In our list below, you’ll find the best investment apps for beginners UK. They cover a range of trading apps, robo advisors and some which reflect a more traditional investment platform but which also have their own app. All of these choices we believe to be especially suited for beginner investors.

Some of the choices will be different for an experienced investor, who may value choice over simplicity compared to beginner investors. However, we’ll take you through what we think the most important factors are in choosing the right tool for a beginner investor.

Every app listed below has an Android and iOS app.

The content in this article is intended as a useful guide for the best investment apps for beginners. This should not be taken as financial advice. If you require financial advice, you can search for a regulated and qualified financial advisor via the Personal Finance Society.

As with all investing, capital is at risk.

- Quick summary

- What features do we look for in an investment app for beginners?

- What are the key things beginner investors should look out for when picking an investment platform?

- Best Investment Apps for Beginners UK

- Conclusion: best investment apps for beginners UK

- Are there non-app based alternatives?

- FAQs

- What is the easiest investment app for beginners?

- How much money should a beginner invest for the first time?

- What’s the best way to invest small amounts of money at a time in the UK?

- Do investment apps work?

- What is the minimum amount I can invest?

- How much money do I need to start investing?

- What are the best ways to learn about investing as a beginner?

- How do I invest in US stocks from the UK?

- What is the cheapest investment app for beginners?

Quick summary

Best investments apps for beginners looking to buy individual stocks:

- Freetrade*; low fees, US stocks, free share at sign-up, great selection

- Stake*; low fees, US stocks, free share at sign-up, good selection

Best investment apps for beginners looking for a simple way to invest in index funds along with other features:

- Plum*; index funds, automatic saving and budgeting functionality, ESG investment options

- Chip*; index funds, automatic saving functionality, ESG investment options

- Moneybox; easy onboarding, limited selection of high-quality funds, portfolios based on risk profile, ESG options

Best investment apps for beginners looking for a robo advisor/pre-made diversified portfolio:

- Moneyfarm*; portfolio in line with your risk profile, actively managed, investment consultant on hand for questions

- Nutmeg; well-designed, ready-made portfolios for easy diversification.

You can find more details about each platform below.

What features do we look for in an investment app for beginners?

We’ve only included apps that:

- Have a mobile app available on both iOS and Android

- Are suitable for beginners

- Have a good review base from existing customers

- Have guidance and information available to help you to learn whilst you invest

- Transparent fees

What are the key things beginner investors should look out for when picking an investment platform?

- Do they offer access to the shares/funds you want? I.e access to US stocks, or access to mutual funds or index funds you’re after (e.g. the Vanguard LifeStrategy series).

- What are the trading fees and the account fees?

- Is there a minimum investment amount?

- Do they offer both a Stocks & Shares ISA account as well as just a General Investment account? (the former has a limit on the amount you can invest but gains will be tax-free)

- Will they put together a portfolio for you or leave it to you to build your own DIY portfolio?

Best Investment Apps for Beginners UK

We’ve split into a few sections:

DIY investment/trading apps:

Index-fund focussed personal finance apps:

Robo advisor / actively managed wealth management apps:

Freetrade

Good for: buying individual stocks and ETFs commission-free

What is Freetrade?

Freetrade* is a stock trading app that was founded by a financial services professional who, on arrival in the UK, was shocked by the quality of investment platforms and stock trading apps in the UK. He set about building his own UK investment app that was up to standard.

Luckily, there are now plenty of great stock trading apps that make investing easier and more accessible than it used to be.

Freetrade has consistently grabbed headlines and has a strong user base, boasting over 1m users and multiple crowdfunds.

It looks like these aren’t just vanity metrics either, with an average rating of 4.3/5 on Trustpilot (with >2k reviews), 4.4 on the App Store (>11k reviews) and 4.6 on the Play Store (>10k reviews).

Freetrade allows you to easily trade a vast array of stocks and shares, ETFs and investment trusts, including buying fractional shares (i.e being able to buy £50 worth of a Tesla share without having to buy a full share). No commission on most trades. Ideal for beginner investors looking to gain exposure to the stock market as part of their investment portfolio.

What can I invest in on Freetrade?

You can invest in over 5,000 UK and US stocks and shares via the Freetrade app (such as Tesla, ASOS, Amazon, Alphabet and PayPal) as well as ETFs such as VUSA (Vanguard S&P 500 UCITS ETF allowing you to invest in a tracker of the top 500 companies in the US).

What is the minimum deposit needed to invest on Freetrade?

You can start from only £2.

What accounts are available on Freetrade?

You can open:

- General Investment account

- Stocks & Shares ISA

- Self Invested Personal Pension

Fees

Trades are completely free. However, if you want to open a Stocks & Shares ISA there will be a £3/month platform fee. This rises to £9.99/month on SIPP accounts.

Free share worth between £3-£200. Limited to the first 10 who click the link above each month and fund their account.

Stake

Good for: investing in individual US stocks and in ETFs, with commission-free trading and access to company financials and analyst ratings

What is Stake?

Stake* is one of the newer kids on the investing app block. Founded in Australia but expanding globally (launching in the UK in early 2020), Stake was the first in the UK to provide easy access (and commission-free access) to US stocks.

The naming is slightly unfortunate though, as there is another company called Stake which is related to bitcoin and sports betting and is completely different (the app for Stake we are talking about here is on the domain hellostake.com).

Stake is not as well-reviewed as competitor Freetrade, but still scores a respectable 3.8 out of 5 on the App Store (>3k reviews) and 4.3 out of 5 on the Play Store (>3k reviews). Trustpilot reviews are very obviously mixed up with the other Stake (discussed above) and so I haven’t included their totals here as they are unfairly brought down by people confusing them with the other company.

As well as offering access to US stocks and ETFs, Stake also provides more advanced trading tools like limit and stop loss orders. If you pay for their Stake Black membership ($9/month), you will also gain access to full company financials and analyst ratings.

What can I invest in on Stake?

You can invest directly in over 4,500 US-listed stocks and ETFs. These are all listed on US exchanges such as NASDAQ and NYSE etc, but Stake are always adding more options so the list continues to grow.

What is the minimum deposit needed to invest on Stake?

To set up an account and get started, you need to deposit £50 minimum.

If you click through the following link and fund your account within 24 hours of setting up your account, you will win up to $150 worth of stock including potentially shares in GoPro, Nike or Dropbox.

What accounts are available on Stake?

Only a General Investment account is available on Stake.

Fees

Stake charges no brokerage fee or FX fees on each transaction (as it holds your balance in USD), but you will incur FX fees on topping up and withdrawing from your account.

Where this is different to Freetrade is that on Freetrade you will incur FX fees on each US transaction (due to holding your funds in GBP).

Get a free stock worth up to $150 in value if you fund your account within 24 hours of setting up your account (via the link above). These include shares such as Nike, GoPro and Dropbox.

Plum

Good for: automated saving, automated investing and simplicity, ideal for beginners

What is Plum?

Plum* is a personal finance app that started life as a Facebook Messenger app. It has evolved massively since then, into one of the best personal finance apps available at the moment.

One of the reasons it is so great for beginners is it provides a way to invest in a set of funds provided by reputable providers such as Vanguard and Legal & General.

Within the app, there are also useful tips, guides and tutorials relating to different areas of investing to help you understand what you are doing.

The reason I like Plum’s set-up so much is that stripping away some of the choices for a beginner removes the overwhelm that can sometimes plague beginners and makes investing much more accessible.

It looks like I’m not the only one, with Plum racking up lots of great reviews. They score 4.4/5 on Trustpilot, 4.7 on the App Store (>38k reviews) and 4.6 on the Play Store (>17k reviews).

What can I invest in on Plum?

Plum has a range of themed funds that are simply different names for funds already being offered by other providers like Vanguard or Legal & General.

For example, you can invest in “Tech Giants” which will give you exposure to shares such as Amazon, Apple and Alphabet. Alternatively, there are the Vanguard Lifestrategy series in their “Growth Stack”, “Balanced Bundle” and “Slow & Steady” options.

Plum has deliberately restricted the options available via its app to avoid new investors from being overwhelmed with thousands of options. This means they have restricted to funds from reputable providers that offer built-in diversification. An approach I really like.

What is the minimum deposit needed to invest on Plum?

You can invest from £1.

What accounts are available on Plum?

General Investment account, Stocks & Shares ISA and they have a SIPP in beta mode currently.

Fees

In order to invest with Plum, you’ll need to have their Plum Plus subscription which is £1/month (with your first month free).

Not only does this give you access to investing, but it also unlocks further features to help you with your money plus earn interest on your interest-bearing pocket (currently 0.40% AER).

There is an average fund management and product provider fee of 0.48% although this is the average across all funds offered. Note the product provider fee is 0.15%.

See my comparison vs investing directly with Vanguard here.

Chip

Good for: automatic savings and simple investment choices

What is Chip?

Chip* is principally an automatic saving app. Offering occasionally market-leading interest rates on its saving products and helping its users to put money away automatically has helped it grow its user base and successfully complete multiple crowdfunding rounds.

With 4.5/5 on the App Store (>11k reviews) and 3.6/5 on the Play Store (>3k reviews), plenty of people are enjoying what they offer.

Chip’s core features are automatic savings and savings accounts. However, Chip has expanded its features to allow its users to invest in a range of funds (such as those by BlackRock).

Like Plum, it has deliberately restricted the choice to not overwhelm beginner investors. These choices are restricted to reputable, low-cost funds which offer you built-in diversification.

What can I invest in on Chip?

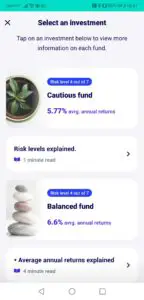

On the ChipAI plan (which is £1.50 every 28 days) you have access to the three core BlackRock powered funds;

- Cautious (based on the BlackRock Consensus 35 Fund)

- Balanced (based on the BlackRock Consensus 60 Fund)

- Adventurous (based on the BlackRock Consensus 85 Fund)

However, on Chip’s ChipX plan (£3 every 28 days), you are able to invest in a wider range of investment options such as an ethical fund or a green energy fund.

What is the minimum deposit needed to invest on Chip?

Start with a minimum of £1.

What accounts are available on Chip?

You can open either a General Investment account or a Stocks & Shares ISA.

Fees

To access investments via Chip you’ll need to subscribe to either their ChipAI (£1.50 every 28 days) or ChipX (£3 every 28 days) accounts.

You will incur a platform fee of 0.75% on ChipAI and 0.25% on ChipX, incurred annually but collected monthly.

You will then incur fund management fees on top (charged by the underlying fund and so is not a Chip platform fee).

See related: Plum vs Chip

Moneybox

Good for: the comfort of a set of simple index funds, with flexibility to edit allocations

What is Moneybox?

Moneybox is an award-winning personal finance app offering you automatic saving capability, savings products and access to investment funds.

You can choose from 3 starting fund options. You can edit the allocation to suit you (including socially responsible investment funds).

They’ve been well received by users with 4.7/5 rating on the Play Store (>9k reviews) and 4.7 on the App Store (>27k reviews).

What can I invest in on Moneybox?

You can invest in a range of index funds from reputable providers such as Vanguard, Legal & General, Fidelity and iShares.

What is the minimum deposit needed to invest on Moneybox?

Start investing from £1 minimum deposit.

What accounts are available on Moneybox?

You can open a General Investing account, Stocks & Shares ISA or Junior ISA.

Fees

To invest with Moneybox, there is a monthly subscription fee of £1 (first 3 months free) along with a platform fee of 0.45%.

On top of this will be fund provider costs which are charged directly by the fund providers and varies based on the funds chosen (but range from 0.12%-0.58%).

See related: Plum vs Moneybox and Chip vs Moneybox.

Moneyfarm

Good for: having an expertly-built diversified portfolio recommended for you based on your risk appetite

What is Moneyfarm?

Moneyfarm* is one of the new breed of wealth management firms leveraging technology to provide services at prices that were not previously achievable.

They provide a level of active management (i.e investing, monitoring and rebalancing your portfolio to align with your risk profile), all for a much lower fee than you would face if you went with a traditional wealth manager.

When you create an account, you’ll be asked a series of questions. This allows them to determine your knowledge, experience, risk appetite and objectives. Based on this they then create a portfolio.

This level of hand-holding is ideal for beginner investors.

You also get your own dedicated investment consultant. So if you have any concerns, questions or queries you have someone who you can easily turn to. This is not something that is available on some of the cheaper platforms. But bear in mind Moneyfarm does have a higher minimum deposit requirement (and higher fees) than some alternatives as a result.

Moneyfarm has been well reviewed, with an average 4.7/5 on Trustpilot, 4.7 on Play Store (>4k reviews) and 4.7 on the App Store (>1k reviews).

What can I invest in on Moneyfarm?

You can select the level of risk and volatility you’re comfortable with, which in turn selects one of Moneyfarm’s pre-built portfolios. But you can’t select or customise the underlying investments within each portfolio.

What is the minimum deposit needed to invest on Moneyfarm?

The minimum deposit on Moneyfarm is £500.

What accounts are available on Moneyfarm?

General Investment Account, Stocks & Shares ISA and SIPP.

Fees

Moneyfarm has a platform fee of 0.68% (which includes the fee for actively managing your portfolio), along with additional costs of 0.29% for the underlying fund fee and market spread.

Nutmeg

Good for: expertly managed portfolios with a range of accounts and a low cost fixed allocation version

What is Nutmeg?

Nutmeg was founded by a stock broker who was frustrated with the exclusivity and lack of transparency in the investment world, and so set about trying to change it.

As a pioneer in the space, Nutmeg was the UK’s first online discretionary investment management company.

Nutmeg has received 4.4/5 on Nutmeg (>1k reviews), 4.8 on the App Store (>12k reviews) and 4.7 on the Play Store (>1k reviews).

What can I invest in on Nutmeg?

If you fancy yourself as a trader, looking to do some mobile trading, then Nutmeg is not for you. You can’t invest in individual stocks or funds through Nutmeg. Instead, Nutmeg serves long-term investors looking for diversified portfolios, of which you can choose from a number of different “investment styles”, such as:

Fully Managed: this is a globally diversified portfolio tailored to your investment goals, actively managed and rebalanced by Nutmeg’s investment team.

Socially Responsible: actively managed globally diversified portfolio that help you achieve your financial goals whilst aligning with your values (focussing on the environment, good governance and social values).

Fixed Allocation: passively managed to remain at an allocation between different asset classes like stocks and bonds (selected based on your risk appetite). Due to the lower level of intervention, these have the lowest cost of Nutmeg’s offering.

What is the minimum deposit needed to invest on Nutmeg?

The minimum deposit required will vary based on the account you have:

- ISA, General Investment Account and SIPP: £500

- Lifetime ISAs minimum is £100

- Junior ISA minimum is £100

What accounts are available on Nutmeg?

On Nutmeg, you have a range of accounts to choose from, such as Stocks & Shares ISA, General Investment Account, SIPP, Lifetime ISA and Junior ISA.

Fees

The fees vary based on the style chosen (i.e Fully Managed, Socially Responsible, Fixed Allocation).

Fully Managed: 0.75% annual fee (on up to £100k, 0.35% beyond), with average fund costs and market spread of 0.28%.

Socially Responsible: 0.75% annual fee (on up to £100k, 0.35% beyond), with average fund costs and market spread of 0.34%.

Fixed Allocation: 0.45% annual fee (up to £100k, 0.25% beyond), with average fund costs and market spread of 0.26%.

Conclusion: best investment apps for beginners UK

There is no one “best investment app for beginners” as it very much depends on what you want to achieve via it. However, we’ve whittled it down to a couple of options for each “type”.

If you’re looking to purchase individual stocks and ETFs to build your own DIY portfolio, then look at:

- Freetrade*; low fees, US stocks, free share at sign-up, great selection

- Stake*; low fees, US stocks, free share at sign-up, good selection

If you’re looking for the most simple way to get into investing, as well as some help with other features such as automatic saving and budgeting, then look at:

- Plum*; index funds, budgeting functionality; ESG options

- Chip*; index funds, budgeting functionality; ESG options

- Moneybox; easy onboarding, a limited selection of high-quality funds, portfolios based on risk profile; ESG options

If you aren’t interested in building your own portfolio and want access to a diversified, expert-made portfolio for you via a robo advisor type platform, then look at:

- Moneyfarm*; portfolio in line with your risk profile, actively managed, investment consultant on hand for questions

- Nutmeg; well-designed, ready-made portfolios for easy diversification

Are there non-app based alternatives?

Yes, if you are not fussed about having an app, or are looking for an investment platform or trading platform which isn’t catered for beginners and therefore has a much wider array of investment options, then some of the platforms below may be of interest to you:

- Vanguard; lowest cost offering on the market, limited selection

- Hargreaves Lansdown; massive selection of stocks and funds

- Interactive Investor; large selection

- InvestEngine*; low-cost, ETF driven

- DEGIRO; cheap share dealing with large selection

Have you used any of the investment apps I’ve listed in this article? I’d love to hear your opinion on the best investment apps for beginners UK. Let me know in the comments section below!

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent. The views expressed are based on our own experience and analysis of the service.