I used to think the only way to riches was a top job in a boardroom, lottery win or making it as a top sportsman (spoiler: I suck at football).

You’d be gutted if my conclusion was “yes, become a top footballer or win the lottery”, but I’m glad to say that isn’t the case.

Luckily, there is a route available to us all!

However, bad news – saving money in a savings account isn’t it.

Stick with me and I’ll show you the route to riches and answer the question; “can saving money make you rich?”.

- What does “rich” even mean?

- Can saving money make you rich?

- So, how do you actually grow your wealth to get rich?

- But first, what are the pre-requisites before you should start investing?

- What investments are a good place to start?

- Savings still have a mighty role to play

- Why additional savings may actually be costing you money

- Learnings

What does “rich” even mean?

Rich means different things to everyone, and an important part of setting out on your journey to becoming “rich” is to first define it.

However, there are a few guardrails we need to set. “Rich” has to come from wealth, not income.

We’ve all heard of the famous athletes earning tens of millions a year who were forced into bankruptcy by their expensive lifestyles.

Once their income started to reduce, they couldn’t support their lifestyle and had to go into bankruptcy.

Whereas if they had funneled their high income into investments then they would be more insulated from any drops in their paid income as they’re still earning an income from their investments.

So by “rich”, in this article we’re talking about having wealth and not income.

Wealth is essentially having more assets than you do liabilities (your net worth).

The question is then how high does your net worth need to be to be considered wealthy?

The median household wealth in the UK is £286,600 (this is where if we put all households out in a line, with the poorest in terms of wealth on one end and the richest on the other and select the middle one). (Source: ONS). This is a good measure of the “average” household wealth in the UK.

The mean average household wealth in the UK is £564,300 (this is where we take all of the aggregated total wealth in the UK and divide by the total number of households). (Source: ONS). This is impacted by the top percentile of households who have massive levels of wealth that drag up the average from the median.

If you want to define “rich” as being in the top 50%, then these stats are a good place to start.

However, even though these might afford you bragging rights, these don’t materially impact your life.

My personal definition for “rich” is also the same as being financially independent, which is where your portfolio returns can cover your living expenses.

After this point, you are truly “rich” because you no longer need to work to earn your money. You have your minions (all of your £’s) doing the work for you.

A quick and easy way to calculate the size of the portfolio needed to cover your expenses is to take your annual living expenses and multiply by 25.

So for me, I need an investable portfolio (so excluding any wealth tied up in my residential house) of between £300k-£500k to meet my threshold of considering myself “rich”.

Run through the process yourself to find your rich range:

- how much would your most basic lifestyle cost per year? (you can do a rough calculation!)

- how much would your comfortable lifestyle cost per year?

Multiply both of these figures by 25 to get your range.

Can saving money make you rich?

No.

You need your money to be working harder for you than a savings account can provide.

However, getting into the habit of having money to save is the bedrock of growing your wealth. Instead of saving this in a savings account, you’ll need to invest it instead.

So, how do you actually grow your wealth to get rich?

It’s a 3 step process:

- Generate a “Personal Profit“

- Invest this regularly

- Let the magic happen

Generating a personal profit

Personal profit = income – expenses.

It is important to create a personal profit each month so that you have new money available to you to direct towards your financial goals, such as paying off debt, saving an emergency fund, saving for a short-term financial goal or investing to grow your wealth.

The first step to improving your monthly personal profit is by setting up a budget, which might shine a light on areas that you can make savings and boost your monthly profit.

Even though the thought of budgeting may fill you with dread, I promise you it is one of the most impactful things you can do for your personal finances (and isn’t as bad as you think it will be).

Remember, a higher personal profit means more available to invest.

The more you have to invest the quicker you’ll be able to reach your financial goals!

Invest this personal profit regularly

Invest your money by buying an asset that appreciates over time or pays you an income.

These are the two main ways you can generate a return on your investment.

Classic investments are:

- Stocks and shares

- Bonds

- Property

- Physical property

- or via the stock market

How does investing make you rich?

By investing, you buy assets that grow in value (for example company shares) and/or earn you an income (for example dividend payments or rental income) that over time grow to make you rich.

The major key to becoming rich via investing is due to, simply, time.

Specifically, the magic of compounded returns, which takes time for the magic to start.

This is when your returns start to generate returns of their own. This literally blew my mind when I first learned about it.

It may be slow at first and you may not be able to notice it, but if you stick with it it’ll start accelerating and accelerating until your money is doing the heavy lifting for you, and normal people like you or me can become millionaires without winning the lottery or making it to the top job in corporate drudgery.

Let’s use an example.

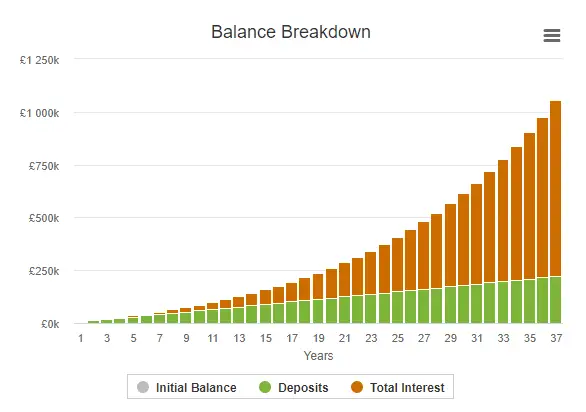

Bill (20) wants to become a millionaire and retire earlier than 65. Bill doesn’t earn a mega-wage, but is mindful of his spending and so he has engineered a monthly personal profit of £500 per month that he can invest.

He invests that in a stocks and shares ISA in an index fund (which is well-diversified and tracks the stock market, so has low fees) and achieves an annual return of 7% per year.

37 years later at the age of 57, Bill has a portfolio worth a staggering £1,054,387 due to the power of compound returns. He has only contributed £222,000 himself, but the rest he has re-invested.

Below you can see the amounts he has invested in the green, with the 7% annual return in the orange.

It took a bit of time for his portfolio to start generating sizeable returns. At the end of year 10, his portfolio provided a return of only £5.6k.

But at the end of the next 10 year period (so at the end of year 20), his portfolio earned him £17.4k.

And if we look at the end of the next 10 year period (so at the end of year 30), his portfolio earned him a massive £41.2k!

The lesson? Start investing as soon as you can!

But first, what are the pre-requisites before you should start investing?

Before you start investing regularly, you’ll need to:

1. Pay off your debts (excluding your mortgage)

It is very likely that your debts are costing you more in interest than you’ll earn investing, so clear those suckers first before investing otherwise you’ll be going backwards.

As mortgages tend to be the cheapest form of debt due to being secured, you don’t need to wait until you have paid this off before you start to invest.

2. Build up an emergency fund

Build up an emergency fund of 3-6 months’ worth of expenses before you start to invest.

This is critical as a lot of the risk in investing (as long as you’re diversified) comes from the variability in returns.

For example, one year your fund may be up +20%, and the next year it’ll be down -8%. Over time, the return tends to trend one way; up.

However, if you get caught in a headlock by life and you need to get hold of some cash fast, then you need an emergency fund that you can call upon.

If you were investing without an emergency fund and life kicks you in the face, and you just so happened to be in one of those down years where your fund is down 8%, then you’ll need to sell and actually materialise that loss (rather than keep it in and wait for it to grow again).

What investments are a good place to start?

Investing is actually much simpler than most people think it is.

The best place to start is stocks and shares, due to the plethora of online brokers with low fees or robo-advisors who can help with your asset allocation, as well as low minimum investment requirements (as opposed to property where you typically need a large deposit and it is hard to diversify).

You don’t need to put much time into it, and you don’t need to analyse and investigate every single company in the FTSE 100 to work out who to invest in.

What if I told you that you could actually get a higher return than the professionals who get paid bags of cash to pick the hottest new stocks for their funds?

Well, welcome to index funds.

This is where you buy into a mutual fund that doesn’t aim to beat the stock market by employing very clever finance people. They instead simply aim to mirror the returns of the whole stock market.

This has advantages because the fees are lower (meaning your returns are not eaten up by paying the aforementioned finance professionals), and you don’t need to worry about who the best stockpicker of their generation is (giving you more time to worry about other things).

The study referenced in this article by WM Company found that 82% of actively managed funds failed to beat the market returns over the course of 20 years.

The three things to look for when investing:

- low fees

- diversification built-in

- investing in line with your risk appetite

I think it is important to quickly discuss diversification.

Going all-in and investing your whole life savings into one company’s shares is risky because you are not diversified.

What if that company has poor management who run the company into the ground?

Or if the industry gets disrupted by a new technology and becomes redundant?

What if the country they operate in restrict their license?

By investing in diversified assets such as index funds (a fund designed to mimic the returns of the whole stock market), it means that you are diversified against most of these risks.

When one company fails in a recession, other companies may be posting stellar growth, offsetting each other and protecting your returns.

Be cautious around any new and speculative “trades” that everyone is talking about. I would restrict any speculative investments to only 1-2% of your total investment portfolio. Having a rule like this helps you to see the wood from the trees and not get sucked into the hype and put your portfolio at risk.

The last thing you want is for you to be diligently building up your portfolio over 10 years only to have your wealth wiped out by investing your life savings into a hyped-up scheme that fails.

By speculative trades, I’m referring to hyped up individual company shares and alternative investments such as bitcoin.

Savings still have a mighty role to play

Savings are taking a bit of a beating in this article, but they aren’t the bad guy. Other than playing a critical role as an emergency fund, savings have further benefits.

1. Instilling the right habits

If you have managed your spending to the point that you are creating regular monthly savings, then you are able to funnel these savings into investments once you’re ready to go.

These regular, monthly investments soon build up and when partnered with compound interest you’ll soon have a building portfolio working for you.

2. Savings are helpful for short-term financial goals

If you’re looking to save money for a short term goal less than 3 years away, such as paying for a wedding or a house deposit, then saving using a savings account (and not investing) is the way to go.

This is due to the variability in returns we already discussed, that investing comes with variability in returns in the short-term. You want to avoid having to take your money out when the market is down.

I got burned by not following this piece of advice recently in the COVID-fuelled stock crash in March 2020. I had been saving for a house deposit by investing in a stocks & shares ISA, even though I knew I needed that money in 1-2 years’ time. When my fund started dropping and continued to drop, I took the decision to exit the fund and hold it in cash and accept it as a lesson learned. The stinger is that I exited the fund at one of the lowest points, before it started to bounce back and rally to the prices it had previously been at (once again: lesson learned).

3. Creating psychological safety

Having an emergency fund gives you the room to breathe and know that you have the ability to weather shocks.

This will allow you to be free of money stress and may even allow you to take risks you wouldn’t normally be willing to take, which might open up a whole world of new opportunities!

Why additional savings may actually be costing you money

Other than for an emergency fund or saving for short-term financial goals, leaving money in a savings account should be avoided.

This is because your money can be hard at work for you growing and compounding in investments, rather than sitting in a low-interest savings account.

Remember when you were a kid you could go to the ice-cream van and grab a 99 that was called that because it was literally 99p? Or the Freddo that only cost 10p?

Like me you’re probably outraged that the same “99” is now £2 and the same Freddo is smaller and costs 25p+?

This is all down to inflation, the general increase in the prices of goods and services over time.

It’s a bit boring so we won’t get into it, but if the inflation rate is higher than your savings accounts interest rate, then your money is becoming worth less and less each year, even though it is growing in size.

This is because you can buy fewer goods and services as they are increasing in price faster than your savings are.

The learning? Once you have an emergency fund and have paid off your debts (excluding your mortgage), start to invest in productive assets rather than keeping your cash in savings.

Learnings

- Find your definition of “rich” that you can aim for and work towards

- Build a budget and boost your personal profit

- Pay off your debts (excluding mortgage) and build up an emergency fund

- Start to invest and let the magic happen

Have you found this article helpful? I would love to hear from you in the comments section below – let me know your thoughts and your plans to get rich!

Snoop vs Money Dashboard

An app has the power to simplify your life. Especially your finances. Rather than cracking…

Budget Like A Boss – What Does My Budgeting Process Look Like?

If you’ve decided you need a budget, most people tend to advise a very similar…

Plum vs Emma – Which One Will Help You Save Money?

Wish you could harness technology to help your finances? You’re in luck. Today we pit…

How Long Do You Need To Be Employed To Get A Mortgage UK?

It seems you have to jump through a million hoops to get a mortgage nowadays….

How to cancel The Gym membership

Sick of the gym or found a better option? Nice. Most gyms are an absolute…

How To Save For A House Deposit In A Year (Whilst Renting In The UK)

As a fellow first time buyer, I’m sure you know the struggle already. We really…

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

Tracking your expenses isn’t all about firing up a spreadsheet and restricting your spending. Having…

Wealthify vs Hargreaves Lansdown

Investing in the stock market used to be an inaccessible world full of jargon, stockbrokers…

Moneyfarm vs Vanguard: Lowest Fees On The Market?

Investing is the most impactful tool you have to reach an ambitious financial goal. Sometimes…

4 of the Best Student Budgeting Apps for Students

If you’re sick of tucking into beans on toast and looking for ways to make…

Pingback: Can you lose money in a savings account? And how to protect against it!

Pingback: The 7 biggest finance mistakes young professionals make in their 20s

Pingback: Should I Save an Emergency Fund or Pay Off Debt? | The Mindful Money Project