Have an unexpected bill but not enough in your emergency fund? A tight budget? Need to pay off some debt quickly? Whatever your need to save £1000 in a month, there are some steps you can take to achieve your savings goal. Using the COST method, I’ll take you through how to save £1000 in a month.

What is the COST method?

I love an acronym. This handy one breaks down the steps you need to take to save £1000 in one month. I have used this approach to help me save a house deposit in 12 months, so I know it works.

The COST method is made up of these 4 steps:

- Cancel

- Optimise

- Stick

- Top up (your income)

The first 3 help you to manage and optimise your expenses with some handy money saving tips, with the last one providing some ideas to boost your income.

Whenever you need to give your finances a shake-up, revisit this article and treat it as a saving challenge. Trust me, it is satisfying to see how much you can save!

How to save £1000 in a month using the COST method

Cancel

Have you noticed how most companies nowadays are clamouring to sign you up for a monthly plan? It used to be that you’d pay a one-time fee to buy a product or service, and that was that. Pay once, use forever (well, as long as it lasted).

Lots of companies have since pivoted their strategy towards monthly payments. Software companies like Microsoft no longer charge a one-off license fee. They now hook you into a monthly subscription.

The benefit for them is obvious; repeatable and predictable cashflow.

The downside for you? Stacks of unused monthly subscriptions. The rub is that these are normally only £1-10 per month and so people tend to brush them off as inconsequential and/or forget about them.

Normally, I would agree. But these can add up. Substantially.

When it comes to saving money, this is the easiest of all easiest wins.

Imagine you have the following set of subscriptions that you cancel this month:

- Netflix £14

- Amazon Prime £8

- Spotify Premium £10

- Disney+ £8

- Sky TV package £100

- Magazine/news subscriptions £25

- Gym membership £60

This person above just managed to save themselves nearly £2.7k a year with a monthly saving of £225!

At the beginning, cutting back on expenses where you can has a massive impact. The saving is instant and within your control.

How to cancel your regular subscriptions:

- Run through your bank statements and make a note of any repeating subscriptions

- For each one, ask yourself whether you use it enough to justify the expense and whether or not it gives you enough value to continue paying for it.

- Pull the trigger and contact the service to cancel your subscription.

The common subscriptions to look for are:

- Entertainment services such as TV, Sky, Virgin, BT, Netflix, Amazon Prime Video etc

- Music services such as Google Play Music, Spotify, Tidal etc

- Magazine/news services such as The Economist, Financial Times, The Times etc

- App subscriptions. These can be as small as 50p per month upwards, but if you have a few they can certainly add up.

See related: Easy and painless ways to save money every month

Optimise

Now that you’ve cancelled what can be cancelled, time to turn your attention to the 2nd easiest win of all; optimising your regular bills.

These are the services you can’t do without, but who typically punish loyalty by slowly increasing your prices over time.

You know the culprits; energy, insurance, phone.

By running a simple comparison search using a service like MoneySuperMarket or GoCompare, you’ll be able to save potentially £100s per year.

Don’t be surprised with how much money you can save from doing a simple comparison check.

I once received a renewal quote from my car insurer and, being a curious chap, proceeded to check MoneySuperMarket to see if there was a better deal. Low and behold, there was. A saving of over £300. The worst part? The quote on MoneySuperMarket was from my existing supplier *facepalm*.

Loyalty never pays in this business, so make sure you run a full comparison check and switch to a better offer if there is one.

Want to automate this process?

Each year you’ll find yourself being met with the same task; searching for better deals to make sure your money isn’t being sucked out of your pocket by a lazy renewal. If you don’t want to do this manually each year, consider using an automatic bill switching service such as Look After My Bills. They’ll do the dirty work for you.

There’s an app for that

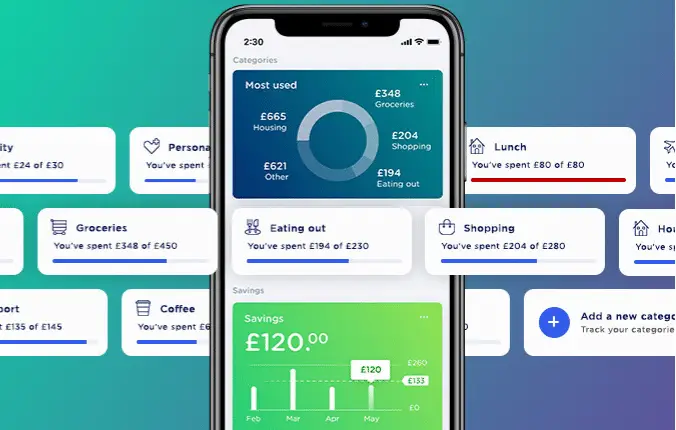

Additionally, some apps are really useful at keeping you on top of your recurring payments. Some even flag when there are cheaper deals available elsewhere.

Budgeting/spend tracking apps such as Emma, Money Dashboard and Yolt are handy at keeping an eye on your monthly subscription spending. There is even one, Wonderbill, which aggregates all of your household bills in one place.

See related: Yolt vs Money Dashboard vs Emma

Whereas smarter money-assistant apps such as Plum and Snoop will flag any bills they think you can get cheaper elsewhere.

See related: Plum vs Yolt & Snoop vs Yolt

The 2nd part of the Optimise pillar is to set up a budget.

People tend to get turned off at the thought of a budget, but this handy little tool has the potential to turn your finances around. You can use it to put resources behind your passions and gives you the confidence that you aren’t wasting money on things you don’t care about.

If you need to save some money quickly, and one-off, you can set a more brutal budget than otherwise.

Look at your past expenses and set yourself a challenging target for your spend categories such as:

- Groceries (check out our article on average food cost per month in the UK here)

- Travel/transport

- Entertainment

For example, if you’re looking to save £1000 in a month as a one-off because you need to pay a bill, then you can be much more brutal and set yourself a “no-spend” month savings challenge where you challenge yourself to not spend any money on entertainment.

Alternatively, you could set yourself a money saving challenge to drop your grocery shopping spending by 20%, resulting in you getting creative with money-saving recipes or shopping in a discounter such as Aldi and Lidl versus your normal shop.

Depending on your budget, these mini-challenges can have a BIG impact.

See related: what are the benefits of budgeting?

Stick

Now that you have set up a budget, it’s time to stick with it in order for you actually start saving money.

There are a few methods you can use that are effective;

- the envelope method

- budgeting apps

Envelope Method

The concept is quite simple. You put the equivalent amount of cash as your budget into an envelope, and mark the envelope with the purpose it is allocated for. For example, if you have a £200 monthly groceries budget, you take out £200 in cash and put it into a physical envelope which you mark up as “groceries”. Whenever you need to spend on groceries, you simply take out some cash from the envelope.

This provides such a great feedback loop because you can instantly see how much cash you have left. Additionally, as you are taking physical cash to the shop with you, you can’t accidentally spend over it in case impulse spending tries to rear its ugly head (tip: leave your card at home so you can’t be tempted).

Once you’ve spent your budget, it’s gone.

Even though it is super effective, the physical envelope method can be a bit old-school. Taking actual cash out is not always safe, and using cash not always convenient.

You can still get the benefits of the envelope method, however, via a digital method.

Instead of having physical envelopes filled with cash, try creating digital envelopes instead. You can set up an online savings account with your bank which you can name “Groceries” and “Entertainment” etc. Then when you want to spend from one of these budgets, simply transfer the cash out. This way you can easily see how much you have left in your budget each month, but you get to keep the convenience of using a debit card. Win-win!

See related: how to stick to your budget

Budgeting apps

Downloading bank statements not your thing? No dramas. With an explosion of really useful budgeting apps on the marketplace, you can analyse and track your spending with very little effort.

Spend trackers such as Yolt, Money Dashboard and Emma link up to your bank account, savings account and credit card accounts to give you an aggregated view of your spending (we pit these three apps head to head here). You can even set your budgets to track your spend against them throughout the month. Having visibility on your spending makes it easier to course-correct if you’re overspending.

See related: Best Spend Tracker apps UK

Top Up Income

Looking at your expenses is the most effective first step, as it gives you an instant boost and is within your control most of the time.

But you can only cut your expenses so far.

Once you’ve optimised your spending and cut out any wastage, you’re going to have to start making some extra money to be able to hit your savings plan of £1000 a month.

The way that you approach this will depend on your goal. If you’re looking for a one-off bit of extra cash to pay an unexpected bill, then some effective ways to raise money quickly is to:

- sell old/unused possessions on eBay, Gumtree or Facebook Marketplace

- sign up for mystery shopper and user experience testing websites

- use 20Cogs

- use matched betting to generate some easy income (tax-free)

Whereas the above are useful ways to give your income a one-off boost, they might not be sustainable in the longer term. If you’re looking to generate a sustainable and reliable income stream, then you can think about ideas such as:

- building up a freelancing income using sites such as Upwork and Fiverr and monetising a skill that you currently have (writing, customer service, bookkeeping, accounting, SEO etc)

- earning income via affiliate commissions and display advertising on your own blog

- gig economy work such as riding for Deliveroo or Uber

- take on a part-time job

- set up a Software-as-a-service or other software business using a visual builder like Bubble (no need to be a programming whizz kid)

Tax implications of side-income

If you are boosting your income on the side, you will need to be aware of any tax implications.

If you have taken on a part-time employed job, then the tax requirements will sit with your employer who will take it directly from your pay via PAYE.

For the other ideas, however, you will need to register for self-employment with HMRC if you’re expecting to earn over £1000 a year. If you earn under this, then you simply just apply for the £1000 trading allowance and you don’t need to pay any tax on it.

If in doubt, contact an accountant who will be able to guide you through the process and give you tailored advice.

Top tips for setting your side-hustle up for success:

- Register for self-employment with HMRC if you think you’ll earn more than £1000 a year

- Set up a separate bank account which you can use to track your business income and business expenses (separate to your own)

- Create a simple spreadsheet or notebook and jot down each expense and income as it comes in

- Keep hold of any documentation such as invoices as and when you incur the expense

All of these things will help your accountant when it comes to tax time, and save you money too!

Areas to focus your newfound savings

With the ability of your newfound savings, you will be able to make stellar progress towards your financial goals which may have been hampering you previously.

- Emergency fund. In order to avoid having an unexpected expense derail you, try to save between 3-6 months’ worth of expenses in an easy-access savings account.

- Pay off debt. Have any debt (not your mortgage)? Funnel your extra savings to paying these off.

- Start to invest. Once you’ve got an emergency fund and no consumer debt, you can start to invest for longer-term financial goals. You’ll benefit from the impact of compounding, and give your money the best chance at beating inflation! You’ll see your net worth increasing pronto (check out how your net worth compares versus the UK average).

See related: how big should my emergency fund be? & can you lose money in a savings account?

Conclusion: how to save £1000 in a month

Using the COST method, you will be able to have a combined £1k+ worth of savings per month.

First, by looking at your expenses, you can quickly and easily make some savings by cutting out wasteful subscriptions and optimising your existing repeating payments such as energy and insurance payments.

Secondly, setting yourself a budget will challenge you to change the way you currently spend your money.

But cutting back only gets you so far. Especially if you are not looking for a one-off month of saving £1000, but a sustainable and reliable saving of £1000 each month, you need to start boosting your income, whilst keeping your living expenses low so you can save almost 100% of your extra income.

FAQs

Money Dashboard Review UK 2021 – Will This Sort Out Your Finances?

If you’re not interested in tracking your spending using a spreadsheet, then using a budgeting…

How To Cancel Unite Union Membership in the UK

Looking to cancel your Unite Union membership but unsure where to start? We’ve done the…

How To Stick To Your Budget When Nothing Works

We’ve all been there, built a kick-ass budget but you’re unable to stick to it….

How to control impulse spending – 8 strategies that work

I’m sure every single one of you reading this has flirted with impulse spending in…

How To Save For A House Deposit In A Year (Whilst Renting In The UK)

As a fellow first time buyer, I’m sure you know the struggle already. We really…

How To Cancel Snap Fitness Membership UK

Finding you never use the Snap fitness gym and are looking to cancel your Snap…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….

Plum vs Yolt: Which One Will Save You Cash?

Being a bit of a personal finance nerd, I have been absolutely spoiled for choice…

Best Investment Apps for Beginners UK: Get Savvy And Build Wealth With These

In our list below, you’ll find the best investment apps for beginners UK. They cover…

How To Cancel Racing TV UK (Sky or Direct)

Staying on top of your monthly subscriptions can help to streamline your finances. You may…

Pingback: How To Stick To Your Budget When Nothing Works

Pingback: How I Paid Off £2,000 Debt and Saved £9,000 In Less Than One Year | The Mindful Money Project

Pingback: What Is A Good Percentage To Save From Your Paycheck?

Pingback: How To Save For A House Deposit In A Year UK - How I Saved £20k+

Pingback: How Long Do You Need To Be Employed To Get A Mortgage UK?