Is there an area not yet touched by the app revolution? If there is, then it certainly isn’t personal finance. An explosion of great new financial apps to help ease the burden of managing your finances have come onto the scene. In this article, I compare two of them; Snoop vs Yolt.

TL;DR Summary of Snoop vs Yolt

For those of you needing the quick answer, I want to open your mind to the possibility of needing both, as they are both good at different things.

Snoop* is best for managing your regular payments such as your energy, broadband, insurance, mortgage and mobile bills. It keeps you on top of your expected payments and jogs you to get a better deal if it reckons you are paying too much.

Whereas Yolt is was best for budgeting and spend tracking out of the two, but it’s offering on subscription tracking isn’t as good as Snoop*.

Try both out side by side, using Yolt to stick to your budget and Snoop to provide contextual tips to help you save money and reduce wasteful subscriptions.

*Update: Yolt has announced they are closing down their service from 4th December 2021.

Yolt Summary

Recommended for: Tracking spend against your budget

Platform available: iOS and Android

The good:

- Ability to set budgets

- Great analytics

- Simple design

- Coaching guides and good onboarding

The bad:

- Can’t add custom categories

- Can’t add offline accounts on Android

- No web app

- Company heavily promoting the Yolt Card

Summary

Yolt will help you easily understand where you are spending your money. With a clean and simple interface, you’ll be able to identify problem areas of spending via their intuitive analytics visuals, as well as track your spending against specific budgets via their budgeting features. If you are looking for more advanced features such as offline accounts, custom categories and the ability to access via the web, you may want to look at alternatives.

But for a quick and simple way to track your spending – you can’t go wrong.

Snoop Summary

Recommended for: Staying on top of your regular payments and subscriptions

Platform available: iOS and Android

The good:

- Can specifically monitor regular payments/bills

- Makes it easy to shop for cheaper deals

- Provides contextual “Snoops” to help you save money

- Great interface and design

The bad:

- No ability to track spend against budgets

- Spend tracking outside of regular payments/bills not as feature-rich as Yolt

Summary

Snoop is great at keeping you on top of your subscriptions and regular payments. I always bang on about stripping out wasteful subscriptions and optimising your regular bills, well using Snoop to stay on top of this makes it a doddle. Easy design and contextual tips on how to save money should help to put £££s back in your pocket. Tracking your spending against a budget, however, falls short compared to alternatives such as Yolt.

Yolt Deepdive

Yolt is a money management app that connects your separate bank accounts so you can view and track your spending all in one place. Their aim is to “give everyone the power to be smart with their money”.

We believe that staying on top of your money shouldn’t be a hassle. That’s why we built Yolt with a fresh approach, smart insights and easy actions, so you can make the most of life.

Pauline Van Brakel – Yolt CPO

It is an ING Bank venture, meaning it has the support, funding and security know-how of a big retail bank.

Launched in the UK in 2017, the app boasted 500k users within its first 18 months, and have now expanded to Italy and France.

Yolt uses the Open Banking API to connect your bank accounts.

Features:

- Connect bank and credit card accounts via Open Banking

- Tag up transactions automatically

- Set budgets (and track spending against)

- Visual analytics to understand your spend

- Subscription tracking

Highlights

Ease of use

Yolt really excels with its ease of use due to its simple design and handy guides. They have a good onboarding process that walks you through the features, with handy guides to help point you in the right direction if you need it. I did have trouble finding where to set a budget initially, but after working through one of their short guides I found it no problem (hint: its on the “actions” tab).

Visual analytics

Transforming your spending and financial data into visual charts will help you understand your current spending much, much easier. Rather than looking at a collection of transactions on a screen, a quick pie chart of your weekly spend easily tells you which category is sucking your wallet/purse dry. Easily knowing where you might want to put your attention to change your spending habits.

I find these data visualisations fascinating, and the team at Yolt have done a brilliant job at getting across the maximum amount of useful information in as few charts as neccessary. In my opinion, these are up there as some of the best in the budgeting app business.

Budgeting

The hardy budget – a cornerstone of personal finance. I always wax lyrical about budgets here at The Mindful Money Project, but sometimes I recognise they can be DULL. Budgeting is something that can and should be automated as much as possible, and this is where an app like Yolt comes in.

Once you’ve set your budget for various categories within Yolt, your transactions will be automatically tagged up against categories dependent on what the spend is for. All you need to do is flick up your app every once in a while to check how you are getting on versus your budget.

Lowlights

No custom categories

If you’re looking to set a budget, or track spending, for a category which is not included in Yolt’s pre-loaded set of categories, then you’re out of luck. Currently there is no ability to create your own custom category. For the more advanced budgeters out there, this might be a game changer. Check out our three-way comparison of Yolt vs Money Dashboard vs Emma to see who comes out on top if you’re after more advanced features.

What are other people saying?

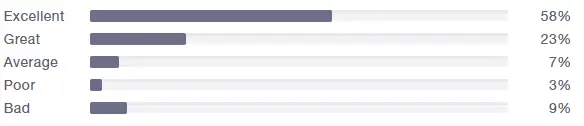

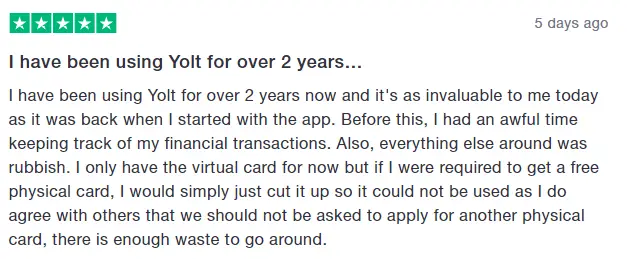

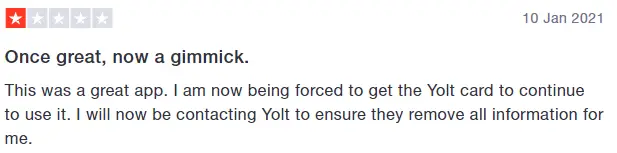

Looking at the Yolt reviews at the time of writing, Yolt scores 3.7 / 5 from 297 reviews. Below I have picked out the breakdown as well as one positive and one negative. A lot of the negative reviews have been in relation to the marketing efforts at pushing adoption of the new Yolt card, which some users are not happy with.

For a deeper dive into Yolt, check out my full Yolt review here.

Snoop Deepdive

Snoop is a money management app that, as the team at Snoop put it, watches your spending and spotting smart ways you can save by finding you a cheaper deal.

Even though their name is questionable, their mascot is a delightful little robot who acts as your financial sage. What isn’t to like!

Features:

- Connect bank and credit card accounts via Open Banking

- Tags up transactions automatically

- Monitors your regular bill payments and subscriptions

- Renewal reminders

- Contextual money-saving tips

Highlights

Contextual money saving tips

When you look at what your spend has been in categories, Snoop provides little snippets of information it calls “Snoops” which help you to save money either by giving you money off offers, or by providing tips and techniques in how to reduce this area of spend. For example, how to save money on groceries by reducing food waste. Or another one I received was how to get some KFC fare for £2 oi oiiii.

Payments hub

The jewel in the crown for Snoop. I absolutely love this feature. I always bang on about how the easiest way to reduce your spending is to make sure;

- you’ve cancelled any wasteful subscriptions

- you are not being overcharged for regular bills such as insurance, utility bills, broadband etc

Snoop’s payments hub feature is great for keeping on top of both your subscriptions and your regular bills.

Once you connect your bank account, you can identify the transaction that relates to the different kinds of recurring transactions such as mortgage payments, broadband, mobile, insurance etc. If you fill out the renewal date as well as your home address, then Snoop will monitor the market and alert you when either your contract is up for renewal or there are cheaper alternatives to switch to.

All of the switching can be done within the app, so is a doddle.

Lowlights

No budgeting functionality

Even though Snoop can be used to track your spending, there is no functionality to track it against budgets. A real oversight in my mind as this is a key feature a lot of people expect in a money management app.

What are other people saying?

Snoop only launched in early 2020, so there aren’t a tonne of reviews on independent review sites like Trustpilot, but the ones that are there are overwhelmingly positive. They’ve received 3 reviews, all at 5 stars.

On the Play Store, they’ve received over 1k reviews, averaging 4.5+ out of 5 stars.

They’ve fared just as well on the app store for iOS, boasting 681 reviews with an average rating of 4.8.

Alternatives to Snoop and Yolt

Conclusion: Snoop vs Yolt

Being a “vs” article, you’d expect me to recommend a clear winner in the fight between Snoop vs Yolt. In this Snoop vs Yolt matchup, however, I think that these two apps can be complementary to each other. I would therefore recommend using them both together.

Yolt is better for budget tracking, whereas Snoop is brilliant at keeping on top of your regular payments and ensuring you aren’t being overcharged.

Now that Yolt is closing down, and Snoop have been working extra hard to continually build out the feature set, the winner out of these two is obvious: Snoop*. Give it a go, and let me know what you think! Hopefully, you’ll be set up with Snoop to start crushing your financial goals.

Have you used either of these apps? Do you think there is a winner out of Snoop vs Yolt or do you use them side by side? I’d love to hear more about your experiences in the comments section below.

Icons made by Freepik from www.flaticon.com

Financial Independence – Why I’m Chasing It

Phwoar, look at the state of that. Camper van loaded up with surfboards (or are…

How to Budget Salary Wisely – 4 Methods To Make You Budget Wise!

Do you always find yourself running out of cash at the end of the month?…

How to save £1000 in a month using the COST method

Have an unexpected bill but not enough in your emergency fund? A tight budget? Need…

Best Credit Score Apps UK – Monitor and Save With These

If you think you’ll ever need to borrow money in the future, and let’s face…

Average Cost of Food For One Person UK

When looking at your own food costs, it is often difficult to know how you’re…

Best Spend Tracker App – Will One Of These Help Your Finances?

Cor I bet you’re bored of using an excel spreadsheet to track your expenses? Me…

How to deal with an unexpected expense

This always seems to be the way of the world – you’ve managed to get…

What is Personal Profit?

A profit and loss statement is how a company keeps track of all of its…

How To Stick To Your Budget When Nothing Works

We’ve all been there, built a kick-ass budget but you’re unable to stick to it….

Chip vs Moneybox: Which One Can Grow Your Wealth?

With some great innovation in financial services over the last few years, we’re comparing two…

Pingback: Plum vs Yolt: Which One Will Save You Cash? | The Mindful Money Project

Pingback: How to save £1000 in a month using the COST method

Pingback: How To Save For A House Deposit In A Year UK - How I Saved £20k+