

- responsive customer service team

- receptive development team (pushing updates and improvements regularly)

- ease of consolidating/connecting accounts

- ability to stay on top of subscriptions

There aren’t a huge number of reviews on their Trustpilot page, but there are a lot more on the Apple Store and Play Store, with 4.4 out of 5 stars with over 3k reviews on the Play Store and over 4k reviews with an average score of 4.7 on the Apply Store.

Alternatives to Plum and Emma

For alternative budgeting and spend tracking apps, try:

- Money Dashboard (see our budgeting app comparison here)

- Snoop* (Snoop vs Emma comparison here)

- Yolt (Yolt vs Emma comparison here)

See related: Yolt vs Money Dashboard vs Emma three-way comparison

For alternative smart AI apps which can help you save automatically, try:

- Cleo (see Cleo vs Plum here)

- Moneybox (see Plum vs Moneybox here)

- Chip* (see Chip vs Plum here)

Conclusion: Emma vs Plum

These are both great personal finance apps.

Emma* is great for spend tracking and budget tracking.

Whereas Plum* is great for the more hands-off personal finance approach.

Considering both have a free account, why not try both and see which one you get on with most?

Have you tried Emma or Plum before? I’d love to hear your own head-to-head Emma vs Plum and which one you preferred.

What Is A Good Amount Of Savings UK?

Generally in life, more tends to be better. But is that true for savings? Whilst…

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

Tracking your expenses isn’t all about firing up a spreadsheet and restricting your spending. Having…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….