The personal finance app world is always evolving. Originally it was simple spend tracking apps. Then came Open Banking. Now, we’re looking at some of the best AI-enabled personal finance apps available at the moment. Both of these are defining the automatic savings app world. We put two head to head; Plum vs Cleo.

Quick summary – Plum vs Cleo

Plum* is best for personal finance beginners who want to build good foundations by optimising bills, saving money and starting their investing journey.

Cleo is great for beginners wanting a novel way to understand their spend in more detail and help to budget, using a digital assistant. However, some of the user experience (incl. withdrawing from your Cleo wallet) is not as good (or reliable) as Plum.

Keep reading to hear my verdict.

This post may contain affiliate links (any links we earn commission on if you go on to make a purchase are marked with an * asterisk). These do not influence our editorial content and we remain independent.

Plum Summary

Recommended for: personal finance beginners wanting to save money, spend less and want a jargon-free and unintimidating route into investing.

Platforms available: iOS and Android

The good:

- Suggests alternatives if can save money on utilities and regular subscriptions

- Automatically puts money away for you

- Clever rules for saving (such as automatically saving a percentage on payday)

- An easy route into investing in the stock market

- Diagnostic Reports feature provides useful comparisons against a “lookalike” audience of similar users (currently iOS only).

- Money Maximiser feature aims to stop you from running out of money before payday, by setting suggested spend limits (based on income, committed spending and savings).

The bad:

- Budgeting a paid-for feature (Money Maximiser)

- Investment platform fees not the best in the market

- Some of the user experiences on the app are not as polished as I would like

Summary

Never want to use a spreadsheet for your finances? No drama. Plum should be all you need to start your personal finance journey. Plug Plum into your bank account via the Open Banking API and you’re ready to go. Plum will put money away for you (the AI is so good you may not even notice the pinch). What’s more, Plum provides an unintimidating way to begin investing in the stock market – perfect for beginners.

Cleo Summary

Recommended for: people wanting a digital assistant to help them track their spending and help saving money.

Platforms available: iOS, Android and Facebook Messenger

The good

- Chat interface is a surprisingly intuitive way of interacting with the app

- Tailored budget provided by Cleo based on historic spending

- Ability to add custom categories

- You may like the personality of Cleo (she’ll occasionally throw some sass your way)

- Auto-saving feature using Cleo’s AI algorithm

The bad

- Some features behind the chat interface so a little obscure to access quickly

- Some of the user experience is not as polished as I would like

- Slow withdrawals

Summary

I must admit I was sceptical of a personal finance app packaged as a “chat bot”. Cleo, however, provided a pleasant surprise.

Having a chat interface was surprisingly intuitive. It really feels like you have a little digital finance assistant on your side and can even answer questions such as “can I afford this pizza?”.

Best suited to beginners looking for a novel way to track spending and want help saving money.

Plum Deepdive

Plum is one of the new breed of personal finance apps. The team bill Plum as “the AI assistant that grows your money”.

By connecting your current account, Plum can “give your bank a brain” (you can also connect your credit card account).

Plum uses its proprietary AI algorithm to figure out how much you can save at any time. It stashes this away in a savings pot for you, helping you work towards your financial goals with ease.

Many users on review sites such as Trustpilot were surprised at how effective it was.

The whole premise is around helping you to save money, cut your household bills and can even help you to invest in the stock market (without all of the jargon and overwhelming choice).

Features

- Uses the Open Banking API to connect to your bank accounts and credit card accounts

- The app will automatically put money aside for you (you can adjust how “aggressive” the savings are in the app’s “Brain”)

- Easy and jargon-free access to a range of simple and reputable stock market funds from large, reputable providers like Vanguard and Legal & General

- Earn up to 0.4% AER on your savings with an easy access pocket

- If you shop through Plum, you can earn cashback with certain partners

- Track progress towards savings goals (Pro subscription only)

- The Diagnostics Reports feature compares your spending against a set of matched lookalike users, providing you a great benchmark

- Money Maximiser sets you a suggested weekly spend to get to payday with money (calculated using your income, committed spending and saving).

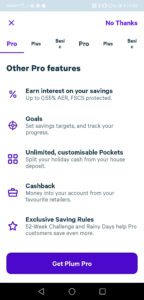

Pricing

There are four different tiers available within Plum. These are:

- Basic (free)

- Plus (£1/month)

- Pro (£2.99/month)

- Ultra (£4.99/month)

Automated investing is only available on Plus, Pro and Ultra plans. With all Plum subscription tiers, you get a 1-month free trial.

The Ultra plan is the most feature-rich, offering you:

- savings goals (and goal tracking)

- Money Maximiser (Plum’s budgeting tool)

- unlimited pockets

- exclusive savings rules

- diagnostic reports (comparing your spending against other “lookalikes”) – this is currently only available on iOS

As there is a free tier, you can always try out Plum for a period and see how you get on with it.

Highlights

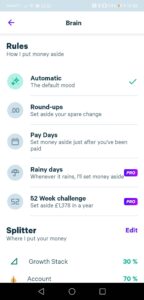

Automatic Savings

Plum will analyse your spending and balance to put money away for you.

You can adjust how “aggressive” this saving can be in the app’s “Brain”.

Lost Money feature

I’m always banging on about keeping your regular payments optimised. And it seems the folk at Plum agree.

Their Lost Money feature will flag alternatives if it thinks you can save money on any of your utilities or regular payments.

Easy access to investment funds

You can invest via the app into the stock market in either a Stocks & Shares ISA wrapper (basically meaning you can contribute up to £20k per year and all gains/income within it are tax-free) or within a General Investment Account (no such contribution limits but any gains/income are taxable).

Plum have designed this perfectly for their target market in my opinion. Sometimes having too much choice can be overwhelming. Especially to beginners.

Just remember that your money is at risk if you invest because the value of your investments can go down as well as up.

There are a set of “Basic” and “Advanced” funds available on the app for you to start investing in.

The “Basic” range is based on your risk profile (even though the app doesn’t provide any recommendations or questions to assess what your risk profile is).

These are from “Slow & Steady” (featuring more bonds, which are less volatile) to the “Growth Stack” fund (which features more stocks and less bonds and so is more volatile). Bonds tend to be less volatile than stocks because their rate of return is more fixed. For example, a company may issue a bond that pays 5% each year for 20 years. As an investor, you know what return you’ll receive over that period. Stocks are much more volatile, but with the extra volatility becomes a potential for higher returns.

The Plum “Basic” funds utilise the Vanguard Lifestrategy series.

…including advanced funds

They also have a set of “Advanced” funds that invest in either a certain theme or region.

For example, they offer the “Clean & Green” fund which invests in socially responsible companies. As well as the “Tech Giants” fund which invests in top tech companies such as Google and Facebook.

Even though Plum has nowhere near the same choice of funds as platforms such as Hargreaves Lansdown*, and doesn’t allow you to invest in individual stocks like platforms such as Freetrade, that is kind of the point. They have picked some solid funds from reputable providers (such as Vanguard and Legal & General), which will provide beginners with ample options, but without triggering overwhelm.

Investing Fees

In terms of fees for investing, it is made up of:

- standard plum subscription cost (see above)

- 0.48% average annual fund management and provider fee (which includes a management fee of 0.15% and a 0.06%-0.9% fund provider fee dependent on the fund choice you make)

Please note: as with all investments, your capital is at risk.

Lowlights

Limited spend tracking functionality

Even though Plum will tag up your transactions to categories, and it is used in features such as Money Maximiser (which suggests a weekly spending limit). There is no such flexible budget tracking or spend tracking functionality. If this is what you are looking for, you’re better off with specialist budgeting apps such as Emma or Money Dashboard.

For example, it is not easy to change a category to which a transaction has been allocated to. Nor are you able to create new custom categories of spend.

Investment fees not the cheapest on the market

Plum is great for starting your personal finance journey and giving you an unintimidating route into stock market investing via reputable funds.

However, their platform fees are not the cheapest available on the market. If you’re looking for rock-bottom platform fees, be sure to shop around all the different platforms (i.e investing directly through Vanguard’s platform should secure lower fees).

Some of the user experiences not as polished as I would like

On the whole, I’ve been very impressed with the design of Plum. It is visually beautiful, and the interface has been thoughtfully designed.

I did have a few instances, however, that weren’t as smooth or polished as I would expect.

For example, when setting up my first investment fund I selected the one I was interested in, followed through the steps and then once I thought it was confirmed it just kept me hanging on a loading screen in my browser (rather than the app). After ~5 minutes of waiting I just loaded up the app to see the fund choice had already been selected and remembered. This is obviously a minor example, but I had a similar experience when first setting up the account which caused me to essentially sign up twice (due to a hanging loading screen).

I still think the app is worth working through regardless of these issues because the benefits are so large. Bear in mind this is also a growing fintech company, so they will be releasing regular updates to fix bugs like this.

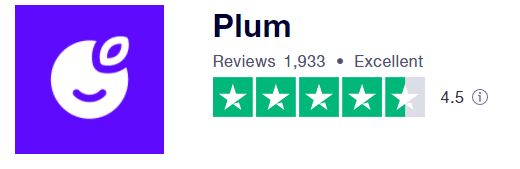

What are other people saying?

Plum is very well reviewed, with an average of 4.5 out of 5 stars on Trustpilot, based on nearly 2k reviews at the time of writing.

Lots of users expressed surprise at Plum’s ability to save up a pot of cash for them without them noticing.

Cleo Deepdive

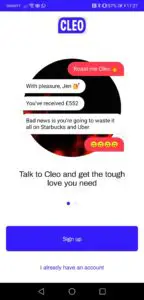

Cleo is an AI-powered “chatbot” which aims to become your digital finance assistant.

There aren’t many chatbot driven finance apps out there, so Cleo certainly has an edge when it comes to novelty.

I thought this was going to be gimmicky and shocking to use, but I was pleasantly surprised when using Cleo. The chat interface is actually better in some instances as it allows you to be more flexible in the questions you ask.

As with other budgeting apps, you connect your bank accounts to Cleo via the Open Banking API.

Cleo then sets to work providing you a customised budget, as well as helping bring out helpful insights for you to understand your spending habits. Further, Cleo can answer questions such as “can I afford this pizza?” and “how much budget do I have left?”.

Not only helping with insights, Cleo also uses their custom AI algorithm to analyse your spending and put money aside for you effortlessly into your Cleo wallet (essentially a savings account within the app).

There is also Cleo Plus which is £5.99 a month and gets you access to:

- Credit coaching (helping you to improve your credit score)

- Cashback (saving money on some 3rd party retailers you may shop with)

- Salary advance of up to £100

Features

- Connects your accounts via Open Banking

- Cleo automatically tags up your transactions to the relevant spend category

- Can set custom spend categories

- Can set custom budgets by category

- Cleo calculates a tailor-made budget for you based on your historic spending

- Interact with Cleo via the chat interface

- Easily track your spending against budget by asking Cleo

- Autosave feature where Cleo puts money aside for you based on its AI algorithm

Highlights

Great onboarding experience

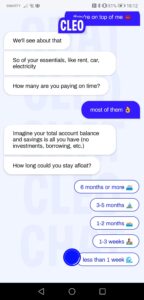

Cleo will ask you some questions to figure out where you are on your personal finance journey.

The app then takes you on a quick tour of how to use the chat interface and what the features are.

Given how new (or at least unfamiliar) a chat interface is for a personal finance app, this was super useful.

Can create custom categories

Sometimes you want to track spend, or set a budget, for a category which is not included by default.

With Cleo, you can set new categories.

Smart tracking

A chat interface surprisingly provides some great ways to get insight into your spending habits.

For example, I can easily ask Cleo “how much do I have left on my budget?”. She easily fires back the amount I have left to spend as well as the daily breakdown.

In my example, she’s telling me that if I spend 34 a day for the next 5 days I’ll be in on target. This is actually a super useful insight when you’re trying to hit your budget and saves you from having to calculate this yourself.

Further, Cleo will give you a budget suggestion based on your historic spending and some questions she asks. Great for personal finance beginners.

Lowlights

Some features hidden behind chat interface

So even though this was also called out as a highlight. Sometimes it can be frustrating.

If you’re just looking to quickly check how you are doing versus your budget, you need to type in a question to Cleo or press a few buttons to get the answer.

In other apps, it tends to be a much quicker solution for quick questions.

Some of the user experience not as polished as I would expect

For an app filled with such great AI, there are still some parts of the experience that I would consider more basic issues that need to be ironed out.

For example, I originally tried signing up with a hotmail email. But this just “hung” with no verification email ever received. Once I attempted a gmail email it worked fine.

Similarly, the autosave feature is a bit clunky to set up. With both card authorisations and direct debit setups, it isn’t as smooth an experience as I would expect.

Slow withdrawals

There have been a few users expressing disappointment with Cleo on Trustpilot this year. Most of this is due to slow withdrawals and issues with errors whilst withdrawing. Worth bearing in mind if using Cleo to build up your savings, you might want to start slow and trial out the full service before jumping in and saving everything with them.

What are other people saying?

Cleo has received great reviews on Trustpilot, with over 1.7k reviews at the time of writing with an average of 4.2 out of 5.

It is worth noting that there have been a few negative reviews this year with users complaining about the auto-save feature with slow service in withdrawing funds along with other bugs meaning the funds are harder than they should be to withdraw.

Alternatives to Plum and Cleo

If you are looking for a more traditional spend tracker and budgeting app, try:

- Emma (get the Emma app for free here)

- Money Dashboard

- Snoop* (see Snoop vs Emma, Snoop vs Money Dashboard and Snoop vs Yolt here).

See related: Yolt vs Money Dashboard vs Emma

However, if you’re looking for other smart AI-enabled autosave apps. Try:

- Moneybox

- Chip

Conclusion: Cleo vs Plum

And the winner is…. Plum!

In our head to head of Cleo vs Plum, you can see the main differences between the two apps which are principally auto-saving apps.

Cleo has the novelty factor with its chat interface and some superior budget tracking capabilities.

But Plum provides the overall better feature set and access to investment funds.

If you’re a beginner to personal finance and only want to go for one app which will help you to grow your money, I would recommend Plum out of the two.

However, given that both offer a free tier, there is no harm in downloading both, giving them a whirl and sticking with the app that you find the easiest (and most useful) to use.

Have you used either Cleo or Plum? I’d love to hear which one you preferred in the comments below, who’s your winner out of Cleo vs Plum?