An app has the power to simplify your life. Especially your finances. Rather than cracking out a spreadsheet, simply plug an app into your bank account. Voila, you’ll find it easier to understand your spending and where you can save some of your hard-earned cash. Two of the best apps are here, but which one is best? Snoop vs Money Dashboard.

Quick Summary

Even though you’re expecting a fight to the death on these two; Snoop vs Money Dashboard, but I’m going to see if I can open your mind to the possibility of needing both, rather than just one individual app.

Now before you rage quit this article, let me explain.

These apps are both good, at different things. They cover each others weaknesses.

Therefore having both in your personal finance set up can be a good thing.

Snoop* is best at keeping on top of your regular, recurring payments and bills such as your energy, broadband, insurance and phone bills. But its budgeting and spend tracking features are basically non-existent outside of that.

Whereas Money Dashboard* is great for budgeting and spend tracking. But its ability to track your regular bills is nothing compared to Snoop.

Therefore, I recommend trying them both. Having one app cover the weakness of the other should ensure there are no blind spots in your money management. This should help you move towards your financial goals more efficiently.

Snoop Summary

Recommended for: keeping on top of your regular payments, bills and subscriptions

Platforms available: iOS and Android

The good:

- can monitor regular payments and bills

- easy to shop for best price on bills (energy, insurance, broadband etc)

- contextual “Snoops” can help save money

- Great design with a delightful personality

The bad:

- spend tracking outside of regular bills is not as good as Money Dashboard

- no budgeting functionality

Summary

Snoop is your handy little robot sage, spotting areas where you could be saving cash. Ideal for keeping on top of your regular payments such as energy, insurance, telephone, broadband and TV. Snoop does, however, fall short when it comes to tracking your spending and help sticking to a budget.

Money Dashboard Summary

Recommended for: spend tracking and budgeting

Platforms available: iOS, Android and Web

The good:

- spending Plan feature predicts your end of month balance

- can add offline accounts, so you can track your net worth

- add custom categories for flexible spend tracking

The bad:

- detailed analytics only available in web app

- regular payments tracker not as good as Snoop

Summary

Money Dashboard is a well-known personal finance app in the space. With a recent re-design, they launched their Money Dashboard Neon app. This provides great features to track your spend across your bank account and credit card accounts, with handy budgeting features. Not only that, but it is flexible to adapt to your own situation with the option to add your own custom budget categories, or to add offline accounts to track your net worth.

The deep dives

Snoop deep dive

Snoop is a delightful money management app that, as the team at Snoop put it, watches your spending and spots smart ways you can save by finding you a cheaper deal.

Even though their name seems a strange choice in the context of growing unease over personal data sharing, their mascot is a delightful little robot who acts as your financial sage. What isn’t to like!

Features

- You can connect your accounts (bank and credit card) via the Open Banking API

- Snoop automatically tags up your transactions

- Regular payments, bills and subscription monitoring

- Reminders when renewals are coming up

- Contextual money-saving tips

Highlights

Contextual money-saving tips

If you dig into the different spend categories, Snoop provides little “Snoops” which can help you save some cash by either offering up discounts from partners or by imparting some useful personalised savings ideas.

For example, how to save money on your weekly food shop by reducing the amount of food you waste (i.e how to be better at planning your food shop). Another Snoop I received was a discount for KFC (can’t complain).

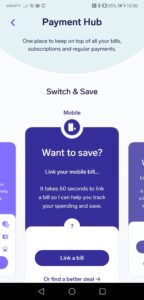

Payments hub

Now this is the feature where Snoop really earns its keep. I bloomin’ love this feature.

Here at The Mindful Money Project, I’m always banging on about how the easiest way to reduce your spending is to make sure:

- you’ve cancelled any wasteful monthly subscriptions you don’t use

- you’ve checked you’re not being overcharged for your regular payments such as insurance, energy, broadband etc

Enter Snoop’s payments hub feature.

It is great for keeping on top of both your regular utility bills, and your subscriptions. Anything recurring, you can stay on top of it with Snoop.

Once you connect your bank account, you can identify the transaction that relates to the different kinds of recurring transactions such as mortgage payments, broadband, mobile, insurance etc. If you fill out the renewal date as well as your home address, then Snoop will monitor the market and alert you when either your contract is up for renewal or there are cheaper alternatives to switch to.

All of the switching can be done within the Snoop app, making it a breeze to get those savings locked in.

Lowlights

No budgeting functionality

There is no capability to set and track against budgets currently, which is a shame. If you wanted to use Snoop to understand your spending habits and living expenses to help identify areas to save money there, then it isn’t as effective as Money Dashboard.

What are other people saying about Snoop?

Snoop only launched in early 2020, so there aren’t a tonne of reviews on independent review sites like Trustpilot, but the ones that are there are positive. They’ve received 3 reviews, all at 5 stars. As there are such a small number of reviews there at the moment, I would take it with a pinch of salt.

On the Play Store, however, they’ve received over 1k reviews, averaging 4.5+ out of 5 stars. This is a much better sign that real users are loving this money app.

They’ve fared just as well on the app store for iOS, boasting more than 600 reviews with an average rating of ~4.8.

Money Dashboard deep dive

You may already be familiar with Money Dashboard, as it is one of the leading money management and budgeting apps on the market.

The app boasts over 500,000 users and has won the 2018 British Bank award for best personal finance app – so they know their stuff when it comes to this.

In early 2020, they completely redesigned their platform and released their new version of the app, called Money Dashboard Neon. This new version is constantly being updated and improved.

Features

- Connect your accounts via the Open Banking API

- Automatic categorisation of transactions

- Add offline accounts which can’t be connected automatically

- Set and track spend against budget categories

- Set custom categories

- “Spending Plan” provides a forecast of your end of month balance

Highlights

Good budgeting functionality

Set your own budgets for different spend categories. If you want to create a budget for a category which is not loaded in Money Dashboard by default, you can create your own custom category. All included in the free app.

Web app availability

Quite unusual for these personal finance apps, but there is a web browser version of the app too. I find this is really handy for any kind of deep dive into your spending, if that tickles your trout.

Can add custom categories

As mentioned above, you can add your own spending/budget categories. This makes it easy to track the right level of detail that you want.

Can add offline accounts to track net worth

Even though it is fairly common to be able to connect your current account, some financial institutions don’t yet offer their data via the Open Banking API for different accounts. This tends to be the case for an investment account or for a savings account with most financial institutions. As such, Money Dashboard has provided the ability to add offline accounts.

This allows you to use Money Dashboard as a net worth tracker too. The only drawback is that you need to manually update these balances to keep it up to date.

Spending plan feature forecasts your ending month balance

This is a great feature. Essentially Money Dashboard will forecast what your ending balance looks like, by taking your current balance and taking off any scheduled recurring payments as well as any of your budgeted spend for stuff like groceries or transport.

This is super useful to give you an idea of whether you are over or under spending for the month ahead, giving you time to rein it in before you have to start dipping into your savings.

Lowlights

Subscription tracking falls short

Even though Money Dashboard does provide you with a view of adding and tracking your recurring and scheduled payments, the feature basically ends there.

Contrasting this to the amazing feature set on these exact payments that we see in the Snoop app and you can see who the clear winner is on this one.

What are other people saying about Money Dashboard?

A lot of the reviews in 2020 are relating to people unhappy with the change from Money Dashboard Classic to the new Money Dashboard Neon app. This is mainly due to the inability to import their category setup and some features that have been changed. Any transition like the one Money Dashboard undertook is going to be a tough one, but the new platform should allow them to more rapidly improve their platform. So something to bear in mind when reading these Trustpilot reviews.

Alternatives to Snoop and Money Dashboard

There are other spend tracking and budgeting apps, such as:

See related: Yolt vs Money Dashboard vs Emma

As well as apps which are great at keeping a track on your regular bills and working to reduce them for you:

See related: how to save £1000 in a month using the COST method

Conclusion: Snoop vs Money Dashboard

I love seeing the explosion of innovation in the personal finance space. Lots of apps are aiming to help us get on top of our finances.

Even though you likely don’t want to be using more than one money app, I genuinely think you will be well served by combining these two apps by using them at the same time.

Why?

Money Dashboard* is great at spend tracking and as a budgeting app with tonnes of customisation potential and flexibility.

Snoop* is great at keeping an eye on your regular payments and bills, giving you plenty of opportunities to save cold hard cash.

I recommend using both of them in combination, as they nicely complement each other and cover each other’s weaknesses.

Have you used either Snoop or Money Dashboard? I’d love to know your experience of the apps. Drop a comment in the section below.

What Is A Good Amount Of Savings UK?

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

How To Cancel Graze Subscription UK

Icons made by Freepik from www.flaticon.com

Pingback: Snoop vs Yolt: Will These Help You Save Money?

Pingback: How to save £1000 in a month using the COST method

Pingback: Easy and painless ways to save money every month