Being a bit of a personal finance nerd, I have been absolutely spoiled for choice over the last few years. Since Open Banking came in, there has been a personal finance app revolution. Here on the frontlines, I’m trialling and testing different apps to see which ones can get your finances battle-ready. In this article, I’ll be comparing two of the heavyweights; Plum vs Yolt.

TL;DR Summary – Plum vs Yolt

Yolt is best for people looking to get engaged in their finances whilst letting a budgeting app do the heavy lifting. It is a simple app which will automate your spend tracking, giving you insight on how you are tracking against your budget. Changing your spending habits and being disciplined with your saving, however, is completely up to you.

Update: Yolt has announced they are closing down their service from 4th December 2021. Although, we have kept in our original comparison for this post.

Plum*, on the other hand, is best for people who want a more hands-off approach who may be at the start of their personal finance journey. Loaded with some smart AI, Plum will automatically siphon off money to build up your savings and stop you from being overcharged on your utility bills and regular payments.

For those of you who want a deeper dive into both of these money apps, keep on reading.

Plum Summary

Recommended for: people looking for a hands-off approach to their finances by using AI and automations

Platform available: iOS and Android

The good:

- Stay on top of utility bills and subscriptions

- Automatically puts money away for you

- Can save a portion of your income at payday automatically

- Easy way to invest in the stock market

- Diagnostic reports feature can provide massive insight by comparing your spend against people like you (iOS only currently)

- Money Maximiser (budgeting) aims to get you to payday without running out of money

- Cashback via the app

The bad:

- Budgeting a paid-for feature (Money Maximiser)

- Not the cheapest investment platform

- Less flexibility for editing transactions

- Some disjointed user journeys when using the app

Summary

Plum is a smart app to have on your side. An ideal companion for someone starting out on their personal finance journey. Plum will help you identify where you’re being overcharged for your regular payments, and help you get a fair price. It will analyse your spending and squirrel away money for you. They have made investing seem much more accessible, which will help you to grow your savings via investing in the stock market for the long-term.

For someone starting out on their finance journey or wanting a hands-off approach; Plum is ideal.

Yolt Summary

Recommended for: Tracking spend against your budget

Platform available: iOS and Android

The good:

- Ability to set budgets

- Great analytics

- Simple design

- Coaching guides and good onboarding

The bad:

- Can’t add custom categories

- Can’t add offline accounts on Android

- No web app

- Company heavily promoting the Yolt Card

Summary

Yolt will help you easily understand where you are spending your money. With a clean and simple interface, you’ll be able to identify problem areas of spending via their intuitive analytics visuals, as well as track your spending against specific budgets via their budgeting features. If you are looking for more advanced features such as offline accounts, custom categories and the ability to access via the web, you may want to look at alternatives.

But for a quick and simple way to track your spending – you can’t go wrong.

Plum deep-dive

Plum is a smart thinking money app packed full of artificial intelligence. The team at Plum sum it up nicely, saying Plum is “the AI assistant that grows your money”.

This should help you to save more money, invest in what matters to you and save on household bills.

Another way of putting it is; Plum gives your bank a brain.

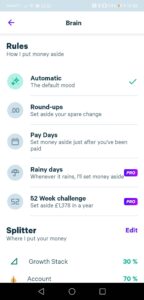

Due to Open Banking, you can connect Plum to your various bank accounts. Plum can then analyse your spending and will automatically set some money aside every few days using a direct debit. The great thing is you can also set up special rules such as saving a portion of your income on payday.

On the free Plum account, Plum Basic, your money will be put aside into your Primary Pocket by default. You don’t earn any interest on this, but you can set up one of Plum’s new, FSCS protected Easy Access Savings Account on the Plum Basic account that earns you 0.25% AER. This is provided by Investec Bank, who have the right to change the rate at any time.

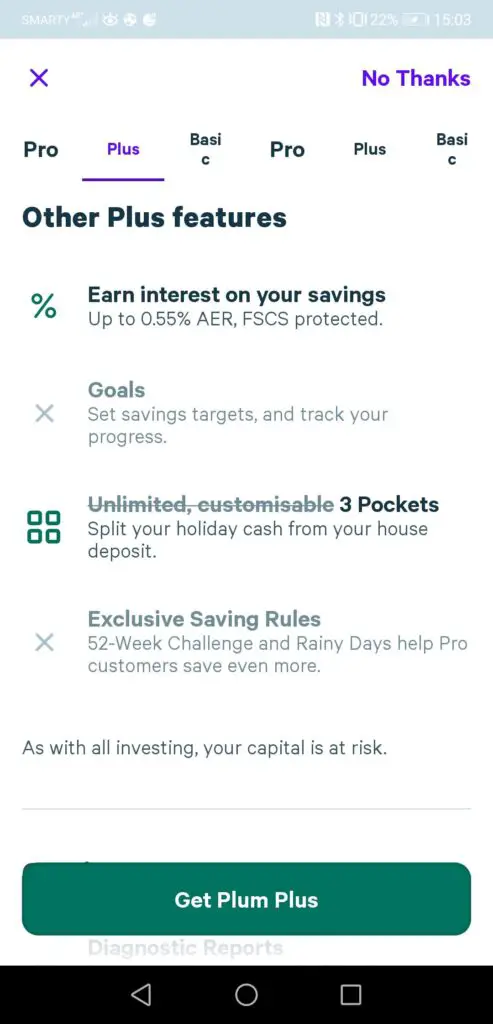

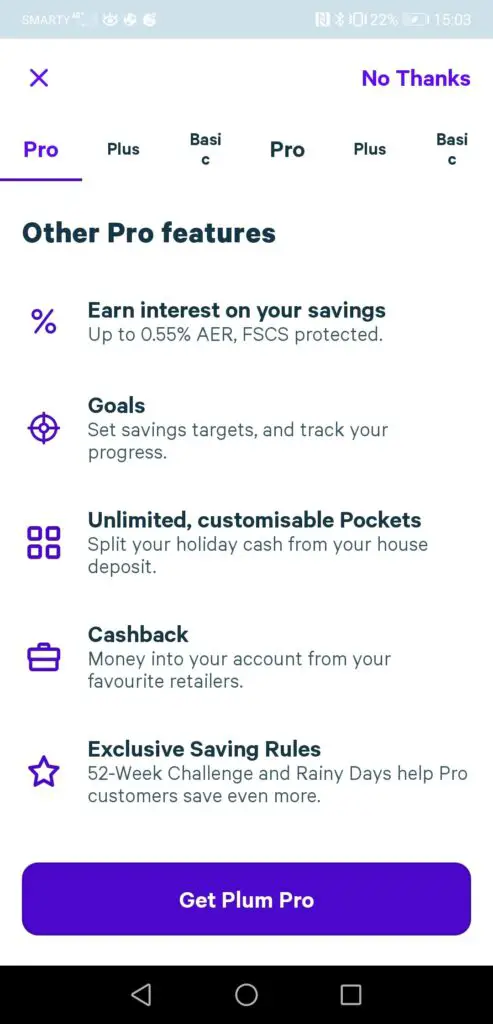

If you subscribe to either Plum Plus, Plum Pro or Plum Ultra, then you can earn up to 0.4% AER interest on your savings.

Alternatively, you have the option to use Plum’s investing feature to put money into investment funds via the app. Just remember that your money is at risk if you invest because the value of your investments can go down as well as up.

Additionally, Plum will also monitor your regular payments and flag if it thinks you are being overcharged, using its “Lost Money” feature.

Features

- Connect to your bank account and credit card account

- Plum automatically puts money aside for you

- Easy access to a range of decent, low-cost investment funds from the likes of Vanguard and Legal & General

- Keep on top of regular payments and utility bills to ensure you aren’t being overcharged

- Earn up to 0.40% on your savings with an easy access pocket

- Earn cashback when you shop through Plum

- Set savings goals and track your progress (Pro subscription only)

- Diagnostic reports compare your spending against your matched “lookalikes” to see how you compare (at the time of writing only available for IOS users on the Pro subscription)

- True balance feature gives you a view on how much of your money is safe to spend after accounting for upcoming payments (iOS only currently)

- Money Maximiser suggests a weekly budget allowance based on historic spending, income and planned Plum savings so you don’t run out of money before the end of the month! For Plum Ultra subscribers only

Pricing

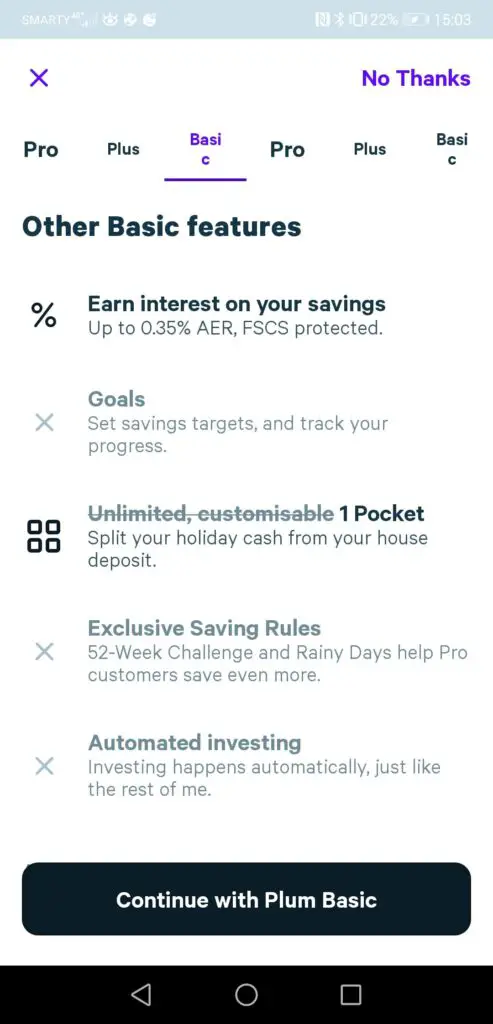

Plum offers four levels of subscription, with differing benefits that come with it. At the time of writing, these are:

- Basic (free)

- Plus (£1/month)

- Pro (£2.99/month)

- Ultra (£4.99/month)

Automated investing is only available on Plus, Pro and Ultra plans.

The Ultra plan is the most feature-rich, offering you:

- savings goals and tracking against these

- Money Maximiser (budgeting)

- unlimited pockets

- exclusive savings rules

- diagnostic reports (comparing your spending against other “lookalikes”) – this is currently only available on iOS

You can always start out with the Basic plan, and if you find that Plum is helping you to save money, you can start to unlock more features by going for their more feature-rich subscriptions.

Highlights

Automated saving

For finance nerds like me, I was worried this feature was going to be irrelevant for my personal finances. After all, I have a budget set so I know exactly how much I have to save each month – which I transfer into my savings on payday.

However, where Plum is brilliant is either if you have a more hands-off approach to your finances or where you don’t currently budget and save diligently. Plum is intended to do the thinking for you, slowly building up your savings over time so you don’t feel the pinch in one go, but over time your spending habits will have been improved and changed.

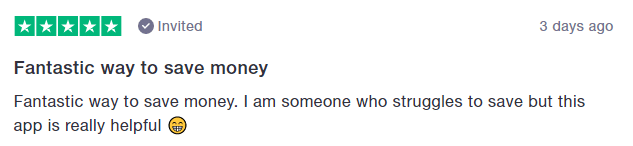

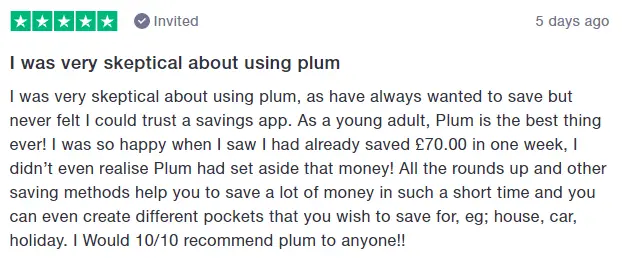

Plum is packed with AI and they use behavioural science research to effectively help you reach your financial goals. Loads of reviews on platforms such as Trustpilot rave about how they didn’t even notice their money building up due to how Plum was siphoning it off.

Or if you’re like me and already budget and save each month already, then Plum is brilliant at scrutinising your remaining spend and trimming off the “fat” where it considers there to be some. But for people like me, the benefits of Plum are yet to come…

Keep on top of regular payments

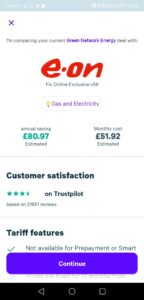

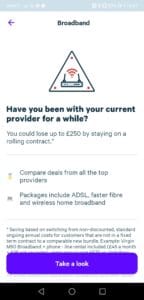

I always wax lyrical on The Mindful Money Project of how important it is to keep on top of your regular payments such as;

- energy bills

- broadband

- mobile phone

- insurance (car, home, phone, pet etc)

As well as your subscriptions such as Netflix, Amazon Prime, magazine etc.

And it seems like the folk at Plum agree. They have a whole feature called “Lost Money” which helps you stop overpaying. If they think you could be paying less on your bills, they will recommend an alternative.

I did find it a bit creepy at first when they told me what energy tariff I was on before I had provided any details (or even connected the bank account where that payment comes out of). But after a bit of Googling as to how they did it, they clarify in their help centre that they use a 3rd party to provide this information based on your address. Plum, if you’re reading, I would recommend making this clear within the app as I’m sure I’m not the only one.

Easy access to investment funds

With the cash that is automatically saved, you have a couple of options. You can:

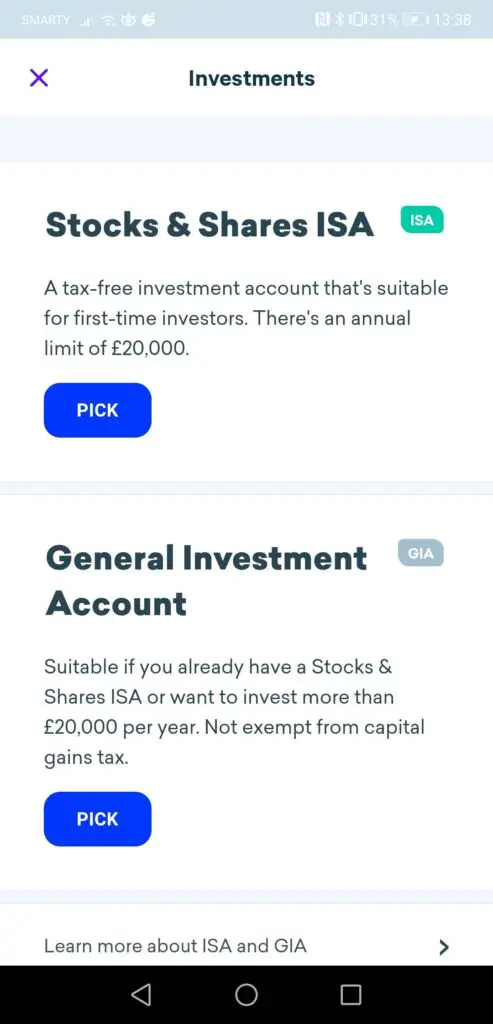

- keep 100% of your savings in a cash savings account

- split a portion to be invested into a range of index funds via either a Stocks & Shares ISA or within a General Investment Account (both available within Plum).

A Stocks & Shares ISA will mean any gains are tax-free, but you can only open one per tax year and only invest up to £20,000 per year. Whereas a General Investment account has no such limits, but also no tax benefits. If you want more information on this topic, there is a great article covering it over at Boring Money.

I have been very impressed with Plum’s selection of funds in this regard. They know their target audience well, and Plum makes it super easy to select a fund that you’re interested in without overwhelming you with choice and jargon.

They have a “basic” range of funds available which are based on your risk profile. Even though they don’t offer any recommendations or questions to ascertain it, they have a range from:

- Slow & Steady

- Balanced

- Growth Stack

The difference between the three is the asset allocation on the fund and is using the Vanguard Lifestrategy series.

For example, Slow & Steady will invest your money into the Vanguard Lifestrategy 20% Equity Fund, whereas the Growth Stack will invest your money into the Vanguard Lifestrategy 80% Equity Fund.

I won’t go into details here on the merits of either approach, but it is great to know you have the options.

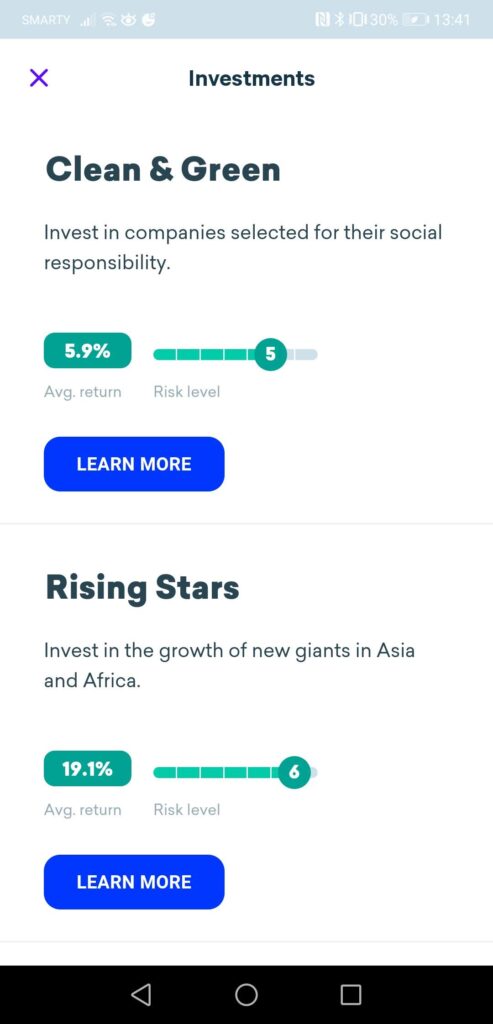

Plum also have an “advanced” set of funds which they describe as being great for “expressing your opinion – pick something that matters to you”. Below I’ve listed some of their options:

- Clean & Green (socially responsible companies)

- Rising Stars (growth of new giants in Asia and Africa)

- Tech Giants (tech stocks like Apple and Facebook)

- American Dream (shares in the top 500 largest companies in the US)

- Best of British (shares of the 100 largest companies in the UK)

- and more…

These are more specific, compared to the broader “Basic” funds.

Even though Plum has nowhere near the choice of trading and investment apps such as Freetrade or Trading212, that is kind of the point. And it works. Plum only provides a limited range of quality, low-fee funds which allow its users to not be overwhelmed and to start to build positive financial habits such as saving and investing. Will you be managing a £100k+ portfolio via Plum? Unlikely. But it is a good place to start.

In terms of fees, it is made up of:

- standard Plum subscription cost

- 0.48% average annual fund management and provider fee (which includes a management fee of 0.15% and a 0.06%-0.9% fund provider fee dependent on the fund choice you make)

Please note: as with all investments, your capital is at risk.

Lowlights

Limited spend tracking functionality

Compared to the likes of Yolt and other budget management apps, Plum’s spend tracking and budget management functionality is very limited.

For starters, you cannot enter a budget and track spend against it.

You cannot edit the category that a transaction has been categorised automatically against.

These features feel very simple compared to the other features Plum have. I understand that they are focusing on where they add value, but for me, if they included better budget/ spend tracking features alongside their brilliant focus on saving money, then I’d be ditching all other apps and heading straight for Plum.

Update: Plum have released their Money Maximiser feature which aims to get you to the end of the month with money. It does this by suggesting a weekly budget based on your income, committed spending (and historic spending) and your Plum savings.

Can’t be used as a full-featured net worth tracker

You also can’t add bank accounts or a saving account that are not yet connected to the Open Banking API, which limits your ability to use Plum as a way to track your net worth.

Now to be fair to Plum, this is not what Plum is about, and so no wonder we don’t see this feature. But it is worth bearing in mind.

Some of the user experience needs ironing out

On the whole, I’ve been very impressed with the design of Plum. It is visually beautiful, and the interface has been thoughtfully designed.

I did have a few instances, however, that weren’t as smooth or polished as I would expect.

For example, when setting up my first investment fund I selected the one I was interested in, followed through the steps and then once I thought it was confirmed it just kept me hanging on a loading screen in my browser (rather than the app). After ~5 minutes of waiting I just loaded up the app to see the fund choice had already been selected and remembered. This is obviously a minor example, but I had a similar experience when first setting up the account which caused me to essentially sign up twice (due to a hanging loading screen).

I still think the app is worth working through regardless of these issues because the benefits are so large. Bear in mind this is also a growing fintech company, so they will be releasing regular updates to fix bugs like this.

What are other people saying?

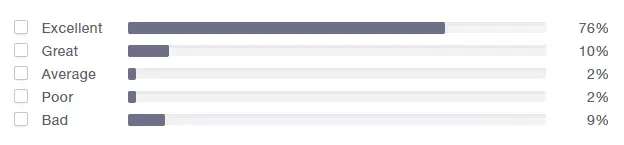

Plum has received over 1,200 reviews on Trustpilot, with an average rating of 4.5 out of 5, which is very impressive. See the most up to date reviews here.

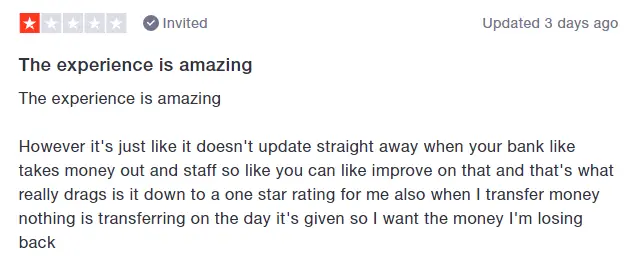

A lot of users leaving positive reviews praise the app for allowing them to save money without really trying or putting much effort in. Whereas the negative reviews mention the time lag between money going in (and out) of Plum (taking upwards of a couple of days), as well as one complaining that a Plum transaction pushed them into their overdraft. As a note on this, by default Plum won’t put money away for you if you are in your overdraft unless you activate the “Overdraft Deposits” feature in the app.

Yolt deep-dive

Yolt is a money management app that connects your separate bank accounts so you can view and track your spending all in one place. Their aim is to “give everyone the power to be smart with their money”.

We believe that staying on top of your money shouldn’t be a hassle. That’s why we built Yolt with a fresh approach, smart insights and easy actions, so you can make the most of life.

Pauline Van Brakel – Yolt CPO

It is an ING Bank venture, meaning it has the support, funding and security know-how of a big retail bank.

Launched in the UK in 2017, the app boasted 500k users within its first 18 months, and have now expanded to Italy and France.

Yolt uses the Open Banking API to connect your bank accounts.

Features

- Connect current account(s) and credit card account(s)

- Can connect savings and investment accounts too

- Yolt automatically tags up transactions

- Set budgets (and track spend against them)

- Visual analytics to better understand your spend

- Subscription tracking

Highlights

Ease of use

The Yolt app is very well designed. Not only is it beautiful visually, but it also has a very clean and simple interface.

They also have some useful guides that provide you coaching through the main features of the app when you first join. I initially found it difficult to find the feature to set budgets, but after following one of these short guides I found it no problem.

Visual analytics

As a budgeting and spending tracker app, this is one of its strong points. From Yolt’s dashboard, you can easily see a snapshot of what spending category is dominating your weekly or monthly spend. You can also easily see how you are performing versus your budget.

All of these well-designed visualisations of your spending data makes it really easy to spot where you are overspending and where you need to focus on.

Budgeting

If you have your own budget and want an app to do the heavy lifting of tracking spend against it, then Yolt is ideal. It will automatically tag up your transactions and all you need to do is flick up the app every once in a while to check how you’re doing against your budget.

Lowlights

No custom categories

Yolt isn’t the most flexible budgeting app out there and this is a case in point. If you want to track your spend against a category that is not included in Yolt’s pre-loaded set, then you’re out of luck.

No offline accounts for Android

One of the benefits of a budget management app like Yolt is that it gives you a snapshot of your finances in totality. In order to make the leap to a full net-worth tracker, you need to be able to add accounts that can’t be connected via Open Banking such as your savings accounts and investment accounts (such as pensions or stocks & shares ISAs). Unfortunately for Android users, this feature is not yet available for Yolt in the android app version.

Pivoting users over to the Yolt card

Yolt are pushing their new users to their Yolt card service, which acts as a prepaid card with the complementary app as a budget tracker. For people only looking for a simple budgeting app rather than a prepaid card & budgeting app combo are out of luck with Yolt’s pivot. If you’re looking for a budgeting app only, I would recommend looking at either Money Dashboard or Emma.

What are other people saying?

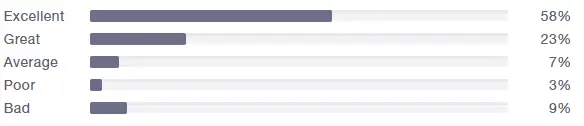

Looking at the Yolt reviews at the time of writing, Yolt scores 3.7 / 5 from 297 reviews. Below I have picked out the breakdown as well as one positive and one negative. A lot of the negative reviews have been in relation to the marketing efforts at pushing adoption of the new Yolt card, which some users are not happy with.

You can find their Trustpilot reviews here.

See my full Yolt review here.

Plum and Yolt Alternatives

The choice isn’t just between Plum vs Yolt. For spend tracking alternatives to Yolt, consider:

- Money Dashboard (see my full Money Dashboard review here)

- Emma (see my Emma app review here)

- For a full three-way comparison, see my Yolt vs Money Dashboard vs Emma comparison here.

For Plum alternatives, consider:

- Cleo (see a Cleo vs Yolt comparison here)

- Snoop* (see a Yolt vs Snoop comparison here)

- Chip* (see a Plum vs Chip comparison here)

- Moneybox (see a Plum vs Moneybox comparison here)

Conclusion – Plum vs Yolt

Using a money app can really help you get on top of your finances. In this comparison of Plum vs Yolt, I should have hopefully opened your eyes to potentially using both.

Yolt is brilliant for easily managing your budget without having to manually track your spending.

Whereas Plum is great at improving your ability to save (and give you a start on investing), whilst keeping you on top of your regular payments and bills.

For people who are further down on their personal finance journey who may already have:

- a budget set up already

- a system to pay themselves first each month on payday

- a savings/investing strategy

Then I would say an automated spend tracking app like Yolt will save you time.

If you are earlier on with your personal finance journey, however, and/or you struggle with putting money aside, then get yourself Plum and let their clever AI slowly squirrel away cash. Over time, it adds up! Further, Plum will really help you save some easy money by stamping out any regular payments that you are being overcharged for.

As these apps cover off each other’s weaknesses though, I would also like to suggest the idea of using both. Yolt is great for drilling into your spending to keep yourself accountable, whereas Plum is great at monitoring your regular payments to ensure you aren’t overpaying, as well as automatically squeezing savings out when it thinks you can afford them. So instead of it being an either-or Plum vs Yolt, how about it being a matter of Plum + Yolt?

Have you tried these apps before? How would you rate them if they went head to head, Plum vs Yolt? I’d love to hear more in the comments section below.

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent. The views expressed are based on our own experience and analysis of the service.

FAQs

Average Food Bill Per Month in the UK – How Do You Compare?

It is often quite difficult to figure out whether your budgeted weekly food budget figures…

THE cheapest way to get Sky Sports

We all love the epics that are shown on Sky Sports, but we’re not as…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….

How to create a personal budget in Excel that’ll even impress your accountant!

When creating a budget, using a spreadsheet app like Excel makes the whole job much,…

Pain-free vs Painful Savings

As part of the Budgeting 101 article, I discussed the lengths you’ll need to go…

How to budget when you get paid weekly

With nearly 17% of jobs getting paid weekly, you’re certainly not alone in trying to…

Can saving money make you rich?

I used to think the only way to riches was a top job in a…

Yolt vs Cleo: Will One of These Help Your Finances?

Another budgeting app face-off. This time, we pitch Yolt vs Cleo. Quick Summary For those…

How To Cancel Glossybox UK

Wanting to cancel your monthly beauty box subscription? We’ve laid out the steps you need…

Why starting to save when you’re young is so important (I wish I did more of it!)

I’m sure most people are in the same camp as me, but I regret not…

Pingback: How To Save For A House Deposit In A Year UK - How I Saved £20k+