Saving £1000 a month is quite an iconic milestone for many of us. A big fat juicy round number which tells you you’re well on your way to financial security. Not to mention a fast-growing savings account balance to boot. But, is saving £1000 a month good? Personal finance is personal. Therefore I’ll help you understand whether saving £1000 a month is good for you, rather than talk in generalisations.

In order to figure out whether saving £1000 a month is good for you or not, let’s ask two questions:

- What percentage of your after-tax income is this £1000 a month?

- Is it sufficient for you to hit your financial goals in the timeframe you want?

What percentage of your after-tax income is this £1000 a month?

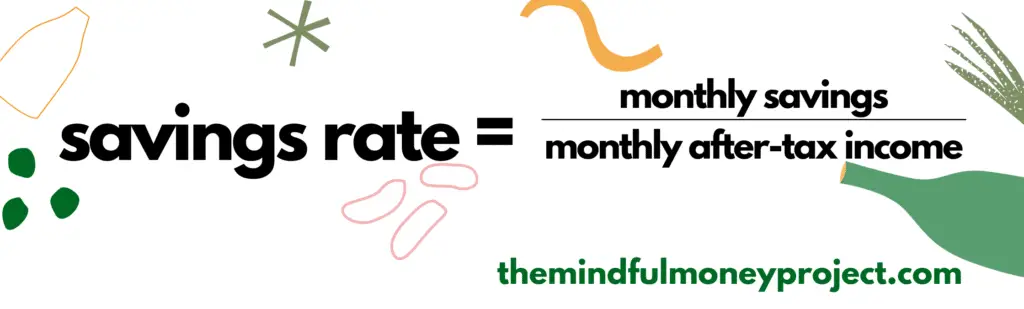

In order to answer question #1 above, you need to calculate your savings rate. Your savings rate is quite simply your savings divided by your after-tax income. It gives you a very handy metric as to how aggressively you are saving your money.

Generally speaking, the higher your savings rate the better (although there are rules of thumbs). This is because it typically means you are living well below your means and you can save and invest for your future.

How to calculate your savings rate

To calculate it, work out how much you save each month on average and divide it by your monthly after-tax income. If you’re employed, this will simply be the amount you receive into your account each month. Alternatively, you can use The Salary Calculator take-home pay calculator to work it out.

See related: how to calculate your savings rate

Is my savings rate good or bad?

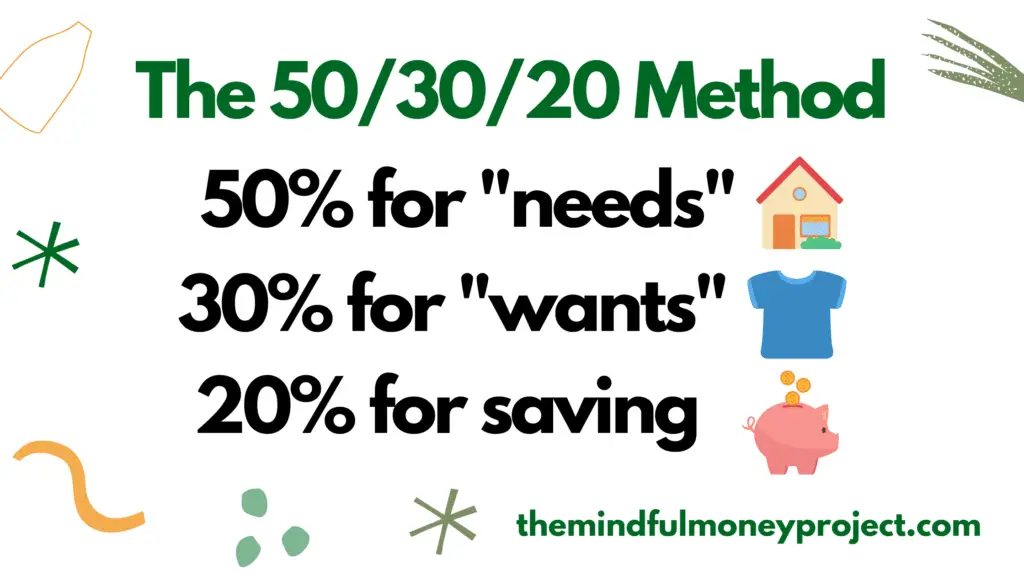

A very common budgeting method is the 50/30/20 method, which says that;

- 50% of your after-tax income is spent on needs such as housing and essential groceries

- 30% of your after-tax income is spent on wants such as clothes, going out, non-essential luxuries from the grocery store etc

- 20% of your after-tax income is saved

This prescription has been so popular because of its simplicity. I like it because it encourages people to build a 20% savings rate at a minimum. It is also a handy benchmark to assess your own savings rate against. I’ve answered the question “what is a good percentage to save from your paycheck?” in a separate article.

What does this mean for me saving £1000 a month?

If your £1000 a month is more than 20% of your after-tax income, you are doing well. You are following or exceeding the very popular 50/30/20 rule, which means you are living within your means and 20% of your income is being saved. However, start to reassess and reduce your “wants” and “needs” expenses to see if you can increase your savings rate further. If you are saving £1000 a month and your savings rate is 20%, this suggests that you are earning close to £90k before tax. At this level of income, you will likely have some luxuries that you can start to squeeze to supercharge your savings.

Recommendation: try adding 1% to your savings rate each month for a year. So month 1 aim for 21%, month 2 22%, all the way up to 32% at the end of the year.

See related: Easy and painless ways to save money every month

If your £1000 a month is 40-50%+ of your after-tax income, then I personally tip my hat to you. You are smashing it. You have clearly optimised your spending and with a high savings rate of >40%, you are maximising your savings potential.

Recommendation: Focus on boosting your income to increase your savings rate further. You can do this by either acquiring new (bankable) skills by taking courses or using side hustle ideas such as matched betting and blogging.

If your £1000 a month is less than 20% of your after-tax income, then it means you are receiving a sizeable after-tax income. Great work on pulling in some big bucks, you’ve done the hard bit. But don’t go too easy on yourself, challenge yourself to increase your savings rate to at least 20%. Big income = big opportunities. Keep spending on the things that bring you value and joy. But brutally cut the rest to jack that savings rate up.

Recommendation: try adding 1% to your savings rate each month for at least a year. So in 12 months time, your savings rate will have increased by 12% points (i.e from 10% to 22%).

Is £1000 a month sufficient to hit your financial goals in the timeframe you want?

Now that we understand the importance of your savings rate as a benchmark, it is time to turn our attention to how it fits into your savings goal(s).

At The Mindful Money Project, I always try to encourage my readers to approach their personal finances with intentionality. So rather than saving for savings sake, save with a purpose.

In short; have a financial goal.

The nature and ambition of your goal will influence the amount of money you need to be saving each month. The best way to illustrate the importance is through an example.

Bill’s £20k goal

Bill the builder is sick of building houses for other people. He’s tired of moving around every year due to dodgy landlords. He wants his own place! Bill has focused in on his short-term financial goal:

- a £20,000 deposit

- and ideally, he will save this deposit in less than 2 years.

How much money does Bill need to save each month in order to hit that goal? £833.

So in this example, if Bill is actually able to save £1,000 a month he is ahead of schedule for his financial goal. He will be able to reach it in 20 months instead of waiting the full 24 months.

Bob’s £40k goal

Bob is Bill’s local competition. Even though he also manages to save £1000 a month, Bob has a goal of saving £40,000 for an investment property that he intends to buy in 2 years’ time.

By saving £1000 a month, Bob is going to save the £40,000 in over 3 years rather than the 2 he was expecting.

Therefore, this savings target is not good enough for Bob’s financial goal.

In summary, if saving £1000 a month allows you to reach your financial goal, it can be considered a good level of saving. However, if it means you are falling short of your financial goal in the timeframe you’re chasing then you will need to do at least one of the following things to get you back on track:

- reassess your goal and potentially change to something more realistic

- OR increase your savings potential by either increasing your income or reducing your expenses

- AND/OR achieve a higher interest rate or rate of return on your savings whilst you wait

For short-term financial goals, the last option will be much less important than the first two because the amount you receive from interest/investment return will be much less than the amount of money you actually save. For long-term financial goals such as retirement, however, this last piece is critical as it allows the magic of compound interest to do its thing.

See related: Why starting to save young is so important

Typical financial goals

You may have a tonne of financial goals in mind already, but if not, then these are the typical goals people pursue:

- pay off your debt such as any balances on a credit card, a personal loan or overdrafts (excluding a mortgage)

- build up your emergency savings so you have a watertight emergency fund with 3 to 6 months worth of expenses

- saving money for a short-term financial goal such as a house deposit

- investing money for a longer-term financial goal such as building up a healthy nest egg of a pension pot for retirement, so you don’t have to rely solely on the state pension.

See related: how to save for a house deposit in 12 months

Summary

Personal finance is personal. It is hard to say whether saving £1000 a month is good or not generally. However, answering the questions below will help you work out the answer for yourself:

- what percentage of your after-tax income is the £1000 a month?

- is the £1000 a month sufficient to hit your financial goals?

These help you to understand whether you are currently saving aggressively compared to your income level. Not only that, but they help you understand if your goal timeframe is realistic.

If £1000 a month means you will not be able to meet your goal, you can do a few things:

- boost your income

- reduce your expenses

- increase the return/interest you get on your current savings

- or re-evaluate your financial goal

Is saving £1000 a month “good” for you? I’d love to hear your thoughts in the comments section below.

FAQs

What is the Average Weekly Food Shop For 2 Adults UK?

With the current cost of living crisis in the United Kingdom, it makes sense to…

How to Save Money Fast in the UK – 13 Easy Wins You Can Implement TODAY

Found yourself in a squeeze and looking to shoot rocket fuel into your personal finances?…

How to budget when you get paid weekly

With nearly 17% of jobs getting paid weekly, you’re certainly not alone in trying to…

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

Tracking your expenses isn’t all about firing up a spreadsheet and restricting your spending. Having…

What Is A Budget?

Everyone talks about a budget, but do we actually know what one is? Budgets are…

How To Save Money On Food Without Cooking (It Can Be Done!)

Food is often one of our biggest expenses. A burrito here and a burger there…

How Much Does It Cost To Own A Car UK

If you’re looking to buy a car in the UK, it’s important to be aware…

Is Saving Money Worth It? The Pros and Cons of Saving Your Hard-Earned Cash

Saving money is one of the most important things you can do for your financial…

Best Budgeting Apps for Families

Staying on top of your own finances is a difficult enough task, yet add a…

Pingback: How to save £1000 in a month using the COST method

Pingback: What Is A Good Percentage To Save From Your Paycheck?