Attaining the title of “millionaire” is an aspirational goal for many. Lots of people want it. Some people become a contestant to try and win it. Many think that once you reach the fabled millionaire status your financial freedom is assured. But what even is a millionaire anyway?

What makes you a millionaire UK

Definition of a millionaire

Attaining millionaire status is an aspiration for many, but the term is often thrown around. You may be asking yourself what does it actually mean? Is it when someone earns £1m a year?

…no!

A millionaire is someone who has a net worth (or wealth) of over £1million. However, there is a standard that is used in cross-country comparisons using the term “dollar millionaire”. You are classed as a dollar millionaire if you’re net worth is over $1m. In the United Kingdom (at the time of writing), this would be ~£740k.

There is more data available looking at dollar millionaires and the numbers of dollar millionaires across countries over time, so it is a useful milestone to be aware of.

You’re more likely to confuse than impress your mates in the pub with that definition though, so the standard in the UK remains intuitively at £1m.

How many millionaires are there in the UK?

Credit Suisse reported an increase of dollar millionaires in the UK to 2.49 million dollar millionaires in 2020 (up 258k from 2019). This accounts for ~4% of the world’s total dollar millionaires.

The largest contributor of dollar millionaires is, rather expectedly, the United States, which contributes 39% of the world’s total.

The density of millionaires has increased over time across most countries. In the UK, 1.7% of the population were millionaires in 2000, but this has grown to 4.7% in 2020. Which country has the highest density of millionaires? Switzerland. With a staggering 14.9% of the population dollar millionaires in 2020. That works out at about 1 in every 7 people!

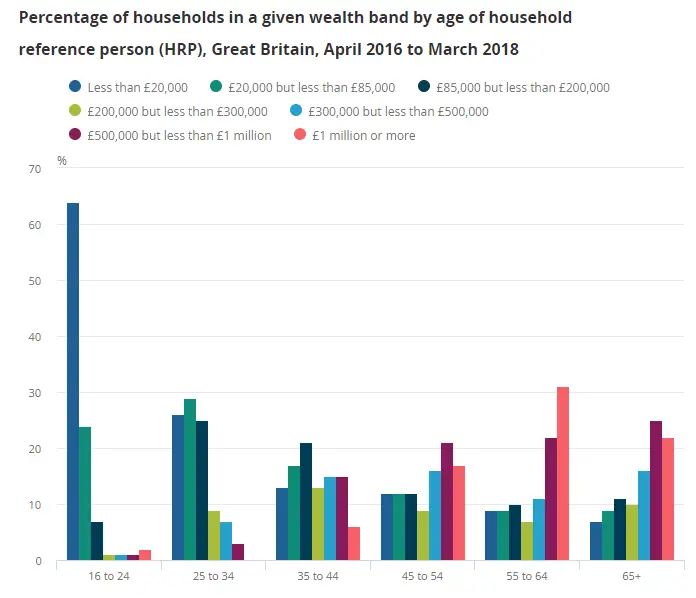

Using data from the Office for National Statistics looking at household wealth (as opposed to individuals), there is a trend towards higher proportions of millionaires as you go up the age groups. For example, in the age group 16-24, ~1% are millionaires. Whereas in the 65+ age group, ~20% are millionaires (this is based on household wealth, and age is based on the lead person in the house).

What is the most common way people have become millionaires?

A survey dubbed the “National Study of Millionaires” in the US by Dave Ramsey’s company has some great information for the make-up of a US millionaire. Whilst not a survey conducted in the UK, I think its findings are fascinating as I would be very surprised if the UK results deviated too significantly.

Some highlights:

- millionaires on average took 28 years to reach this figure

- they reached this through diligent saving and investing over time

- 79% of millionaires didn’t receive any inheritance

- only 15% of millionaires were in senior roles such as C-suite of Vice President levels

- one third of millionaires never made more than $100,000 in a year

The top 5 careers for millionaires were:

- Engineer

- Chartered Accountant

- Teacher

- Management

- Attorney/Law

How to become a millionaire in the UK

Spend less than you earn

No matter what you earn, if you spend more than that then you won’t be making much progress. Rather than building wealth, you’ll actually be building up debts.

The process of spending less than you earn takes time. But you can follow these steps to improve:

- track your spending for a period of time

- set yourself a budget (this might include cutting back on some areas but also deliberately allocating enough money to certain areas to live the lifestyle you want guilt-free)

- continue to track your spending to ensure you’re sticking to your budget

Apps like Emma*, Plum* and Money Dashboard* make this whole process much simpler. Plum* especially is suited for people who may be approaching their finances properly for the first time.

To find the right app for you, I’ve put together a comparison of Emma vs Money Dashboard here, with a comparison of Plum vs Emma here.

Invest the difference

Money sitting in your bank is not working for you. If you put your money to work, aka invest it in productive assets, then over the long term it will make a significant difference (especially given the meagre interest rate we currently have).

One of the wondrous concepts in personal finance (yes, I said wondrous and personal finance in the same sentence!), is compound interest.

If you haven’t heard of it yet, you’ll likely start to hear a LOT about it when you start to read more about investing.

Essentially, this is when you earn a return on your money, which goes on to make a return itself. So over time, your money compounds.

Investing doesn’t need to be complicated either. A simple index fund tracking the global stock market will give you the diversification required to reduce your risk, but the exposure to global stocks to help drive returns.

To highlight how important compound interest can be, I’ll illustrate it with an example.

If you are 25 and invest £200 per month, by the time you’re 65 and ready to retire you will have a whopping £525k waiting for you (assuming a 7% annual return). How much would you have actually paid in to that? Only £96k! So that means that a massive £429k actually came from your money earning money on itself (i.e compound interest). How mad is that?! You can play around with the inputs in this compound interest calculator to see the impact it has.

Investing in equities is not the only route though, you could go down the route of property investment as part of your portfolio.

Grow your income

Boosting your income is likely your most powerful lever. Especially at the beginning. If you can increase your income, and minimise the increases in costs, then this extra money can be funnelled straight into investments. Over time, this can make a huge difference.

You can grow your income by:

- upskill yourself (for example by learning to code or by learning a new marketable skill like Carpentry)

- negotiating raises for your existing jobs

- switching jobs to boost salary for the same job

- change industry (see below)

The Capgemini World Wealth Report gives us a prediction of the industries that will generate the most millionaires in the future next few years to 2025, with some interesting (and not so interesting) findings.

Unsurprisingly, Financial Services is the #1 industry at minting millionaires (these are defined as dollar millionaires excluding their primary residence). Bankers are notorious for earning megabucks, but you’ll have to work exceptionally hard for it. 90+ hour weeks are not uncommon.

Similarly, Tech comes in at #2. Not only does this relate to the classic companies you relate to Tech such as Google and Facebook, but also growing startups and disruptors in a range of industries. There is a range of skills that are in demand in this industry, such as computer science (for engineer roles), data science, product management and commercial skills such as marketing and brand management.

One of the newer growth areas is Healthcare, which comes in at #3.

Interestingly, the experts thought that the Education sector would produce some considerable millionaires, coming in at #7 on the list.

Rinse and repeat the above

Once you have the steps above nailed, it’s only a matter of time. You will become a millionaire, it is just a matter of when.

If you think it will take too long, then you can take some actions to speed the process up. You can reduce your expenses, increase your income, or try to boost your investment returns.

Track your net worth

Being able to see the impact of your actions and discipline on your net worth number is a complete game-changer. It enables you to quickly see if you are heading in the right direction. Or gives you the ability to recognise if you’re not. Only if you know you’re not, are you able to put in place steps to get yourself back on track.

You can easily track your net worth by just firing up a spreadsheet and jotting the different accounts you have down. Make sure to include these different categories:

- Financial wealth (things like ISAs, saving accounts, your pension pot etc)

- Physical wealth (things like a car or other physical assets can go in here)

- Property wealth (self-explanatory, but any real estate you own goes here)

- Liabilities (you’ll need to ensure you take off any debt that you owe, for example, your mortgage and any credit card debt)

Over time, you can just add each month as it goes, which gives you a great picture of how you’re doing over time.

I’ve distilled the wealth data from the Office for National Statistics so you can easily check out how you compare against the UK data here.

What Is A Good Amount Of Savings UK?

Generally in life, more tends to be better. But is that true for savings? Whilst…

“Why Should I Track My Expenses?” – We’ve got 7 reasons why!

Tracking your expenses isn’t all about firing up a spreadsheet and restricting your spending. Having…

How To Cancel Graze Subscription UK

Bored of your Graze boxes or want to try a competitor’s version? We get you….