Don’t want to dust off a spreadsheet? A budgeting app can do most of the heavy lifting for you in looking after your personal finances. But with a few different options, it can be hard to choose which one is right for you. I’ll make the decision easier with a three-way comparison; Yolt vs Money Dashboard vs Emma…

Update: Yolt has announced they are closing down their service from 4th December 2021, so it is now out of Money Dashboard and Emma!

This post may contain affiliate links (any links where we earn commission are marked with an * asterisk).

Quick Summary

Emma* – best for those who want an easy to use app with great design

Money Dashboard* – best for those seeking the best free features which can adapt to their financesYolt – best for those seeking a simple app to help get on top of fairly simple finances

Update: Yolt has announced they are closing down their service from 4th December 2021. I have left in our original comparison, but please bear in mind that from this date Yolt is no longer available.

These apps have some core functionality which we will be comparing:

- connecting accounts (bank, credit card, investments)

- categorising transactions

- analytics/insights

- budgeting

- subscription tracking

- ease of use

I will compare these features below, before providing a verdict. For those of you who want more detail, along with screenshots of the apps, keep reading to the “deepdive” section.

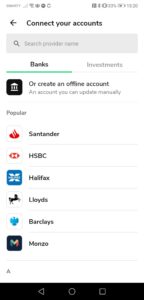

Connecting Accounts

| Yolt | Most banks and credit cards compatible but not much availability of investment accounts compared to the others. You can create an offline account for free (iOS only). |

| Money Dashboard | As well as most banks and credit card company’s being compatible, there is a great selection of investment and alternative finance platform compatibility such as Wealthify and Coinbase. For any you can’t connect, you can create an offline account for free. |

| Emma | Most banks and credit cards are compatible. Emma also connects to a range of investment and alternative providers such as Coinbase and Nutmeg, but not as many as Money Dashboard. If you’re a subscriber to Emma Pro, you can create an offline account for any you can’t connect. |

Due to the wider range of investment accounts, and the ability to create offline accounts for free, Money Dashboard takes the win.

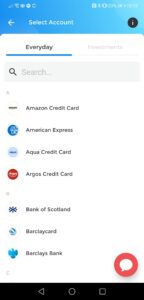

Categorising Transactions

| Yolt | Automatically categorises transactions based on spend type, which you can override. Can use tags to track different spend outside of these default categories, but cannot create new categories. I found this very limiting. |

| Money Dashboard | The app categorises transactions automatically. You can override this, and the app will attempt to remember for future transactions. You can also add new categories of spend for free. |

| Emma | As with the others, Emma also categorises transactions automatically. Their AI algorithm did the best job out of the three. It didn’t need too many overrides and when I did apply an override, all future transactions from that vendor remained consistently in the corrected category. You can also create custom categories (although this is part of their Emma Pro feature set). |

I got on best with Emma’s categorisation algorithm, finding the app needed minimal intervention. Frustrating to see the custom categories feature is only available for Emma Pro subscribers, which made it a tighter call than it otherwise would have, but Emma takes the win here.

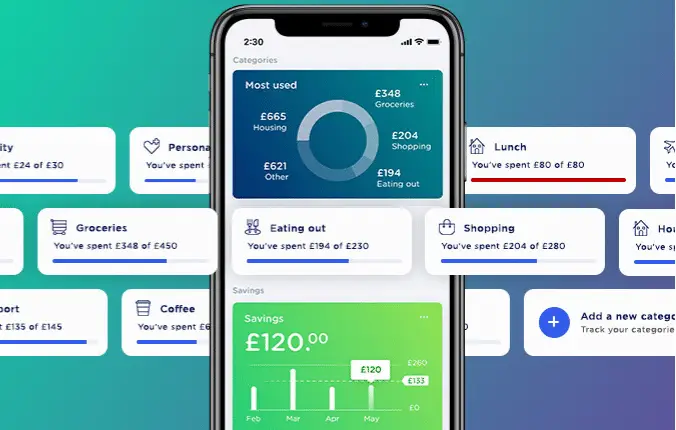

Analytics

| Yolt | Clean and intuitive visualisations of your spend. I found the pie chart breaking down my spend over a period really useful, as well as their bar chart showing my spend over time per category. |

| Money Dashboard | Wealth of visualisations available on their web app, but not as many in their iOS or Android app, which is a shame. You can pretty much only view your spending over time per category. |

| Emma | The visualisations within the Emma app are clean, intuitive and detailed. They surface great insights on the dashboard page giving you a snapshot of areas to focus on. Further, you can view your spend over time, per category and against budget really easily. |

Due to the design and detail of visualisations available within the app, Emma takes the win here.

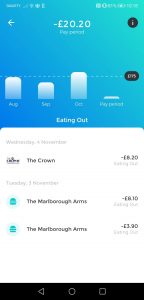

Budgeting

| Yolt | Ability to set budgets, but frustratingly tucked away under the “Actions” tab. No custom categories. Can flex to payday cycles as opposed to calendar months. |

| Money Dashboard | Can set budgets easily, with the ability to both create custom categories to track against and can flex to payday cycles instead of calendar months. The Spending Plan feature is great if you’re new to personal finance, giving you a forecast of your ending month balance. |

| Emma | Easily set budgets to track against, can flex to a payday cycle and can create custom categories (Emma Pro subscription needed). |

Due to the Spending Plan feature, which forecasts your month ending balance after taking into account your recurring expenses and budgets, Money Dashboard takes the win here.

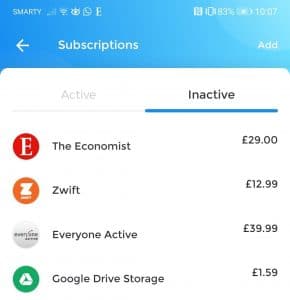

Subscription Tracking

| Yolt | Identify recurring transactions, and has the capability to include extra details such as the renewal date of the subscription. This is super useful to remind you to look for cheaper options when you can! |

| Money Dashboard | Identifies your existing and upcoming recurring payments, enabling you to stay on top of your regular payments. |

| Emma | Provides a view of your upcoming committed spending (your recurring payments) based on your previous payments. Emma provides contextual links to help you save money by searching price comparison sites. |

Yolt narrowly edges this one for me, due to the ability to add additional information which you can use to stay on top of your bills.

Platform

| Yolt | Available on iOS and Android |

| Money Dashboard | Available on iOS, Android and web app (via your browser) |

| Emma | Available on iOS and Android |

Money Dashboard wins this as it is the only platform to offer a web app.

Ease of use and design

| Yolt | Has handy guides and walk-throughs when signing up. Clean and simple design. Some features unnecessarily hidden, but ideal if looking for something simple and clean. |

| Money Dashboard | Clean and smart visual design which I like, but some of the experience isn’t as slick as the others. |

| Emma | Easy to use, intuitively designed and definitely the most colourful out of the three. The app “personality” might not be to everyone’s taste, but I like the feel and vibe of the app. |

Due to the ease of use and the colourful visual design, Emma takes the win here for me.

Price

| Yolt | Free |

| Money Dashboard | Free |

| Emma | Free to use but can unlock more features such as custom categories and offline accounts in their Emma Pro premium subscriptions |

Verdict

Yolt

The good:

- Simple design

- Clean visualisations

- Subscription tracker

The bad:

- No custom categories

- No offline accounts on Android version

Money Dashboard

The good:

- Custom categories

- Offline accounts

- Spending Plan feature

The bad:

- Detailed analytics only on web app

Emma

The good:

- Intuitive design

- Insightful analytics

- Weekly cash quiz

The bad:

- Some features only for Emma Pro

If you’re looking for more detail, keep on reading. In the below deepdive section we include screenshots and more detail on each of the main sections.

Yolt vs Money Dashboard vs Emma – The Deepdives

What do these apps do?

These apps are all a version of a money management app, helping you with your budgeting and spend tracking, ultimately helping you to successfully work towards your financial goals (including your savings goals). I’ve found these types of apps to be a godsend for my own personal finances, helping me to save money and cut down on sneaky “hidden” spending on my credit card (who was I even kidding?!), whilst not having to spend hours tagging up every single transaction in a bulky spreadsheet.

They can help you to:

- aggregate your accounts in one place

- set budgets

- track spending

- keep on top of subscriptions

They connect your bank accounts (and also your savings account and investment account) so you have a complete picture of all of your spending in one place. Further, they’ll tag up each transaction automatically to different categories such as “Eating Out”, “Groceries” and “Travel”. An automated way to understand your spending habits? What’s not to like!

You can use these apps to set budgets for these categories, and as such is an easy way to automatically track your spending against your planned budgets for each of these categories.

Before these apps came about, you would have needed to pull your bank and credit card statements from all of your different providers and likely run them through a spreadsheet to analyse your spending by yourself.

They all connect to your bank using the Open Banking API, which means that you never hand over your details directly to these apps.

For more information on Open Banking, this guide/explainer from Money Saving Expert is very useful.

Connecting bank accounts

This is the bread and butter of these personal finance apps. They need access to your bank account in order to be of any use to you.

Even though they all use the Open Banking API to connect to financial institutions, they do have variations in which accounts they can connect.

Most of the big high-street UK banks are available on all. Including Barclays, HSBC, Halifax, Lloyds as well as their smaller competitors Monzo and Starling Bank.

Through these, you’ll be able to add your current account, your savings account, your credit card account and even in some instances your investment or crypto account.

However, both Money Dashboard and Emma provide more flexibility to use their app as a net-worth tracker by including some investments accounts such as Nutmeg, Wealthify and PensionBee.

Even though it is close, Money Dashboard takes the crown here because it connects to more investment providers such as Hargreaves Lansdown and alternative investment providers such as Coinbase.

Worth noting that both Emma and Money Dashboard have the capability to add manual offline accounts so you can track balances of accounts you can’t connect. This functionality is free in Money Dashboard but is part of their paid feature set for Emma. Yolt also offers this functionality but only on its iOS app currently.

You can find the full listing of available financial institutions for each app using the link below:

Categorising transactions

Once the budgeting app has connected to your account, it will start importing and categorising your transactions automatically.

This is where these apps come in super handy, as it means this tagging process happens automatically once you’ve got it set up the way you like it.

All of the apps provide automatic categorisation with the ability to override. They all have the ability to remember for future transactions from the same vendor.

However, out of the three, I found Emma to be the most consistent, relevant and intuitive around these categorisations.

It is worth noting that you can create custom categories in both Emma and Money Dashboard, but not in Yolt. This feature in Emma is part of its premium feature-set; Emma Pro.

Analytics

The ability to quickly see your spending versus your budget or over time is really helpful. It can help you spot trends and issues but is a pain to crunch the data yourself. This is where these apps come to the rescue yet again.

Yolt’s interface for its dashboard is clean and intuitive, surfacing a handy pie chart to analyse your total spend. As well as providing you with bar charts for spend per category over time.

Money Dashboard’s analytics is less intuitive and feels unnecessarily hidden away on their app. On their web-app (which you can access through the browser), the analytics are far better featuring useful visualisations such as pie charts and spend over time.

Emma’s in-app analytics are very good. There is a useful dashboard which surfaces the insights from your spend, your budget and your main categories. Once again viewing your spend over time as a total budget or against particular categories is easy, intuitive and the design of these visualisations are stunning.

Overall, Emma takes the win on the analytics and data visualisations.

Budgets

Having one of these apps will no doubt improve your budgeting setup, removing both time and complexity. For them to be an effective budgeting companion, being able to set a budget for different categories and track your spending is a core feature requirement. How do they stack up?

All have the ability to set a budget and track the spend against it. The Yolt app, however, doesn’t have the ability to create your own custom categories (on its Android app), whereas the other two do (and the Yolt iOS app).

The app that really shines here is Money Dashboard with its “Spending Plan” feature.

It will take your bank balance as at today and predict your ending balance for the month, giving you an easy snapshot of how much you have left to spend outside of your budgets. It does this by taking your balance, taking off any committed spending and takes off your remaining spend from any planned budgets such as “Transport”, “Groceries” and “Entertainment”. This is a great feature, in my opinion, stripping away the old issue of not knowing how much money you truly have in your bank account to spend.

Payday flexibility

Being able to track against a custom period, such as a payday cycle, is important when budgeting. All of the apps enable you to track a payday cycle as opposed to a simple calendar month.

Subscription tracking

I’m always banging on about how important it is to stay on top of your recurring expenses. Nothing hurts me more than seeing a lot of good money lost on wasteful subscriptions that are not being used.

Luckily, all of these apps feel the same!

They all have the ability to track recurring expenses and subscriptions, as well as the ability to change the predicted next payment. This helps to give you a better forecast on any “pre-committed” spending across all 3 apps.

However, Yolt narrowly edges it on this front because of its ability to also include a renewal date next to each subscription. This is a handy place to keep you aware of when it is time to renegotiate (or potentially cancel!). Although, it is worth mentioning Emma’s hatred for bank fees with a special section looking at quantifying the total amount spent on bank fees across all of your accounts in a period – a definite eye-opener!

Platform

Both Emma and Yolt are apps available on iOS and Android.

Money Dashboard has iOS and Android apps but also a web-app that is available in the browser. This web-app also gives more features such as better analytics and data visualisation.

Security/Privacy

All of the apps are authorised and regulated by the FCA, and operate bank-level security. They all use the Open Banking API to make the connection with your financial institutions, so you never give over your details directly to the apps themselves.

Monetisation

Yolt makes money via commissions from third-party service providers if you take out one of their financial products (such as a loan or sign up to an investment account) via their app.

Emma also makes money via commissions from third-party service providers if you take out a product from their app, but also operate a paid-for version of the app; Emma Pro, which gives you access to premium features such as offline accounts, exporting data to CSV, splitting transactions to multiple categories and custom categories.

Money Dashboard also makes money via commissions from third-party service providers if you take out a product from their app. But they are different to the other two because they also earn revenue from selling aggregated and anonymised insight and analysis from their users’ spending data to third-parties.

It is worth noting the third-party services these apps promote are backed by a reputable financial institution that you would have seen advertised elsewhere. For these third-parties, they see these personal finance apps as a great source of “advertising” for their services, because someone who is interested in budgeting is very likely to look for a cheaper credit card or to set up an investment account, as an example.

Price

Both Yolt and Money Dashboard are free. The Emma app has a free version, but to unlock some of their features they have a premium subscription called Emma Pro.

At the time of writing, this Emma Pro plan was £4.99 a month (or less if you pay for it yearly), but gives you the following features:

- Manual accounts : the ability to add manual accounts so you can track your net worth more accurately

- Custom categories: allowing you to really fine tune your budget

- Data export: allowing you to manipulate your data. Bearing in mind Emma aggregates your data from multiple sources this is actually a good time saver

- Split transactions : assigning part of a transaction to one budget category and part to another

- Advanced transaction editing : this means you can update transactions regardless of merchant, speeding up the sometimes painful process that I’ve experienced(!)

Ease and Design

All of the apps are well designed with good onboarding.

Yolt is very intuitive and walks you through the key features when you first sign-up. They also have some handy “guides” which walk you further through some of the key steps you should take to get the most out of the app. Out of the three, it is the most stripped back in terms of its design, very clean and simple. I’m a fan of the data visualisations also. However, it doesn’t have a dedicated tab for budget setup/tracking, which means you will need to root around to find it if you haven’t followed the guides.

Money Dashboard is also clean and simply designed, but some of the user experience isn’t quite as slick. For example, it isn’t abundantly clear how and where to setup and track your spending against budgets. In my opinion this should be pulled out as a separate tab as it is one of the key features of an app like this. Similarly, it’s data visualisations are lacking compared to both Yolt and Emma.

Emma is very intuitive. Critically, it also has a great analytics tab which allows you to set budgets and track your performance against those targets really easily. Due to this, Emma takes the win for its ease of use and design.

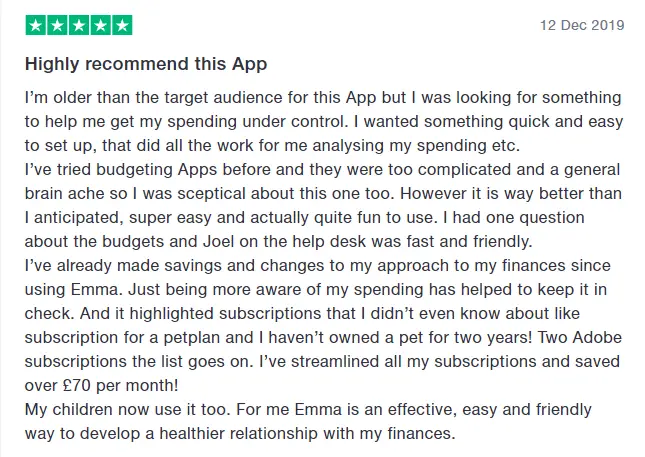

The Emma app clearly targets a younger demographic (its logo is a big gummy bear and the colours are quite soft and playful), but due to its intuitive design, anyone of any age should have no bother navigating it.

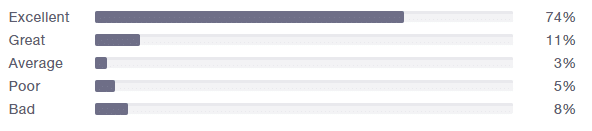

What do other people say?

Taking a look at Trustpilot, we can see the breakdown as per below. It is worth noting that Emma has the lowest number of total reviews.

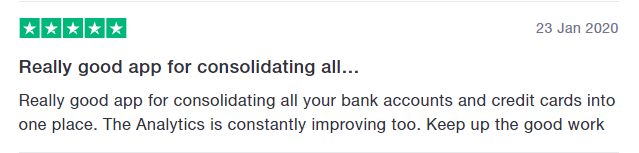

Emma

With the breakdown:

Picking out a couple of the positive reviews:

Whereas the negative reviews focus more around having trouble connecting to their bank accounts:

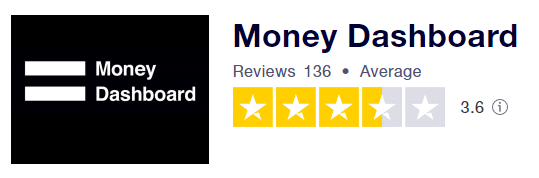

Money Dashboard

With the breakdown:

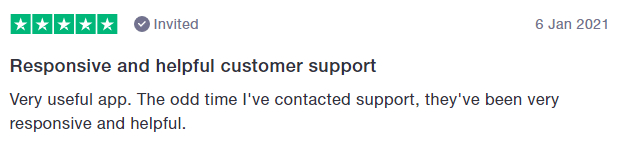

Picking out some of the positive reviews:

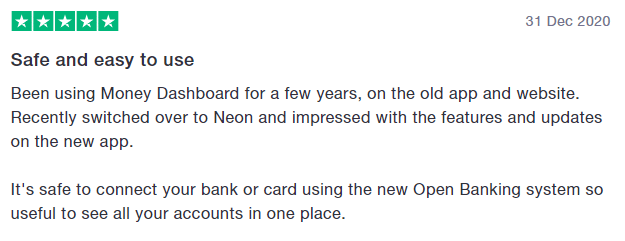

It is worth noting that a lot of the negatives for Money Dashboard relate to their move from their old product, named “Classic”, to their new product, named “Neon”. This new version was built from the ground up on new technology around the Open Banking API. They are adding new functionality all the time to their Neon offering, but a lot of people were unhappy when the switch was made that it didn’t have the full feature-set. The discussion on Money Dashboard in this comparison and my reviews are all centered around their new, Money Dashboard Neon product.

They launched this new version back in April 2020, and the bulk of the negative reviews were also received around that period.

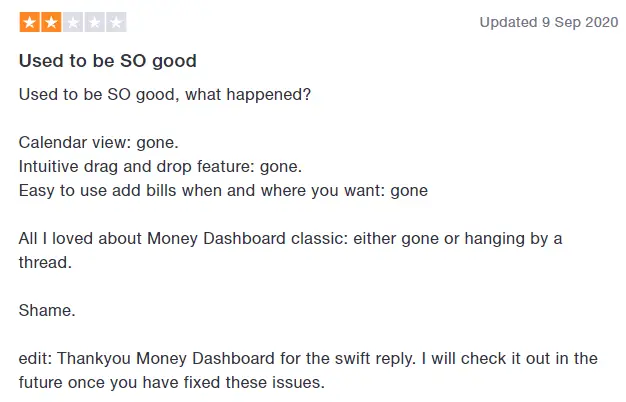

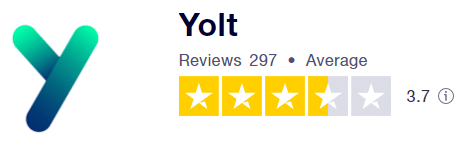

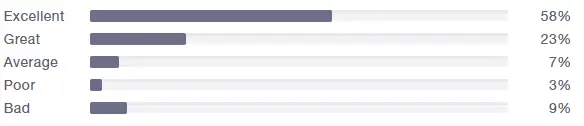

Yolt

With the breakdown:

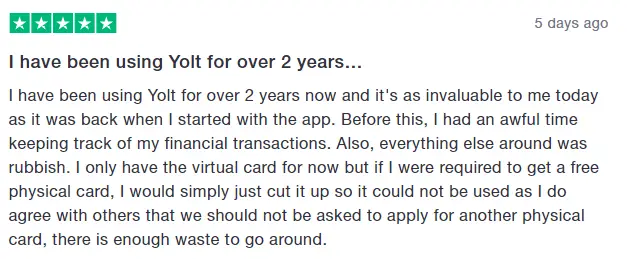

Picking out some of the positive reviews:

And some of their negative reviews, which have a common theme around people not happy needing to take out their virtual or physical cards as part of the service.

Conclusion: Yolt vs Money Dashboard vs Emma

For people who want a top-class spend tracker and budget management app that boosts their budgeting chops, Emma is my recommendation from this three-way head to head. This is due to its intuitive design, clever categorisations, superior connections and beautiful analytics.

However, if you think you’ll need lots of new custom categories and like the flexibility of accessing your data via the browser on your laptop, then Money Dashboard will serve you well!

If you’re looking for a very simple budgeting app, and aren’t fussed about fancy features, then Yolt will provide a good starting point. It’s a great option to cut your teeth into budgeting using an app, but do consider revisiting the other two options when you’re looking for more advanced features.

You can read my full reviews of each of the apps here:

Find out more and get the apps here:

I hope this three-way head to head comparison has helped you decide which app might be right for you; Yolt vs Money Dashboard vs Emma! Have you used any or all of these apps in the past? I’d love to hear your opinion on which is the best in the comments section below.

Non-affiliate links:

Pingback: How to Budget Salary Wisely - 4 Methods To Make You Budget Wise!

Pingback: Snoop vs Yolt: Will These Help You Save Money?

Pingback: Plum vs Yolt: Which One Will Save You Cash? | The Mindful Money Project

Pingback: Wonderbill Review: A Tool To Finally Get On Top Of Your Bills? | The Mindful Money Project

Pingback: 4 of the Best Budgeting Apps for Students in the UK in 2021

Pingback: How to save £1000 in a month using the COST method

Pingback: Average Food Bill Per Month in the UK - How Do You Compare?

Pingback: How to set up a budget in Google Sheets | The Mindful Money Project

Pingback: Snoop vs Money Dashboard | The Mindful Money Project