We all love a free app nowadays, don’t we? I sure do. But, sometimes it isn’t always clear if an app is actually free or not. So, I’m answering the question; is Emma budget app free?

What is Emma?

Emma* is a budgeting app and spend tracking app (that has closed a wildly successful crowdfunding round), which offers a host of features powered by the Open Banking API.

This allows you to connect your bank accounts, your credit card accounts and even some investment and/or savings accounts.

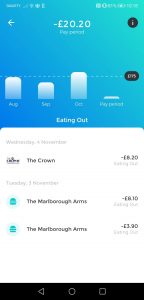

By having access to your accounts (read-only, mind), Emma helps you to categorise and analyse your spending to better understand your spending habits. This is ideal for tracking your spending against your budgets and gives you useful insights such as comparing your spending against other users (damn Emma, I don’t want to know I spend more than 95% of your users at Gregg’s *facepalm*).

Is Emma Budget App Free?

Yes.

Emma has a decent set of features that you can see in the next section. The features offered on their free plan rival the best budgeting apps out there (with their intuitive design still unbeatable in my opinion), and for most people, there is not a need to upgrade to their premium plan to unlock the additional features.

There are two tiers for the Emma app, the free version and the paid-for Emma Pro plan. If you upgrade, it unlocks a suite of features that aren’t available on the free plan. The team have announced plans to introduce further tiers which unlock bigger and better features.

What is included in the free Emma app?

On the default, free app, you get plenty enough features to manage your finances and help you understand your spending habits, create and stick to budgets, and move closer to your financial goals.

Some of the features available on the free Emma app are:

- Connecting your bank accounts via Open Banking (also credit card accounts and some investment accounts)

- Ability to set budgets and track spend against them

- Spend tracking

- Automatic transaction categorisation

- Subscription tracker

- Spend analysis and insight

- Spending visualisations

- Cashback

- Bank fees tracker (bit scary seeing this one!)

- Access to the Emma weekly quiz (prize money up for grabs!)

As full disclosure, I personally used the free Emma app for 5 years to track my spending on the go. It saves you the faff of having to fire up a spreadsheet and download files from multiple different banking providers.

What is included in Emma Pro?

Emma Pro is their premium subscription that unlocks some additional features. These are definitely not required, but can certainly help you to hit your financial goals.

- Earn cashback

- Track your net worth by adding offline accounts (that you can’t connect via Open Banking)

- Create custom categories to track spending exactly as you want to

- Export data to Excel

- “Turbo syncs”, up to 4 automatic syncs a day with your connected accounts

- Smart rules – automate transfers to offline accounts

- Savings goals

- Advanced transaction editing (such as splitting between two different accounts)

- Ability to rename transactions

- and more (the team are constantly rolling out updates)

How much does Emma Pro cost?

Emma Pro is currently available at £59.99 per year, but they normally run loads of introductory offers. When you first sign up and they offer you the option to sign up to Emma Pro at a discounted rate, they then offer a second discounted rate – so if you know it is for you this can be a good way to save some money.

How does Emma make money?

Emma principally makes money through the subscription it charges users.

However, it also makes money through any commissions paid to them when their users sign up to a third party service via their app such as setting up a new card or shopping through their cashback portal as an example.

They have said they do not sell aggregated and anonymised user data or spending patterns to market research companies as a revenue stream.

Read my review

I’ve written a full Emma app review here that you might find interesting. Similarly, we have a comparison of the three main budgeting app players here.

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent. The views expressed are based on our own experience and analysis of the service.

What Is A Good Amount Of Savings UK?

Generally in life, more tends to be better. But is that true for savings? Whilst…

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

Tracking your expenses isn’t all about firing up a spreadsheet and restricting your spending. Having…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….