If you’re sick of tucking into beans on toast and looking for ways to make your money go further, you need a budget. A key part of budgeting is being able to track your spending against your budget. This is normally a monotonous activity. But as with anything else, there’s an app for that! In this article, I’ll help you find the best student budgeting apps in the UK.

We found loads of other articles discussing the “best student budgeting apps”, but they’re either touting US-only apps such as Mint or a budget app that has since been discontinued (such as Squirrel and Wally). Ours is only featuring budgeting apps that are for UK students and are still operating!

You know the feeling.

Beginning of term when that student loan payment drops. That feeling of being flush with cash.

Then bam, the last month before your next loan payment comes in, you’re back to your ol’ trusty beans on toast.

Damn.

This was so frustrating for me as a student, and I’m sure you find it frustrating too!

A good way to make sure you’re not tempted to overspend is by using one of these budget and spend tracking apps. For students, this tracking makes the difference! Don’t mess about with a rubbish app though, keep reading to find out the best budgeting apps for students.

Open Banking

All of the apps we feature here were made possible due to the development of the Open Banking API.

Open Banking is basically an agreement between banks and financial institutions to give you control over your financial data. Allowing you to easily share your data with other banks/financial firms as you see fit.

This means that you can give the apps in this article secure, read-only access to your transaction and balance data for them to run their services.

Why is this good? Well, more and higher quality services are being provided by financial technology start-ups which wouldn’t have been viable previously without access to this data.

If you’re interested in more information on Open Banking, you can read this great guide here from MoneySavingExpert.

Best student budgeting apps

Emma

This app has to be 1st on my list for best budgeting apps for students. Emma is billed as “your best financial friend”, and is specifically aimed at a younger demographic, with playful visuals and elements of gamification including daily “quests”.

But if that isn’t your cup of tea, you don’t have to engage in those features. The app’s core features are what helps it stand apart from the crowd, and why I use the app myself.

The app is available on both iOS and Android*.

The core features

You can connect your financial accounts to Emma (not just your student bank account but also your credit card account and some investment account or savings account). You then set your budget targets (helpfully, Emma can help you set a monthly budget by showing what your average spend is per category). Emma will then automatically categorise transactions (fairly accurately, from my experience).

Not only that, but Emma will provide handy “weekly spending reports” and notifications if you’re spending too fast on your categories. As well as insights such as benchmarks against other users that help you to understand your spending habits better. All with the purpose of helping you work towards your financial goals. Ideally, this will help your student loan go a bit further than it otherwise would!

You have the ability to visualise your spending using handy charts and can track your spending over time.

Taken together, these all should help you to keep your spending on track.

However, Emma makes money from a paid-for subscription which unlocks additional features. For a free budget app, the free version is more than enough to track your finances, improve your financial situation and start working towards your financial goals, but the paid-for features do provide additional flexibility:

- Custom categories

- Manual accounts (/offline accounts that you can’t connect via Open Banking) – super useful if you want to use Emma to track your net worth

- Export transactions to CSV

- Splitting transactions to multiple categories

The pros for a student

- Intuitive design and easy to set up

- Connects to most bank accounts (so no problems connecting your student bank account)

- Provides notifications if spending too fast

- Automatic categorisations

The cons for a student

- Have to pay for a full-suite of features such as ability to add custom categories

- Operates on a monthly or payday cycle, so you’ll have to budget at the monthly level rather than the total time between student loan payment

- Doesn’t help you to build a budget, just helps with tracking spend against the budget

Read my full Emma review here.

Money Dashboard

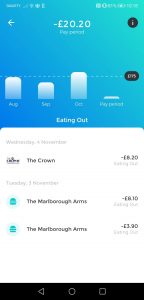

Another handy free budgeting app and spend tracker. Even though, in my opinion, it isn’t quite as intuitive as Emma, it makes up for it with features included for free that are behind Emma’s premium subscription. Additionally, Money Dashboard has a great “Spending Plan” feature that helps you to keep on track of your spending.

Money Dashboard is one of the UK’s leading fintech companies and has been operating for quite a while. In 2018, they won the 2018 British Bank award for best personal finance app.

In early 2020, they redesigned their app with the launch of the Money Dashboard Neon offering.

Money Dashboard is available on both iOS and Android*. Further, it has a web app which you can access via your browser, giving you access to more features and better visualisations due to the larger screen size.

The core features

As with Emma, with Money Dashboard you can connect your bank accounts. The app will automatically categorise your transactions and provide you with some analytics to visualise your transactions to better understand your spending habits.

It also has a great “Spending Plan” feature. This allows you to specify the committed spending such as bills, subscriptions and rent. It also allows you to set a budget for such things as “Going out”, “Groceries” and “Travel” i.e things that you spend on a more discretionary basis when you feel like it. It will then calculate based on your current balance and your spending patterns, how much you will have left at the end of the month. This, along with a picture of your true balance (i.e how much you have left after your bills and other commitments), almost act by giving you a set spending limit which is super useful insight when you might be getting used to managing your own money for the first time.

This is handy as a student because it will provide you with a view into the future to see what your expected ending balance will be like. No more running to your parents whilst you await the saviour of student finance!

Some features, such as custom categories and the ability to export your data come as standard.

The pros for a student

- Connects to most bank accounts

- Can add manual/offline accounts (ideal for tracking your net worth or a savings goal)

- Flexibility by adding custom categories

- Spending plan feature helps you to look ahead with your finances

The cons for a student

- Operates on a monthly or payday cycle, so no ability to budget for the full period between student loan payments. You’ll need to break the time between payments down into monthly budgets to stick to

- Money Dashboard monetises by aggregating and anonymising user spending data and behaviour

Read my full Money Dashboard review here.

Read my full comparison of Money Dashboard vs Emma here.

Yolt

Update: Yolt has announced they are closing down their service from 4th December 2021. Check out either Plum or Cleo as great alternatives.

Yolt is another spend tracking app that aims to “give everyone the power to be smart with their money”.

It is an ING Bank venture, meaning it has the support, funding and security know-how of a big retail bank.

Launched in the UK in 2017, the app boasted 500k users within its first 18 months, and have now expanded to Italy and France.

The app is available on both iOS and Android.

The core features

As with the other two, the bread and butter of this type of app is to connect your bank accounts and automatically categorise your transactions.

You can also track this spending against a budget that you set.

Additionally, you’ll be able to view your spending by category or by merchant over time. They also have a handy and well-designed dashboard with some visualisations that will allow you to easily see which category makes up most of your spending.

The app has some handy guides to walk you through the process also, with a very simple and intuitive design.

However, the app is less flexible than the others, with no ability to add custom categories. Currently, they are working on a release of the Android app, which means that the current Android app also doesn’t have the ability to add offline/manual accounts (the iOS app does).

Update: Yolt have decided to move their service beyond just a budgeting and spend tracking app and are now requiring users to take up their Yolt card which comes paired with their budgeting and spend tracking app. You may love this or hate this new move, but bear in mind that it is now competing against the likes of Monzo as a banking provider as opposed to Emma/Money Dashboard as a budgeting and spend tracking app.

The pros for a student

- Connects to most bank accounts

- Easy and simple set up and layout

- Handy guides to walk you through the process

- Has an “earn money” section which might give offers around becoming a user experience tester to earn some extra ££’s

The cons for a student

- No ability to add custom categories

- Operates on a monthly or payday cycle, so no ability to set the period to the period between student loan payments. You’ll need to split this period down into monthly chunks for your budget

- No longer available as a standalone app

Read my full Yolt review here, as well as comparisons against the other budgeting apps here.

Monzo

Now, this is slightly different from the other apps. Monzo is not a data aggregation spend tracker. It is a full-on current account.

But hear me out!

Monzo is one of the new breed of startup banks that have taken the UK banking scene by force in the last couple of years. They are full FCA authorised and regulated.

You may have seen the synonymous pink Monzo cards being flaunted from people’s wallets – they’re certainly eye-catching.

Monzo is a useful tool for a savvy student, because they have brilliant budgeting and spend tracking features already rolled into their app.

You get instant transaction notifications, and they automatically categorise your transaction based on their algorithm (you can easily override though). Further, you can set budgets that you can track against.

Monzo is available on both iOS and Android.

How can a student use Monzo?

I used this exact system when I was a student.

I budgeted my rent and bills and kept these in my normal current account, where the bills/rent came out as a standing order or direct debit each month.

Then, I transferred my weekly budget for “going out”, “travel” and “groceries” into my Monzo account.

Why?

Because this was then the only card I carried around with me.

I could easily see how much I had left for the week on all of my “discretionary” spending that I could decide when or not to spend.

If I was being tempted with some beers, I just look into my Monzo app, and as long as there was some ££ in there I knew the answer.

This system means you know:

- All your bills are being paid for (as they are in your main, normal bank account not being touched)

- You can easily work out whether you have money to spend on your discretionary spend such as going out to the pub and going to the cinema

The pros for a student

- Instant notifications

- Spend tracking

- Keeps your discretionary spending separate

The cons for a student

- Can’t connect other bank accounts

- Have to set up a Monzo account, but is a quick and easy process

Conclusion

If you’re looking to manage your money well to avoid the dreaded beans on toast as a student, then utilising one (or multiple) of the above budgeting apps should go some way to help you.

Either going for the ultimate ease of the Emma app, the flexibility of Money Dashboard, the simplicity of Yolt or the separation that Monzo gives you, means that you’ll be well on your way to making your money last you longer.

The verdict: the best student budgeting app is…..

It is super intuitive, easy and well-designed.

However, if you have trouble sticking to your budget, then using a system like the one described above using Monzo will work a treat. It did for me!

That being said, the Money Dashboard team are developing their offering week after week and they do come with more features as standard (i.e free) such as custom categories and offline accounts – super handy for tracking all of your accounts that cannot be connected by Open Banking. Given that both Emma and Money Dashboard offer free accounts, I would suggest trying both and keeping the one you intuitively enjoy using the most.

Other articles you might find useful:

Have you had any experience with these apps already? Which one do you think is the best budgeting app for students in the UK? Or are there additional budgeting apps for students in the UK that you would like to see included? I’d love to hear your thoughts, so drop a comment in the comment section below.

This post may contain affiliate links (any links we earn commission on if you go on to make a purchase are marked with an * asterisk). These do not influence our editorial content and we remain independent.

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

Tracking your expenses isn’t all about firing up a spreadsheet and restricting your spending. Having…

How to Budget Salary Wisely – 4 Methods To Make You Budget Wise!

Do you always find yourself running out of cash at the end of the month?…

Moneyfarm vs Vanguard: Lowest Fees On The Market?

Investing is the most impactful tool you have to reach an ambitious financial goal. Sometimes…

Easy and painless ways to save money every month

Maybe you’re preparing for a particularly financially tight month. Or you’re looking for ways to…

How To Save Money On Food Without Cooking (It Can Be Done!)

Food is often one of our biggest expenses. A burrito here and a burger there…

Snoop vs Money Dashboard

An app has the power to simplify your life. Especially your finances. Rather than cracking…

How to control impulse spending – 8 strategies that work

I’m sure every single one of you reading this has flirted with impulse spending in…

Should I Save an Emergency Fund or Pay Off Debt?

Maybe you’ve been gifted some cash or come across a windfall. Or you’ve engineered yourself…

Wonderbill Review: A Tool To Finally Get On Top Of Your Bills?

Ah bills, bills, bills. I feel like we should extend the saying “the only certainties…