Another budgeting app face-off. This time, we pitch Yolt vs Cleo.

Quick Summary

For those of you who need a quick answer, let me ruin any kind of build-up and jump straight to it. I’m sure you didn’t come here for a tease anyway!

Cleo: best for people who are dipping their toes into their personal finances for the first time and/or don’t already have a budget.

Yolt: best for people who already have a budget and are looking for a quick and easy way to track their spend

Update: Yolt has announced they are closing down their service from 4th December 2021.

Cleo Summary

Recommended for: personal finance beginners who haven’t yet set a budget and/or struggles to save money

Platform available: iOS, Android and Facebook Messenger

The good:

- Great onboarding

- Chat interface is a surprisingly useful and easy way to engage with your finances

- Cleo provides a tailored budget to you

- Custom categories

- Cleo has personality (she may occasionally fling you some sass)

The bad:

- Some features hidden behind the chat interface so a little obscure

- Some of the user experience not as polished as I’d like

- Most suitable for beginners

Summary

If you’re sceptical about a money app being packaged as a “chat bot”, then you’re in for a treat. I was sceptical too, but the interface gives it some advantages that no other personal finance app has.

If you’re starting out on your personal finance journey, Cleo is a great place to start. She’ll help build your awareness of your own financial habits, provide guidance to set and stick to budgets, and can help you save money without even trying.

Yolt Summary

Recommended for: people who already have a budget and only need a simple spend tracker.

Platform available: Android and iOS

The good:

- Easily set budgets

- Intuitive design

- Easy to understand analytics

- Simple spend tracker

The bad:

- No custom spend categories

- No browser access

- No offline accounts on Android app

- Yolt pushing new Yolt Card accounts for new users (Classic Yolt still available on Android)

Summary

One of the OGs in the budgeting app spaces, Yolt easily connects to your bank account and categorises your spend automatically. Not only does this help save you a tonne of time, but by making the process as easy as possible, but the Yolt app can help you stay on top of your budget.

There are apps out there that have a more sophisticated and “smart” feature set with artificial intelligence and sassy characters. But if you want to remain in full control of your finances, and simply want an easy way to track your spend against your budget, then Yolt is more than up to the job.

Cleo Deepdive

Intro

Cleo is an AI-powered personal finance assistant who you can “chat” with. Sounds weird? It is. But it is surprisingly more intuitive, useful and effective than you’d initially expect.

As with other budgeting and money management apps, you can connect your bank accounts via open banking which gives Cleo access to your transactions and balances. With this it can help you track your spend, set budgets and provide its insight.

Cleo provides you a tailored budget based on your historic spend within the first 5 minutes of setting the app up. She can help you keep track of your spend.

And what I’ve found most impressive is her ability to help answer questions such as “can I afford this pizza?” or “how much budget do I have left?”.

This makes the chat interface a really intuitive and useful way to get some insights to help you manage your money better.

Cleo even has an autosave feature which will squirrel money away for you into the Cleo wallet (you of course have access to this cash if you need to transfer it back out of your wallet). This is a real easy way to work towards your financial goals and a healthier looking savings account.

There is also Cleo Plus which is £5.99 a month and gets you access to:

- Credit coaching (helping you to improve your credit score)

- Cashback (saving money on some 3rd party retailers you may shop with)

- Salary advance of up to £100

Features

- Connect your bank account and credit card account via Open Banking

- Automatically tags up transactions

- Custom spend categories

- Set budgets by category

- Cleo calculates a tailor-made budget for you based on historic spending

- Interact with Cleo via the chat interface for immediate answers to questions such as “can I afford this pizza?”

- Easily understand your progress against your budget by asking Cleo the question

- Autosave feature where Cleo works out how much you can save and puts it away for you into the Cleo wallet

Highlights

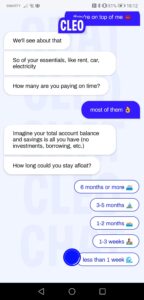

Great onboarding with Cleo asking you questions and showing you around

When you start out with Cleo, she will ask you some questions to get a feel for where you currently are on your personal finance journey.

She then takes you on a whistle-stop tour of her capabilities.

As a chat based money management app is still a very new concept, this is invaluable. And in my opinion well executed.

The key features are explained, and it is very easy to use and explore.

Can create custom categories

If you’re looking to have flexibility in the types of spend you are tracking, then Cleo has your back. You can add custom categories or use some of their pre-programmed categories such as “Eating Out” and “Groceries”.

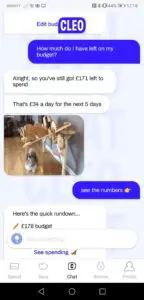

Smart tracking

Now this is the big shock. I was expecting the chat bot AI to be a bit naff to be honest. But how wrong I was!

Having a chat interface actually provides some great ways to get insight into your spending habits that you simply don’t get elsewhere with a more typical spend tracking app like Yolt.

For example, I can easily ask Cleo “how much do I have left on my budget?”. She easily fires back the amount I have left to spend as well as the daily breakdown.

In my example, she’s telling me that if I spend 34 a day for the next 5 days I’ll be in on target. This is actually a super useful insight when you’re trying to hit your budget and saves you from having to calculate this yourself.

Lowlights

Some of the features are hidden away behind the chat so need to know what to ask

Even though I flagged this exact thing as a highlight too, sometimes it can be frustrating.

Sometimes you just want to flick open the app and get an answer straight away.

Whereas with Cleo you’ll need to type out a question or make a couple of clicks to get Cleo to answer you.

Some of the user experience not as polished as I would have expected

For an app filled with such great AI, there are still some parts of the experience that I would consider more basic issues that need to be ironed out.

For example, I originally tried signing up with a hotmail email. But this just “hung” with no verification email ever received. Once I attempted my gmail email it worked fine.

Similarly, the autosave feature is a bit clunky to set up. With both card authorisations and direct debit setups, it isn’t as smooth an experience as I would expect.

What are other people saying?

On Trustpilot, Cleo has been reviewed 1.7k times with an average score of 4.2, with 83% of these scores rates as “excellent”. On the Google Play store Cleo has over 20k reviews averaging 4 stars out of 5.

Lots of people are calling out that they’re enjoying Cleo’s personality, the chat interface (“having my own personal budgeter”) and insights (“she makes it fun to see how awful your spending habits are”).

Although it is important to call out some negative reviews so my readers are aware of some of the potential pain points with Cleo. A lot of the negative reviews are around a slow customer service experience, with potential issues around accounts not being connected and issues with withdrawing money from the autosave feature wallet.

Yolt deepdive

Intro

Yolt is one of the original faces on the money management app scene.

Having been launched in the UK in 2017, Yolt boasts over 500k users and is backed by ING Bank – so you know it knows money.

As with Cleo, it connects to your bank account using Open Banking, helping you to stay on top of your budgets, your spending and trim down your wasteful subscriptions.

Features

- Connect Yolt to your bank account or credit card account

- Automatically tags up transactions

- Ability to set budgets

- Track subscriptions and repeating payments

- Visualisations help you understand where you’ve spent your money

Highlights

Simple and intuitive

Yolt has a simple feature set, and works well. Connecting bank accounts, changing a transaction category and setting budgets are all easy tasks.

In case you’re lost or unfamiliar with Yolt, they have a helpful onboarding process and some coaching guides in the app which help you to find the features you need.

Automatic spend categorisation

When your transactions come in from your bank, Yolt will automatically tag up to the category it thinks is most appropriate. This can save you a TONNE of time versus manually tracking your expenses or tagging up transactions manually in a trust ol’ spreadsheet.

Budgeting

Probably what you’re here for! Easily set budgets in Yolt and track spend automatically against them.

This gives you all the information you need to understand where you’ve gone overboard on your budget or where you have some more room to play with.

Lowlights

Not the most flexible

If you want to get more specific with the categories of spend you are tracking, then you’re all outta luck. You’ll have to stick with their built-in category set.

You may find you can get round it with their “tags” system, but it would be much easier if they just allowed for custom categories.

For the more advanced budgeters out there, this might be a deal breaker.

It might be worth checking out another budgeting app such as Emma* or Money Dashboard. Both of which do have this functionality.

Company pushing the Yolt card

Yolt is pushing users to sign up for the Yolt card and slowly phasing out the Classic spend tracking app. The Yolt Card is a prepaid card you can use for your transactions. Lots of the negative reviews accruing to Yolt relate to the new Yolt Card accounts.

Not a smart assistant

Yolt looks much simpler than it is when compared against the likes of Cleo, what with its AI-powered chat interface.

This is great if you already have yourself a budget, but something like Cleo might be a better alternative if you are just starting to dip your toes into your personal finances.

What are other people saying?

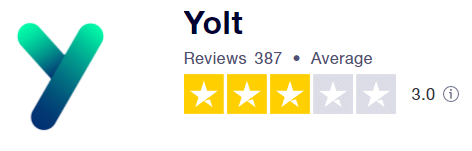

At the time of writing, Yolt scores 3 out of 5 on Trustpilot, with 51% of reviews as “Excellent”.

The most recent negative reviews are all in relation to the new Yolt Card accounts, with people’s accounts being blocked and slow resolution from Yolt’s customer service teams.

Alternatives to Yolt and Cleo

Both Cleo and Yolt are great options if you want to take some steps to improve your personal finances. There are, however, alternatives.

For alternative spend trackers:

- Emma* (read my Emma review here)

- Money Dashboard (read my Money Dashboard review here)

Check out my three-way head to head of Yolt vs Money Dashboard vs Emma to find out which spend tracker takes the crown.

If you want to try an AI-enabled app or another automatic savings app, try these alternatives:

- Moneybox

- Chip

- Plum (check out my Yolt vs Plum comparison here).

Conclusion: Yolt vs Cleo

Thse two apps are very different beasts.

One is the scrappy upstart (Cleo), full of personality and innovation aimed at personal finance beginners.

The other is the reliable and steady ol’ faithful (Yolt), able to help both beginners and experienced personal financistas alike.

Both can be great apps to help improve your personal finances, but they depend on where you currently are with your personal finances.

Yolt is great if you’re already engaged in your finances, have created yourself a budget (maybe a zero-based budget) and you want an easy way to track your spend using an app.

Whereas Cleo is more of an actual money management assistant who can help you not only set a budget, but can help you stick to it. Further, Cleo will squirrel away money where it thinks you can afford it with its Autosave feature, so you start to build savings on autopilot.

This is a great place to start if you’re a beginner. But little bits of money being saved here and there from Cleo are not going to get you to your big financial goals. This is where you may want to graduate onto something like Yolt to track your spend against your own zero-based budget, with higher levels of saving and investment.

Have you used either Cleo or Yolt? I would love to find out which one you preferred. Drop a comment in the section below.

Icons made by Freepik from www.flaticon.com

Are Money Saving Apps Safe?

Ah apps. Love them or hate them, they are an increasingly important part of our…

Best Spend Tracker App – Will One Of These Help Your Finances?

Cor I bet you’re bored of using an excel spreadsheet to track your expenses? Me…

17 Actionable Tips on How to Pay Off Debt Faster

You’re not alone. Living with debt has become a common issue for people in the…