Generally in life, more tends to be better. But is that true for savings? Whilst having more money in the bank doesn’t really sound like a bad thing, it pays to have a good target for your savings. And a plan for when you get there. In this article, we’re not going to be discussing the statistics for average savings across the UK. Sometimes these can be misleading and downright demotivating. Instead, we’ll discuss how you can look at your own finances and decide whether you are on track with your savings.

What is a good amount of savings UK

In this we’re referring to purely your cash savings. So any savings sat in a current account, or savings account. Not counting money stashed away in investments such as stocks & shares ISAs, pensions and general investment accounts.

Where are you currently on your personal finance journey?

In order to provide a useful answer to your question “what is a good amount of savings?”, you’ll first need to understand where you sit on your own personal finance journey.

Even though everyone is unique and individual, each and every one of our finance journeys tends to be broadly similar. There are some key basics we need to get right before we move on to the next stage.

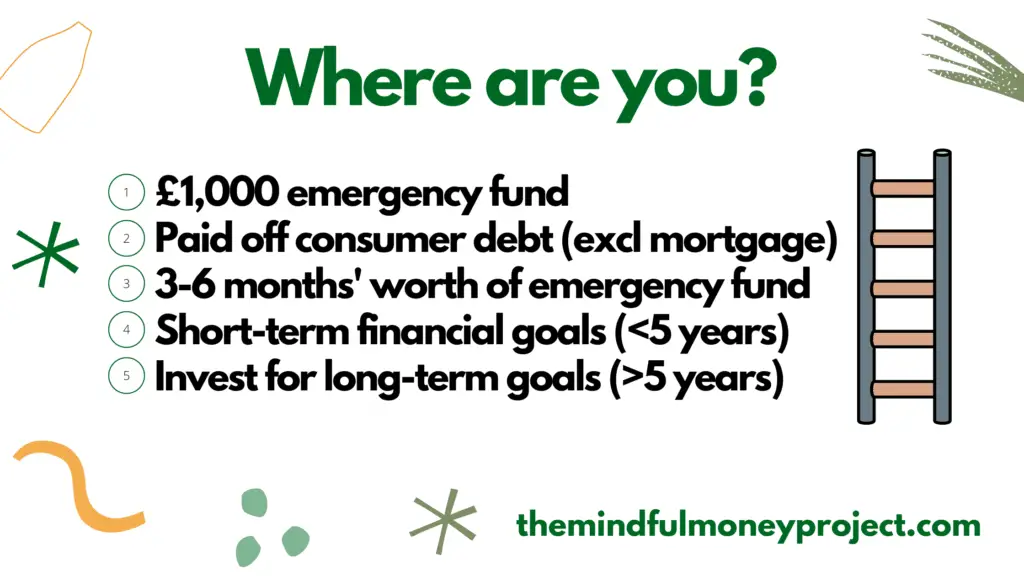

Typically, it will run like this:

- Saved up a £1,000 emergency fund

- Paid off all consumer debt (non-mortgage)

- Saved up a larger emergency fund (many people say 3-6 months’ worth of expenses here)

- Save up for short-term financial goals (house deposits, weddings etc)

- Invest for the future (not sat in savings accounts, but invested for higher returns over a longer time period of 5+ years)

So take a look at the above and have a think as to where you currently sit.

I tried to jump to #5 before having #1 and #2 sorted. Guess what happened? When the market tanked in March 2020 due to the pandemic, I ended up selling at the bottom of the market and lost 30%. Doh. Now I’ve learned my lesson, I always ensure I am not jumping ahead of the “ladder” above.

Now, if the market drops, I don’t mind. I have money in an emergency fund and no consumer debt. Worst case I dip into my emergency fund, but that buys me time to ride out the market drop without turning any paper losses on my investments into actual losses.

Each of these steps should be considered an individual milestone. You can aim for, and track, your progress against these as you go to serve as motivation.

What is a good amount of savings for me?

As this will be different for everyone, what is considered to be a good amount of savings will vary from person to person.

However, there are some baselines that are great yardsticks to measure yourself against.

The bare minimum to aim for should be…

3 months emergency fund.

A 3 months emergency fund should be the bare minimum you should aim for over time. This is a healthy level of cash savings that will help you to weather some financial storms.

This is calculated as 3 months of the necessary expenses you need to live (think housing, food, travel to work etc).

It helps to provide a healthy buffer against anything coming your way. Imagine you lose your job, well now you have 3 months (instead of 1) to find a new one. Imagine your roof suddenly blew off in a freak storm, no worries you have a bit of a buffer to put it straight without incurring debt.

The actual size of your emergency fund should vary based on factors such as:

- Risk tolerance – if you’re more risk-averse then you’ll benefit from a larger emergency fund

- Income variability – consistent income each month with no seasonal variation? you can probably get away with a smaller emergency fund than most

- Employed vs self-employed – self-employed person would likely feel more confident with a larger emergency fund, however, even if you’re employed you may not be completely safe, so don’t be too overconfident that your firm won’t have a round of restructuring or redundancies!

- Responsibilities – if you own a home, for example, there is a higher likelihood of something going wrong that you get left with the costs for, so a larger emergency fund may be beneficial here

- Future plans – if you’re planning to quit your job to go part-time or to go travelling, you may want to preemptively increase your emergency fund if income in that period is going to be tight

- Age – similarly to the point above, you may be more inclined to have a higher emergency fund as you age because typically you’ll have more responsibilities and potential future plans to retire or have dependents such as children who you’ll need to support if they get hit with an emergency too

Generally, 3 months tends to be the minimum you would want. Whereas the ideal would be higher based on the factors above. I’m aiming for between a 6-12 month emergency fund, but 12 months may be excessive for my situation (but I’m fairly risk-averse).

How do I calculate my emergency fund target?

If you don’t use a budgeting app, then try downloading your bank statements for the last few months. Jot up next to each transaction whether it was “necessary” or a “luxury”.

Things I’d consider “necessary”:

- housing

- utilities

- council tax

- essential food shopping

- travel to work

Things I’d consider a luxury are things like travelling for leisure, going to the pub, Netflix etc.

Once you have this, total up the “necessary” expenses and then divide by the number of months in the bank statements you have downloaded. This will give you your average necessary expenses. Times this number by 3 and that will be your emergency fund target.

However, it depends on where you are in your journey

As I mentioned earlier, it really is a journey.

If you are starting out, then building up a £1,000 emergency fund is great progress.

If you’ve got lots of investments but very little cash savings, then you may want to re-address the balance to ensure you’re not exposed if anything goes wrong etc.

Where should I store my emergency fund?

Another classic question relates to where you should stash away your emergency fund.

Premium bonds, stocks & shares ISAs, Lifetime ISAs (LISA), and retirement saving accounts (SIPP etc) are all mentioned in this debate. But they all make pretty lousy emergency fund candidates.

A good emergency fund should be easily available when you need it.

This means that, generally, cash savings accounts, regular savings accounts (if no withdrawal limits), easy access savings accounts or even a standard bank account tend to be the best options.

They should be:

- easily available

- not incur penalties to withdraw

- not have a maximum limit of withdrawals per year

As otherwise, there is no point in having an emergency fund to pay for something that is, ahem.. an emergency, but having to wait two weeks for the money to be released to your account.

Is there a maximum amount of savings I should have?

This, once again, will be different for everyone, but some general observations can apply.

Once you’ve nailed your emergency fund, and this flexes for everybody based on the different factors I discussed earlier, then after that it depends on if you are saving for a short-term savings goal such as a wedding or a house deposit.

If you are, and you’re expecting to hit it in less than 5 years, then saving for this in cash savings may make the most sense.

Why?

If you started investing your money in the hope of using it in 5 years, you’d be gutted if the market was down when you come around to using it in 5 years’ time. The market is variable and unpredictable. Even though you can make some gains by investing, the risk of having to take out the money in a downmarket for short-term financial goals normally outweighs this.

Whereas investing is great for long-term goals (5+ years). Because generally, over the longer term, the market goes up. It also means you have more time to ride out a bad market.

Some other considerations to holding too much cash

FSCS protection

After the 2007 financial crash and the collapse of Northern Rock, the government put in place a deposit protection scheme to help avoid a similar run on another bank.

This scheme, called Financial Services Compensation Scheme (FSCS for short), will help protect your money in the event of a bank going bankrupt.

Great, right?

Pretty much.

However, there is a limit.

The FSCS will protect up to £85,000 of your money in each individual bank. This means if you have more than this amount, you’ll be best served splitting it between different banks.

Some banks are actually part of the other, so be careful when deciding on a new bank. You can easily check on the FSCS website here.

Opportunity cost of saving

With interest rates rarely beating inflation, your money may actually be losing value over time.

If inflation runs higher than the interest rate you’re getting on your money, then your money is able to buy you less over time. This is essentially saying that the money is losing value.

Now where these cash savings is being held as an emergency fund, this helps to avoid an even bigger loss. For example, if you were in a down market and you needed some emergency surgery that you needed to pay for, you would have to sell some of your investments, and crystallise the loss, in order to fund it.

However, past a certain point, the extra cash sitting in your bank is not necessarily providing you extra security. Instead, it is just not working hard enough for you to keep up with inflation, and therefore losing value.

Once you’ve saved up an emergency fund you are satisfied with and saved up enough for your short-term financial goals, the money left over can be invested to beat inflation. And therefore growing your wealth.

Over the long term, the magic of compound interest can really accelerate your wealth beyond what you thought possible.

Try plugging in different inputs into the compound interest calculator here. But if you invest £500 per month for 30 years, you’ll end up with nearly three-quarters of a million pounds! You’d have “only” paid in £180k worth of that over the 30 years, meaning that your money has, by itself, generated nearly £600k over that period.

Compound interest needs time to work its magic though, so the key is to get started as soon as you can.

Next steps: how to get into investing

If you’ve built up an impressive emergency fund and are ready to “graduate” onto investing, then we’ve prepared a list of the best investment apps for beginners here.

These apps are purposely designed for beginners and so make the world a lot simpler and easier if you’re just starting out.

Bear in mind though that they tend not to be the cheapest. Check out a super low-cost index fund provider like Vanguard if you know a bit about investing already, as their fees can’t be beaten (yet).

Conclusion: what is a good amount of savings (UK)?

Even though personal finance is indeed personal, there are some basics that apply to almost all of us.

Aiming for a minimum of an emergency fund containing 3 months’ worth of expenses is when most of us can say “brilliant, I think I have enough savings now”. This needs to be in an easy access account so you can use it if an emergency does strike.

Just because you’ve hit a 3 month level of emergency savings doesn’t mean you stop saving though. No no no! It just means what you do with those savings changes. Instead of saving towards an emergency fund, you may continue to save towards a short-term savings goal (such as a wedding or a house deposit). If your only goals are more than 5 years away, then you should think about investing.

Either using a stocks & shares ISA, lifetime ISA, or increasing your contributions to your pension pot are all good investment wrappers to start to accelerate your net worth.

Even though we aim to help guide you through this kind of question, this article is not specific financial advice. Please carry out your own research or find a financial advisor before making any changes to your finances.

How to Save Money Using Envelopes

As we come up to the new year, lots of us will be setting new…

How to cancel The Gym membership

Sick of the gym or found a better option? Nice. Most gyms are an absolute…

How The Timeframe of Your Personal Finance Goal Makes A Big Difference

So you’ve cranked out your budget, made some easy savings and upped your Personal Profit….

How Long Do You Need To Be Employed To Get A Mortgage UK?

It seems you have to jump through a million hoops to get a mortgage nowadays….

How To Cancel NFL Game Pass UK

Looking to trim back your subscriptions? Good on ya! In this article, we’ve pulled out…

Plum vs Cleo – Will These Clever Apps Save You Money?

The personal finance app world is always evolving. Originally it was simple spend tracking apps….