As a fellow first time buyer, I’m sure you know the struggle already. We really are being squeezed from all angles at the moment. Rising rental costs, higher deposit requirements and a rising average house price meaning we need to save even more. Not to mention rising living costs & a stubbornly static average wage. Oosh, what a story.

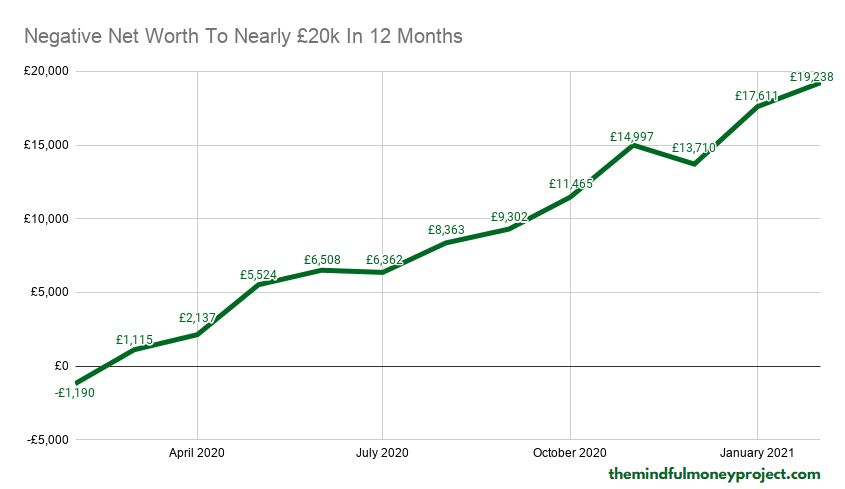

Even against that backdrop, there are ways that you can save a deposit to get on the housing ladder. The steps I took allowed me to save £20k in 12 months. I’ll show you how I did it, the mistakes I made along the way and actionable tips you can use. All helping show you how to save for a house deposit in a year in the UK whilst renting.

My story

Moving to the big smoke for university, I soon came to realise just how damned expensive the capital could be. I rinsed through about £2k of savings in my first term alone – ouch!

Almost all of my savings were swallowed up in the first term alone!

Once I had graduated and started training as an accountant, I thought the savings would follow. After all, the only way is up when you’re no longer living like a student right? The only problem: I always had reasons not to be saving.

It was always; “when I get a raise”, or…

Maybe next month I’ll start…

We all know how that rodeo ends: very predictably. After 7 years of living in London, I decided to move back to the South-West.

What did I have to show for it?

After excluding my pension balance, I was sitting in the red!

The only reason my pension was growing was that I literally couldn’t touch it. D’oh! Not great money management for an accountant, is it? In my time in London, I wasn’t the only accountant I knew who couldn’t manage their own money particularly well either. But I’ll blame it on all of the delightful beers the capital has to offer us (bit of a cop-out).

I wasn’t the only accountant I knew who couldn’t manage their own money particularly well

Fast forward to today, in early 2021, and I have saved just short of £20,000. This was saved with the intention of using it as a deposit to buy a house. What’s more, I was able to save for a house deposit whilst renting at the same time.

I’m actually aiming for a larger deposit. As well as saving for additional costs such as stamp duty and surveying fees. I’ll also need to keep back £5,000 as my emergency fund. But theoretically, this mortgage deposit would be sufficient for a house up to a £200k property value assuming a 90% loan to value (or more if a mortgage lender issued a 95% LTV mortgage – but due to the higher risk of going into negative equity I’m going to hold out for a smaller LTV mortgage).

The numbers

I ran the numbers ahead of writing this article. Even though I knew I was making great progress, it is really motivating to see it on paper.

At the end of February 2020, I was actually sitting on a negative net worth excluding my pension of -£1,200. That’s right, negative one thousand and two hundred pounds. This was mainly due to a credit card and personal loan balance, along with paltry savings.

Fast forward to the end of February 2021, and I was able to grow my net worth (excluding my pension) by £20k, in 12 months.

In 12 months, I was able to grow my net worth (excluding pension) by £20,000

I’m hoping by publishing the details of my progress in this article, I can help other people to engage with (or reinvigorate) their own personal finances.

Helping just one person get closer to homeownership will be a happy result for me. My intention with this article is not to show off, as I am aware I have been very fortunate throughout this pandemic to keep my health and income, but instead to help people understand the steps I took to get to this point.

Whenever I read “saving tips” I tend to get turned off with how generic they feel, but my goal with this article is to show you how quickly they can all add up. The steps I took, and the lessons learned, are still applicable in a pre (or indeed post) pandemic world.

How to save for a house deposit in a year whilst renting in the UK

The steps I followed to save for a house deposit in a year whilst renting were simple but worked really effectively.

Claimed free money from the government via a LISA

A Lifetime ISA (LISA) is a great way to boost your savings, with help from the government. You can deposit up to £4,000 a year, and the government will provide a top-up of 25%. This means that by simply saving in a LISA, I got an additional £1,000.

There are some restrictions on using LISAs which mean that if you need to take cash out for a reason other than buying your first home or for retirement, then you’ll be hit with a penalty.

You also need to have had the LISA for at least 12 months in order to use it for a house deposit. So open one up ASAP to ensure you can use the benefits in a year’s time.

Read more about Lifetime ISAs over at MoneySavingExpert.

Action: Open a LISA and aim to max out the £4k limit to get the maximum benefit

Kept my subscriptions lean

I always bang on about the importance of keeping your subscriptions lean here on The Mindful Money Project.

Most companies have moved to a recurring billing model, as it is great for them to get predictable revenue streams.

It isn’t great for you as you need to constantly be funding this!

I went a bit brutal on my monthly subscriptions and kept them deliberately lean. This resulted in me cancelling my Amazon Prime account, Netflix account, The Economist subscription, cancelling old app renewals and pieces of software I no longer use and additionally reducing my phone bill from a standard contract with Three to a sim-only plan with Smarty for only £10 a month (absolute steal given my handset still works).

This saved me around £900-£1000 per year, with only ~10 minutes worth of work

The only monthly subscriptions I kept on were the ones that I use regularly and get a lot of value from. Currently those are Zwift and Spotify for me.

The beauty of giving your monthly subscriptions a trim is that you make a monthly saving each and every month for no additional work. Anything that requires a one-time effort for a repeating benefit can amplify your savings.

In reality, securing these savings are super easy.

Action: Comb through your subscriptions and really ask yourself whether you need them or not. Cancel any you don’t need.

See related: how to save £1000 in a month using the COST method

Optimised existing bills

This area is really frustrating. Generally, you would expect to be rewarded for being a loyal customer.

In reality, though, we know we rarely are.

The worst culprits?

- Insurance companies

- Energy companies

- Telecoms

By simply running a comparison on sites such as MoneySuperMarket, you can easily save yourselves £100s a year.

Unless you step in and run a comparison, your existing supplier will just push you to a default plan or renew your contract at less than competitive rates.

An absolute shining example of one of these wins was on my car insurance. My existing insurer gave me a renewal quote which was about £86 per year cheaper than what I had been paying.

Initially, I thought that was decent but decided to do a quick check on a comparison site (after all, it literally takes 30 seconds).

Guess what I found?

A quote for £307 a year less. But that wasn’t the worst bit, guess who the quote was from? My existing damn supplier! Absolute facepalm.

My insurer drew a blind eye to my loyalty by keeping my price higher than a new customer would get

In this game, you don’t get rewarded for being a loyal customer.

I found similar wins on energy, simply by calling up my current supplier and asking if they had cheaper rates.

There are some services that automate this service for you such as Look After My Bills. If you don’t want to outsource it to a service like Look After My Bills, there are lots of apps that help you stay on top of your renewals and flag areas they think you can make savings. Some apps such as Snoop, Plum and Wonderbill are good places to start.

Action: Run regular comparison checks each year on your insurance, energy and other regular bills.

See related: Wonderbill review

Stayed on top of housing costs

When I was looking to improve my finances, I spent most of my time trying to improve the following two areas:

- fixed expenses

- recurring expenses

We’ve already talked about recurring expenses. These are mainly your subscriptions and bills such as energy and insurance. These are great because once you optimise them once, you continue to reap the savings for at least a year.

The next target was my fixed expenses. These tend to be costs that are fixed for a period of time such as housing costs. For all my fellow renters out there, you know they’re normally fixed due to contractual agreements with a minimum term of 6-12 months before you can leave. If these are taking up something like 20-40%+ of your monthly paycheck, then squeezing out any savings here are going to have the biggest impact on your finances.

The biggest of mine, which is likely similar across all of you currently reading, was my monthly rent expense. If you’re trying to save a house deposit whilst renting, trying to reduce your rent costs is one of the biggest levers you can pull.

When focusing on your biggest expenses, even a small saving can make a big difference

I know of friends who easily spend over £800 a month for one room in a house share in London. Or people who spend over £1500 a month for a tiny one-bed flat which they live in by themselves.

Even though it is tough for all, saving for a deposit whilst renting adds a bit of complexity to the picture. That doesn’t mean it is impossible though. On top of the other areas which I’ve flagged in this article, reducing your existing housing expenses can have a big impact on your ability to save.

Some strategies that work:

- move back in with parents if that is an option (highest impact)

- downsize to a smaller place (it is important to remember this is only temporary but it will supercharge your ability to save)

- move to a similar-sized place which is also further out from the city centre (and therefore cheaper)

With the last option, you need to make sure that the added commuting time doesn’t result in more costs than staying put as otherwise it would be a pointless move!

How did I reduce my housing expenses?

After moving out of London, I decided to houseshare with a friend.

Moving out of London generally helped me reduce my rental expense, but not only that, I took the smaller room in the house to keep my rental costs as low as I could.

This meant that rather than spending over £1k on housing costs each month, I kept my rent under £500. My housing in London wasn’t too expensive anyway, so in reality, for me, this resulted in a saving of about £200 per month.

Focusing on your largest spend items, like housing, means any saving will be amplified compared to more incremental improvements such as keeping your subscriptions lean.

Learning: be mindful of housing costs, as this is one area you can make BIG savings.

Paid off my debt first

At the beginning of Jan 2020, I had a personal loan balance of just over £3,000 and a credit card balance of nearly £2,000. Clearing these rapidly meant that all of my savings could actually go towards building up my savings rather than just paying off debt and interest.

I followed the debt avalanche method, where you pay off the highest interest debt first. For me, this was my credit card debt.

A debt avalanche is when you pay off the debt in order of most expensive to least expensive. This compares to the debt snowball method which aims to pay off the smallest balance first.

Once I paid that off, I started to overpay on my personal loan. The interest rate on my personal loan was really low, at around 3%, so I didn’t try to renegotiate or find a cheaper alternative. But paying it off early saved me a bit of cash in interest. Critically though, it meant that all of the money I was previously paying to repay my loan could now be put towards saving for my house deposit.

If you have debt, you need a strategy to get rid of it. Chances are, it is costing you a lot in interest payments over time.

You can take a few steps to develop a strategy:

- write a list of all of your debt along with the interest rate and required minimum payment next to each

- try to reduce the cost of your debt if possible (you can either speak to your lender, see if there are cheaper options available to you or speak to a debt advice charity like StepChange who will be able to provide you advice).

- decide on an approach;

- debt avalanche method – paying off highest interest debt first

- debt snowball method – paying off the smallest balance first

- make sure you are maintaining your minimum repayments on the others in the meantime

- don’t take on any more debt

Learning: to supercharge your savings, aggressively pay off your debt

See related: should I save an emergency fund or pay off debt?

Cut back on my spending

This was an area that was no doubt helped by the lockdowns introduced in early 2020 and which on-off lasted for the full year, restricting the opportunity to spend.

The big spend items for me normally are going out to eat/ drink with friends and any spend on holidays. With these out of the window due to the pandemic, I was able to funnel these straight into savings.

But initially, I seemed to have an aversion to not spending and found myself buying all sorts of tat online. Not to mention my food shops started to skyrocket.

To counter this I engaged a bit more mindfully with my spending and downloaded the Emma budgeting app. I connected this to my accounts and used it to keep a more detailed track of my spending.

I also adjusted my budget to reduce the amount I have allocated for travel (most of the year was spent working from home), groceries (I increased my budget to reflect more time spent at home), and entertainment/going out (literally nowhere to go).

As we start to ease out of the lockdown, I will be re-adjusting my budget to increase both my entertainment and travel expenses, bringing my food shop budget down to partly offset.

Learning: create a budget if you don’t have one already, and download a spend tracker app to easily hold yourself accountable.

See related: best spend tracker app UK

Increased my earnings

I was extremely fortunate to have my primary job remain secure through the period, with no drop in income or too much uncertainty over the security of that income stream.

Throughout the year though, my income remained flat from my day job.

I did, however, start looking for other income sources to supplement my main income.

Diversifying my income sources has been a goal for a long time, which I was able to make some great progress on in the last 12 months

In late 2019, I took on a freelance role using my experience in accounting and management reporting to help a scale-up to improve their internal finance processes. I got this contract through someone I used to work with.

This provided about a 20% boost to my after-tax income (after taxes were paid on my freelance income), which massively helped me accelerate my savings.

Although the strain of managing a demanding day job and taking on additional work in my spare time did take its toll. I’ve since finished working on that freelance contract, and am looking to income sources that don’t require the same level of consistent engagement and output. Watch this space!

For all aspiring side-hustlers out there, I highly recommend this article on The Humble Penny which covers most things you need to be aware of from a tax perspective when you take on a side hustle.

Learning: seek out ways to boost your income once you have optimised your expenses. You likely have a skill, experience or passion that you can monetise!

Paid myself first

When I first started to earn a regular paycheck, I would always find myself waiting until the end of the month to save anything I had leftover.

Of course, that leftover cash never materialised.

Not surprising, considering I wasn’t intentionally engaging with my money or saving for anything in particular.

This is probably a very similar story for the readers of this article.

There’s a great concept in personal finance called paying yourself first, and I find it works a treat when it comes to saving.

Rather than saving anything you have left over at the end of the month, you save upfront. The minute you get paid. Once that paycheck drops into your account, transfer your savings straight into a separate account.

Opening a separate savings account also meant that it was out of sight and out of mind. I couldn’t be tempted to dip into it. I set up a savings account with Marcus, the online savings arm of Goldman Sachs, which at the time was the highest paying easy-access savings account.

You can even go a step further and set up automatic transfers on pay day to transfer your savings money to your savings account, bill money to your bill account etc, and have direct debits and standing orders automatically pay your bills for you.

Learnings: define how much you should be saving up front, and spend the rest, rather than the other way around. Then automate!

See related: 4 budgeting methods

The hiccups

Things are never plain sailing, and I made a few mistakes along the way which I shouldn’t have.

I didn’t align my savings accounts with the timeframe of my goal

I knew I was looking to have a deposit by the end of 2020, with the idea of originally buying somewhere early 2021. Even so, I still decided to have a stocks & shares ISA investing in volatile but diversified global stock funds. If the timeframe of my goal was 5+ years, this would have been a fine approach, as a longer timeframe reduces the volatility of these kinds of investments. But I set myself up to fail by investing for such a short goal timeframe of less than a year.

When the market dipped in March/April 2020, I panicked. I recognised my mistake and couldn’t bear to see my deposit savings go up in smoke, so I sold out and transferred to a cash LISA instead which was a more standard regular savings account.

It actually meant that I sold out pretty much at the bottom of the market, which then subsequently rebounded (d’oh).

Even though I understood the importance of aligning my saving/investing strategy with my goal, I ignored it. There is no keener teacher than the real world, so from now on I am aligning my savings/investing strategy extremely diligently with the timeframe of the goal.

So from now on, I am aligning my savings/investing strategy with the timeframe of my goal

For example, my savings for my house deposit are going into a simple savings account mixed between my cash LISA and a cash ISA (as should be using them in the next year), whereas my savings for early retirement are being invested into a globally diversified stock fund as I won’t need this for 15+ years.

Luckily, the impact of this mistake wasn’t hugely material, costing me about £400. If I was sitting on a bigger portfolio, however, this could have been a hefty financial mistake.

Learning: make sure to align your savings and investing strategy with the timeframe of your goal. Don’t get burned as I did!

Not recognising the importance of sinking funds

For ages, I never included sinking funds in my budget.

What is a sinking fund? Basically a pot of money for a specific thing that builds over a period of time. So for example you might set up a fund to pay for Christmas each year, where you put in £50 per month. This means that when Christmas rolls around you have a ready-made pot of cash to spend.

I figured that as I was increasing my savings balance each month, I didn’t need to specifically carve out a fund for these one-off annual events. Each year, I would then blow through my budget on the likes of Christmas, or holidays, or be tempted to go for the monthly car insurance option even though I could secure further savings on the annual plan.

Once I started to take account of all of these in my budget, I was way more motivated to stick to my budget (no one-off costs causing me to miss) and it enabled me to be more thoughtful about allocating money in my budget.

The catalyst for me to set up my sinking funds was actually due to car repairs. I have a fully-funded emergency fund that gives me confidence I can meet any unexpected car repairs. But as I made the conscious decision to buy an old used car with (now) over 100k miles on the clock, I need to be putting money aside for regular maintenance and repairs. The biggest change I’ve noticed by adopting sinking funds as opposed to dipping into an emergency fund is psychological in my approach. Instead of holding off on any repairs or maintenance until it really needed it, I can now see that I have some money for that purpose building up and I will book my car in for a service, or to get that niggly issue sorted before it has time to develop. I highly recommend adopting sinking funds!

Recap of lessons learned

- Align your saving/investment accounts with the timeframe of your goal

- Budgets work, run your numbers and track your progress! (use an app to help)

- Optimise your spending and remember to focus on where you can move the needle (housing costs I’m looking at you)

- Set up an automatic monthly transfer to your savings account – out of sight, out of mind!

- Set up a LISA ASAP due to the 12 months limit

- Explore methods to make more money on top of your day job

Conclusion: how to save for a house deposit in a year whilst renting in the UK

I recognise that saving for a house deposit in a year whilst renting is a pretty aggressive savings target. I’m hoping by sharing my experience of getting to a funded house deposit in 12 months, you can pick up some methods that you can use to help you on your journey.

Especially if you are a young person, you don’t need to lose hope that you can never get on the property ladder if you don’t have a fat gifted deposit from the Bank of Mum & Dad. By engaging with your finances and making mindful decisions about your goal, you will get there. It might not be 12 months, but what matters is that you do get there.

What is next for me? I am going to continue to aggressively save so that I have a bigger deposit for when the time comes (likely end of 2021 now), continue to work to supplement my primary income, and will start to engage with a mortgage lender or mortgage adviser in a few months to plan for the other costs that I need to prepare for such as stamp duty, surveying costs, conveyancing costs etc. They should provide invaluable mortgage advice which can help me prepare before I’m ready to pull the trigger. I’ll also focus on improving my credit score, as I have over 6 months before I am expecting to get on the property ladder.

I hope this has been useful to find out how to save for a house deposit in a year whilst renting in the UK, but I would love to hear your thoughts in the comment section below.

FAQs

THE cheapest way to get Sky Sports

We all love the epics that are shown on Sky Sports, but we’re not as…

How To Cancel Peloton Subscription UK

Bored of your Peloton and want to cancel? We’ve laid out the steps you need…

Pain-free vs Painful Savings

As part of the Budgeting 101 article, I discussed the lengths you’ll need to go…

What is Personal Profit?

A profit and loss statement is how a company keeps track of all of its…

Snoop vs Emma: Which Is Best?

Ever had the joy of tagging up your monthly bank statements manually in a spreadsheet?…

Financial Independence – Why I’m Chasing It

Phwoar, look at the state of that. Camper van loaded up with surfboards (or are…

What Is A Budget?

Everyone talks about a budget, but do we actually know what one is? Budgets are…

How To Cancel Racing TV UK (Sky or Direct)

Staying on top of your monthly subscriptions can help to streamline your finances. You may…

Yolt vs Money Dashboard vs Emma – The Comparison!

Don’t want to dust off a spreadsheet? A budgeting app can do most of the…

Pingback: How to save £1000 in a month using the COST method

Pingback: Is Saving £1000 a Month Good? | The Mindful Money Project

Pingback: 13 Tips On How to Save Money Fast in the UK That You Can Do TODAY

Pingback: The 7 biggest finance mistakes young professionals make in their 20s

Pingback: How I Paid Off £2,000 Debt and Saved £9,000 In Less Than One Year | The Mindful Money Project

Pingback: How The Timeframe of Your Personal Finance Goal Makes A Big Difference

Pingback: Pain-free vs Painful Savings | The Mindful Money Project

Pingback: How Long Do You Need To Be Employed To Get A Mortgage UK?