Heard Facebook rebranded its corporate identity to Meta? This was the first introduction to the Metaverse for a lot of people. With lofty visions being thrown about, I’m sure you’re asking the question; “how do I invest in the metaverse?”.

This article aims to provide information on how to invest in the Metaverse (especially applicable to UK investors). However, nothing in this article should be taken as investment or financial advice. Even though I take great care to ensure the accuracy of the content produced, please do your own research before you invest your money and be aware of the risks.

What is the Metaverse?

Roundhill Investment defines the Metaverse as a successor to the current internet that will be interoperable, persistent, synchronous, open to unlimited participants with a fully functioning economy, and an experience that spans the virtual and ‘real’ world. Quite a mouthful!

Similarly, Facebook CEO Mark Zuckerberg signalled how important he thinks the Metaverse will be to his company, after announcing its corporate rebrand to Meta. Meta has described the Metaverse as:

a set of interconnected digital spaces that lets you do things you can’t do in the physical world. Importantly, it’ll be characterized by social presence, the feeling that you’re right there with another person, no matter where in the world you happen to be.

Imagine a (digital) world in the future where you can work, live, socialise, play games, go to a digital cinema to watch a blockbuster release, watch a live gig or make money selling your digital creations. This certainly sounds like it has all the makings of a dystopian future to me. A world in which our physical bodies are plugged into a virtual world akin to The Matrix.

Putting my existential cynicism to one side, you can easily see why the Metaverse may be a massive commercial opportunity.

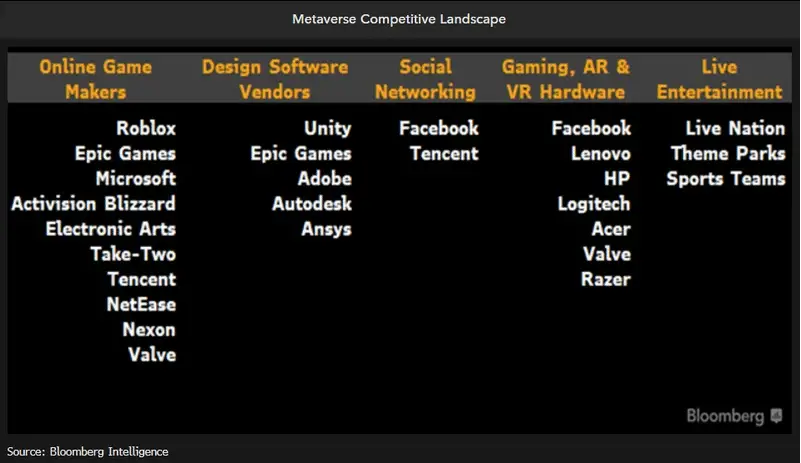

Bloomberg Intelligence has estimated the “market opportunity” for the Metaverse can reach $800 billion by 2024. This represents a compound annual growth rate of ~13%.

They estimate the market opportunity to come from:

- ads (hence why social media companies like Facebook are getting involved)

- gaming (both software and headsets/ physical hardware manufacturers)

- live entertainment (for example live concerts and theatrical releases)

As an investor, this means this virtual space offers plenty of investment opportunity.

From investing directly in a digital asset on a pre-existing platform such as virtual real estate, to buying into crypto which is used to support the worlds, all the way to buying up stocks in companies that are working on this area now.

Given how new the space is, this would certainly fall under my own “speculative” portion of my investments, but dipping your toes in with a few Metaverse project(s) is likely to provide some great upside if the predictions come true.

How do I invest in the metaverse?

#1: More direct: buy up metaverse related cryptocurrencies/NFT

The most direct route to invest in the Metaverse is by investing directly into one of the existing platforms/worlds. You can do this by either buying up “digital land” using NFTs, or by purchasing one of the platform’s cryptocurrencies:

Buying up virtual real estate

If you invest in NFTs (non-fungible tokens) by buying virtual land in some games/platforms such as The Sandbox and Decentraland, you’ll have direct exposure to this new form of digital asset in the form of digital land you can develop or sell on in the future.

You can buy these NFTs through platforms such as OpenSea, a digital marketplace for NFTs.

The downside of investing directly is that it becomes difficult to diversify. What if the platform you invested in ends up losing? You may be inclined to buy up digital assets across multiple platforms, but this will likely soon become expensive for all but the investors with an already sizeable portfolio.

Cryptocurrencies

You can buy the cryptocurrencies used on some of the platforms such as The Sandbox (SAND) and Decentraland (MANA) using a standard crypto exchange such as Binance or Coinbase. Similarly, a lot of these are based on the Ethereum blockchain, so Ethereum should benefit from the rise of the Metaverse, so investing in Ethereum (once again through a crypto exchange) will provide exposure to the growth of the Metaverse.

#2: Invest in companies related to the Metaverse

There are lots of newer startups in this space, and we’re likely to see some winners coming through over the next 12-24 months, however, access to these smaller startups are going to be harder as they’re still at seed/series A stage.

There are, however, publicly listed companies that you can easily invest in which are either involved in the development of a range of services that will benefit the Metaverse or supply products/services which will benefit from the growth in the Metaverse.

For example, Facebook has shown just how deep they’re willing to go on the Metaverse considering they’ve changed their whole corporate identity around it. They’ve explained their vision for the Metaverse, and labelled lofty expectations of the Metaverse becoming the successor to the mobile internet. If they do succeed in realising that vision, then owning Meta (formerly FB) stock now is a great way to gain exposure to that future (assuming you are comfortable investing in Meta given its checkered past on data privacy).

Meta are well placed for this space given their dominance on ads, their sprawling social media network and their investments into virtual reality headsets and augmented reality via Oculus.

However, there are also other tech companies who are well placed to strike. Chip makers such as Nvidia and Qualcomm, cloud computing providers such as Microsoft and Amazon, and games engines such as Unity may prove vital in developing the infrastructure behind the Metaverse.

Not to mention game developers and content owners such as Microsoft (they own Minecraft), Roblox, Epic Games (owner of Fortnite) and Roblox will be in building out the platforms themselves. It is worth noting that Fortnite have already hosted massive virtual gigs featuring big names like Arianna Grande, a key vision for the future of the Metaverse with Bloomberg Intelligence predicting live entertainment to be a key use case of the Metaverse, predicted to exceed $200 million in 2024.

The benefit to investing in these companies that are related to the Metaverse is that they are publicly available and so can trade easily. Additionally, a lot of these companies have other revenue lines and modes of business which are not 100% reliant on the Metaverse.

#3: Invest into a Metaverse focused exchange traded fund (ETF)

With any nascent area, it can be hard to pick out the winners from the losers. Putting money into a range of individual stocks to get broad exposure to an area may be prohibitively costly depending on your broker and their minimum investment limits, not to mention whether you have the firepower to diversify successfully whilst not trashing your asset allocations.

However, interestingly there is already a Metaverse focused exchange traded fund (ETF) on the market. An ETF is essentially a collection of stocks that trade on an exchange just like an ordinary stock. The Roundhill Ball Metaverse ETF (META) by Roundhill Investment is designed to easily offer investors exposure to the Metaverse. It focuses on providing exposure to companies which:

- develop infrastructure to support the Metaverse (such as Clouflare, Nvidia and Qualcomm)

- gaming engines responsible for the creation of the virtual worlds such as Unity and Roblox)

- pioneers in content, commerce and social capability on the Metaverse

The ETF is a very recent launch, debuting on 30th June 2021, so we cannot speak to a lot of its historic performance given the short timeframe.

At the time of writing, its top 10 holdings are:

- Meta Platforms Inc (formerly FB)

- Nvidia

- Roblox

- Microsoft

- Unity

- Snap

- Autodesk Inc

- Amazon

- Apple

- Sea

How to buy the META ETF?

The META ETF is listed in the US and traded on the New York Stock Exchange, so if you are based in the US you’ll be able to easily buy from multiple brokers.

However, if you’re based in the UK (like I am), it becomes decidedly harder. This is due to European regulation on packaged financial products like this based in the US. From my research, Stake* offers a way to invest into the ETF, but you will require to show you are a sophisticated (accredited) investor, by means of having a portfolio >$30k on their platform.

Other popular platforms such as Freetrade*, eToro and Hargreaves Lansdown don’t have META available to invest.

How much does it cost to invest in the META ETF?

The META ETF expense ratio is 0.75%.

Conclusion: How do I invest in the Metaverse?

The Metaverse certainly offers some exciting opportunities for investors looking to invest in this virtual space of the future. If it does come anywhere near to the “successor of the internet” as some are loftily prophecising, then whoever backs the companies who are helping to make that vision a reality will likely share in some pretty large spoils.

There are multiple ways to do it. The creation of the META ETF provides a super easy way to gain exposure to companies that operate in the space, but access is limited for European/UK investors. Investing directly into companies that will benefit from the growth of the Metaverse is the most accessible route in my opinion, as it provides a level of built-in diversification and low fees (if trading via a low commission brokerage like Freetrade or Stake).

How are you investing to get exposure to the growth in the Metaverse? I’d love to hear in the comments section below.

*Any links with an asterisk may be affiliate links. Even though we may receive a payment if you use this link to sign up for the service, it does not influence our editorial content and we remain independent.

What Is A Good Amount Of Savings UK?

Generally in life, more tends to be better. But is that true for savings? Whilst…

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

Tracking your expenses isn’t all about firing up a spreadsheet and restricting your spending. Having…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….

How To Cancel Hellofresh Subscription UK

Bored of the meal kits or want to try a competitor? We get you. We’ve…

How To Cancel Les Mills On Demand UK

Bored of your subscription or wanting to move to another provider? We get you. We’ve…

How To Cancel Laithwaites Wine Plan UK

Bored of the service or wanting to move to a different wine subscription club? We…