Since Open Banking came into play, competition has heated up in the financial services space. Lots of new startups have built amazing tools that can help you to manage your money. I’m looking at two such apps today; Plum and Moneybox. But who wins in the head-to-head; Plum vs Moneybox? I’ll reveal my verdict at the end.

Plum vs Moneybox: What are these apps?

Plum* and Moneybox are both personal finance apps available on iOS and Android.

They both offer some level of automatic saving capability by connecting to your bank accounts.

Plum touts its app as the “AI assistant that grows your money“, with Moneybox giving you the ability to “save and invest for your future“.

They provide a way to earn interest on your savings and offer a route into investing in the stock market. This is especially well suited to beginners.

Plum vs Moneybox: The Comparisons

Automatic saving capability

Plum

Plum’s core feature is its automatic saving algorithm. It analyses your spending patterns and your income to figure out an amount that can be put away for you.

Users on Trustpilot have praised the app for its ability to build up a savings pot for them without them noticing. I found the feature pretty useful, with a good level of adaptability to find the level of auto-saving that is right for you.

It does this via its different automatic saving levels. These savings levels adjust how much cash will be put away for you.

These are labelled “moods” and range from “Shy” (expecting 50% less saving than normal) all the way up to “Beast Mode” (75% more savings than the default setting).

All in all, there are 6 “moods” to choose from, so you can play around over time to find the balance that works for you and your money.

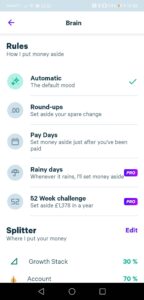

Other than automatic saving, there are additional rules within Plum you can set up:

- Round-ups (set aside your spare change)

- Set aside an amount on payday automatically (perfect for “paying yourself first”)

- Rainy day fund (only available on some paid-for plans, this rule literally puts money aside for you every day it rains)

- 52 week challenge building up to £1,378 in a year (only available on some paid-for plans).

- You can choose to split where this saved money ends up i.e into one of your pockets or investment accounts

Moneybox

As far as smart automatic saving capability, Moneybox is Plum’s dumber younger brother. It won’t overlay smart AI in figuring out when and how much you can afford. But it does have some solid savings rules that will be sufficient for the majority of people.

Rules like:

- £1 round-ups (i.e save the spare change up to the nearest pound)

- Double round-ups (i.e double the rounding up)

- Can specify which account you want the round-ups and other rules to pay into (i.e into your savings or investment account)

- Payday boost (saving a set amount of money on a specific day – great for “paying yourself first” which is a key concept in personal finance).

- Regular payments (i.e save £x per week)

For the round-up rules, you’ll need to connect to one of the compatible banks via the Open Banking API (should be easy to do and they have most of the main UK banks available to connect).

Even though you may have connected a separate bank account that is used for the roundup rules, the money actually gets taken via the account you set up the direct debit for when first signing up for Moneybox.

This money gets taken on a weekly cycle.

Winner: Plum due to the smart AI working on your behalf

Platform availability

Both apps are available on the App Store (iOS) and the Play Store (Android) – as you would expect.

Winner: Draw

Account options

Plum

- Free Primary Pocket (earn no interest)

- Interest bearing easy access saving Pocket (offered via Investec)

- Stocks & Shares ISA

- General Investment Account

- Personal Pension (currently in beta)

Moneybox

Savings Accounts

- Simple Saver

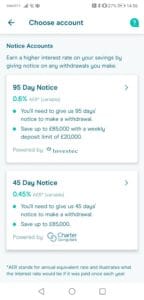

- 95 Day Notice

- 45 Day Notice

Investment Accounts

- Stocks & Shares ISA

- Lifetime ISA

- General Investment Account

- Personal Pension

Winner: Moneybox due to the wider range of accounts

Interest rates

Plum

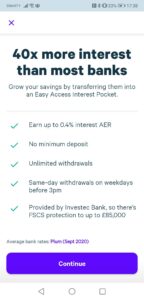

The Primary Plum Pocket earns no interest, however, you can open one of the easy-access interest pocket’s that are offered by Investec Bank Plc via the app.

On their Basic plan, which is free, you can earn 0.25% AER with an easy access interest pocket.

On any of their paid plans, this interest rate jumps to 0.4% AER.

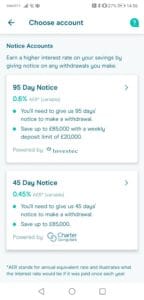

Moneybox

For the savings account products offered via the Moneybox app, the interest rates are offered as below:

- Simple Saver: 0.25% AER (offered by Shawbrook Bank)

- 95 Day Notice: 0.6% AER (offered by Investec)

- 45 Day Notice: 0.45% AER (offered by Investec)

Winner: Moneybox. Plum offers the same rate on the free account as Moneybox’s Simple Saver, but can’t compete with Moneybox’s notice accounts.

Plum vs Moneybox: Investment platform

Ease of access

I absolutely love the way both Plum and Moneybox have designed their investment platforms. Both make it super easy to open an account in a few clicks (the likes of a Stocks & Shares ISA or General Investment Account).

Both also provide useful guides and informational articles explaining investing key concepts too.

For example, Moneybox has an “Invest like the best” guide which gives you some more information around investing and why it is worth doing. A really well-written guide which will bring you up to speed with everything you need to know to set up your portfolio.

Plum also has some great informational articles such as “what are shares and bonds?” and “what are the risks of investing?”.

All of this is explained in fairly simple language, avoiding as much jargon as possible. I love it!

It is worth noting though that neither Plum nor Moneybox offer financial advice and to make it clear that with investing, your capital is at risk.

Funds available

Plum

Plum Basic Funds

There are 3 “Basic” funds available within Plum, which offer a range of asset allocations to match your risk profile.

These range from “Slow & Steady”, “Balanced Bundle” and “Growth Stack”.

These are all driven by the Vanguard Lifestrategy series (for example the “Growth Stack” is actually the Vanguard Lifestrategy 80% fund), which are a set of globally diversified funds by a reputable provider (Vanguard).

The only difference between the three funds is the asset allocation between stocks and bonds. The more growth focussed fund (i.e “Growth Stack”) has a higher allocation towards shares, 80% in the instance of “Growth Stack”, with the remainder allocated to Bonds. Bonds are generally less volatile, but with the lower volatility comes a lower potential for returns.

I love the way they have slimmed down the potentially massive options of funds, and have picked out three solid options from a reputable provider.

Plum Advanced Funds

Plum also has a set of funds which it calls “advanced funds”. These allow you to invest based on a particular theme or industry. For example, you can invest into American companies only with their “American Dream” fund. Alternatively, you could put money into the top tech companies via the “Tech Giants” option.

These are also funds offered by reputable providers such as Vanguard and Legal & General.

Moneybox

With Moneybox, they have three main options for how you can invest your money based on your risk level.

These are:

- Cautious fund

- Balanced fund

- Adventurous fund

Similarly to Plum’s Basic funds, the difference between the three funds is the asset allocation.

With the adventurous fund, you have a higher allocation towards stocks and shares, with a lower proportion in less volatile assets like property, bonds and cash.

The default asset allocation for each fund has been set by investment experts based on Modern Portfolio Theory, with the aim of maximising returns at a given risk level.

Moneybox, however, gives you the ability to customise and adjust your asset allocation between the funds as you see fit.

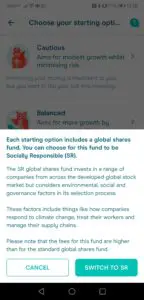

There is also a socially responsible version of these three funds, which I will discuss in more detail below.

As with Plum, Moneybox uses reputable providers for its fund options such as Old Mutual, Fidelity and iShares.

Socially Responsible Investment Options

Plum

If you’re looking to invest exclusively into investment funds with a focus on high Environmental, Social and Governance (ESG) scores, then Plum can help you there.

One of its available advanced funds is called “Clean & Green”, which only invests in companies who score well on the ESG scorecard. The fund is the ASI UK Ethical Equity Fund by Aberdeen Standard Investments.

Note that the basic funds can’t be switched to an ESG version.

Moneybox

Moneybox also caters for investors looking to invest in ESG funds. You can switch the global shares component in any of your 3 fund choices (Cautious, Balanced or Adventurous) to a socially responsible version. This changes the global shares component to a socially responsible global shares index offered by Old Mutual (Old Mutual MSCI World ESG Index).

Note that this option will only switch your equities fund to a socially responsible fund. The other components of your asset allocation such as Bonds and Property remain as the default.

With Moneybox, you do have control of setting a custom asset allocation (where in theory you can dial up the ESG global shares index to 100%), but the suggested allocations were designed by investment experts using Modern Portfolio Theory to try to maximise the returns at each risk level.

Fees

Unfortunately with both, you will need to pay some kind of monthly fee to use their investment service.

For Plum, you need to be a subscriber to at least the Plus plan (£1/month) to access their investment platform.

You will be charged an average 0.48% average annual fund management and provider fee (which includes a management fee of 0.15% and a 0.06%-0.9% fund provider fee dependent on the fund choice you make).

For Moneybox, you pay £1 a month (although this is waived for the first 3 months), and 0.45% of the value of your investments per year. Additionally, there are fund provider costs of 0.12%-0.30% per year.

Out of the two, the platform fees are cheaper on Plum (£1/month + 0.15% management fee), however there are some more expensive fund options on Plum than Moneybox (i.e the Clean & Green fund offered by Aberdeen Standard Investments has a fund management fee of 0.90%). This is the result of offering the “advanced funds” option.

Winner: Plum due to better range and lower platform fees

Other Features

Plum has a strong feature set, going beyond just automatic savings and savings products.

- automatic savings algorithm (its core brain!)

- setting to not auto-save when you’re in your overdraft

- savings rules such as payday saving, round up rules and custom rules such as the 52 week challenge and rainy day rule

- savings goals

- “Money Maximiser” which is a budgeting feature. This suggests a weekly allowance based on your income, committed expenses, expected expenses based on your spending habits and also based on expected savings from Plum

- Diagnostic Reports (iOS only) which compare your spending against matched lookalikes (great at benchmarking your spending against people like you)

- Lost Money feature which keeps you on top of your recurring bills and subscriptions. If Plum thinks you can save money, it will flag it to you – especially useful for energy and broadband bills where the firms try to mug you off with renewals!

Moneybox

As well as the savings rules such as payday saving and round ups, Moneybox also offers:

- Mortgage advice

- House deposit calculator (albeit basic)

- Lifetime ISA

- Cashback via Moneybox+ with 3rd parties

Winner: Plum due to a much wider feature set helping you with money management, budgeting, saving and investing.

Withdrawals

Plum

Withdrawals from your Plum pockets are unlimited and free of charge.

They are processed in less than 2 hours but Plum do say to allow up to 24 hours. In my own experience, it was pretty quick, within the 2 hour period.

Withdrawals from investments will take longer because the funds need to be sold on your behalf – allow up to 5 working days for the funds to be deposited into your Plum account.

Moneybox

Stocks & Shares ISA and General Investment Account have no fees and unlimited withdrawals. The time for withdrawal generally takes 1-2 weeks.

For Simple Savings accounts, the funds will be sent back to you on the next available working day. However, note that you only get one withdrawal per month.

For the 45 day and 95 day notice accounts, it will take either 45 days or 95 days to be able to withdraw, with which the amount requested to withdraw still continues to earn interest. The money is then received the next working day after the notice period ends. It means it is less flexible but that is why they offer higher interest rates.

Lifetime ISA withdrawals are a little bit more complicated as they are impacted by the government penalty if it is used for anything other than your first home purchase or retirement. See below from Moneybox which helps explain the penalty you would incur if withdrawing from your Lifetime ISA outside of those two reasons.

Winner: Plum due to no limits on withdrawals per month unlike Moneybox

Pricing

Plum

There is a range of tiers available on Plum. You start out on the free “Basic” plan, but if you want to upgrade you get a 30-day free trial to try it out.

Note that Plum regularly change their pricing ranges and features. These are typically tweaks to the number of interest pockets you can open, the interest rate being offered, and may even feature price changes. The below was correct at the time of writing but may change.

Plum Basic (free)

- default pocket plus 1 additional interest pocket (provided by Investec Bank Plc)

- earn up to 0.25% AER on money in your interest pocket

- auto-saving ability

Plum Plus (£1/month)

- auto-saving ability

- default pocket plus 1 additional interest pocket (provided by Investec Bank Plc)

- earn up to 0.4% AER on money in your easy access interest pocket

- access to investment funds via the app

Plum Pro (£2.99/month)

- auto-saving capability

- default pocket plus 10 additional customisable interest pockets (provided by Investec Bank Plc)

- earn up to 0.4% AER on money in your easy access interest pocket

- cashback from 3rd party retailers

- exclusive savings rules such as the rainy day rule and a 52-week challenge

- access to investment funds via the app

- Diagnostic Reports helping you benchmark against other Plum users (iOS only currently)

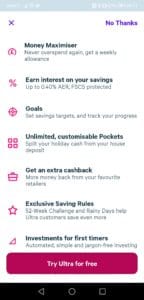

Plum Ultra (£4.99/month)

- auto-saving capability

- default pocket plus 10 additional customisable interest pockets (provided by Investec Bank Plc)

- earn up to 0.4% AER on money in your easy access interest pocket

- Money Maximiser (budgeting tool)

- set savings goals

- cashback through 3rd party retailers

- savings rules such as 52-week challenge and rainy days rule

- access to investment funds via the app

Moneybox

The fees charged by Moneybox varies based on the account you’re setting up.

For any of their savings accounts (such as their Simple Saver or either of their notice period accounts), there are no fees.

This is also the case for their Cash Lifetime ISA.

However, for their pensions and investment accounts there will be fees charged.

Pensions – for the first £100,000 the platform fee is 0.45%, after this amount it is 0.15%. Additionally there will be a fund charge / provider fee, for the Fidelity fund this is 0.14%.

For all other investment accounts (i.e Stocks & Shares ISA, Stocks & Shares Lifetime ISA and General Investment Account), you will be charged £1 a month (for the first three months this is waived). There will additionally be a platform fee of 0.45% per year. On top of this, you will pay a fund management charge dependent on the funds selected, ranging from 0.12% to 0.28% per year.

Winner: Plum. Saving is free on both but the investment platform is cheaper on Plum

Is my money safe with Plum and Moneybox?

Plum

Plum is authorised and regulated by the Financial Conduct Authority (FCA). They support Face & fingerprint ID and use 256-bit TLS encryption which helps to keep your account and details secure. They will also never share your data with any other parties without your consent.

In terms of Financial Services Compensation Scheme (FSCS) coverage with Plum, the “interest pockets” are held with Investec Bank Plc and therefore are protected (alongside any other funds held within Investec by you) up to the £85,000 FSCS limit.

Any money held in the standard Pocket in Plum is an e-wallet and so isn’t afforded the same protection. This money is held in a ring-fenced account and can’t be lent to other customers. So if Plum or their e-money provider were to go out of business, your money should still be safe.

For Plum investments (i.e investments held within the Plum app), even though the value of your investments will fluctuate due to market forces, your share of the fund will be protected. This means that if anything happens to either Plum or the investment provider, you’ll be able to get your investment back or sell it at market value.

This is because your share of the fund is safeguarded by a regulated custodian, whose job it is to keep your shares safe.

And what if the custodian fails? In that case, you could benefit from the FSCS protection.

Moneybox

Moneybox are authorised and regulated by the Financial Conduct Authority. Further, your money is protected by the Financial Services Compensation Scheme (FSCS) and they use bank-level encryption for all of your personal information.

For their investment products, Moneybox is protected by the FSCS scheme up to £85,000. Although bear in mind this does not protect you from investment losses, only in the instance that Moneybox goes out of business.

For its cash and savings products, this money is held in ring-fenced accounts with third-party banks. This is covered under each respective bank’s FSCS scheme.

Moneybox partners with various banks for various products, the full list of which can be found on Moneybox’s website here:

- the Personal Pension is held with Barclays Bank Plc.

- Cash Lifetime ISA is held with either OakNorth Bank plc, Investec Bank plc or across a range of diversified banks who all have FSCS coverage

- 95 day Notice account is held with Investec Bank plc

- 45 day Notice account is held with Charter Savings Bank plc

- reward savings account is held with Cynergy Bank

Winner: Draw.

Moneybox vs Plum: what are other people saying?

Plum

At the time of writing, Plum has received 4.5 out of 5 stars on Trustpilot based on nearly 2k reviews.

On the Play Store (Android), Plum has received an average of 4.6 out of 5 stars from over 13k reviews.

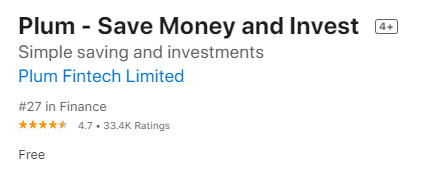

And on the App Store (iOS), Plum has received 4.7 out of 5 stars from over 33k reviews.

Moneybox

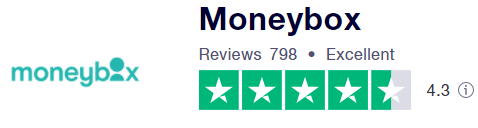

At the time of writing, Moneybox has received an average 4.3 out of 5 stars on Trustpilot from nearly 800 reviews.

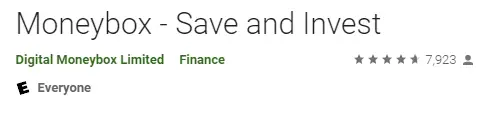

On the Play Store (Android), Moneybox has a rating of 4.7 out of 5 from nearly 8,000 reviews.

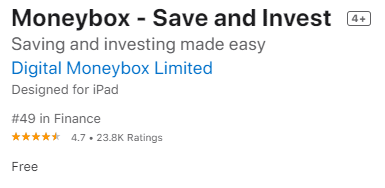

And on the App Store (iOS), it has a rating of 4.7 from nearly 24,000 reviews.

Alternatives to Plum and Moneybox

If you’re looking for an automatic savings app, try looking at;

- Chip* (read our Chip vs Plum comparison here).

- Cleo (read our Plum vs Cleo comparison here).

However, if you’re looking for a budgeting and spend tracking app which you can connect to your bank account, you can look at:

- Emma* (read our Emma Review here).

- Money Dashboard* (read our Money Dashboard review here).

- Snoop*

See related: Yolt vs Money Dashboard vs Emma.

Similarly, some of the newer banks offer great budgeting and spend tracking capability within their own app that you get for free with your bank account. New banks such as Starling Bank and Monzo are great for this.

Plum vs Moneybox: My Verdict

And my overall winner of Plum vs Moneybox is…. Plum! But only just.

Why?

- Wider investment choices

- Wider feature set and smart AI

- Cheaper investment platform fees

However, I was very impressed with Moneybox who provide some great products and a very accessible route into stock market investing. Not to mention, their wider range of accounts such as a Cash Lifetime ISA.

Plum

The good:

- strong automatic saving capability

- wider feature set

- wider investment choices

The bad:

- investment platform fees not the cheapest in market (though they are cheaper than Moneybox)

- spend tracking not as flexible as a specialist budgeting/spend tracker (such as Emma or Money Dashboard)

Moneybox

The good:

- thoughtfully designed

- great informational explainer articles

- wide range of accounts

The bad:

- investment platform fees not the cheapest in market

- not as many money management features as Plum

Who are these good for?

Plum* is great for personal finance beginners wanting a helping hand with their money management. It offers a way to help you start saving money and putting it to work.

Moneybox, however, is great for a range of people from beginners (where they provide easy access to different investment fund(s) and great informational articles), but also for more advanced personal financers who want to put their money away into the range of Moneybox’s accounts (some of which occasionally offer market-leading rates).

Parting thoughts… the natural evolution

Both of these apps are great ways to get into stock market investing and the habit of regular saving and investing.

These are brilliant habits to develop, and both Plum and Moneybox guide you very well.

I love how they have designed their investment platforms to restrict the sometimes massive choice you can find elsewhere to only the investment option(s) you need at this stage.

Making it less intimidating and more welcoming should hopefully improve the rates of people participating in investing – which can only be a good thing.

However, it must be said that these investment platforms are rarely the cheapest available on the market.

If you are going to invest a large sum of money or want to invest a chunk regularly each month, you will be well served to run a price comparison of the market to find the cheapest platform.

For example, both Plum and Moneybox provide you the details of the funds that make up your portfolio. You can shop around and check on different platforms such as Vanguard and Hargreaves Lansdown* to find the cheapest platform fees. Even though the percentages sound small, higher fees can make a massive difference to your returns over a long period of investing.

Have you used Plum or Moneybox before? If so, I’d love to hear your thoughts – drop a comment in the section below.

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent. The views expressed are based on our own experience and analysis of the service.